BUSINESS

Auto financing in Pakistan rises to Rs319bn in December

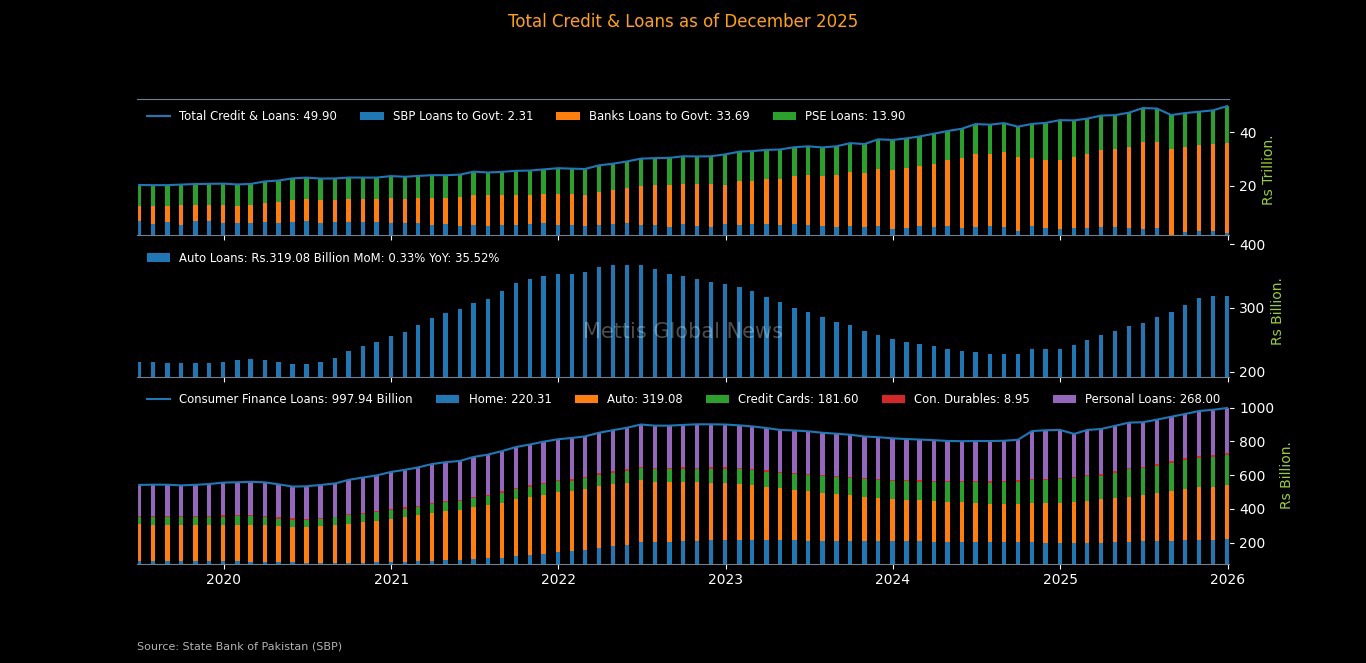

Automobile financing in Pakistan has increased to Rs319.08bn in December 2026, witnessing a rise of 0.33% MoM compared to Rs318.03bn recorded in November 2026, according to the latest data released by the central bank.

On a year on year basis, car financing increased by 35.52%, as in the same period last year, the figure for financing was reported at Rs235.45bn.

This decline is mainly attributed to higher interest rates, an increase in car prices, regulative curbs for acquiring loans, and higher taxes on the import of automobiles and their parts.

Going by the data provided by the State Bank of Pakistan (SBP), consumer financing for house building stood at Rs220.31bn by the end of December 2026, up by 10.3% YoY.

Month-wise, the financing for house building has increased by 2.79% compared to Rs214.32bn incurred in the previous month.

Meanwhile, financing for personal use clocked in at Rs268bn, down by 5.97% YoY and 0.32% MoM.

Thereby, the overall credit disbursed to consumers registered a rise of 14.97% YoY to clock in at Rs997.94bn. Compared to the credit of Rs987.2bn in the previous month, consumer financing has recorded a 1.09% MoM rise.

The data released by the central bank further showed that outstanding credit to the private sector rose 0.85% YoY to Rs10.67tr in December 2026.

On a sequential basis, private sector loans reported a rise of 8.27% MoM compared to the credit of Rs9.86tr in November.

Under the credit to the private sector, the loans to the manufacturing sector clocked in at Rs5.86tr in the review period, down by 6.14% YoY while up 10.35% MoM.

The borrowing from the construction sector stood at Rs219.34bn in December, up by 0.27% YoY and 7.95% MoM.

Going forward, the data further shows that loans to the agriculture, forestry, and fishing sectors rose to Rs617.91bn in the month under review, up by 34.09% YoY, and on a sequential basis, the loans to the same sector recorded growth of 12.04% MoM.

Netflix results likely to take backseat to Warner Bros deal questions

Netflix has been locked in a heated battle with Paramount Skydance, which has offered $108.4 billion for all of Warner Bros Discovery

Netflix’s plans to accelerate revenue growth by buying Warner Bros will be in focus on Tuesday when it reports fourth-quarter results, as the streaming pioneer battles Paramount for one of the most prized studios in Hollywood.

A strong lineup of originals, including the final season of hit TV series “Stranger Things”, the latest “Knives Out” movie, and Christmas Day National Football League games, are expected to power the best holiday-quarter revenue growth since 2020.

But investors are looking ahead and Netflix has yet to see meaningful returns from two of its most costly bets – pushes into advertising and videogames. The end of “Stranger Things”, its most-watched show ever, also leaves a hole that Netflix may turn to Warner Bros to fill.

Its $82.7 billion pursuit of Warner Bros’ streaming and studio assets would provide Netflix with a prized content library that includes “Friends”, “Game of Thrones” and “Harry Potter”.

Netflix, which has built fewer blockbuster franchises than rivals like Disney, can tap the cultural clout of the titles to come up with a new generation of streaming-tailored spin-offs, prequels and sequels. Investors will want to know how.

Tuesday’s earnings call with analysts will be Netflix’s first since it announced the deal on December 5.

“The earnings will be overshadowed by what Netflix says about the deal … what’s next and the questions around it,” PP Foresight analyst Paolo Pescatore said.

Netflix prepares all-cash offer for Warner Bros, source says

Netflix has been locked in a heated battle with Paramount Skydance, which has offered $108.4 billion for all of Warner Bros Discovery including cable assets that Netflix doesn’t want.

The race is expected to drag on for months as both companies try to sway investors, with Netflix planning to switch its cash-and-stock deal into an all-cash offer, Reuters has reported. Strong regulatory scrutiny in the U.S. and Europe is also likely.

Buying Warner Bros would make Netflix the biggest global streamer by far with about 428 million subscribers. Investors are going to want to understand why that won’t fall afoul of antitrust rules – Netflix believes it is competing with YouTube, America’s most-watched TV distributor, although regulators may be skeptical, Reuters has reported.

Uncertainty over the outcome has piled pressure on the Netflix stock, which has declined for four straight months and marked a weak start to 2026 with a 6% fall. Nearly a third of the analysts covering the shares have lowered their targets since the deal announcement.

The upside for Netflix of the HBO acquisition is potentially stabilizing subscriptions, whether the services remain separate or together. Netflix has the industry’s lowest cancellation rate and could stem user losses at HBO Max by bundling the services and deploying its recommendation engine, among other plans the company could lay out after results.

Paramount to nominate directors for election at Warner Bros Discovery, files lawsuit

LIVE EVENTS FUEL EARNINGS

As for the results themselves, analysts expect that live events will play a more central role in driving revenue by attracting and retaining viewers.

The Detroit Lions vs Minnesota Vikings match on Netflix on Christmas Day broke records to become the most streamed game of the major league sport in the U.S. The streamer also recently expanded its U.S. WWE rights to include the historical library.

Its overall revenue likely rose 16.82% in October to December to $11.97 billion, slightly slower than the 17.2% growth in the previous quarter, according to data compiled by LSEG.

Analysts project about 13% revenue growth for Netflix in 2026.

Although the company stopped sharing subscriber figures a year ago, Visible Alpha estimates net additions of around 10 million, ending the year with more than 327 million users.

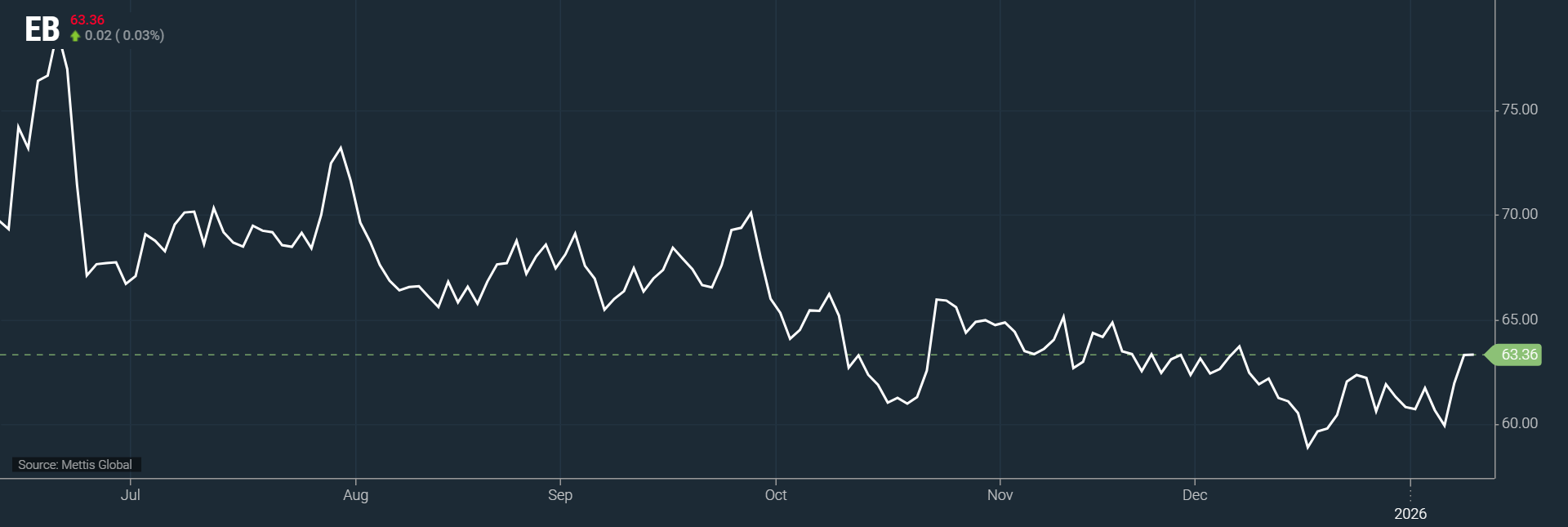

UAE stocks jump as supply fears lift oil

Abu Dhabi’s benchmark index advanced 0.7% to a second session

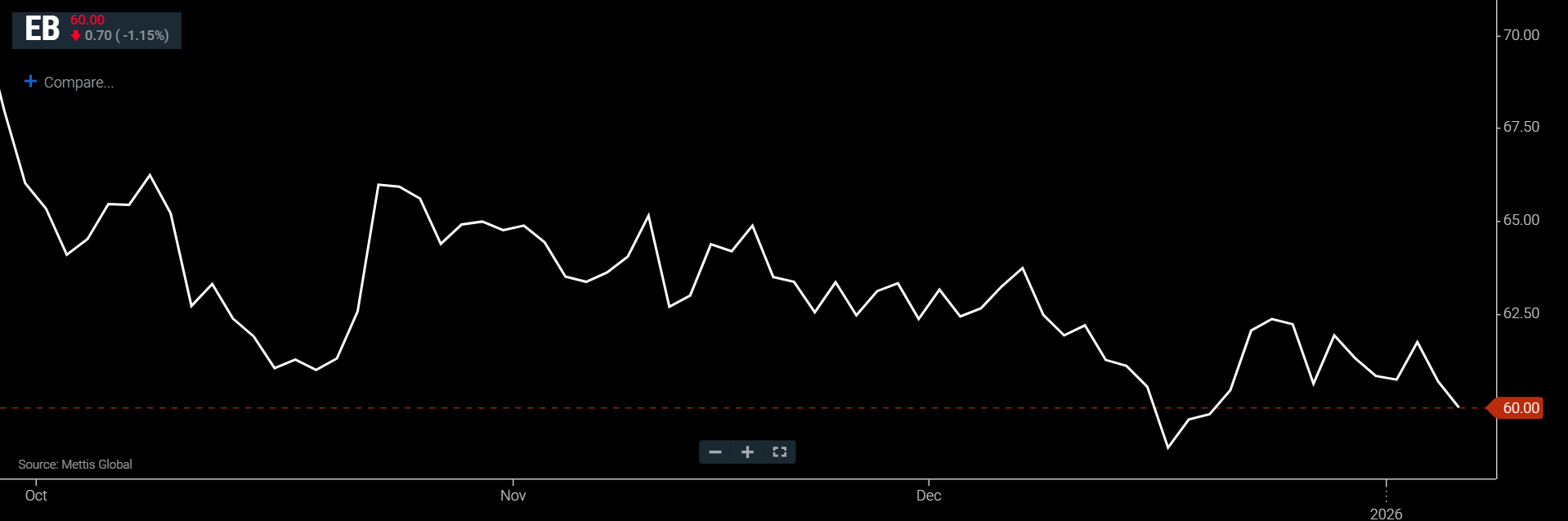

Stock markets in the United Arab Emirates closed higher on Friday tracking oil prices, as investors continued to weigh supply risks despite the receding likelihood of a U.S. military strike against Iran.

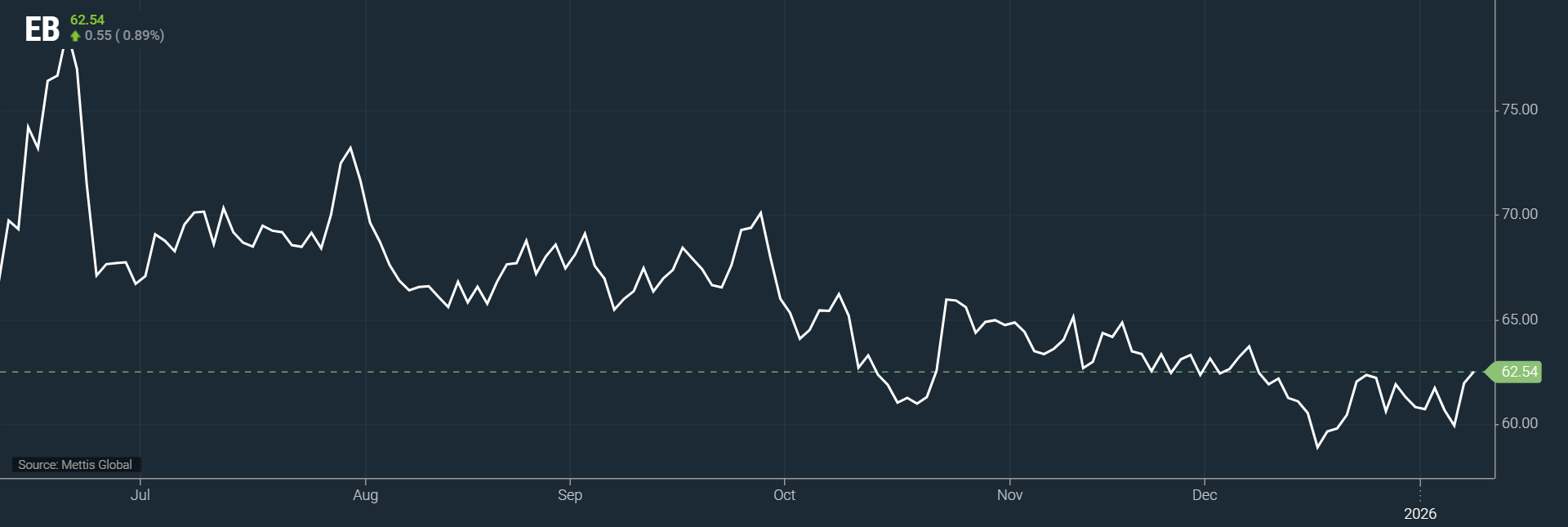

Oil prices, a key contributor to the Gulf’s economies, were up 1.22% to $64.54 a barrel by 1106 GMT.

Dubai’s main market climbed 0.9%, snapping a two-sessions losing streak, as heavyweight financial and real estate stocks led the rebound.

Blue-chip developer Emaar Properties rose 1.1%, while top lender Emirates NBD Bank jumped 1.3%.

Dubai World Trade Centre and UK’s Informa Group are said to be eyeing a listing of a joint events business, Bloomberg News reported on Friday.

Abu Dhabi’s benchmark index advanced 0.7% to a second session with Adnoc Gas gaining 0.6% and construction giant Aldar Properties increasing 1.3%.

Among the gainers, state-controlled AD Ports Group surged 4.4% after it finalised a deal to sell land to Danube Properties for AED 840 million ($228.71 million).

Abu Dhabi state oil firm ADNOC is weighing entering Venezuela’s energy industry and could seek a partnership with another international producer to participate in the nation’s gas projects, Bloomberg News reported on Thursday, citing people familiar with the matter.

Dubai index notched up 1.5% in the week, while Abu Dhabi recorded 1.1% weekly gains, according to data compiled by LSEG.

Air India, Singapore Airlines to deepen ties with ‘cooperation framework’

Airlines said the agreement could include expanding both carriers’ corporate travel programmes

Air India and Singapore Airlines on Friday announced an agreement to improve cooperation between the two flag carriers, a step towards offering more routes, coordinating schedules and broadening the scope of their collaboration outside their home markets.

The pact, described by the two airlines as a “commercial cooperation framework agreement”, comes as Air India faces a financial hit from an airspace ban imposed by Pakistan, which has forced the airline to discontinue some routes to the U.S. from India.

The airlines said the agreement could include expanding both carriers’ corporate travel programmes, a key source of high-yield revenue for airlines.

The pact is subject to regulatory approvals and signing of definitive agreements, the airlines added.

Air India already has a codesharing agreement with Singapore Airlines, which owns a 25% stake in the company. Tata Group owns the remaining 75%

Punjab govt urged to lift ban on medical representatives’ visit to public hospitals

‘They are not criminals. They are doing a respectable job,’ says Pakistan Pharmaceutical Manufacturers Association’s former chairman Tauqeer Ul Haq

Pakistan’s pharmaceutical firms have approached the Punjab government to lift a ban on medical sales representatives’ visit to government hospitals and develop standard operating procedures (SOPs) to regulate such visits if need be.

Earlier, the provincial government arrested, and released on bail, three medical sales representatives from a public hospital in violation of rules banning them entering the buildings to meet doctors there.

Pakistan Pharmaceutical Manufacturers Association (PPMA) has written a letter to Punjab Minister for Specialized Healthcare and Medical Education Khawaja Salman Rafique, seeking an appointment with him and sharing its concerns over the ban and arrest of their staffers.

“We are expected to meet the health minister in the next couple of days,” PPMA former chairman Tauqeer Ul Haq told Business Recorder.

“The medical representatives (MRs) are responsible to inform doctors about medicines and their side effects,” he said, adding “This is more than a business. It happens around the globe. This is not good for the patients as well.”

He stressed that the Punjab government should develop SOPs for MRs if authorities think such visits are creating issues. For instance: restricting the time they can visit, or setting a limit on the number of hours per visit.

“They (MRs) can be regulated with the pharmaceutical firms on the board…instead of arresting them. They are not criminals. They are doing a respectable job,” the PPMA former chairman said.

Haq added that pharmaceutical firms supply medicines to government hospitals at cost-price to support them.

They have also created job opportunities for many youngsters, who work as MRs.

“They are doing respectable jobs. If they lose their jobs where will this youth go? They are taxpayers. They are not criminals. They should not have to worry about arrests. There is already a shortage of job opportunities in the country,” he said.

Earlier, PPMA senior vice chairman Kamran Nasir said that the association is assessing the situation and will come up with a measured response, including reaching out the government of Punjab to ensure that no untoward incident takes place in the future that will be detrimental for all stakeholders.

The Punjab Health Department has enforced a blanket prohibition on the presence of medical representatives from private pharmaceutical firms in public-sector hospitals. It issued formal instructions to all medical superintendents. Under the directive, hospital administrations were required to initiate legal action and disciplinary measures against any one including doctors, it was learnt.

The restrictions were aimed at curbing improper influence on prescribing decisions, remove potential conflicts of interest, and protect patients in public hospitals from commercial interference.

Is Pakistan entering a once in a generation moment?

Pakistan appears to be entering a rare moment of strategic opportunity as global geopolitical alignments shift and long-standing power structures come under pressure.

Developments ranging from political upheaval in Venezuela and continued instability in Iran to rising tensions involving the Middle East are reshaping how major powers deploy influence.

As global uncertainty rises, countries with security capacity, manufacturing depth and regional reach are gaining renewed relevance and Pakistan is increasingly one of them.

A central feature of the current global landscape is the recalibration of United States foreign policy.

Rather than engaging in prolonged nation-building efforts, Washington is favoring limited but decisive interventions, coupled with pressure on regional powers to assume greater responsibility for their own security.

This approach has been visible in Latin America, the Middle East and beyond, and it has accelerated the emergence of new regional security frameworks.

The implications for emerging markets, including Pakistan, were explored during a recent KTrade Research webinar on global power realignment.

For Pakistan, this shift has particular significance in the Middle East. Gulf states, led by Saudi Arabia and increasingly coordinated with Turkey, are rethinking their long-term defence and security arrangements.

Years of conflict in Ukraine have exposed serious strains in Western defence supply chains, prompting regional actors to seek reliable alternatives that can deliver equipment, maintenance and munitions without long delays.

Pakistan’s defence manufacturing capacity and operational experience have therefore moved back into strategic focus.

This growing security role carries economic implications that extend well beyond arms sales.

Defence cooperation is increasingly tied to co-production, industrial localization and technology partnerships.

These arrangements require supply chains, skilled labor, research and long-term capital investment.

If developed strategically, they could help Pakistan move away from a narrow export base dominated by textiles and low-value goods toward more durable, higher-value industrial activity.

At the same time, global supply-chain realignment is creating additional openings.

As companies seek alternatives to concentrated production hubs in East Asia, countries offering competitive energy costs and labour are gaining attention.

Security challenges remain, particularly along Pakistan’s western border.

Prolonged uncertainty in Iran and Afghanistan risks the expansion of militant safe havens, which could increase pressure on domestic security and complicate regional engagement.

Managing these risks while maintaining constructive ties with neighbors will be critical to sustaining any broader strategic gains.

The larger risk, however, lies at home. Pakistan has historically struggled to convert geopolitical relevance into lasting economic reform.

Short-term inflows and political comfort have often taken precedence over investment in productivity, industrial ecosystems and export diversification.

Repeating that pattern would squander a moment that may not return soon.

What distinguishes the current period is the convergence of factors. Pakistan finds itself aligned with shifting US priorities, rising Gulf security needs, and a global search for new supply-chain partners a combination rarely seen in recent decades.

The opportunity is real, but so is the test.

The question facing Pakistan is no longer whether the world is changing in its favour. It is whether the country can finally change fast enough to take advantage of it.

