Oil markets rally amid U.S., Iran standoff

Crude oil prices jumped sharply as rising geopolitical tensions between the U.S. and Iran rattled energy markets.

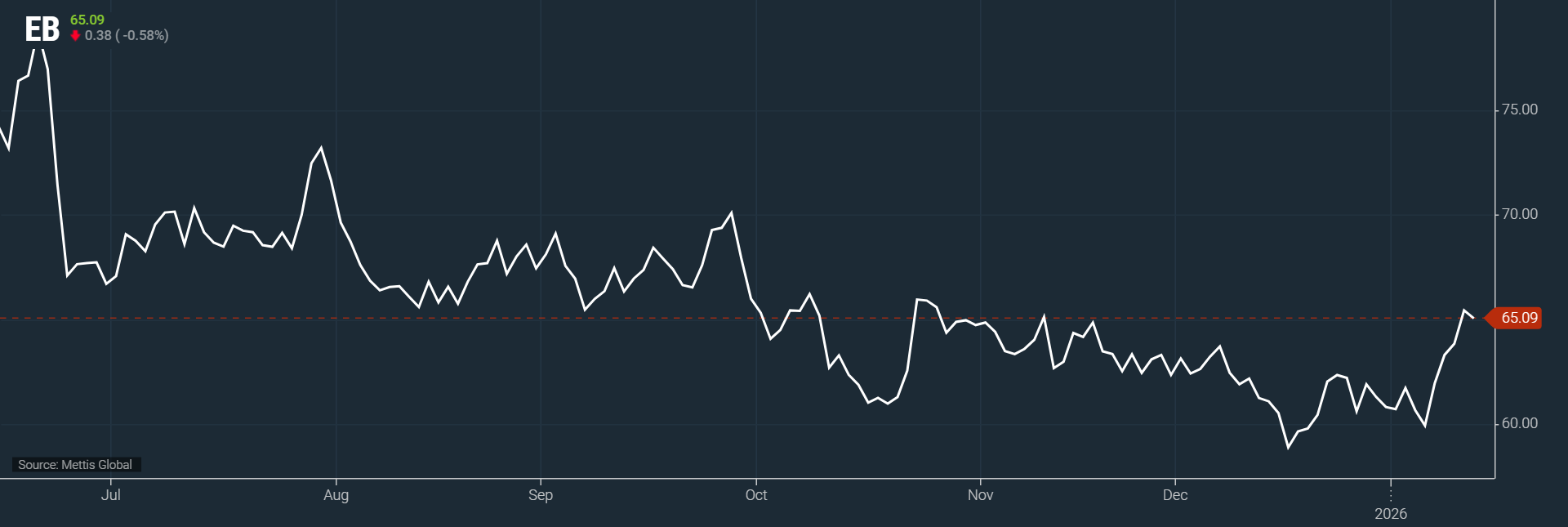

Brent crude futures went up by $0.38, or 0.58%, to $65.09 per barrel, according to data by Mettis Global.

West Texas Intermediate (WTI) crude futures increased by $0.38, or 0.62%, to $60.77 per barrel by [12:17 pm] PST

WTI crude and Brent crude, the global benchmarks, surged more than 2.5% during U.S. trading hours, fueled by concerns that escalating tensions could disrupt supply through the Strait of Hormuz, a key oil transit route.

The spike came after former U.S. President Donald Trump revealed on Truth Social that he had canceled all meetings with Iranian officials, reaffirming his support for ongoing anti-government protests in Iran, according to CNBC.

Trump’s hardline stance signals that diplomatic engagement with Tehran may be temporarily off the table, raising the risk of broader regional instability that could affect oil exports.

Energy market watchers note that Iran, a major oil producer, plays a strategic role in global oil flows.

Any disruption in the region could tighten supply and push crude prices even higher, adding pressure on global markets already adjusting to post-pandemic demand dynamics.

Meanwhile, U.S. equities saw modest declines despite a cooler-than-expected core consumer price index (CPI) for December, highlighting investor caution.

The combination of geopolitical risk in the Middle East and domestic economic uncertainty could keep oil markets volatile in the near term, presenting both challenges and opportunities for traders, investors, and global energy policymakers.