Gold slips on firm dollar, U.S. jobs data in focus

Gold prices edged lower on Thursday as a firmer U.S. dollar weighed on the market ahead of a key U.S. jobs report that could shape expectations for future Federal Reserve policy, while geopolitical risks remained in focus.

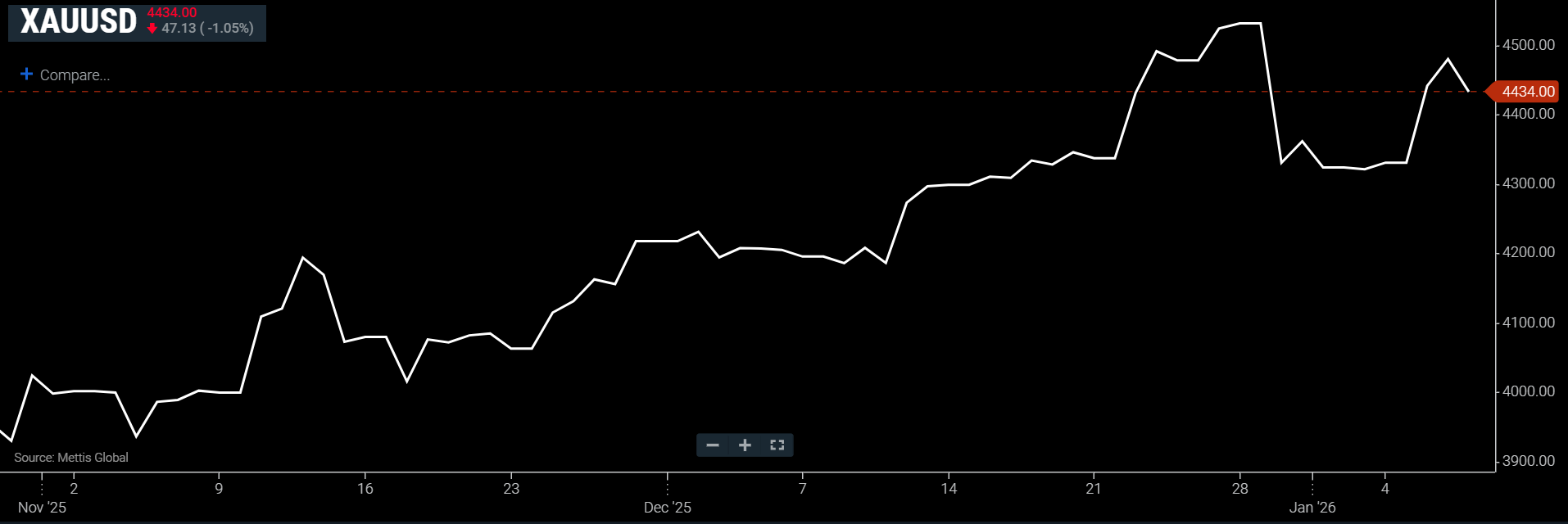

Spot gold fell 1.05% to $4,434 an ounce as of [12:17 PM] PST, according to data reported by Mettis Global.

U.S. gold futures for February delivery also declined 0.3% to $4,449.60, CNBC reported.

Market participants are balancing geopolitical tensions with macroeconomic signals from the United States, said Bernard Sin, regional director for Greater China at MKS PAMP.

He pointed to U.S. pressure on Venezuela and speculation over potential flashpoints under former President Donald Trump’s so-called “Donroe Doctrine,” alongside incoming U.S. economic data.

Recent softer U.S. jobs data has strengthened expectations of further Fed rate cuts, which typically support non-interest-bearing assets such as gold.

However, sentiment remains cautious, with investors wary of volatility and profit-taking at elevated price levels, Sin added.

Gold is trading about $110 below its record high of $4,549.71 reached on December 29, with gains capped by dollar strength and selling at higher levels.

Data released on Wednesday showed U.S. job openings fell to a 14-month low in November, while hiring remained sluggish, signalling easing demand in the labour market.

Attention now turns to Friday’s U.S. non-farm payrolls report for further clues on the Fed’s policy outlook.

Geopolitical concerns also lingered after the United States seized two Venezuela-linked oil tankers in the Atlantic Ocean on Wednesday, including one sailing under the Russian flag, as part of Washington’s efforts to influence oil flows in the region.

In other precious metals, spot silver slipped 0.4% to $77.85 an ounce, after hitting an all-time high of $83.62 on December 29.

Platinum fell 0.8% to $2,288.23 an ounce, easing after touching a record high of $2,478.50 last Monday, while palladium lost 0.5% to $1,756.42 an ounce.