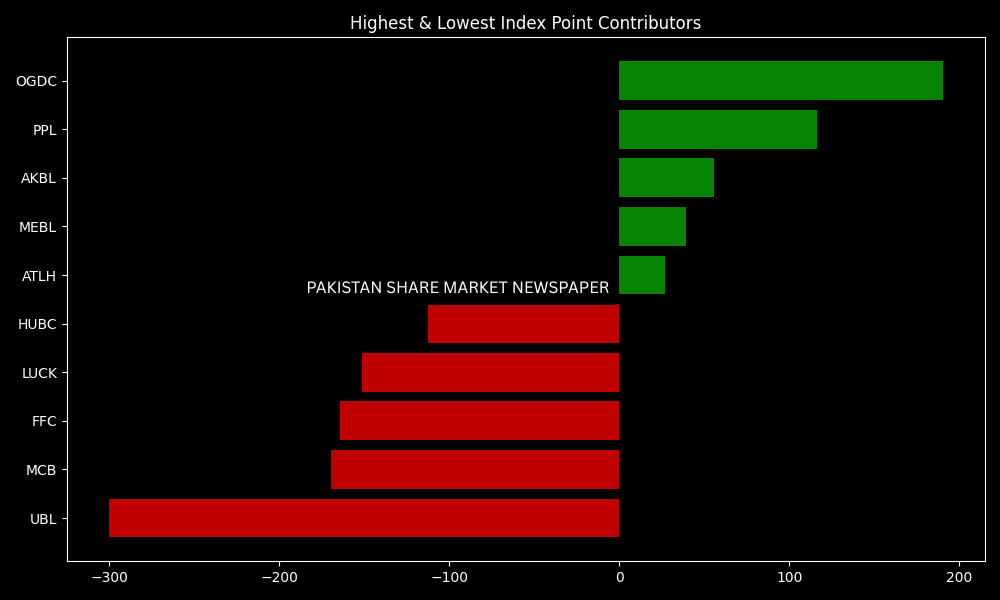

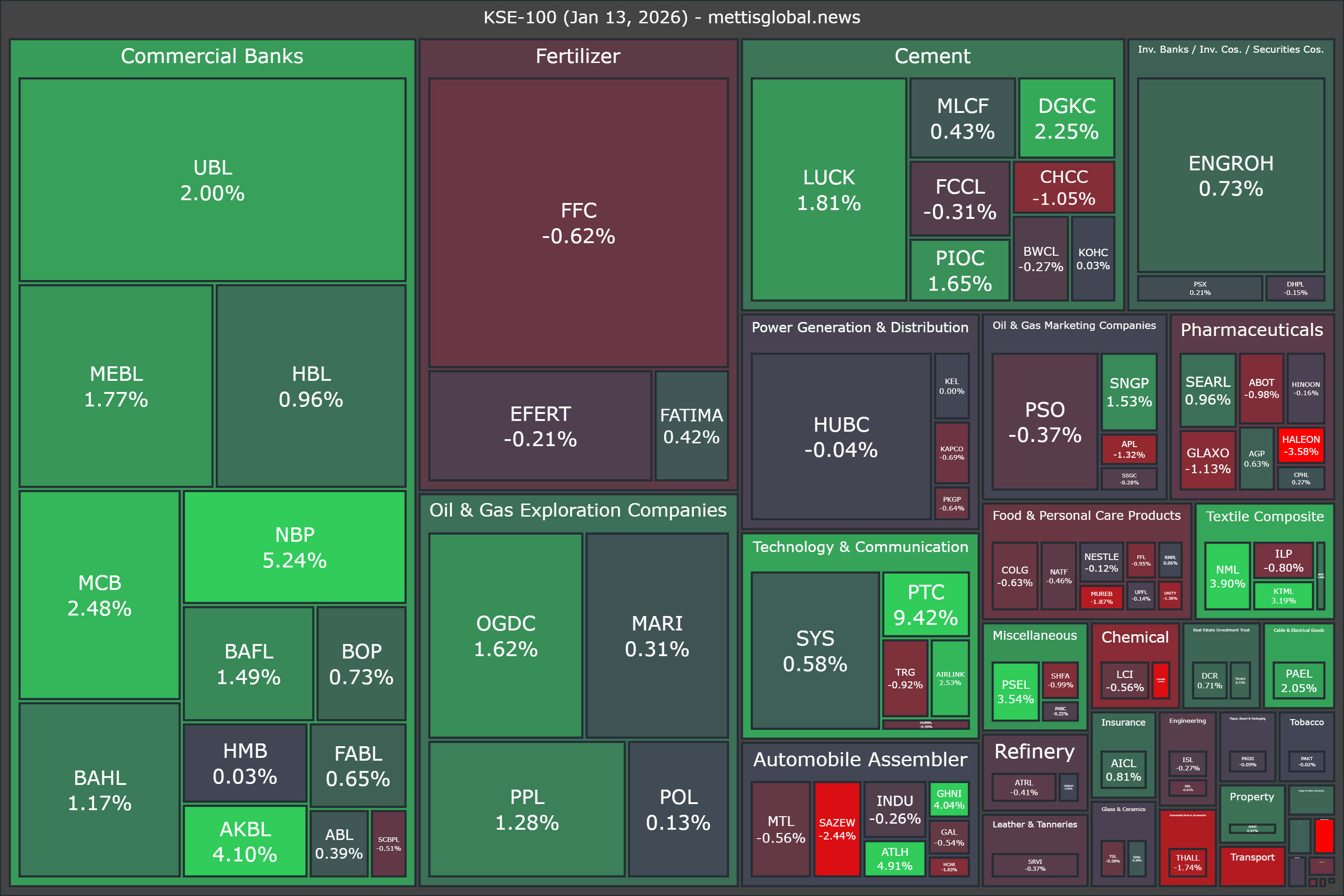

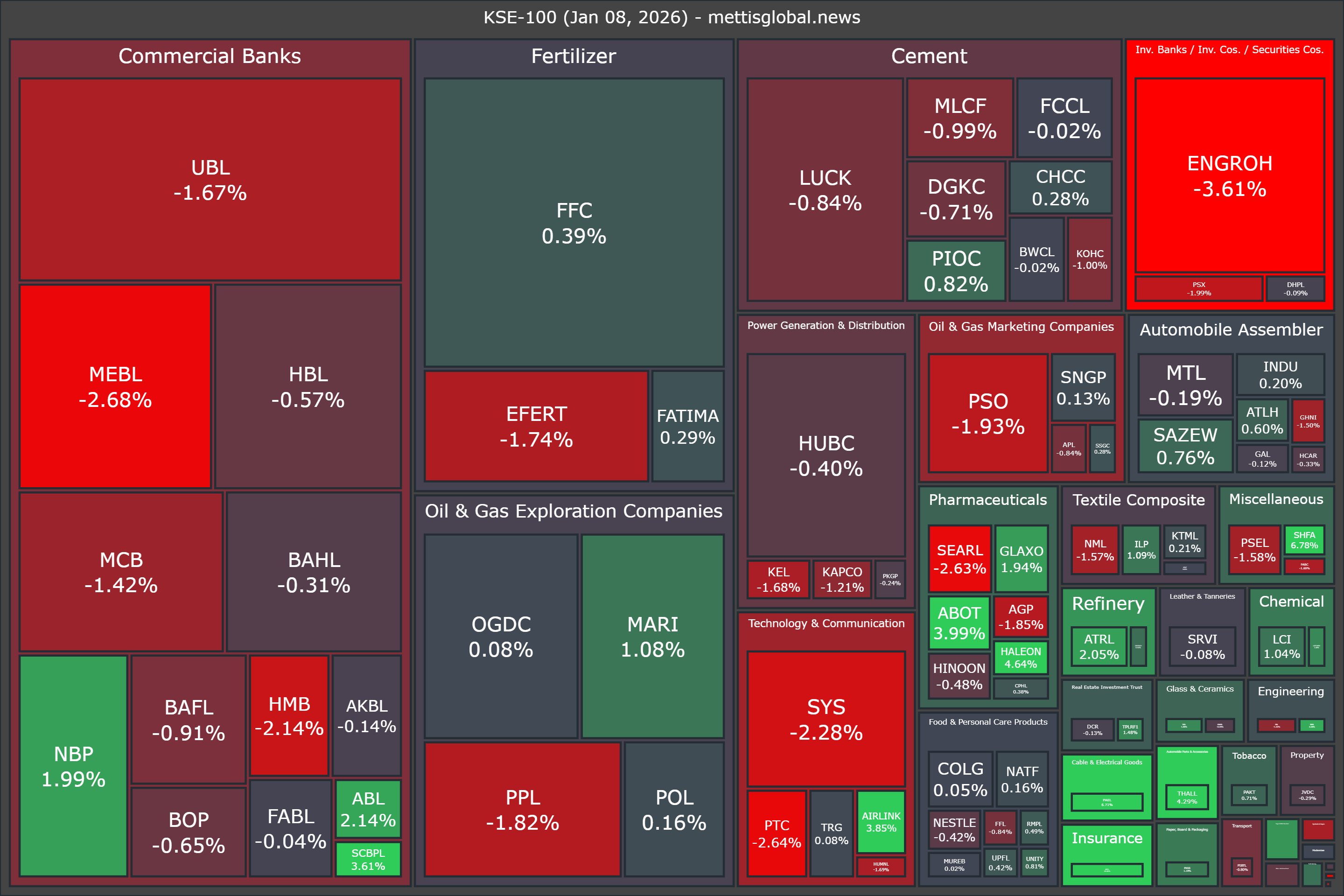

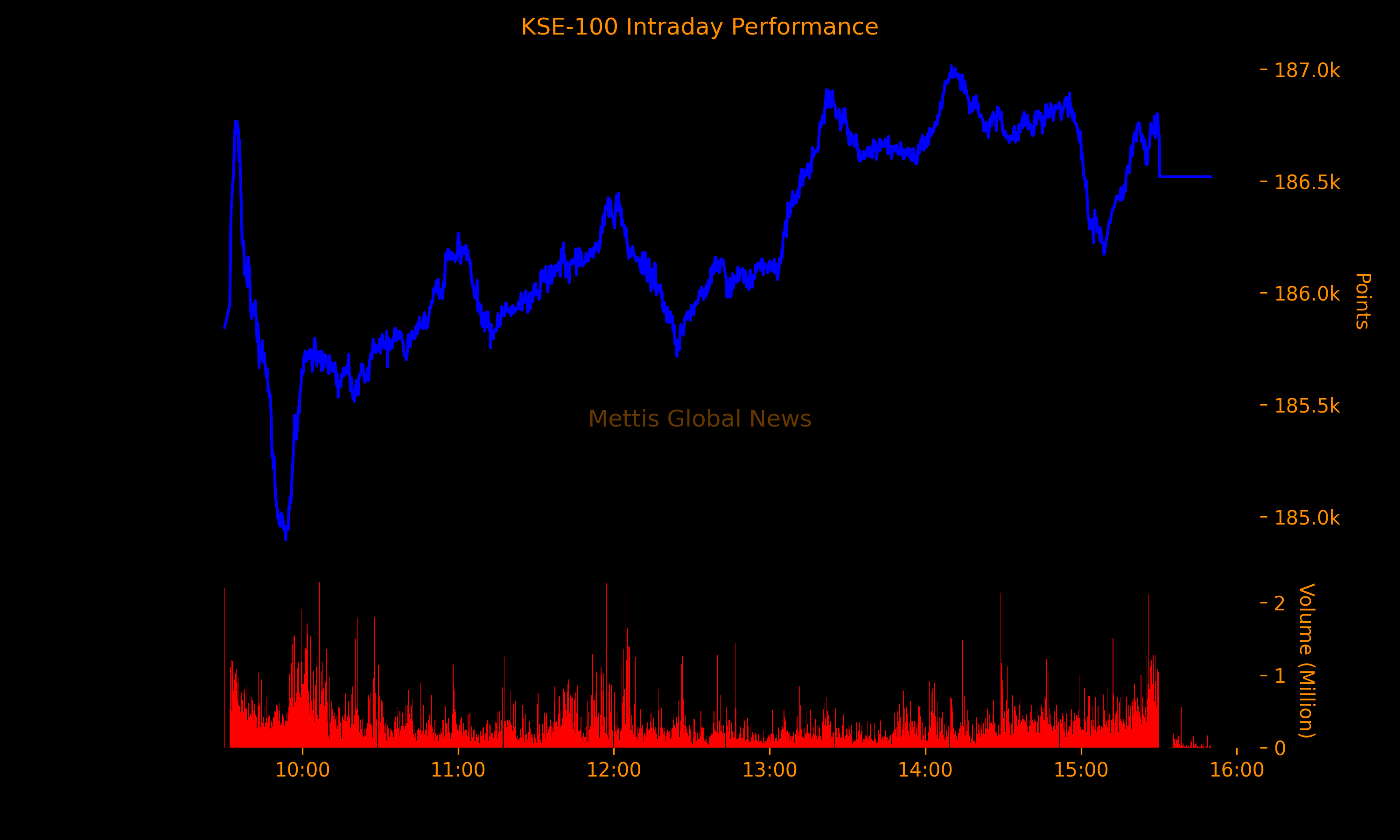

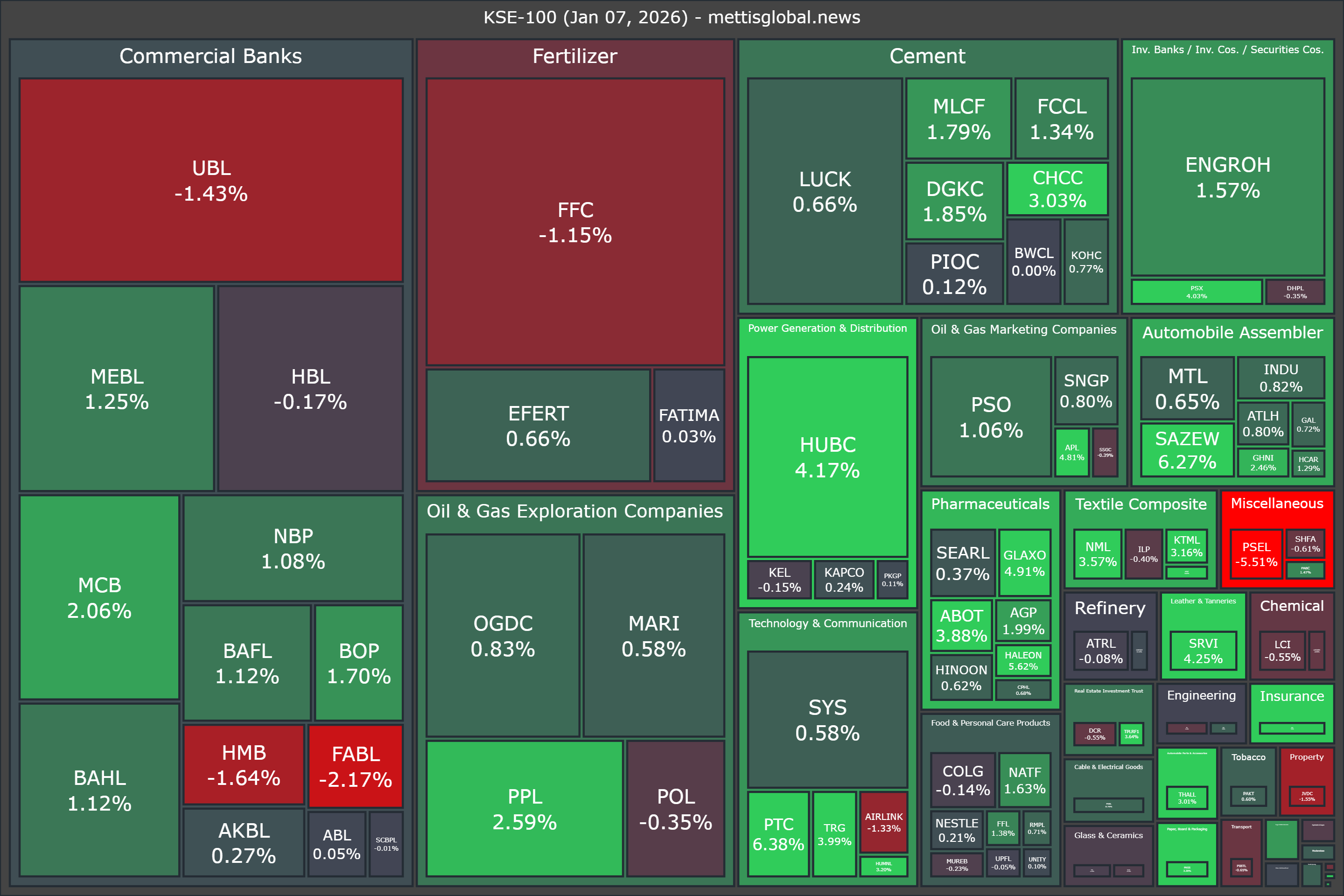

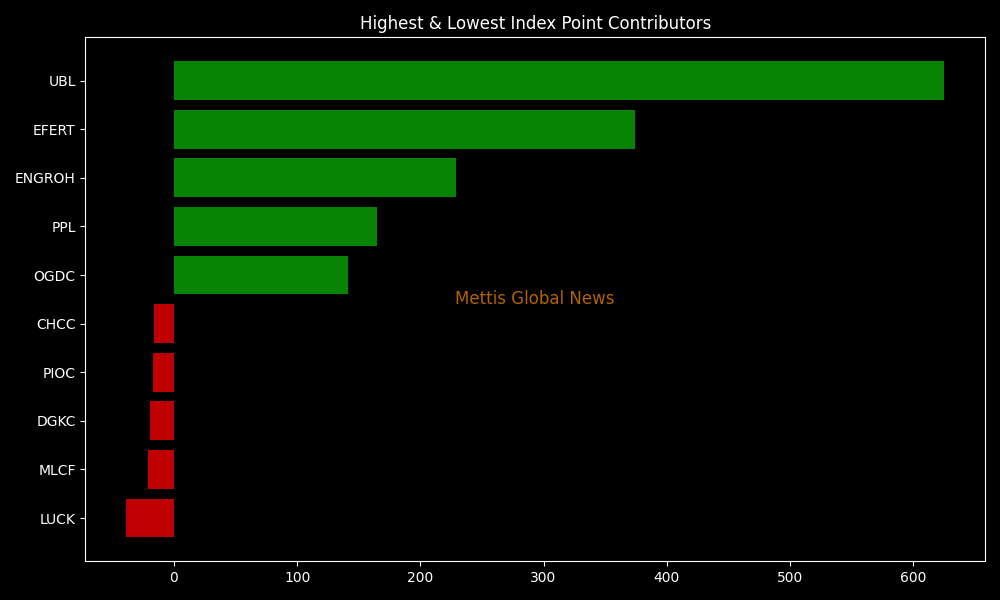

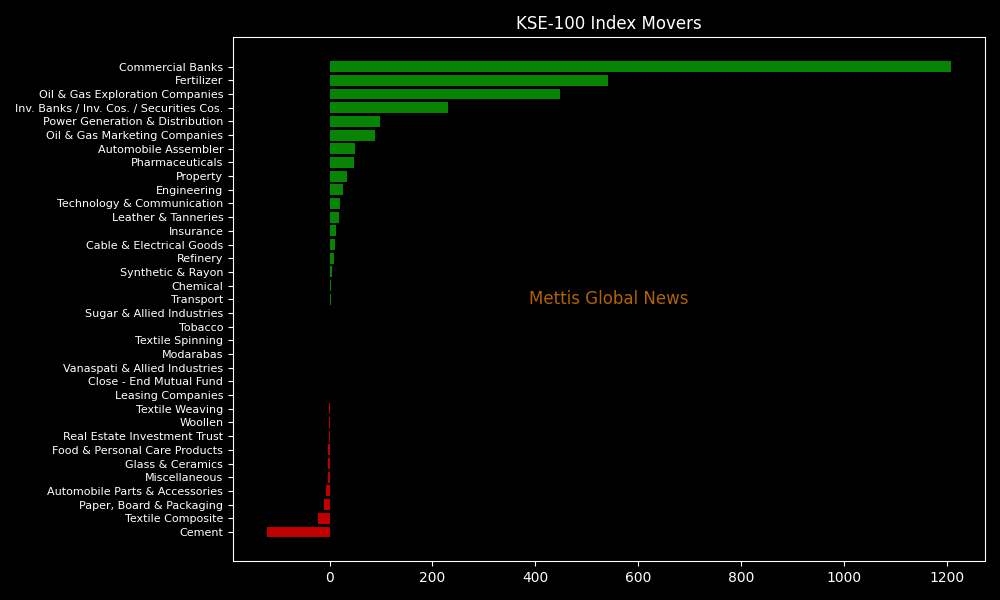

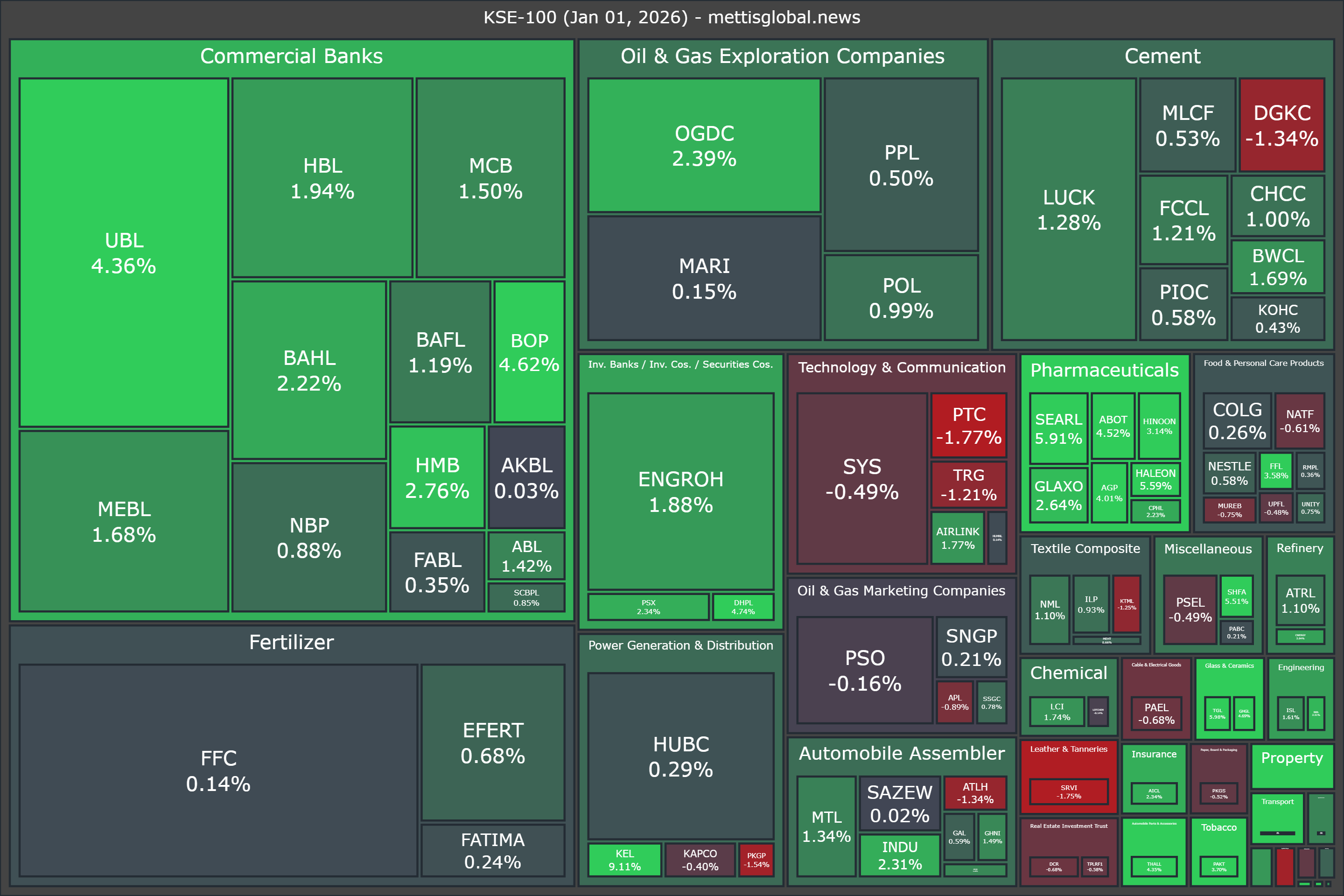

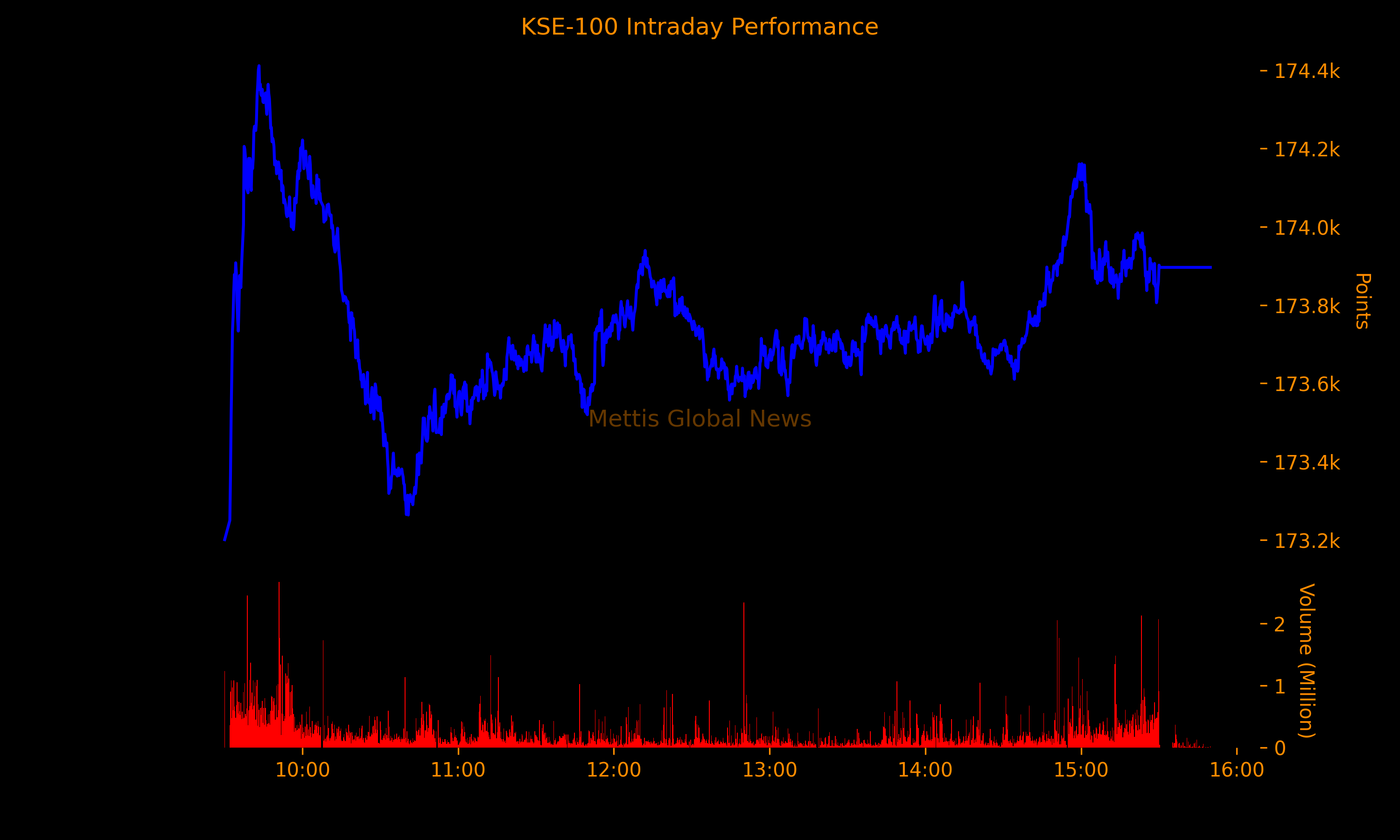

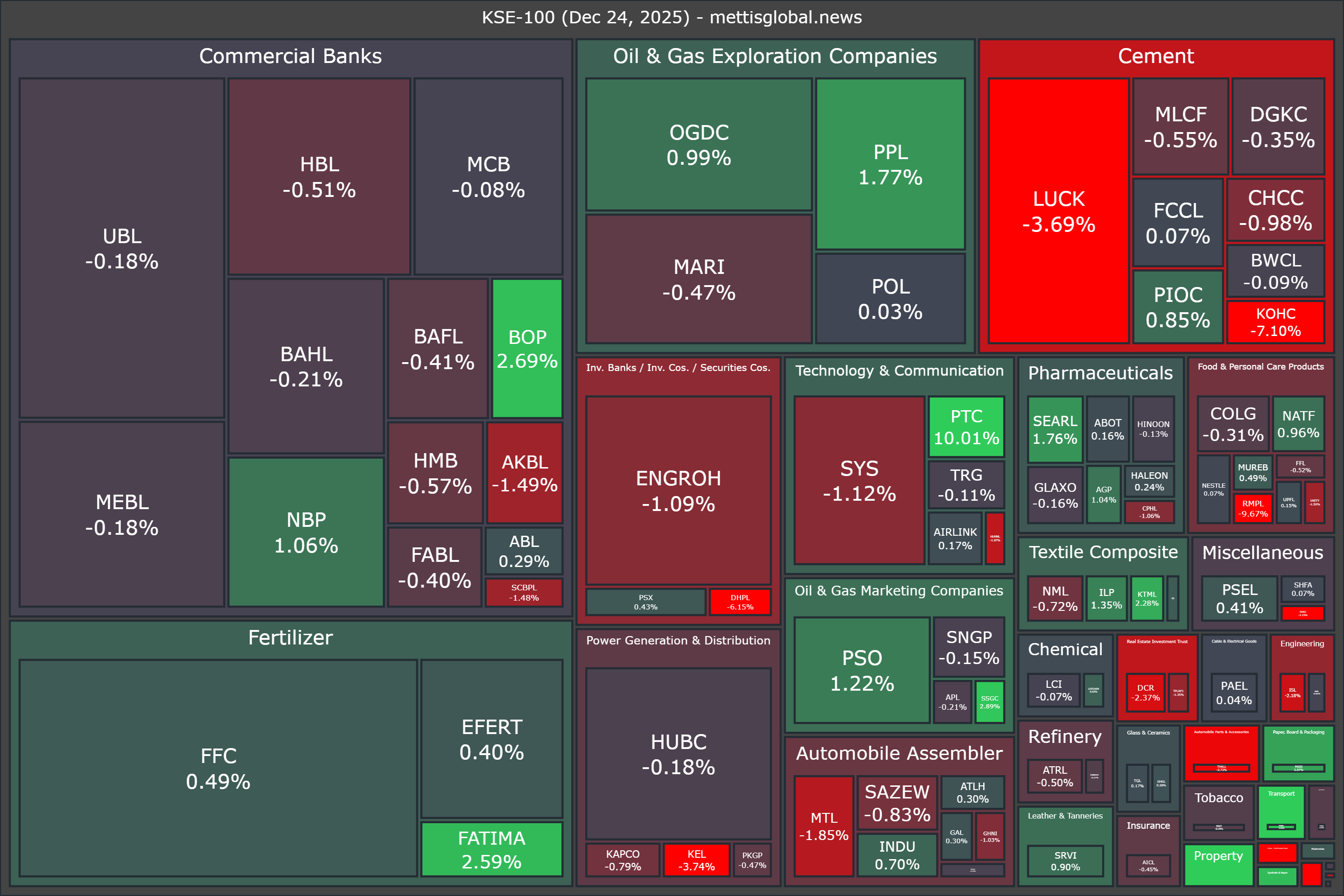

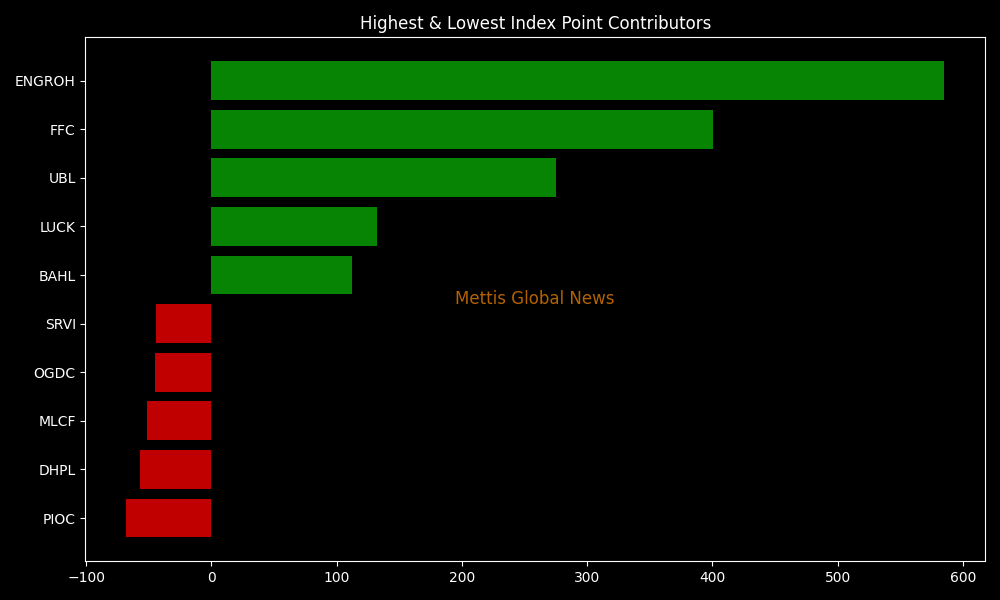

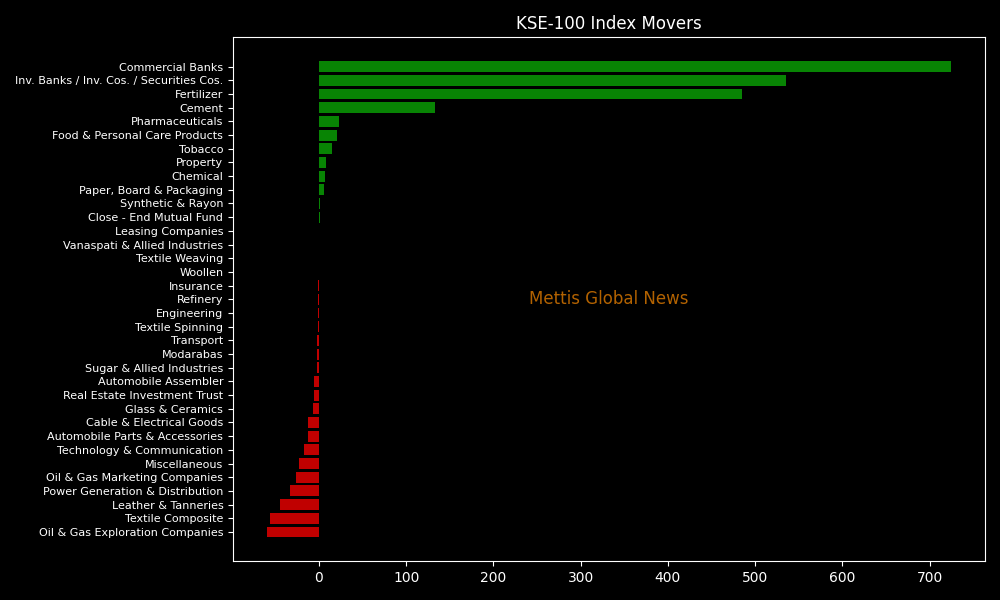

PSX Closing Bell: Bulls Keep the Flame Alive

pakistansharemarketnp@gmail.com0Edit

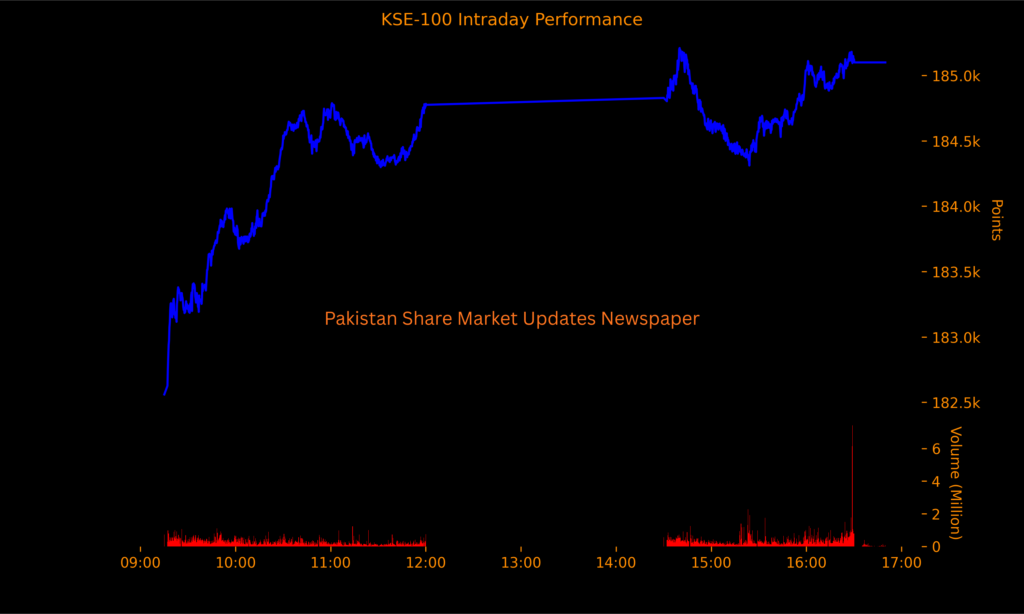

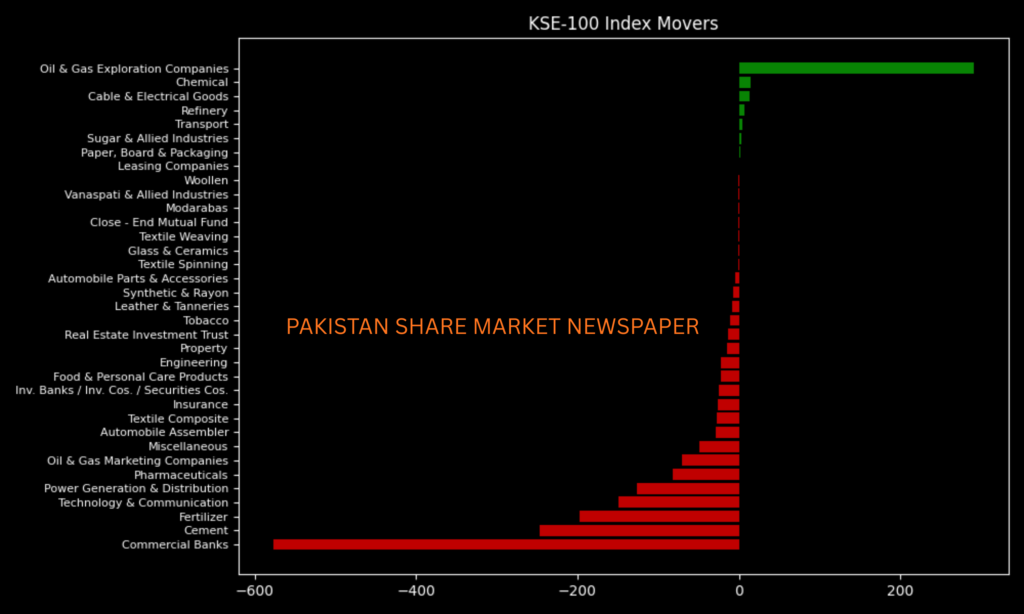

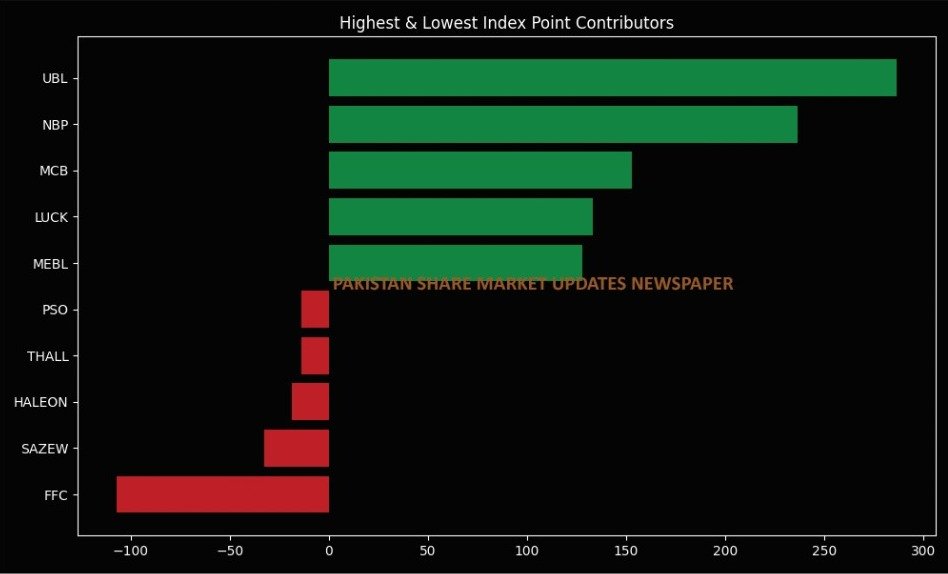

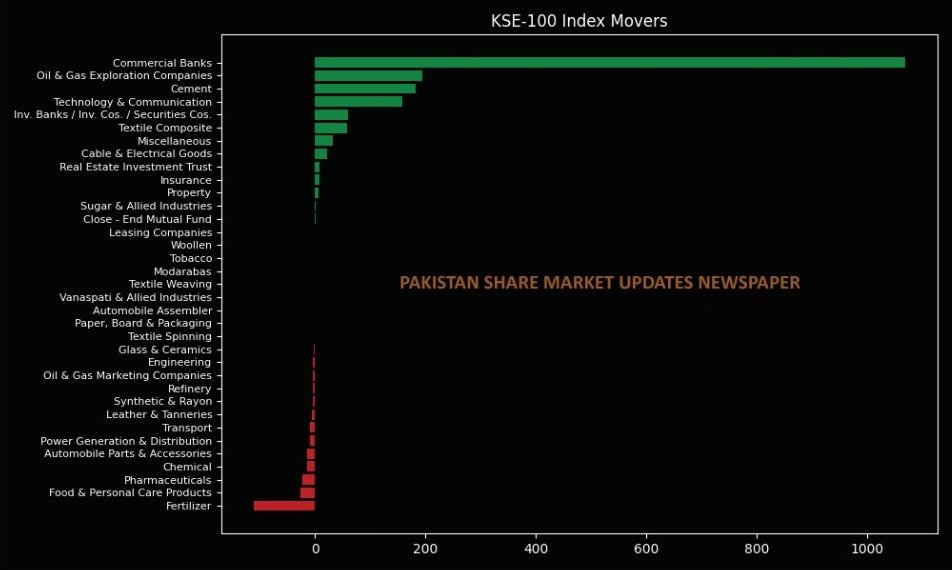

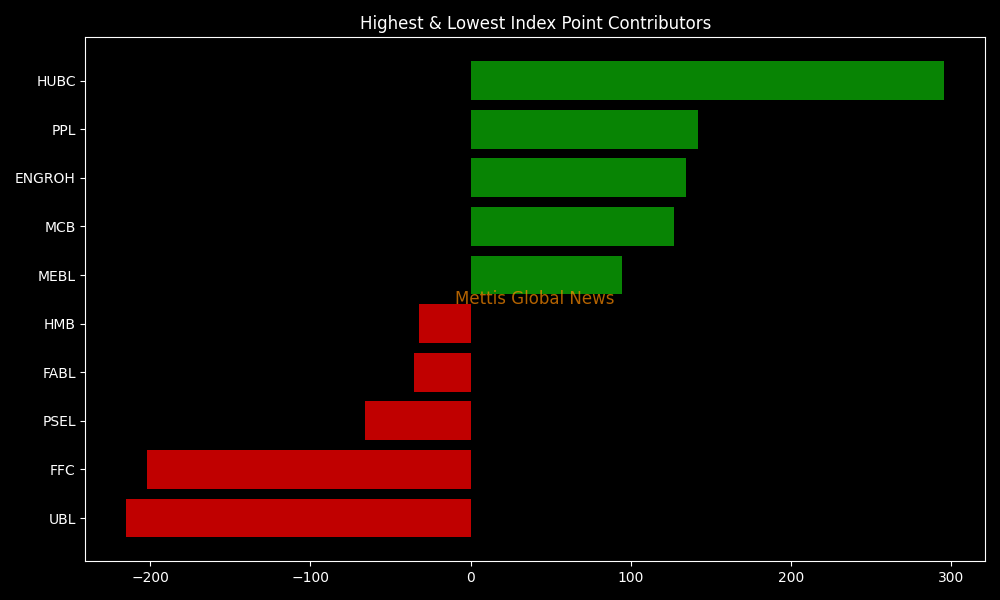

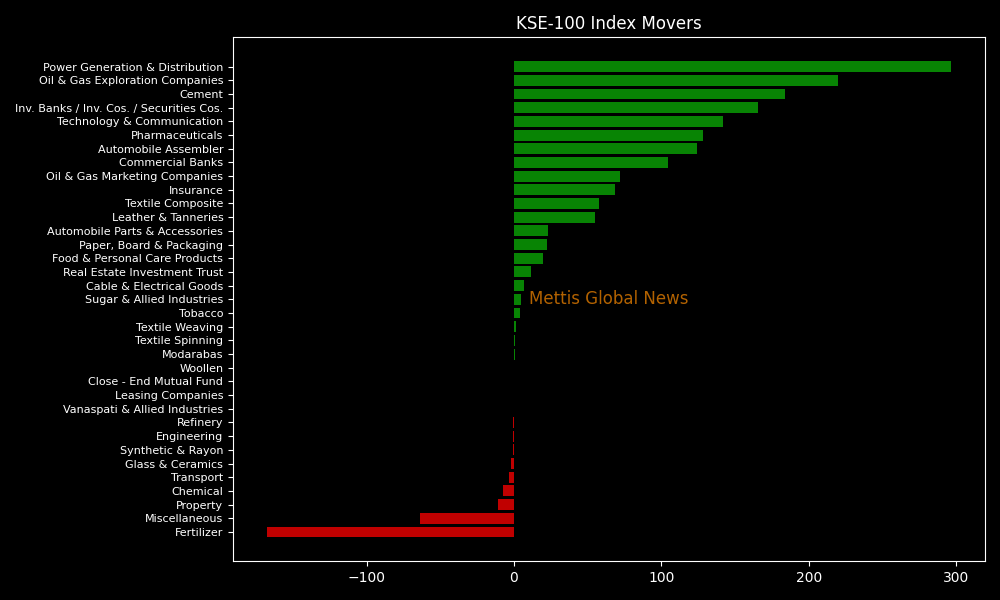

