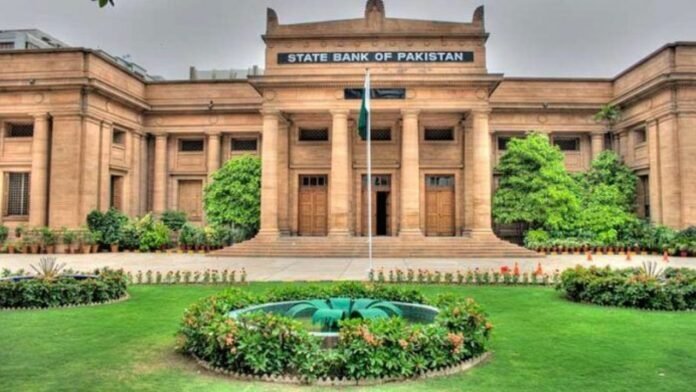

SBP injects Rs10.5t into market via Open Market Operations

By Commerce Reporter

KARACHI: The State Bank of Pakistan (SBP) has successfully conducted an Open Market Operation (OMO), injecting a total of Rs10.48 trillion into the banking system. Of this amount, Rs10.27 trillion was injected through a reverse repo OMO, while the remaining Rs214.7 billion was provided through a Shariah-compliant Modarabah-based OMO.

Open Market Operations (OMOs) are a key tool used by the SBP to manage liquidity in the financial system by either injecting funds into the market or mopping up excess liquidity. In the case of OMO injections, the SBP lends funds to banks and Primary Dealers (PDs) against eligible collateral to address any liquidity shortages.

The eligible securities for such injections include marketable government securities like Market Treasury Bills (MTBs) and Pakistan Investment Bonds (PIBs). On the other hand, during OMO mop-up operations, the SBP sells MTBs to banks to absorb surplus liquidity and stabilize the market.

This move comes as part of the SBP’s ongoing efforts to manage liquidity in the banking sector, ensuring smooth financial operations and stability in the system.