Current account posts $100m surplus in November

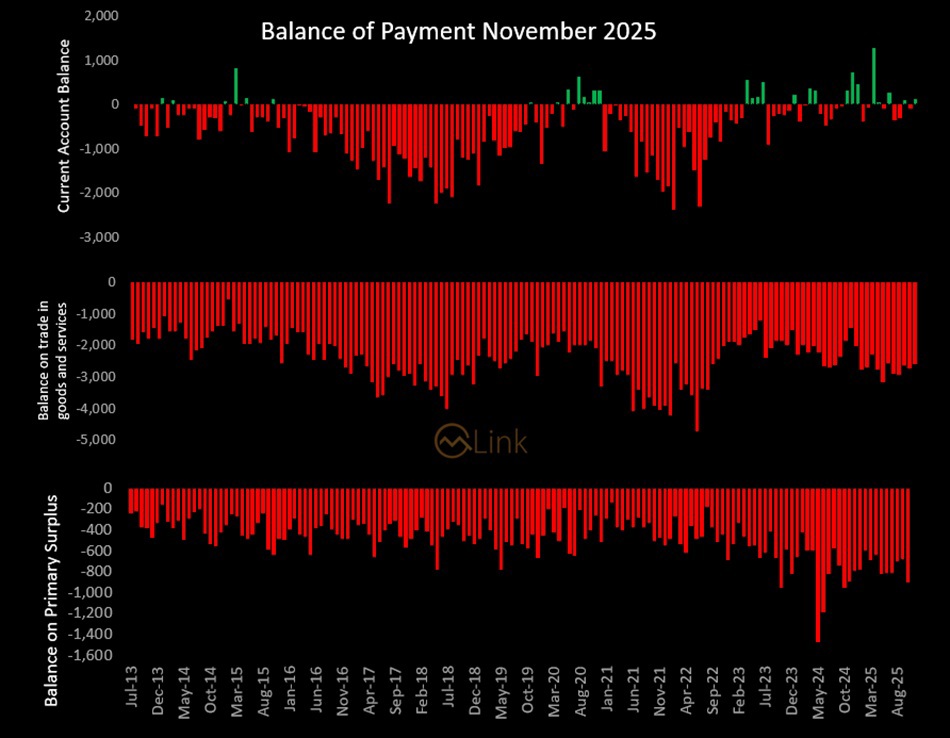

Pakistan has recorded a current account surplus of $100 million, the latest data issued by the State Bank of Pakistan (SBP) revealed today.

Last month, the country recorded a current account deficit of $291m, while in November, 2024 the current account surplus stood at $709m.

On a cumulative basis, the current account deficit in 5MFY26 was recorded at $812m, showing an increase of 261.4% when compared to the surplus of $503m in 5MFY25.

During November, total exports fell by 10.7% to $3.09bn compared to $3.46bn in the same month of last year. While it fell 10.4% as against the exports of $3.44bn in the previous month.

Total imports rose 15.3% to $5.68bn as compared to the imports worth $4.93bn recorded in November of last year. Compared to the previous month, imports fell 11.7%.

Accordingly, the trade deficit in goods and services rose 76.2% from a year ago to $2.59bn. On a monthly basis, it narrowed 13.2%.

Cumulatively, the trade deficit in 5MFY26 was recorded at $14.09bn, a rise of 27.1% when compared to the deficit of $11.08bn in 5MFY25.

During the first 5 months of current fiscal year, exports rose 0.8% to $16.62bn compared to $16.5bn in the same period last year.

Imports rose 11.4% to $30.71bn in 5MFY26 compared to $27.58bn in the same period last year.

The data further details that the workers’ remittances in November increased by 9.4% to $3.19bn as against $2.92bn in November 2024; while on a monthly basis, the remittances went down by 6.8% as compared to $3.42bn in the previous month.

Cumulatively in 5MFY26, workers’ remittances were recorded at $16.15bn as compared to $14.77bn in 5MFY25, depicting a rise of 9.3%.