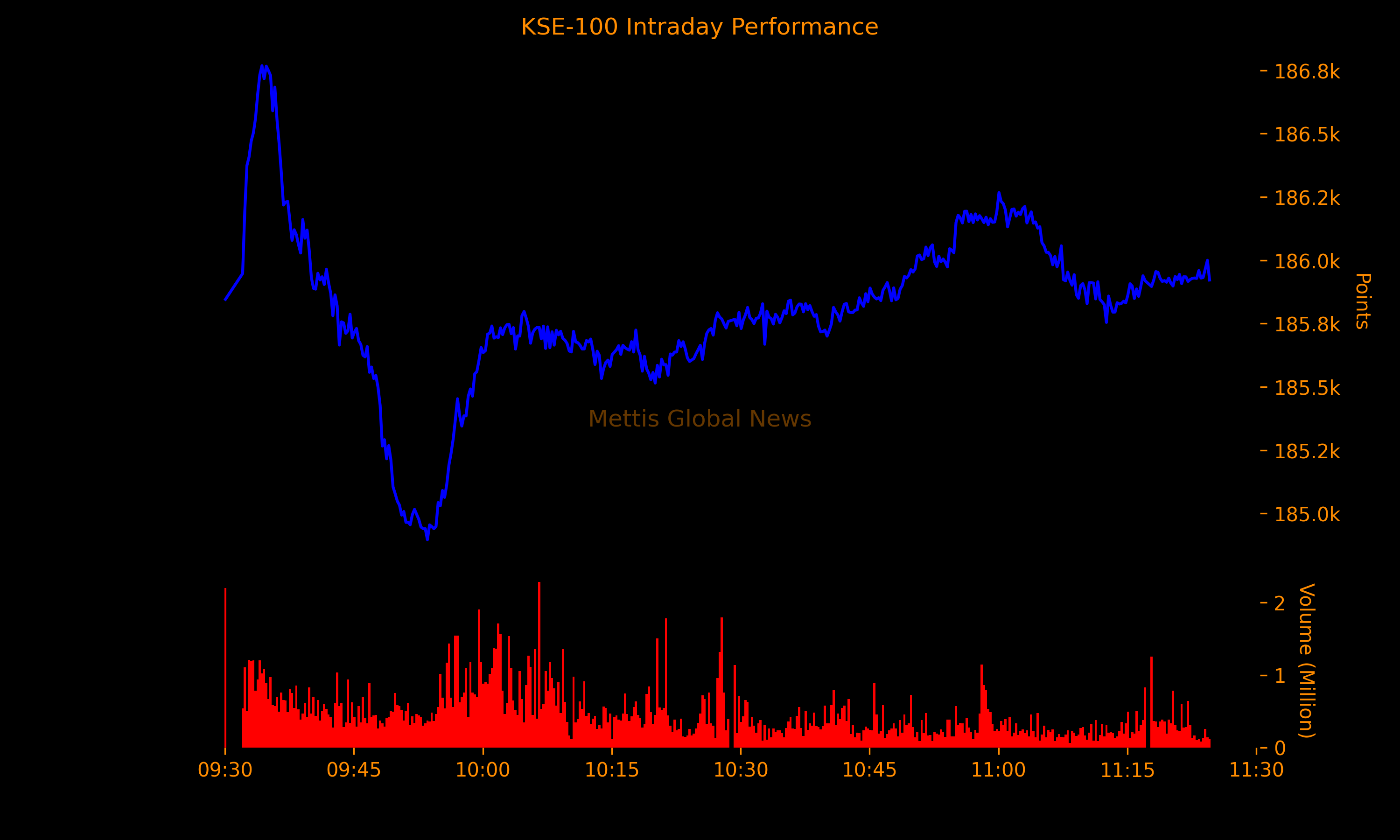

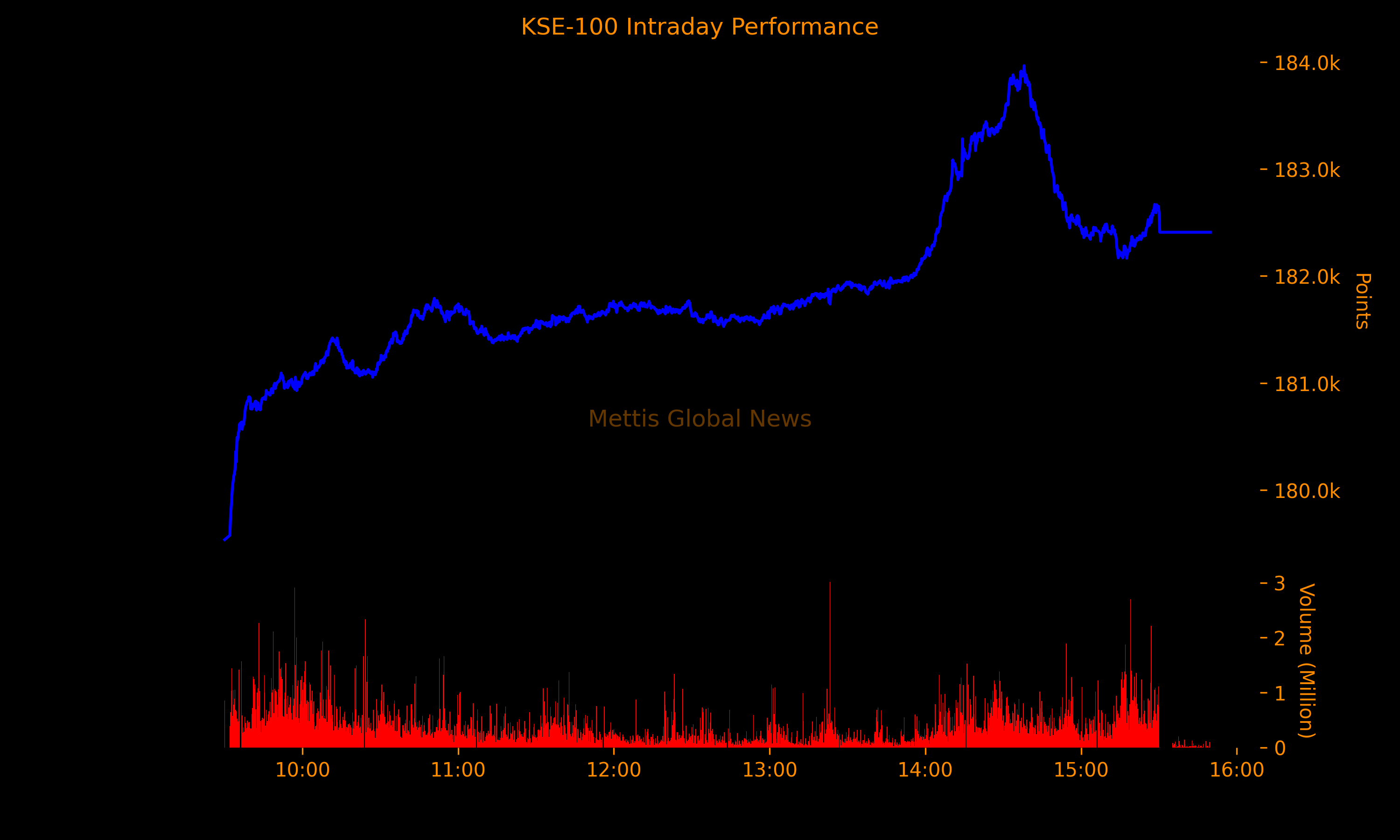

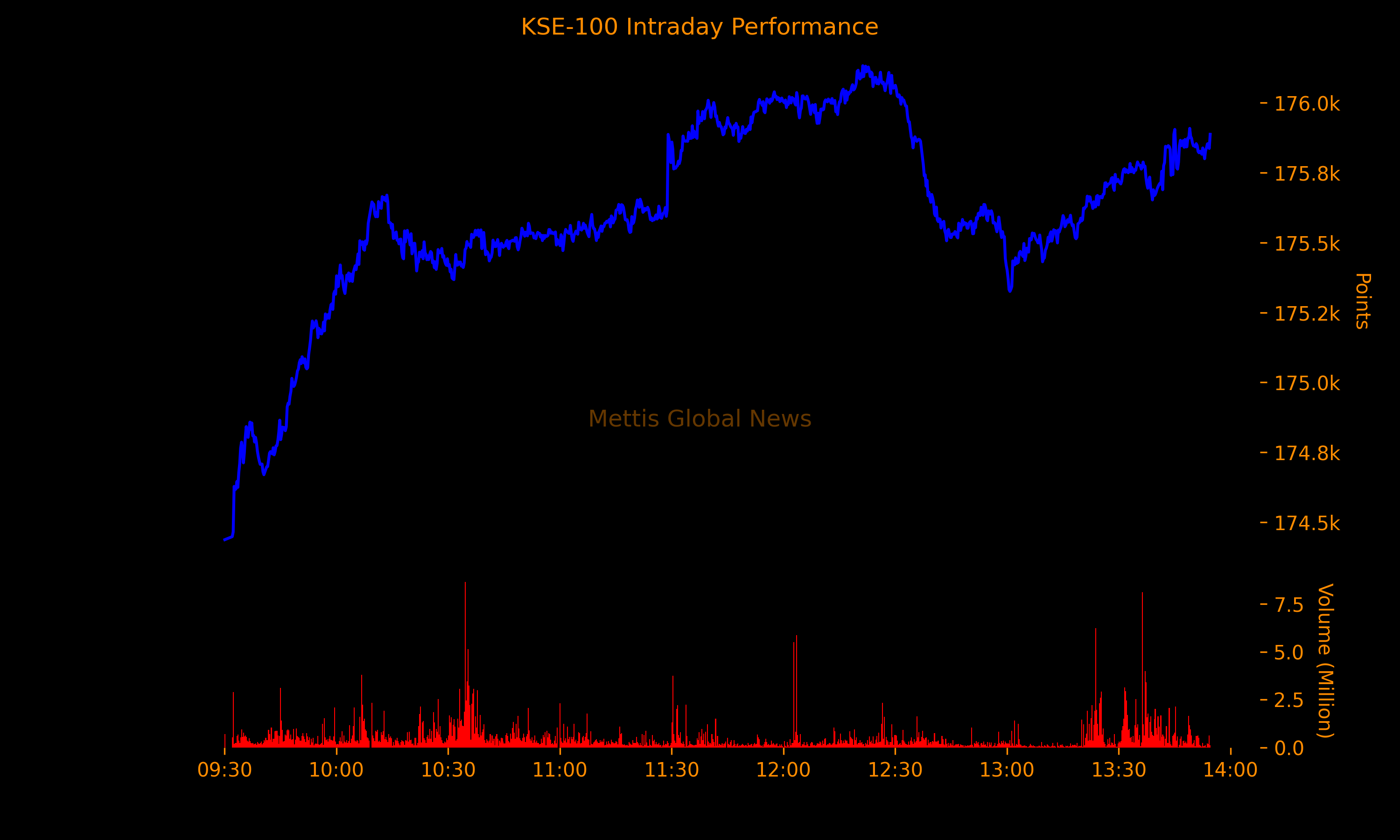

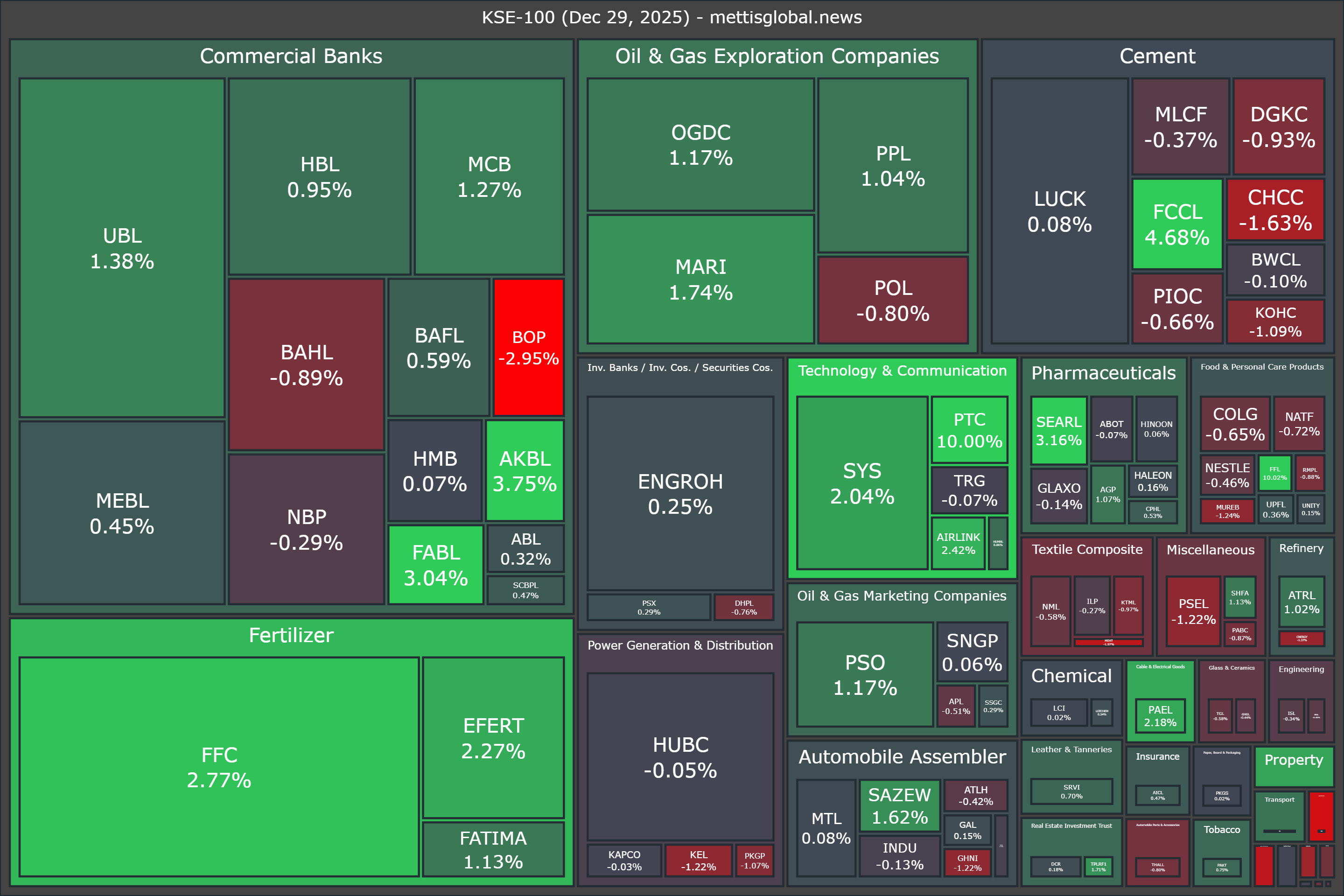

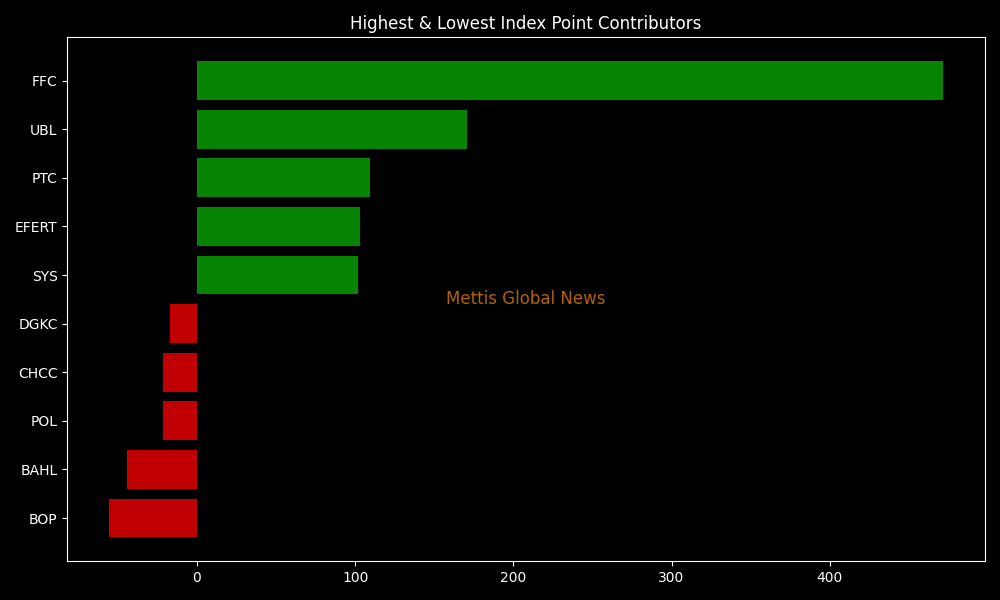

The benchmark KSE-100 Index concluded Friday’s trading session at 185,098.83, showing an increase of 3,642.50 points or 2.01%.

The index remained positive throughout the day showing an intraday high of 185,208.98 (+3,752.65) and a low of 182,559.69 (+1,103.36) points.

Market mood drew additional support from the federal government’s move to maintain existing fuel prices for the upcoming fortnight beginning January 16, 2026.

The price of High Speed Diesel has been retained at Rs257.08 per litre, while petrol continues to be sold at Rs253.17 per litre.

Internationally, concerns linked to the prospect of US action against Iran and the resulting implications for global markets subsided after Washington scaled back its posture by pulling out a portion of its military personnel from bases across the Middle East.

The total volume of the KSE-100 Index was 381.92 million shares.

Of the 100 index companies 89 closed up, 11 closed down, while 0 were unchanged.

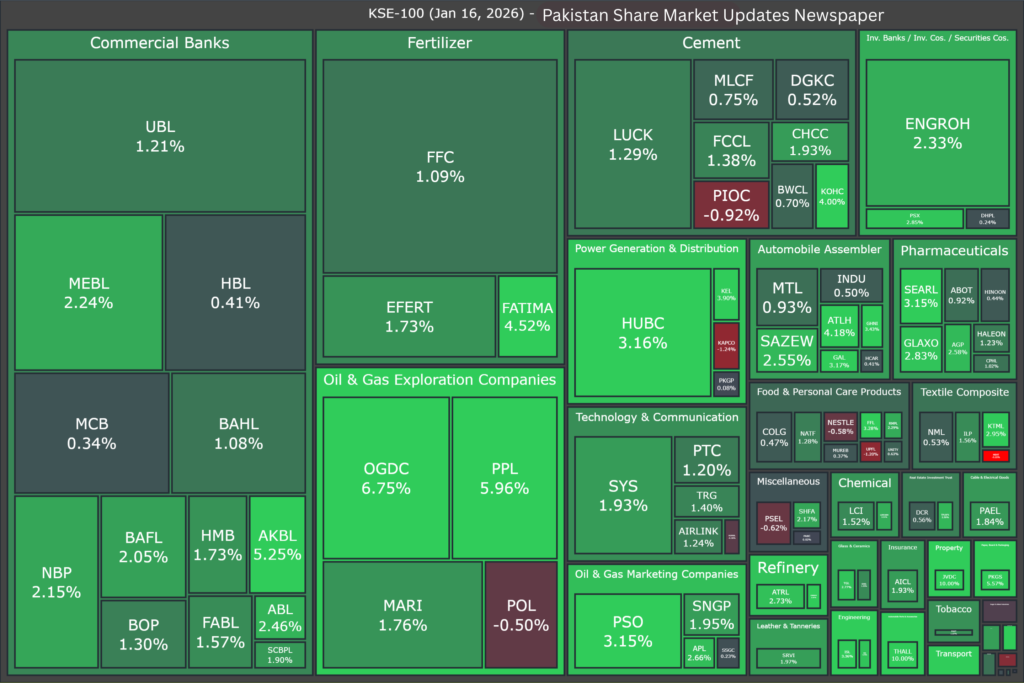

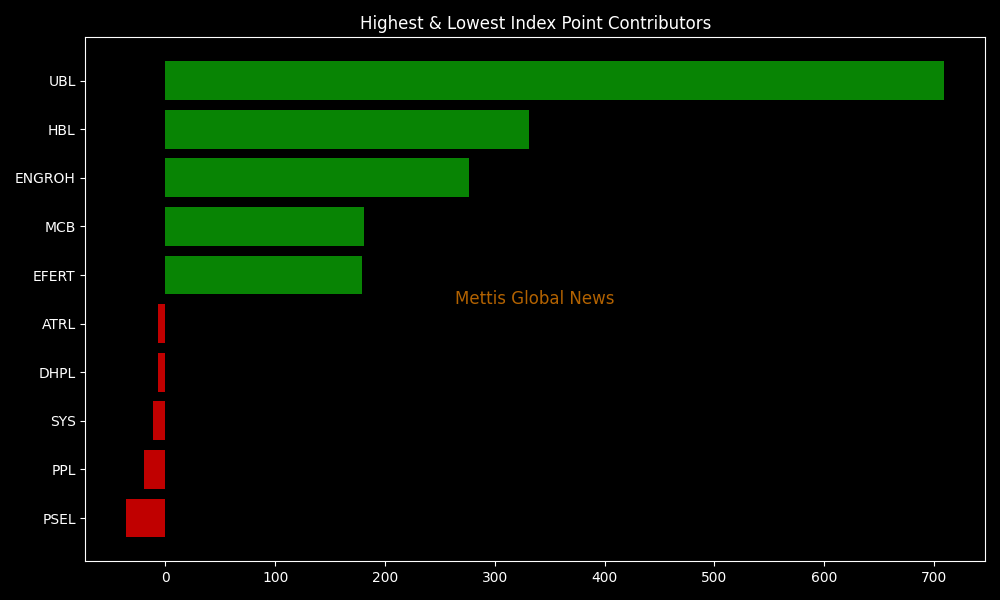

Top gainers during the day were THALL (+10.00%), JVDC (+10.00%), OGDC (+6.75%), PPL (+5.96%), and PKGS (+5.57%).

On the other hand, top losers were MEHT (-3.22%), KAPCO (-1.24%), UPFL (-1.20%), GADT (-1.05%), and PIOC (-0.92%).

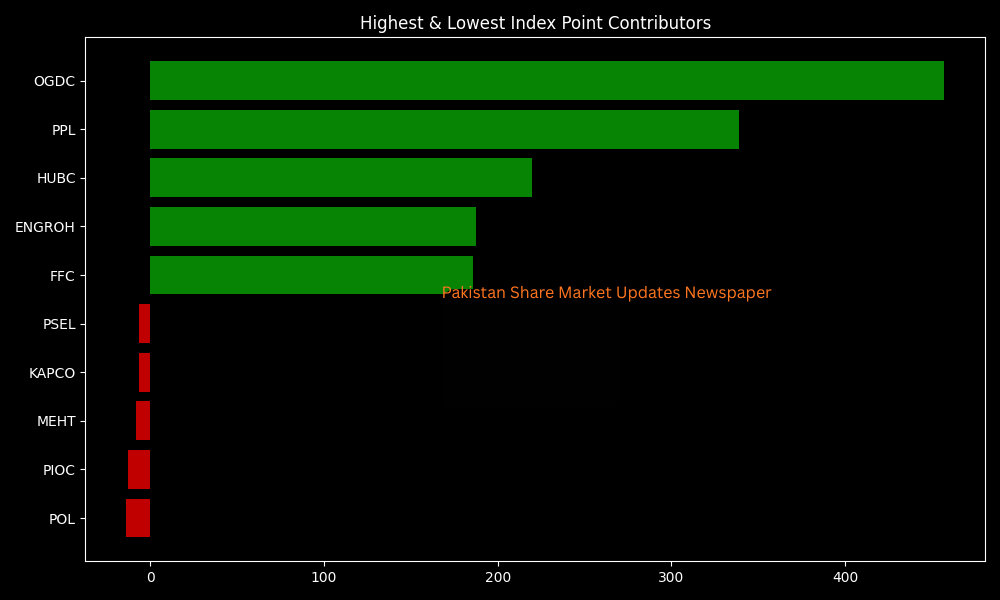

In terms of index-point contributions, companies that propped up the index were OGDC (+457.09pts), PPL (+339.24pts), HUBC (+219.60pts), ENGROH (+187.38pts), and FFC (+185.86pts).

Meanwhile, companies that dragged the index lower were POL (-13.90pts), PIOC (-13.20pts), MEHT (-8.16pts), KAPCO (-6.84pts), and PSEL (-6.48pts).

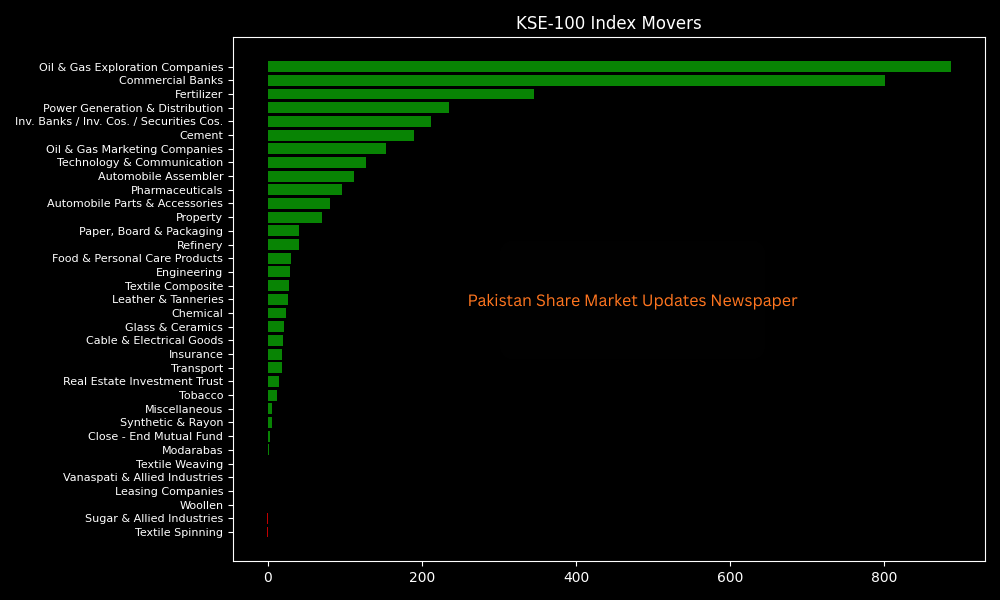

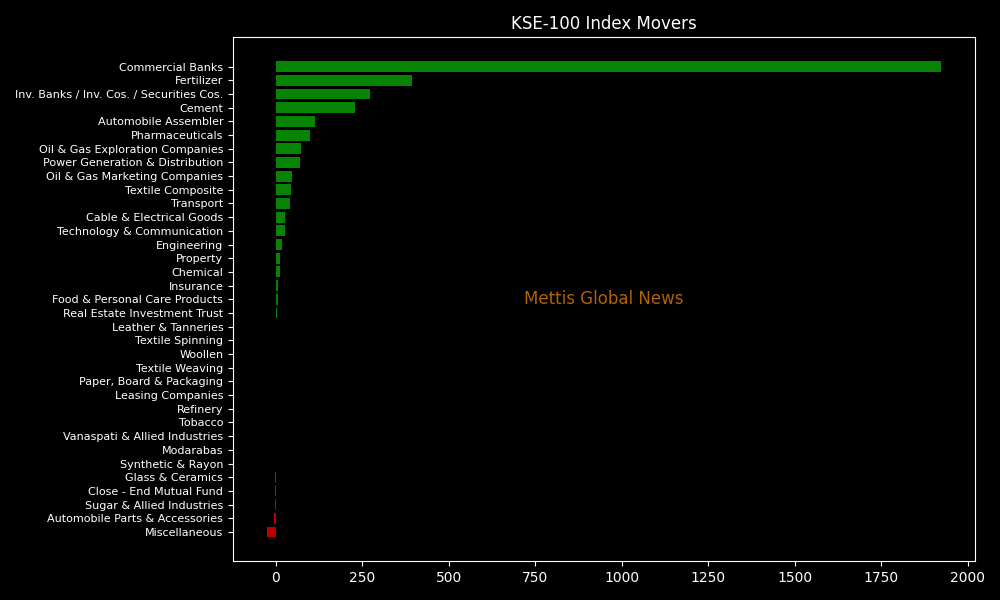

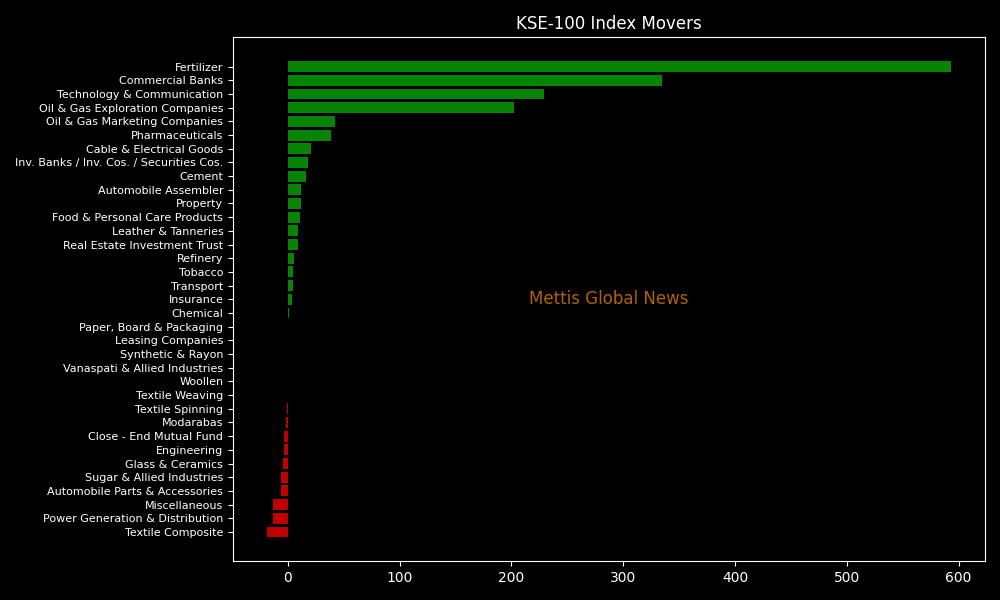

Sector-wise, KSE-100 Index was supported by Oil & Gas Exploration Companies (+886.47pts), Commercial Banks (+800.78pts), Fertilizer (+345.51pts), Power Generation & Distribution (+235.59pts), and Inv. Banks / Inv. Cos. / Securities Cos. (+211.72pts).

While the index was let down by Textile Spinning (-1.04pts), Sugar & Allied Industries (-0.61pts), Woollen (+0.00pts), Leasing Companies (+0.01pts), and Vanaspati & Allied Industries (+0.04pts).

In the broader market, the All-Share Index closed at 111,509.34 with a net gain of 2,327.02 points or 2.13%.

Total market volume was 959.53 million shares compared to 820.03m from the previous session while traded value was recorded at Rs69.46 billion showing an increase of Rs23.49bn.

There were 451,058 trades reported in 482 companies with 334 closing up, 117 closing down, and 31 remaining unchanged.

| Symbol | Price | Change % | Volume |

|---|---|---|---|

| AHCL | 18.21 | 6.31% | 72,955,233 |

| KEL | 6.4 | 3.90% | 39,195,090 |

| PIBTL | 20.93 | 3.67% | 36,204,591 |

| MDTL | 8.32 | 2.09% | 34,721,632 |

| NCPL | 73.21 | 3.08% | 32,544,008 |

| DSLNC | 7.73 | 1.71% | 28,683,195 |

| CNERGY | 7.62 | 2.97% | 24,408,560 |

| PPL | 264.76 | 5.96% | 24,058,939 |

| WTL | 1.74 | 1.16% | 24,021,962 |

| NBP | 273.29 | 2.15% | 23,508,115 |

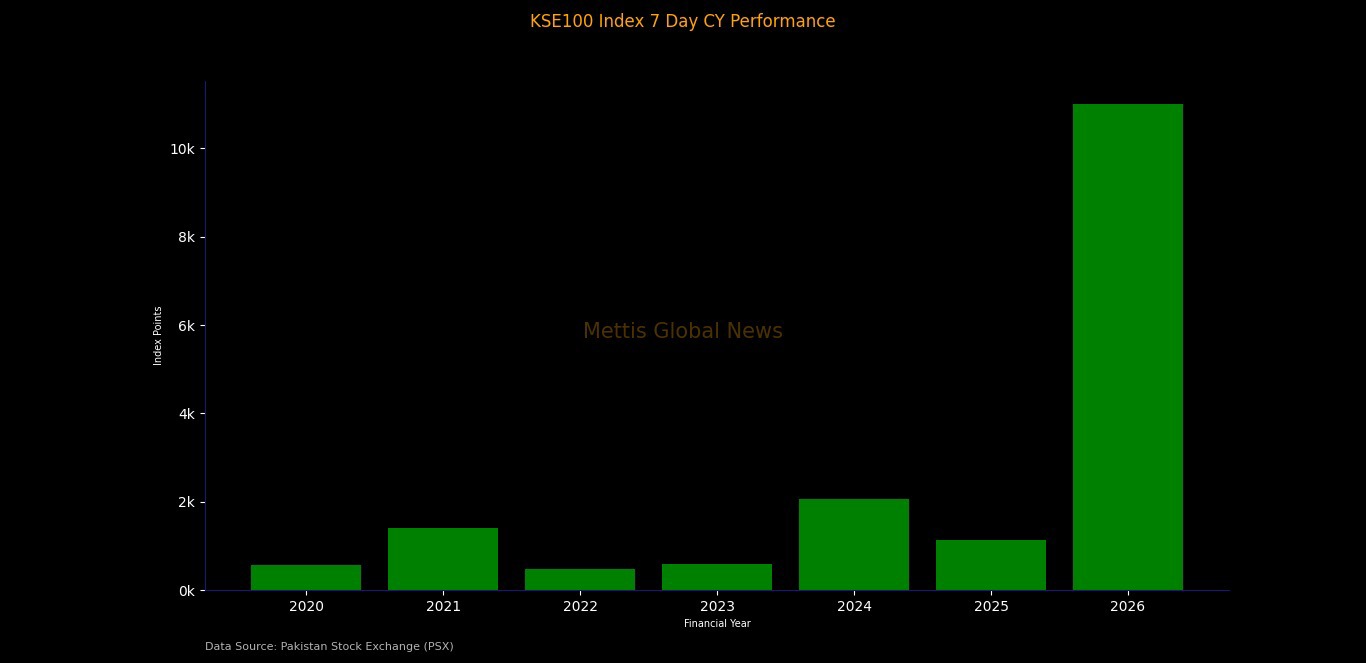

To note, the KSE-100 has gained 59,472 points or 47.34% during the fiscal year, whereas it has increased 11,045 points or 6.35% so far this calendar year.

Mari Energies launches cloud and AI infrastructure platform

pakistansharemarketnp@gmail.com0Edit

Mari Energies Limited (PSX:MARI) has taken a significant step in Pakistan’s digital evolution with the launch of a Cloud and AI infrastructure platform through its fully owned subsidiary, Mari Technologies Limited.

The platform, developed under Sky47 Limited a majority-owned subsidiary of Mari Energies is located at Silicon Valley of Capital Smart City near Islamabad, according to the company’s statement issued today.

Designed to provide secure, scalable, and sovereign digital infrastructure, the Sky47 platform aims to support enterprises, government institutions, and innovators in running mission-critical workloads locally, while adhering to global standards of performance, reliability, and compliance.

The platform represents a major stride toward strengthening Pakistan’s technological landscape and fostering innovation in cloud computing and artificial intelligence.

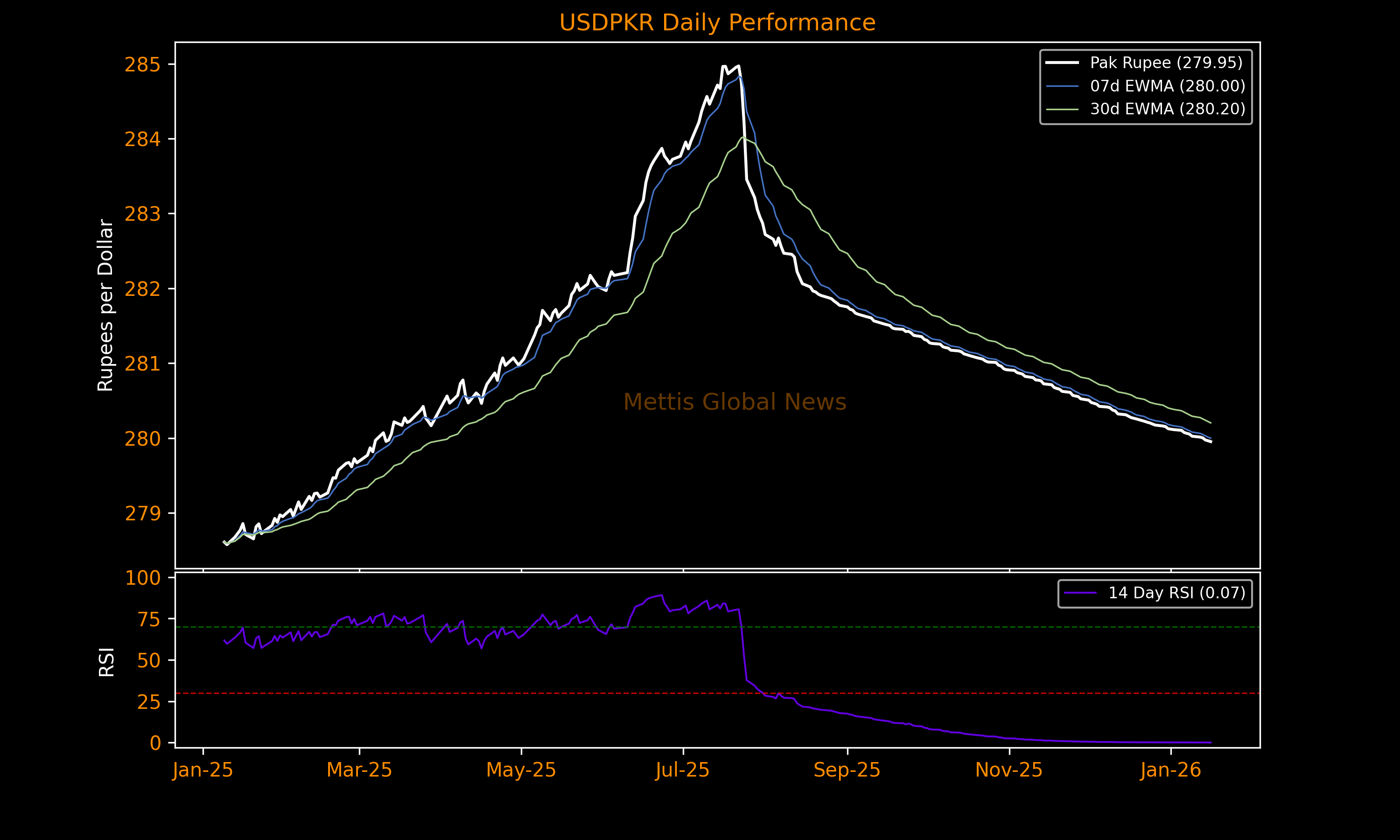

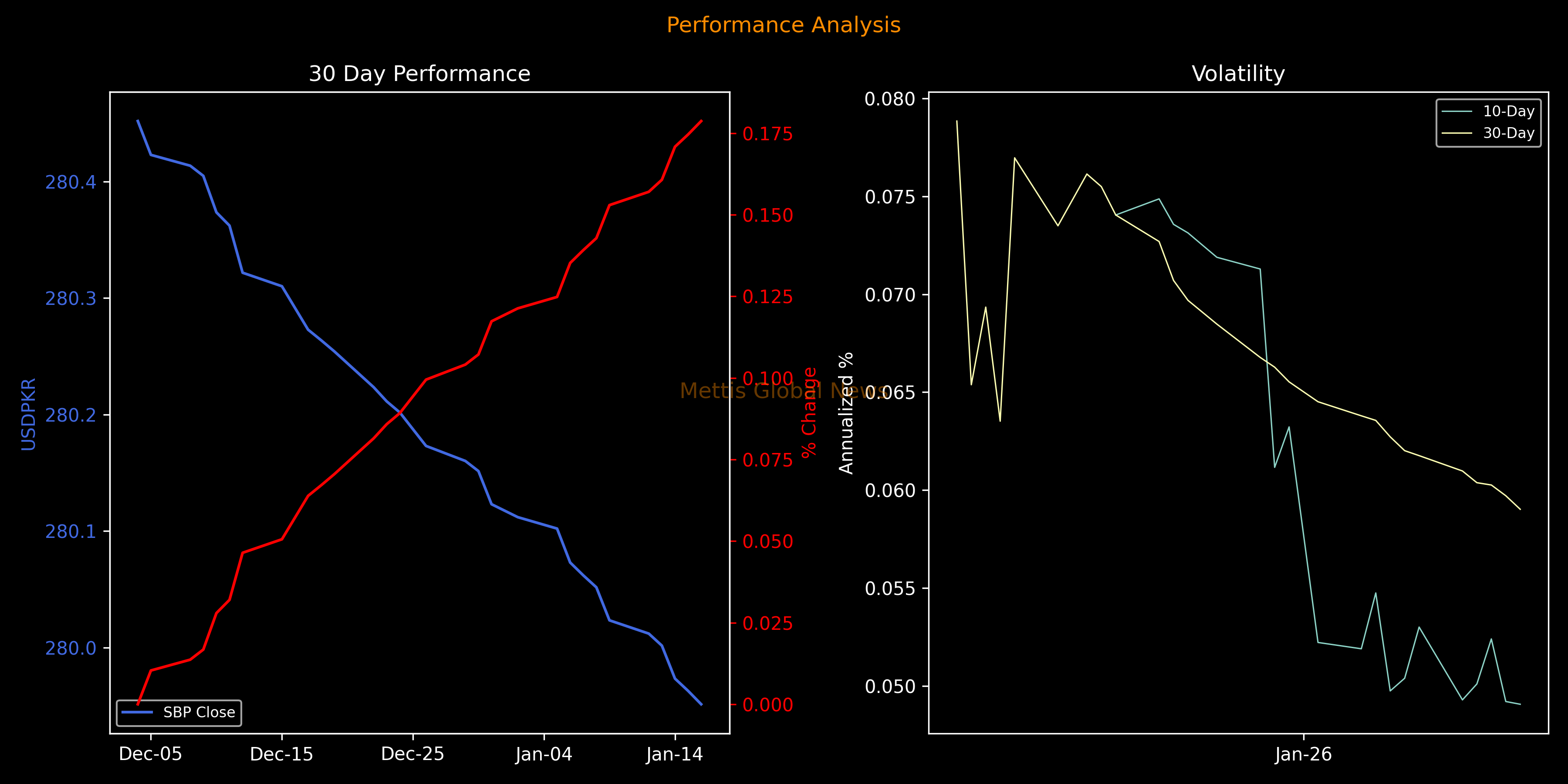

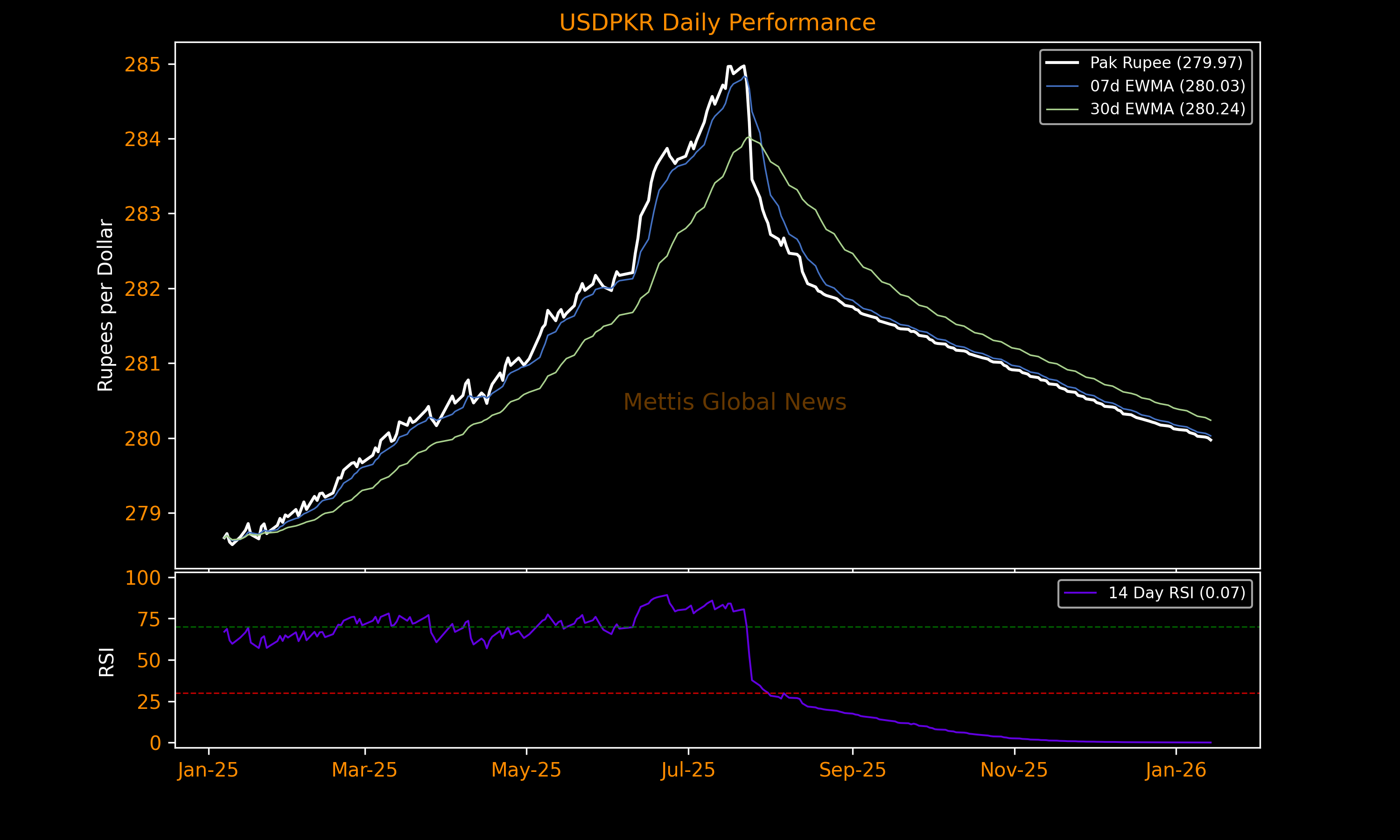

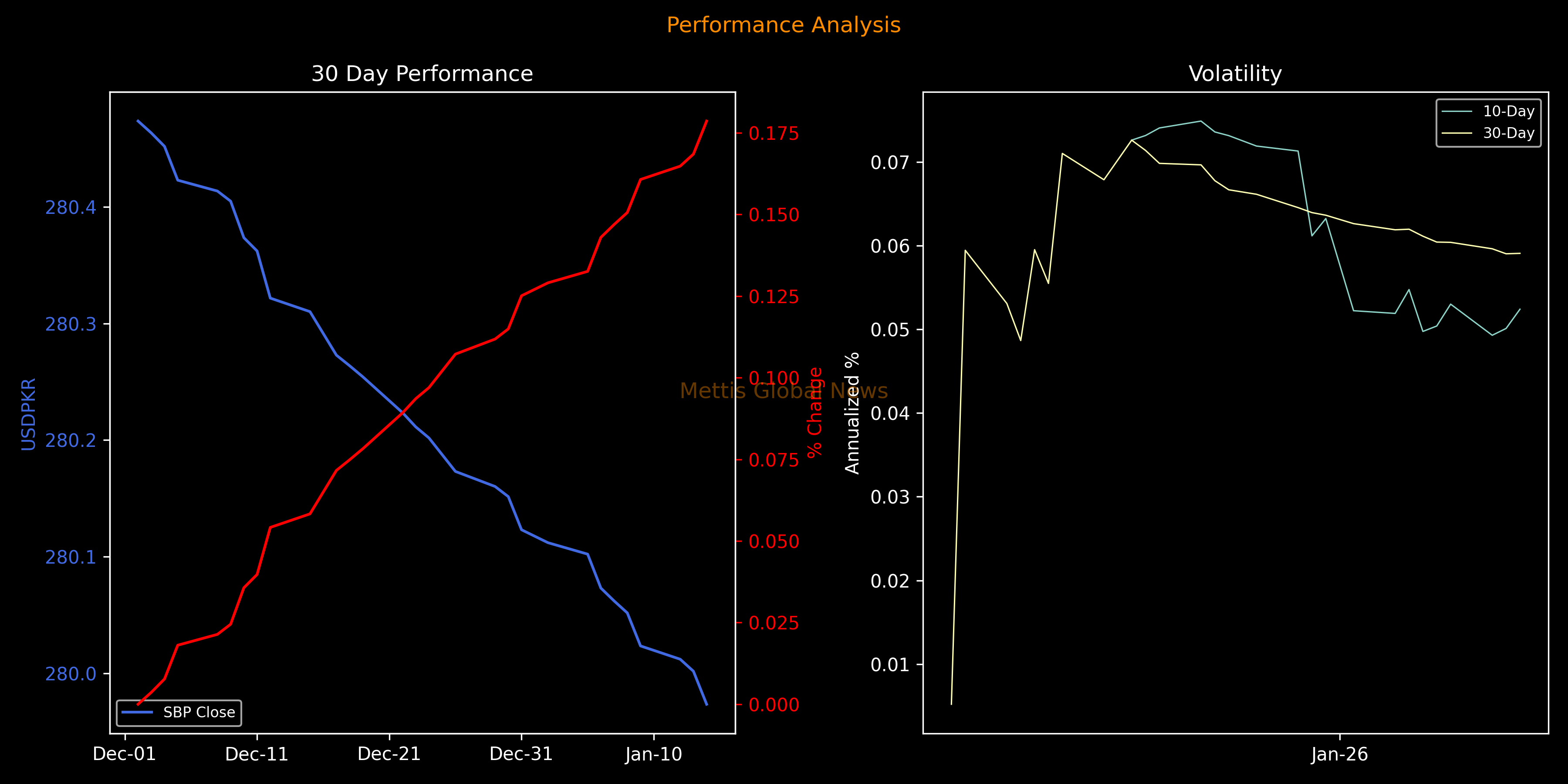

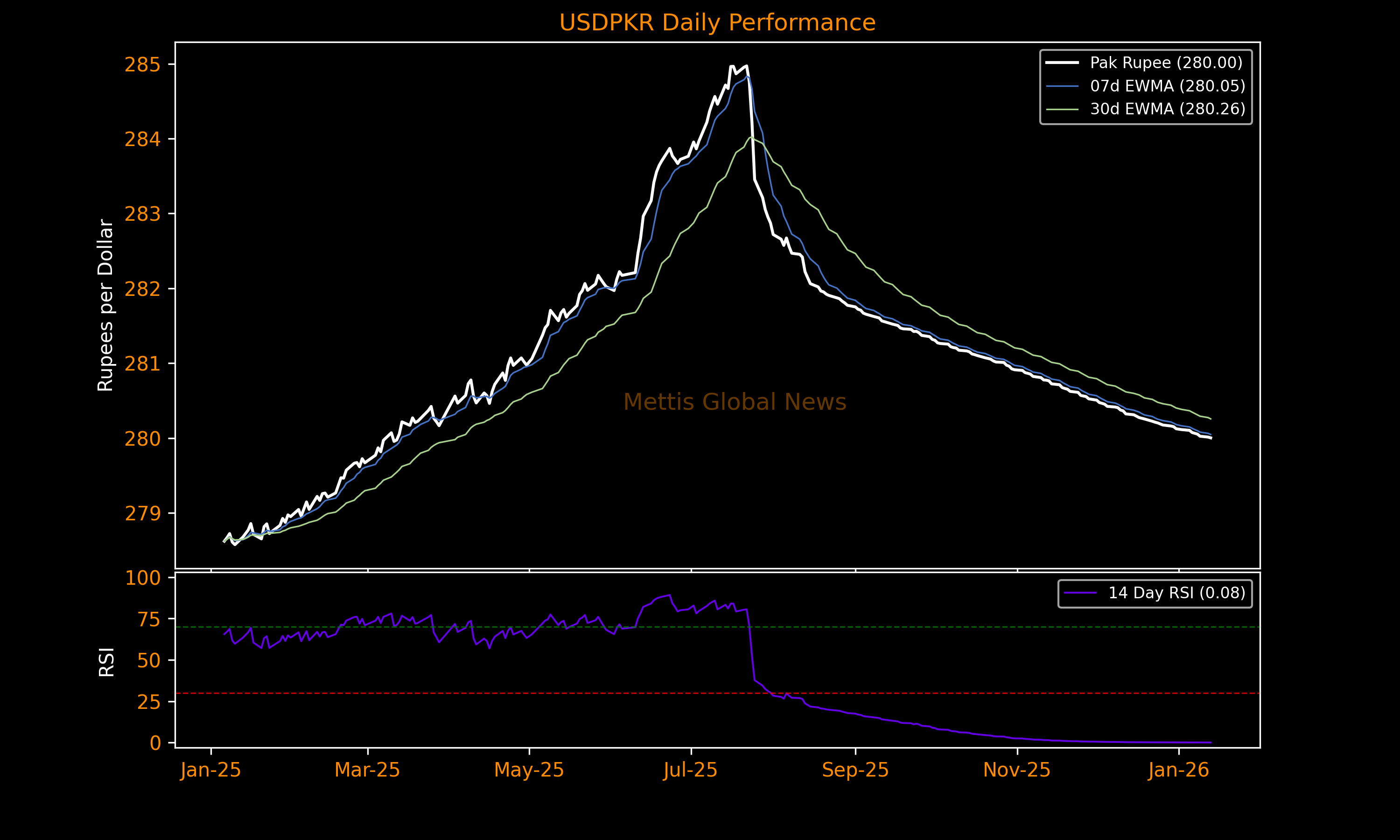

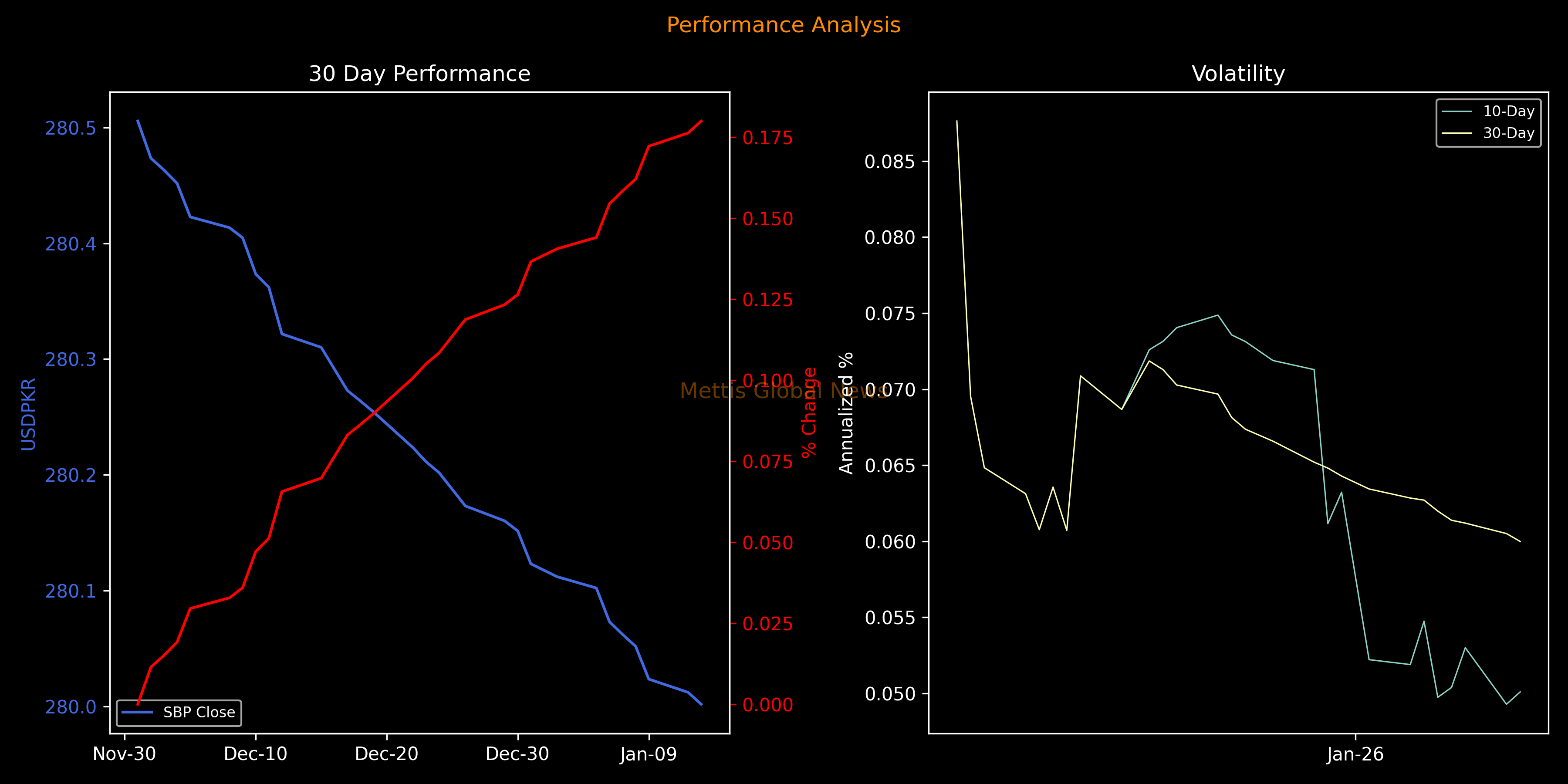

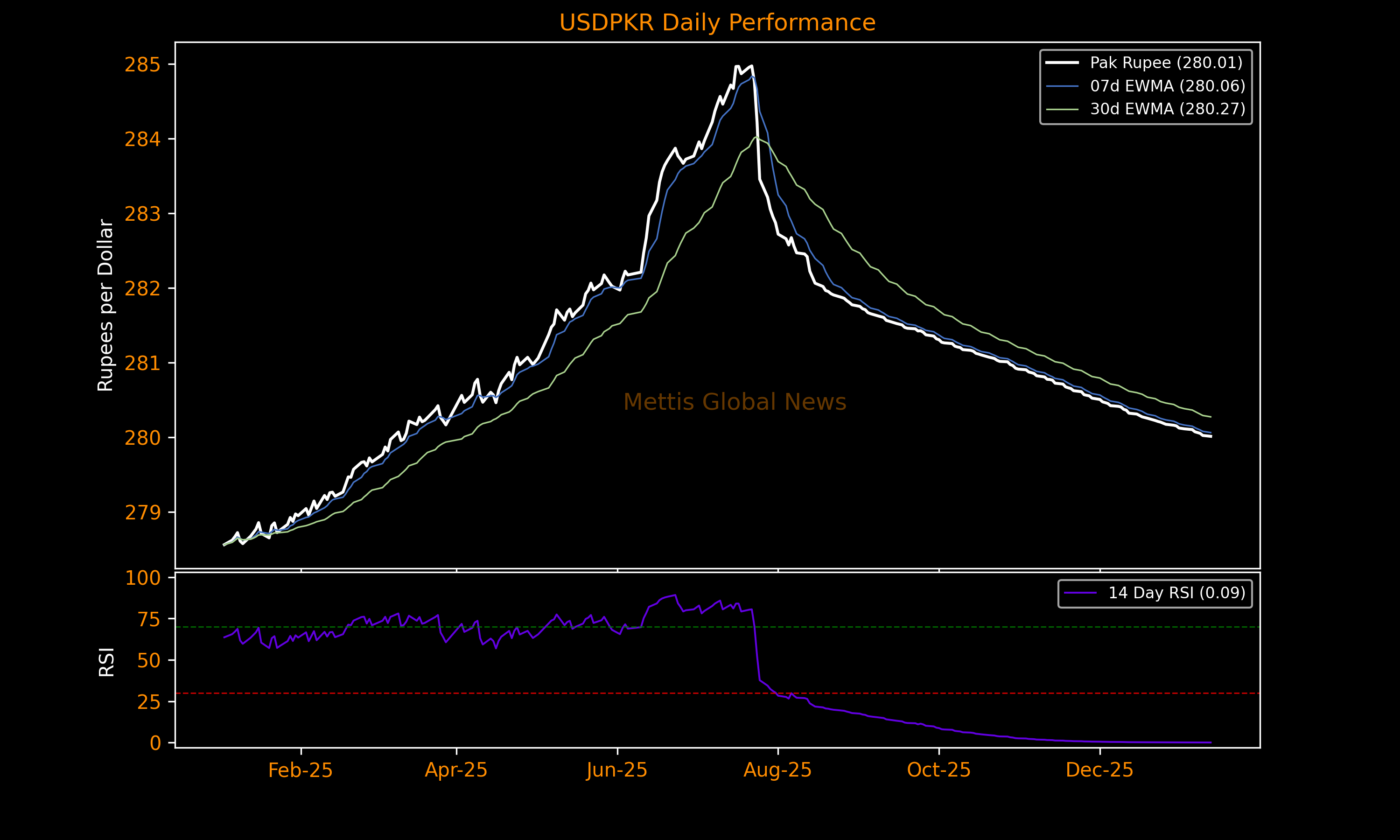

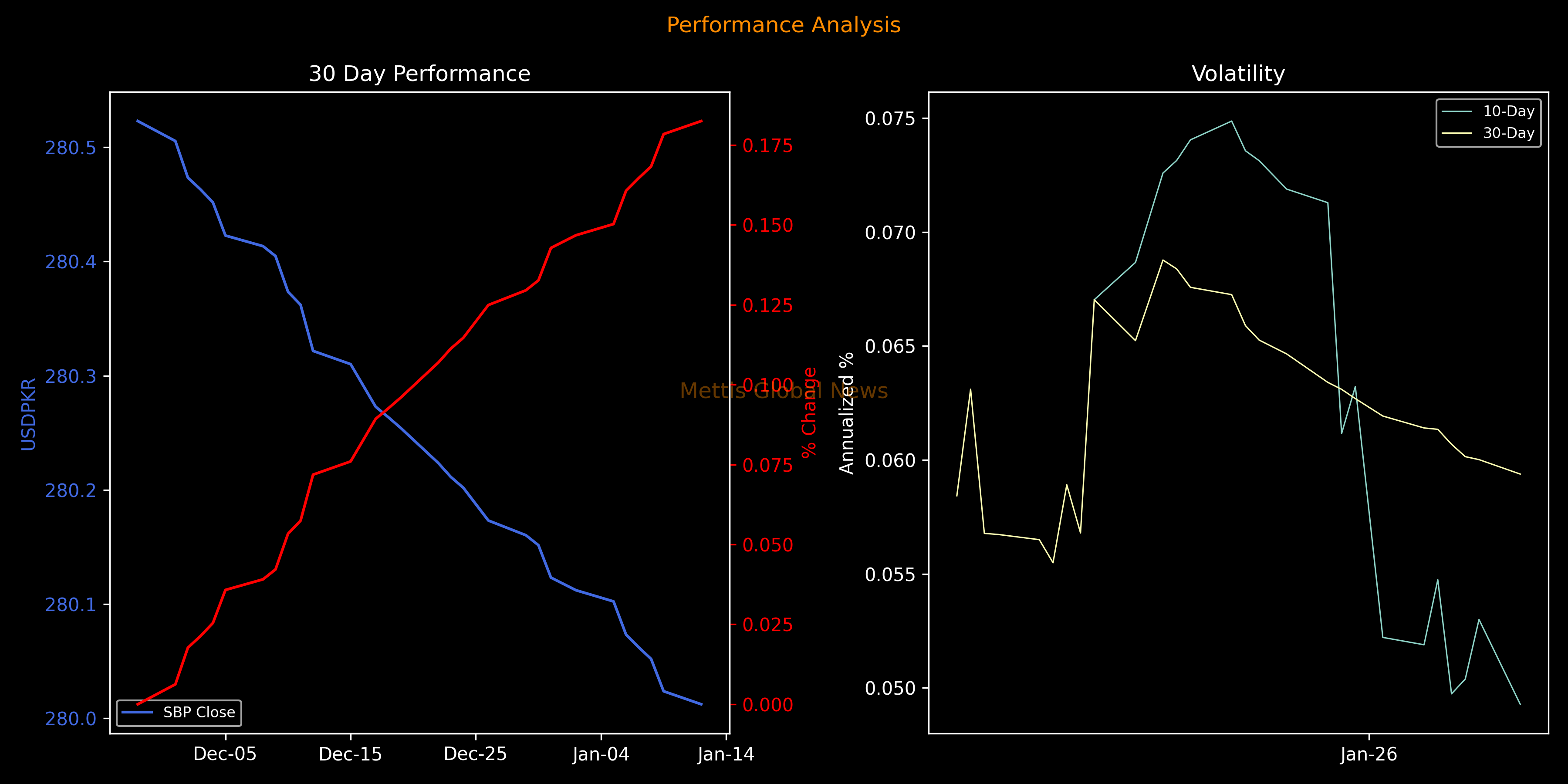

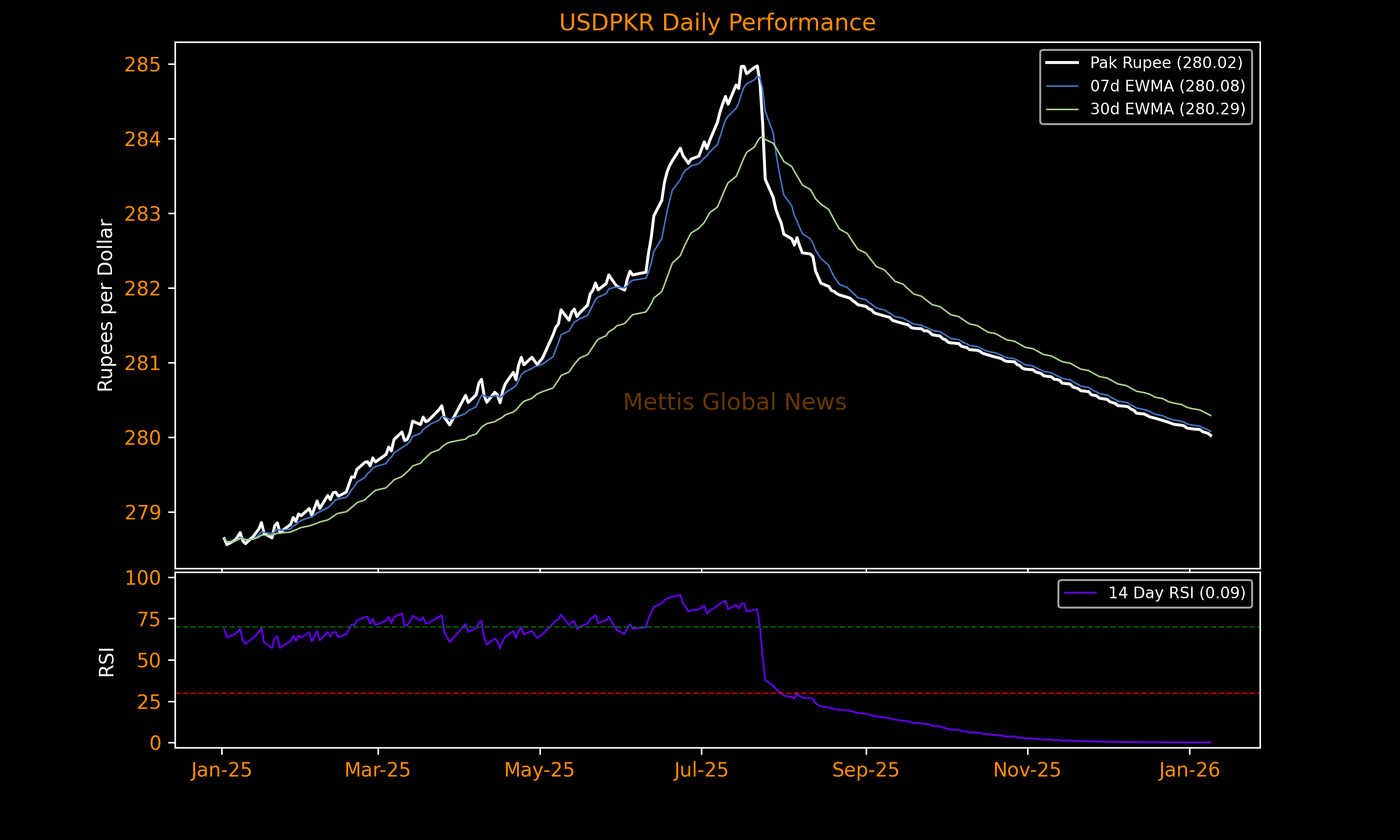

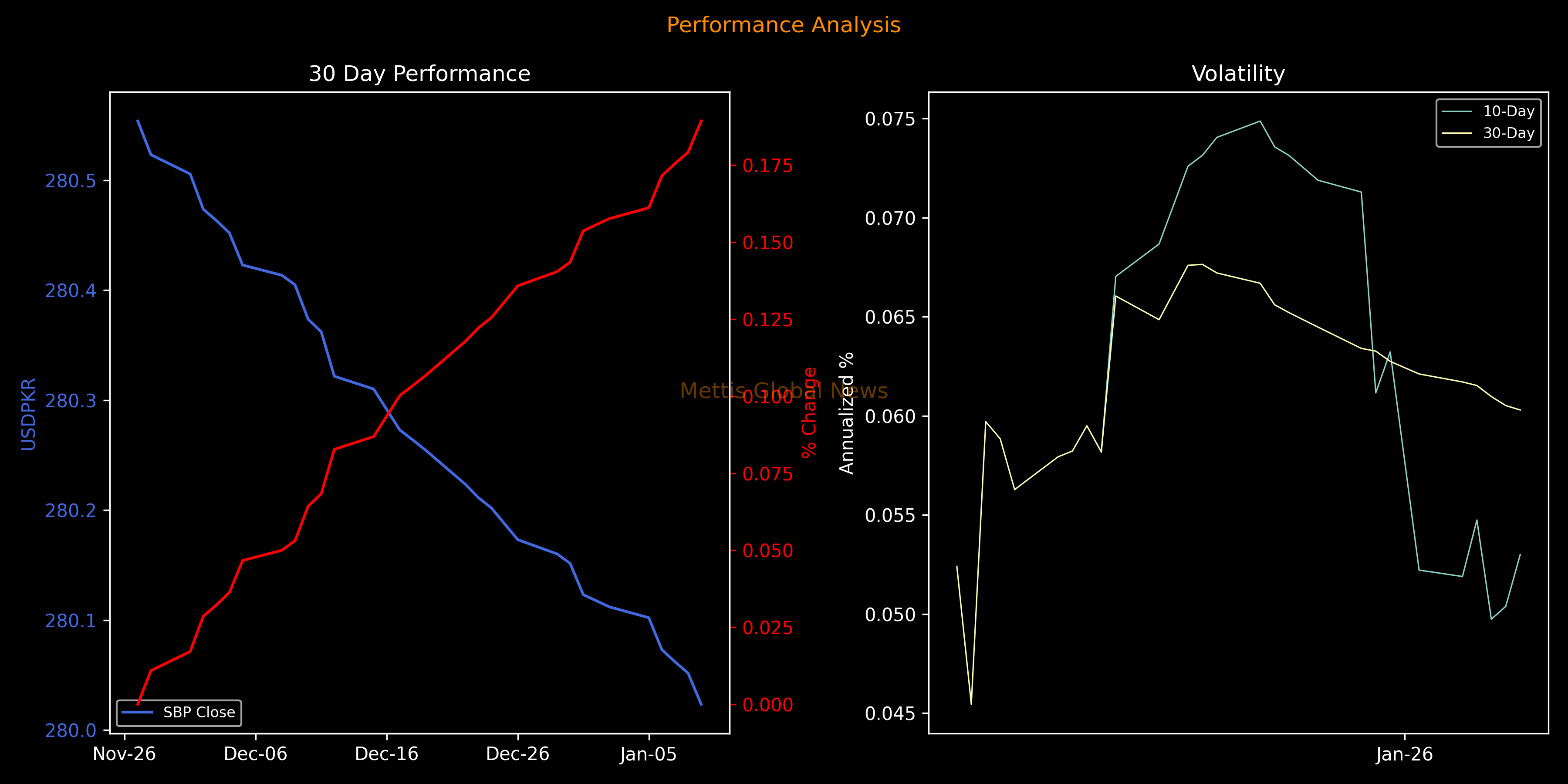

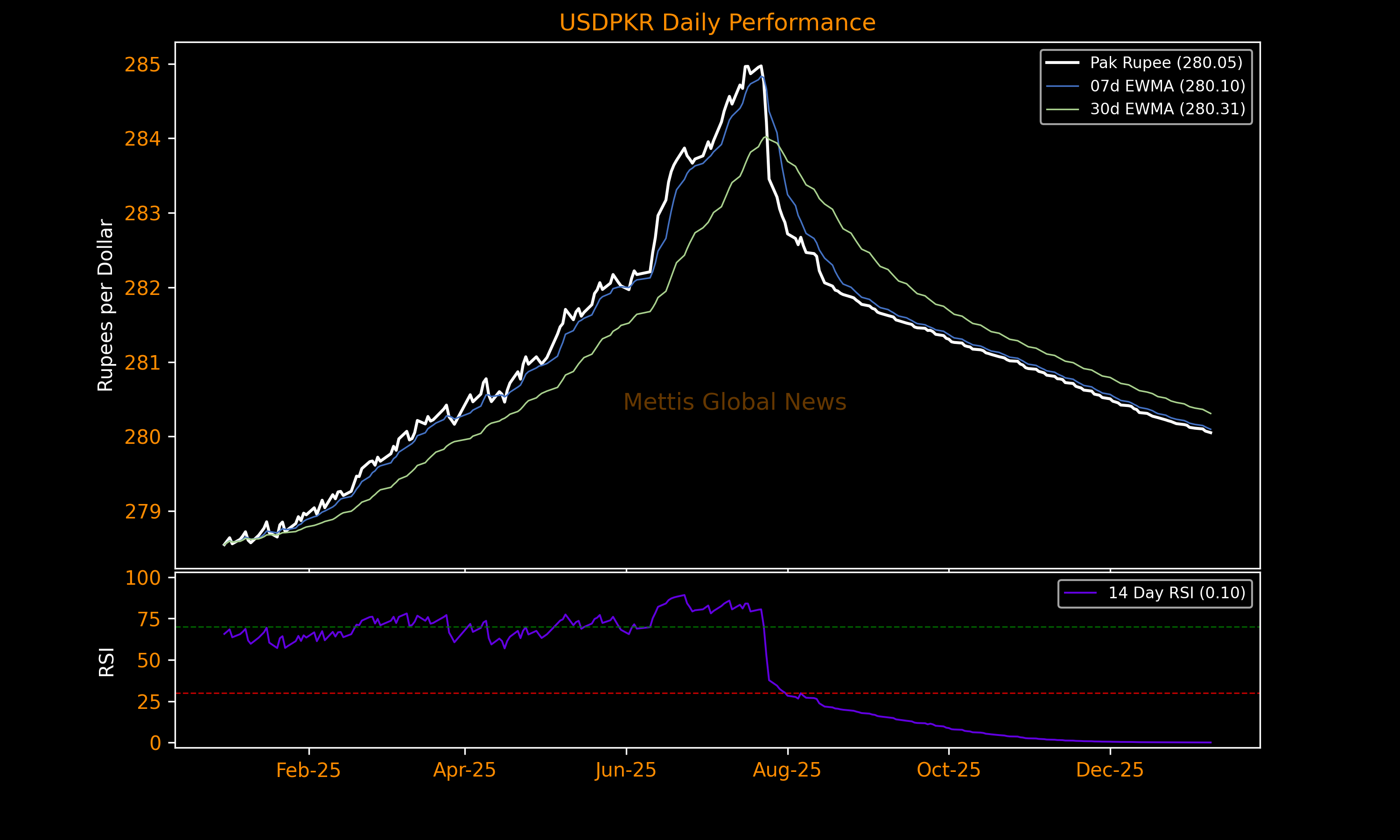

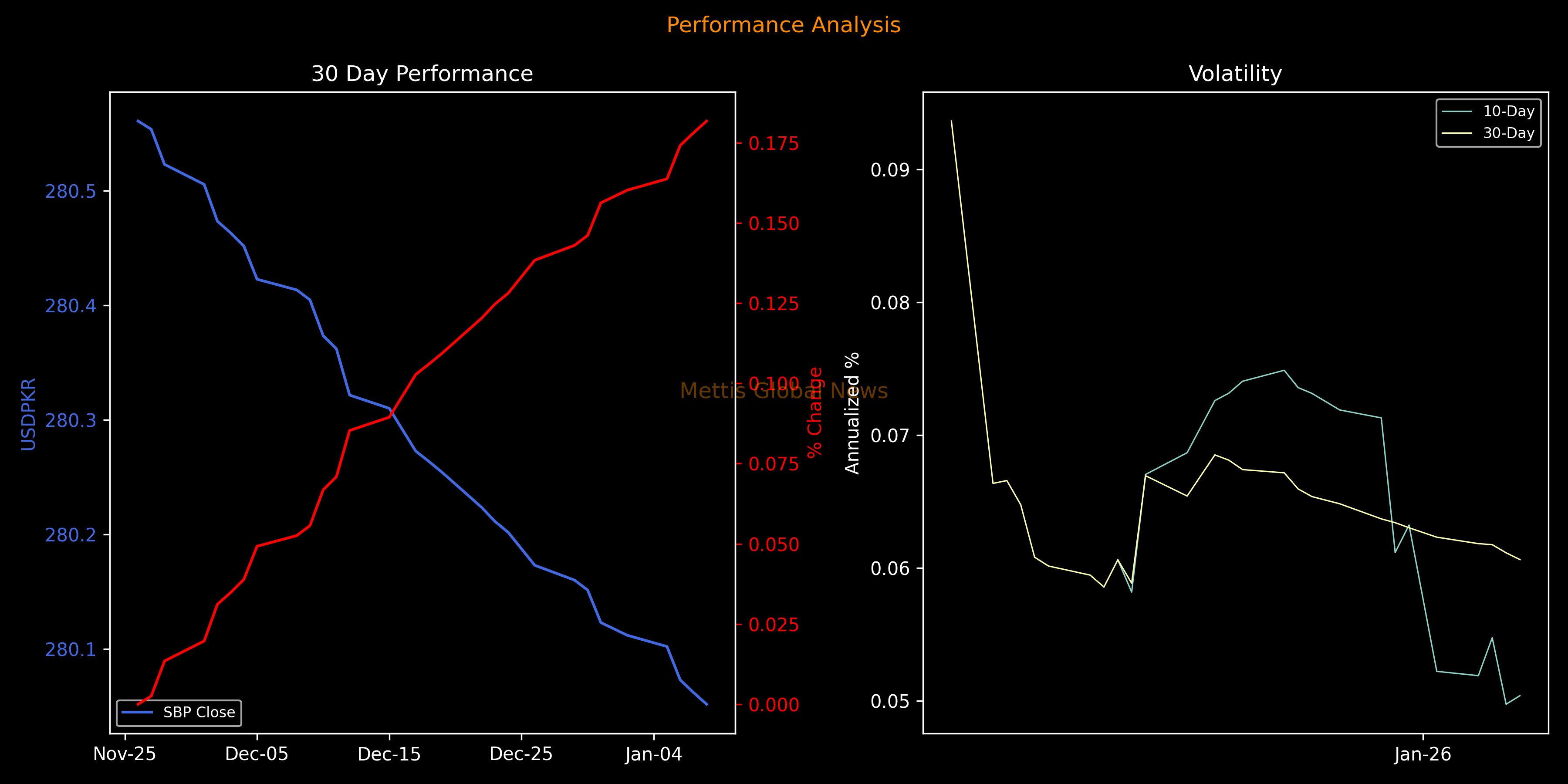

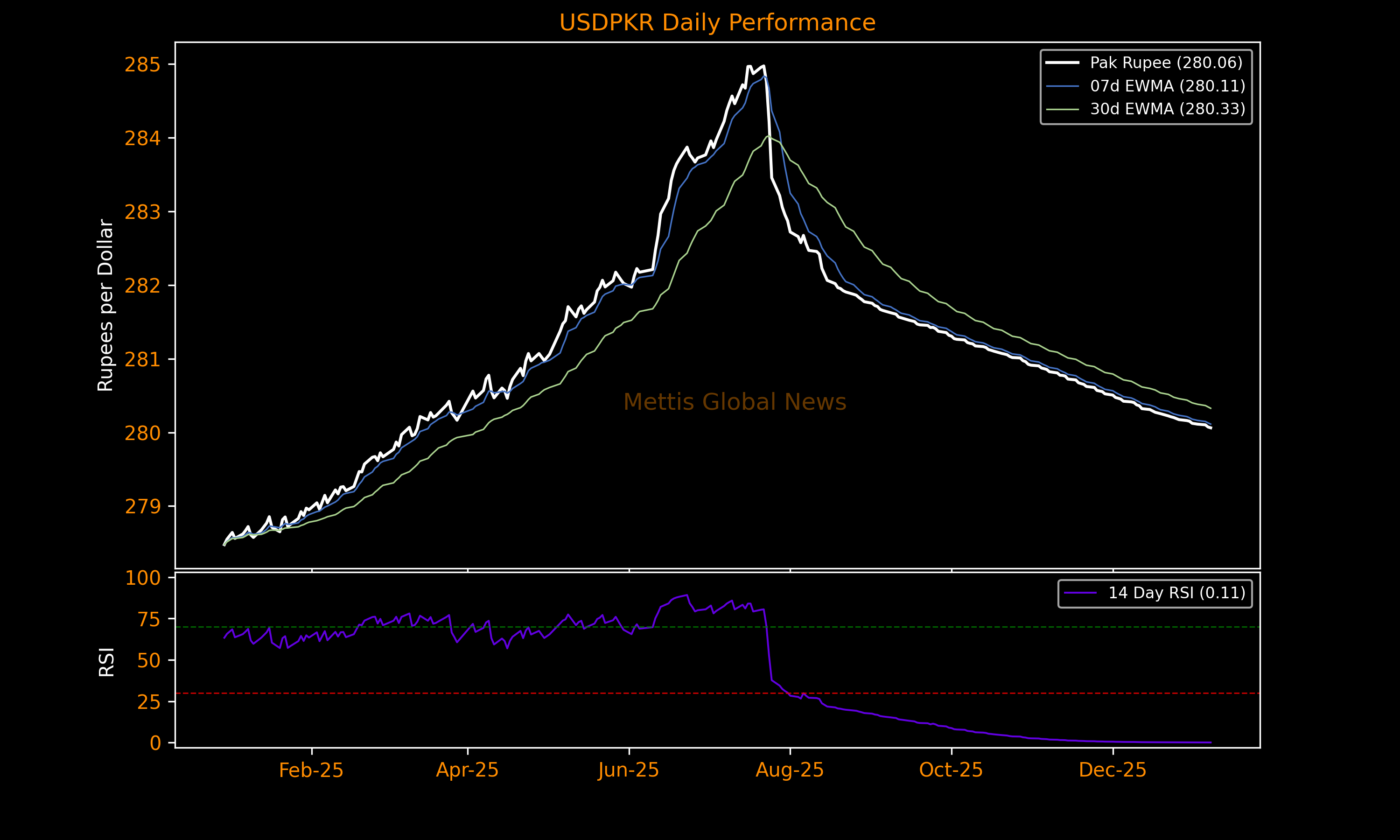

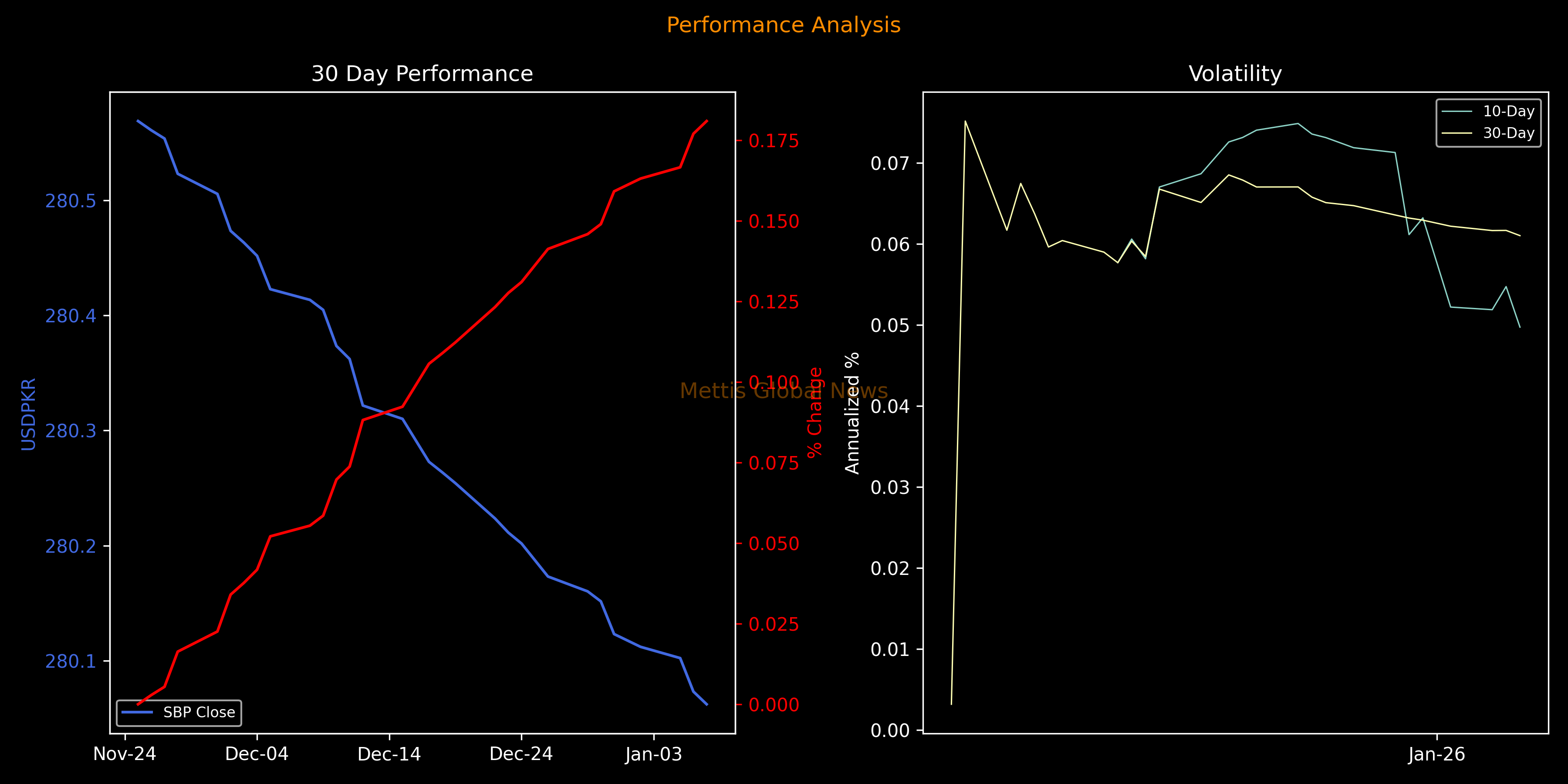

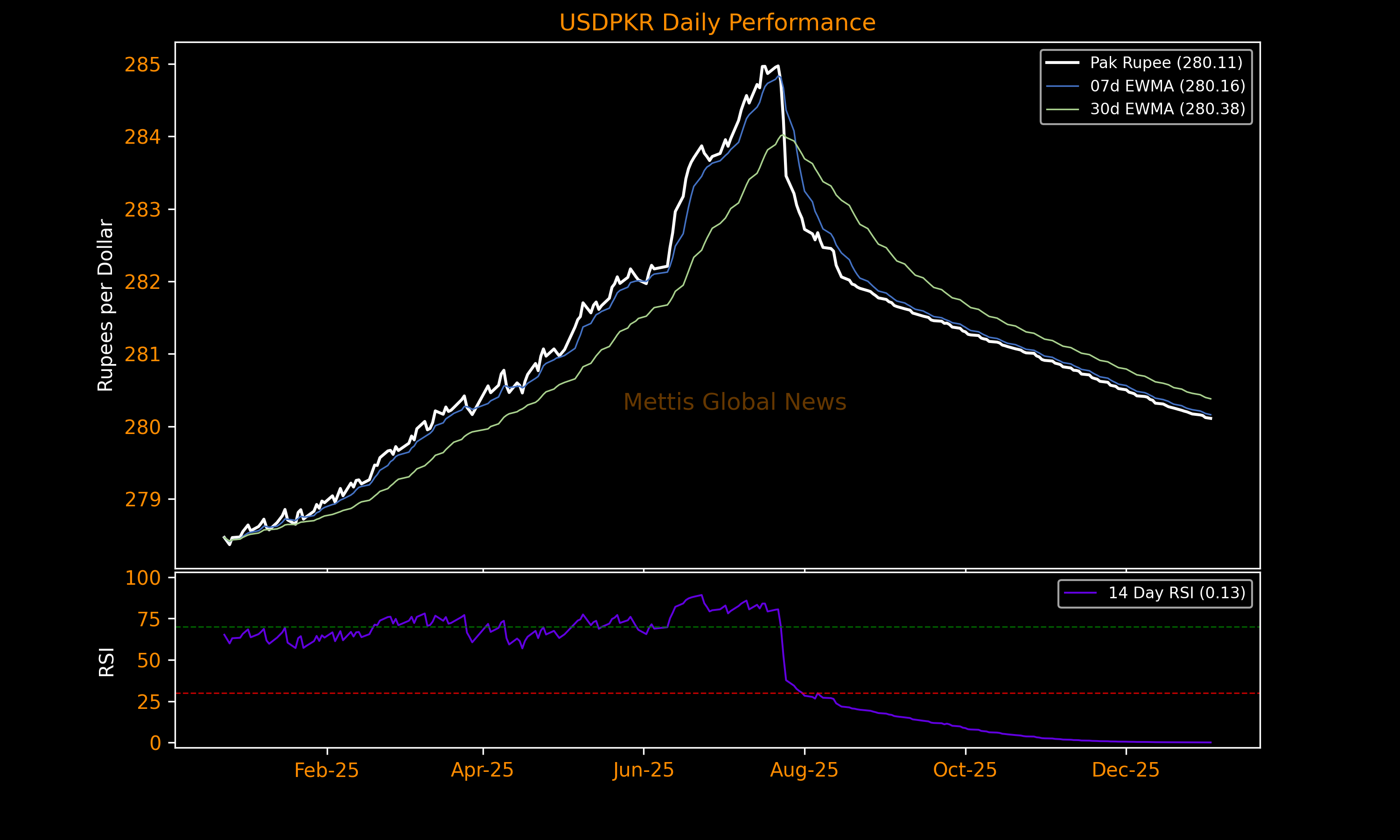

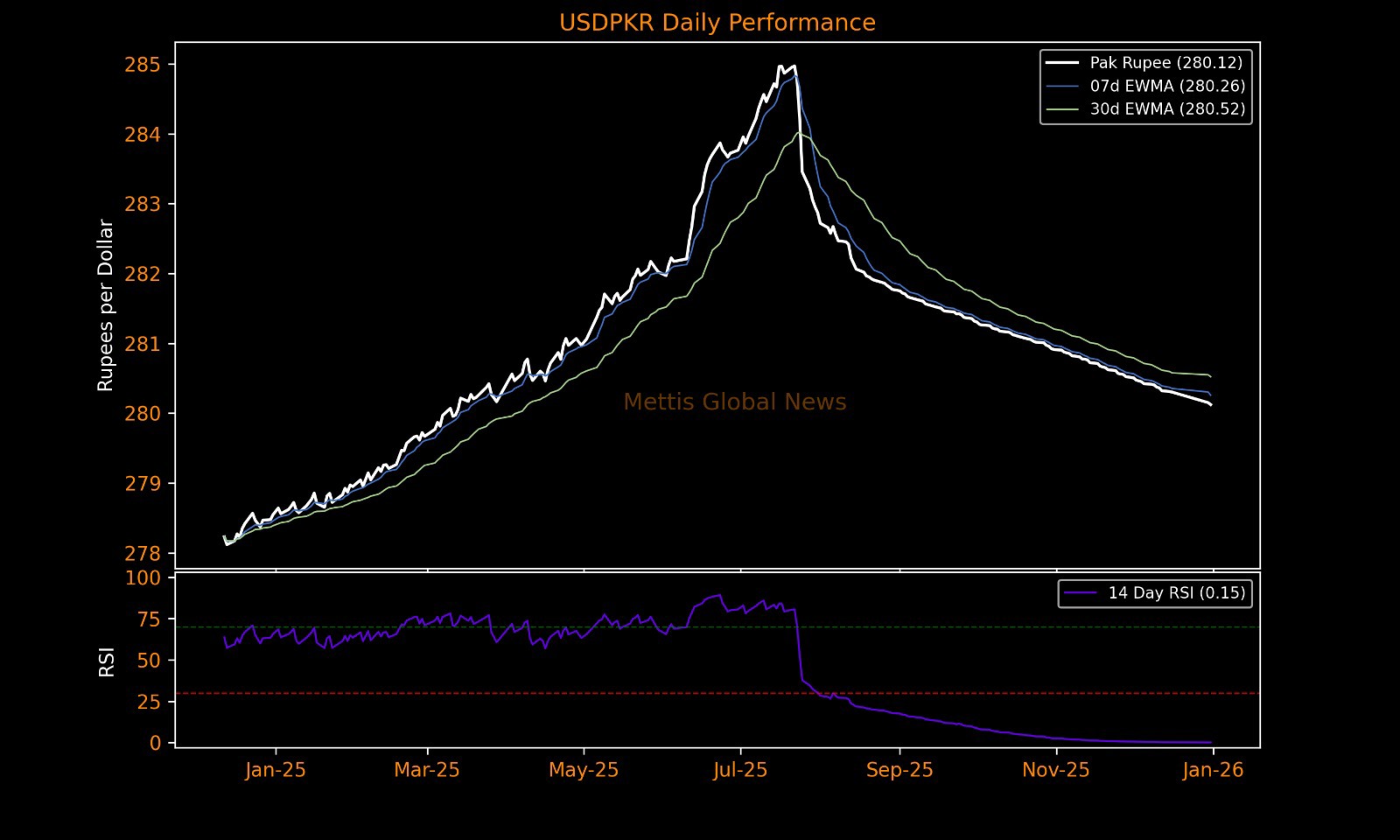

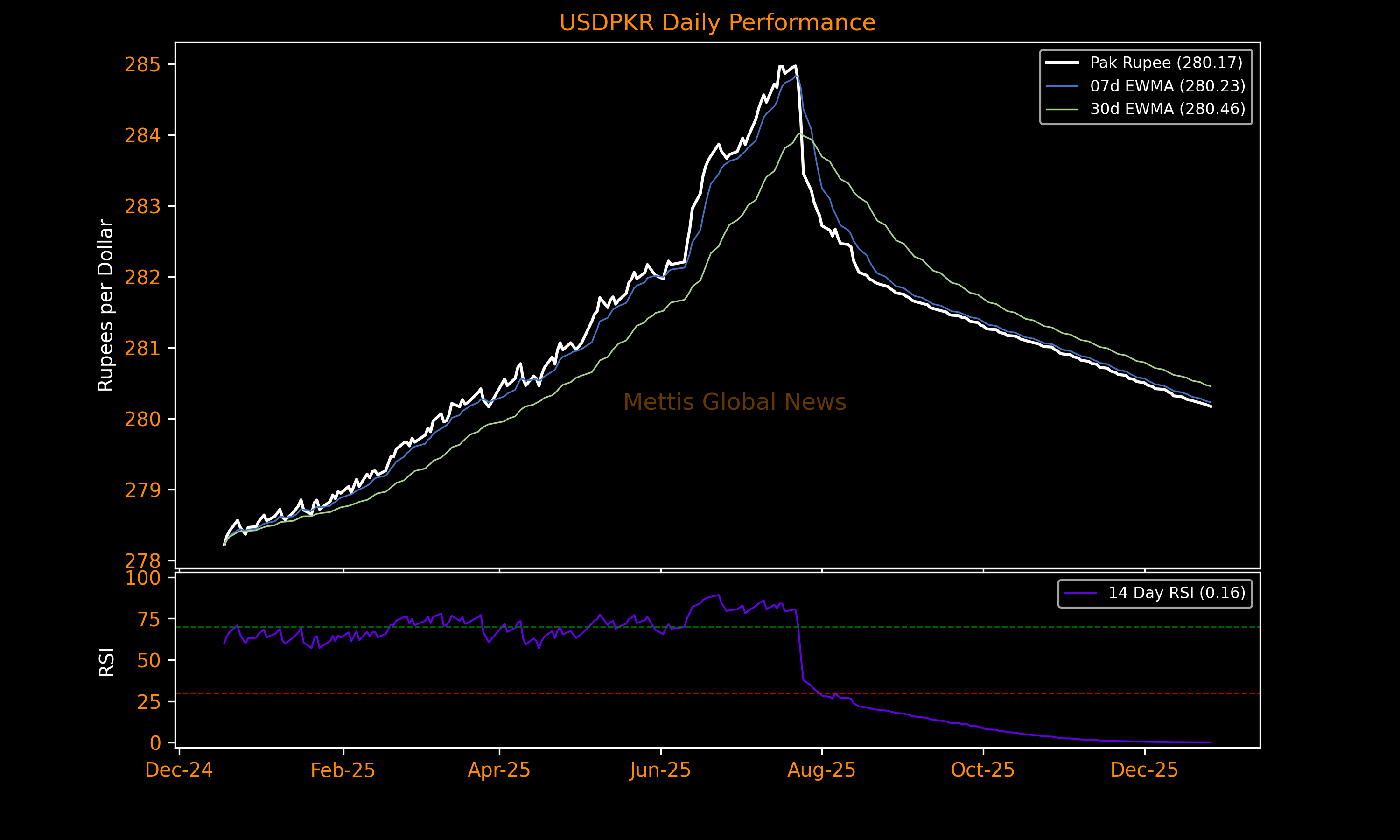

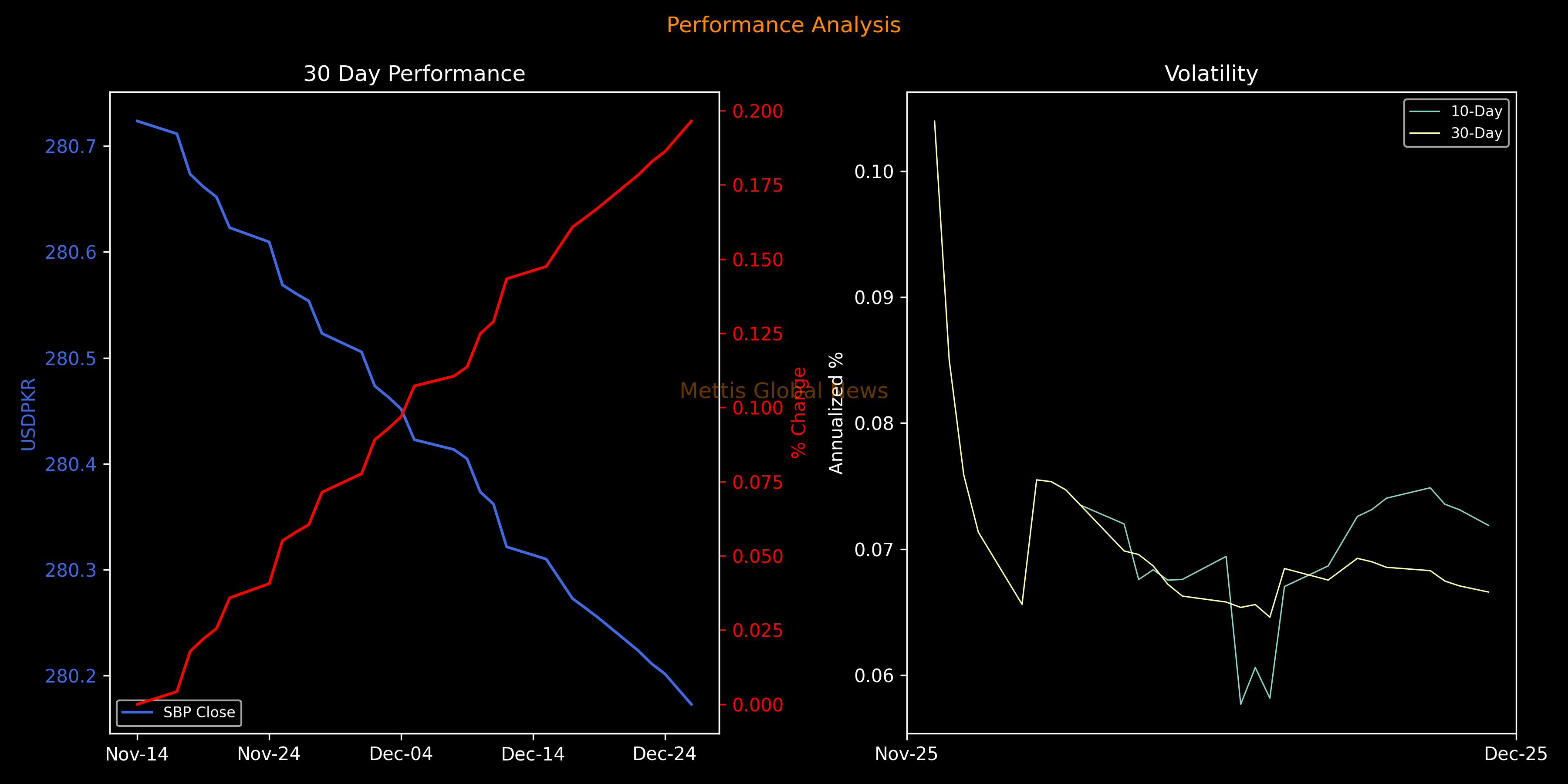

PKR holds steady against USD

pakistansharemarketnp@gmail.com0Edit

The Pakistani rupee (PKR) strengthened by 1.15 paisa against the US dollar in Friday’s interbank session to settle the trade at PKR 279.95 per USD, compared to previous closing of 279.96.

Throughout the day, the currency saw an intraday high (bid) of 280.3 and a low (ask) of 281.

In the open market, exchange companies quoted the dollar at 280.75 for buying and 281.00 for selling.

In comparison to major currencies, PKR strengthened 53.13 paisa or 0.16% against the Euro, closing at 325.07 compared to the previous value of 325.60.

Against the British Pound, PKR gained by 1.15 rupees or 0.31% to 374.93 compared to 376.07 a day ago.

The local unit gained 49.32 paisa or 0.14% against Swiss franc to close at 348.83.

Against the Japanese Yen, PKR’s value decreased 0.38 paisa or 0.22% to close the session at 1.7693 versus 1.7655 a day ago.

Pakistani Rupee decreased 1.28 paisa or 0.03% against Chinese Yuan to close at 40.18 from 40.16.

The local currency fell by 0.09 paisa or 0.00% against Saudi Riyal to 74.65. While it strengthened by 0.31 paisa or 0.00% against the U.A.E Dirham to close at 76.22.

During the current fiscal year, PKR has increased against the US Dollar by 3.81 rupees or 1.36%. While it has gained 17.16 paisa or 0.06% so far this calendar year.In the Money Market, the benchmark 6 Month Karachi Interbank Bid and Offer rates inched down by 2bps to 10.08% and 10.33%.

Performance Summary

| Currency | Jan 16, 2026 | Jan 15, 2026 | 1D | 7D | 1M | FYTD | CYTD | |||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| USD | 279.9515 | 279.9630 | 0.0115 | 0.00% | 0.0720 | 0.03% | 0.3586 | 0.13% | 3.8130 | 1.36% | 0.1716 | 0.06% |

| EUR | 325.0657 | 325.5970 | 0.5313 | 0.16% | 1.0777 | 0.33% | 3.7240 | 1.15% | 7.5914 | 2.34% | 3.7848 | 1.16% |

| GBP | 374.9250 | 376.0743 | 1.1493 | 0.31% | 1.1466 | 0.31% | -0.3326 | -0.09% | 13.9316 | 3.72% | 2.2468 | 0.60% |

| CHF | 348.8275 | 349.3207 | 0.4932 | 0.14% | 1.2675 | 0.36% | 3.0777 | 0.88% | 6.4999 | 1.86% | 4.3951 | 1.26% |

| JPY | 1.7693 | 1.7655 | -0.0038 | -0.21% | 0.0082 | 0.46% | 0.0372 | 2.10% | 0.2007 | 11.34% | 0.0199 | 1.12% |

| SAR | 74.6517 | 74.6508 | -0.0009 | -0.00% | 0.0192 | 0.03% | 0.0558 | 0.07% | 1.0087 | 1.35% | 0.0428 | 0.06% |

| AED | 76.2188 | 76.2219 | 0.0031 | 0.00% | 0.0196 | 0.03% | 0.1017 | 0.13% | 1.0486 | 1.38% | 0.0571 | 0.07% |

| CNY | 40.1759 | 40.1631 | -0.0128 | -0.03% | -0.0706 | -0.18% | -0.4074 | -1.01% | -0.5725 | -1.42% | -0.1031 | -0.26% |

52 Week Performance

| Currency | High | Low | Trading Band | % Since High | % Since Low | High Date | Low Date | Days Since High | Days Since Low |

|---|---|---|---|---|---|---|---|---|---|

| USD | 278.6523 | 284.9710 | 6.3187 | -0.46% | 1.79% | 20-Jan-25 | 22-Jul-25 | 361 | 178 |

| EUR | 285.0438 | 335.1574 | 50.1136 | -12.31% | 3.10% | 03-Feb-25 | 03-Jul-25 | 347 | 197 |

| GBP | 339.8470 | 390.0418 | 50.1948 | -9.36% | 4.03% | 17-Jan-25 | 26-Jun-25 | 364 | 204 |

| CHF | 303.4906 | 359.7698 | 56.2792 | -13.00% | 3.14% | 03-Feb-25 | 23-Jul-25 | 347 | 177 |

| JPY | 1.7602 | 1.9999 | 0.2397 | -0.51% | 13.03% | 14-Jan-26 | 22-Apr-25 | 2 | 269 |

| SAR | 74.2677 | 75.9801 | 1.7124 | -0.51% | 1.78% | 20-Jan-25 | 16-Jul-25 | 361 | 184 |

| AED | 75.8661 | 77.5864 | 1.7203 | -0.46% | 1.79% | 20-Jan-25 | 22-Jul-25 | 361 | 178 |

| CNY | 38.0307 | 40.1759 | 2.1452 | -5.34% | 0.00% | 17-Jan-25 | 16-Jan-26 | 364 | 0 |

Fertilizer offtake increases 23% YoY in December

pakistansharemarketnp@gmail.com0Edit

Fertilizer consumption in Pakistan witnessed strong performance in December 2025, as overall nutrient offtake increased by 23% year-on-year to 770,000 tonnes, according to the latest Monthly Fertilizer Review released by the National Fertilizer Development Centre (NFDC).

In December, urea offtake was at 1,356,000 tonnes, registering an increase of 36.8% compared to the same month last year. On the other hand, DAP consumption decreased by 44.6%, to 80,000 tonnes.

Nutrient-wise, nitrogen offtake increased by 34%, potash by 29.8% but phosphate fell by 41.5%.

Table 1: Fertilizer Offtake – December 2025 vs December 2024

| Product/Nutrient | December 2024 (‘000 tonnes) | December 2025 (‘000 tonnes) | % Change |

| Urea | 991 | 1,356 | +36.8% |

| DAP | 144 | 80 | -44.6% |

| Nitrogen | 532 | 714 | +34% |

| Phosphate | 90 | 53 | -41.5% |

| Potash | 2.8 | 3.6 | +29.8% |

| Total Nutrients | 625 | 770 | +23.2% |

Cumulative nutrient offtake during Rabi 2025-26 (Oct-Dec) was 1,758,000 tonnes, which increased by 11.1% over Rabi 2024-25. Nitrogen and potash offtake increased by 21.1 and 33.1%, respectively while phosphate offtake decreased by 19.2%.

Table 2: Cumulative Offtake – Rabi 2025 vs Rabi 2024

| Product/Nutrient | Rabi 2024 (‘000 tonnes) | Rabi 2025 (‘000 tonnes) | % Change |

| Urea | 2,003 | 2,526 | +26.1% |

| DAP | 697 | 543 | -22% |

| Nitrogen | 1,174 | 1422 | +21.1% |

| Phosphate | 398 | 322 | -19.2% |

| Potash | 10.9 | 14.5 | +33.1% |

| Total Nutrients | 1,583 | 1,758 | +11.1% |

Total domestic fertilizer production during December 2025 was 754,000 tonnes. Urea and DAP production was 502,000 and 76,000 tonnes, respectively. Production of other products i.e. NP, CAN, SSP, SOP and NPKs was 85, 76, 7.9, 6.2 and 1.1 thousand tonnes, respectively.

Table 3: Domestic Production – December 2025

| Product | Production (‘000 tonnes) | % Share |

| Urea | 502 | 66.6% |

| DAP | 76 | 10.1% |

| NP | 85 | 11.3% |

| CAN | 76 | 10% |

| SSP | 7.9 | 1% |

| NPKs | 1.1 | 0.1% |

| SOP | 6.2 | 0.8% |

Regionally, urea offtake during December 2025 increased by 42.9% and 36.1%in Punjab and Sindh, respectively while its offtake decreased by 18.9%, 7.2% and 12% in KP, Balochistan and AJK/GB over December last year.

During December 2025, DAP offtake decreased by 45%, 47% and 71% in Punjab, Sindh and Balochistan, respectively while its offtake increased by 6.1% in KP over December previous year.

Table 4: Province-wise Offtake – December 2025

| Province | Urea (‘000 tonnes) | % Change | DAP (‘000 tonnes) | % Change |

| Punjab | 917 | +42.9% | 56 | -45% |

| Sindh | 374 | +36.1% | 18 | -47% |

| KP | 27.6 | -18.9% | 4.6 | +6.1% |

| Balochistan | 31 | -7.2% | 1.2 | -71% |

On the pricing front, domestic fertilizer prices showed mixed trends. Urea (Sona) declined slightly by 1.3% to Rs. 4,302 per 50 kg bag, while other urea brands dropped by 0.6% and prices of DAP, NP, CAN and SOP decreased by 0.1, 1.1, 0.2 and 1.7%, respectively

Internationally, urea and DAP prices remained stable in key markets such as China and Middle East.

Table 5: Domestic Fertilizer Prices – December 2025

| Product | Price (Rs./50kg) | % Change (MOM) |

| Urea (Sona) | 4,302 | -1.3% |

| Urea (Other) | 4,222 | -0.6% |

| DAP | 14,591 | -0.1% |

| NP | 9,171 | -1.1% |

| SSP (Granular) | 3,359 | +0.1% |

| CAN | 3.986 | -0.2% |

| SOP | 12,084 | -1.7% |

| NPK | 9,520 | +0.0% |

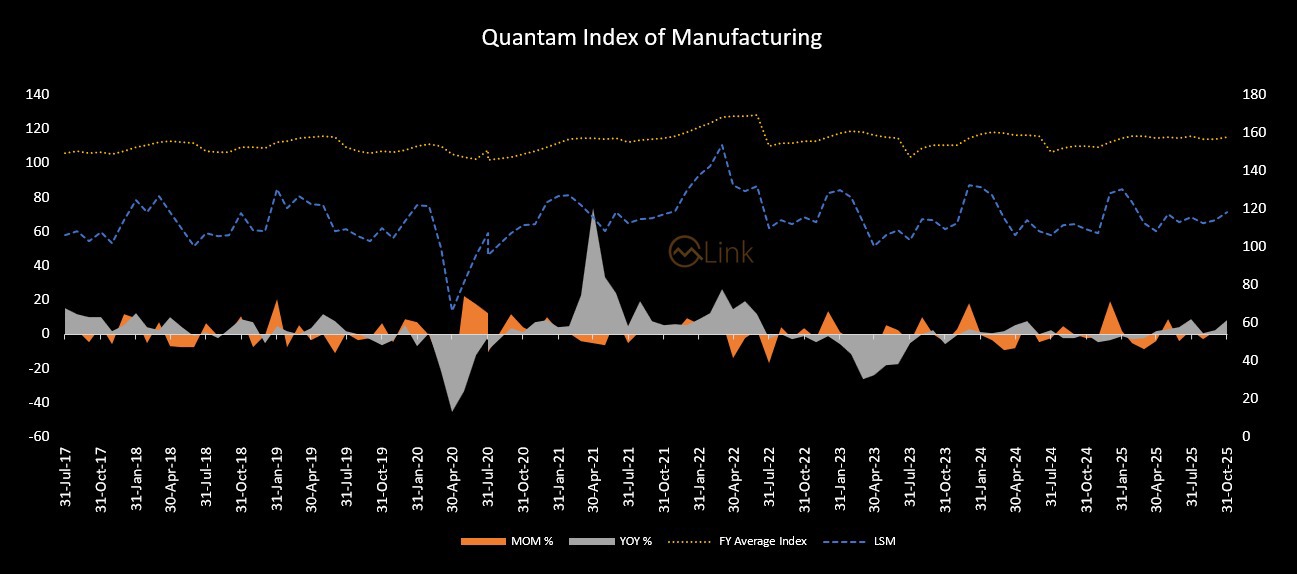

Big industry output grows 10% YoY in November

pakistansharemarketnp@gmail.com0Edit

Pakistan’s large-scale manufacturing sector sustained its recovery trajectory in November 2025, with the Quantum Index of Manufacturing (QIM) reaching 118.28, showing continued industrial momentum amid exceptional performances in automobiles, petroleum products and garments.

According to provisional data with base year 2015-16, Large Scale Manufacturing Industries (LSMI) output grew 10.37% year-on-year (YoY) in November 2025, while posting a modest 0.16% month-on-month (MoM) increase compared to October 2025.

On a cumulative basis, the sector recorded a 6.01% growth during July–November FY26, with the QIM averaging 115.72, up from 109.65 in the same period last year.

Seafood exports rise 22% to $253m in H1 FY26

pakistansharemarketnp@gmail.com0Edit

Pakistan’s seafood exports rose 21.6% year-on-year in value to $253.24 million during the first half of FY2025–26.

Export volumes increased 19.1% to 122,629.11 metric tons between July and December 2025, showed stronger foreign demand and improved export capacity.

The increase compares with the same period of FY2024–25, when exports stood at 102,942.05 metric tons valued at $208.25m.

This marked a 19.1% rise in volume and a 21.6% increase in value, according to the Marine Fisheries Department, as per a press release issued.

Federal Minister for Maritime Affairs Muhammad Junaid Anwar Chaudhry, commenting on the figures, said export momentum remained steady throughout the six-month period.

He said the trend indicated improved competitiveness of Pakistan’s marine fisheries in global markets.

Frozen fish remained the largest export category, with shipments of 26,669.37 metric tons valued at $53.33m.

Exports of shrimps and prawns generated $40.46m, while frozen cuttlefish accounted for $36.13m.

Additional earnings came from shrimp meal, crabs, sardines, mackerel, flatfish species and fish meal, pointing to diversification and growth in value-added processing.

China retained its position as Pakistan’s largest seafood export destination, importing more than 83,602 metric tons worth $149.2m nearly 59% of total exports during the period.

Thailand ranked second with imports valued at $31.3m, mainly shrimps and prawns. The United Arab Emirates, Malaysia and Japan followed, with rising demand for cuttlefish and fish meal.

Exports were also recorded to the European Union, Saudi Arabia, Vietnam, Kuwait and the United States.

Monthly export data showed consistent growth, peaking at $56.42m in November and $55m in December, supported by seasonal demand and logistical improvements.

Non-tax revenue from the fisheries sector increased to Rs127.7m, up from Rs118m in the corresponding period last year.

The minister said fisheries remain a key component of Pakistan’s maritime economy, supporting hundreds of thousands of livelihoods in coastal communities along the Arabian Sea, particularly in Sindh and Balochistan.

Historically contributing around 1% to GDP, the sector has recovered from pandemic-era disruptions through expanded processing capacity, improved cold-chain logistics and stricter certification aligned with international standards.

He attributed recent gains to initiatives under the Ministry of Maritime Affairs, including collaboration with the International Maritime Organization on sustainable fishing practices and investments in port infrastructure at Karachi and Gwadar.

While stressing the need for regulatory compliance to protect marine biodiversity amid climate-related challenges.

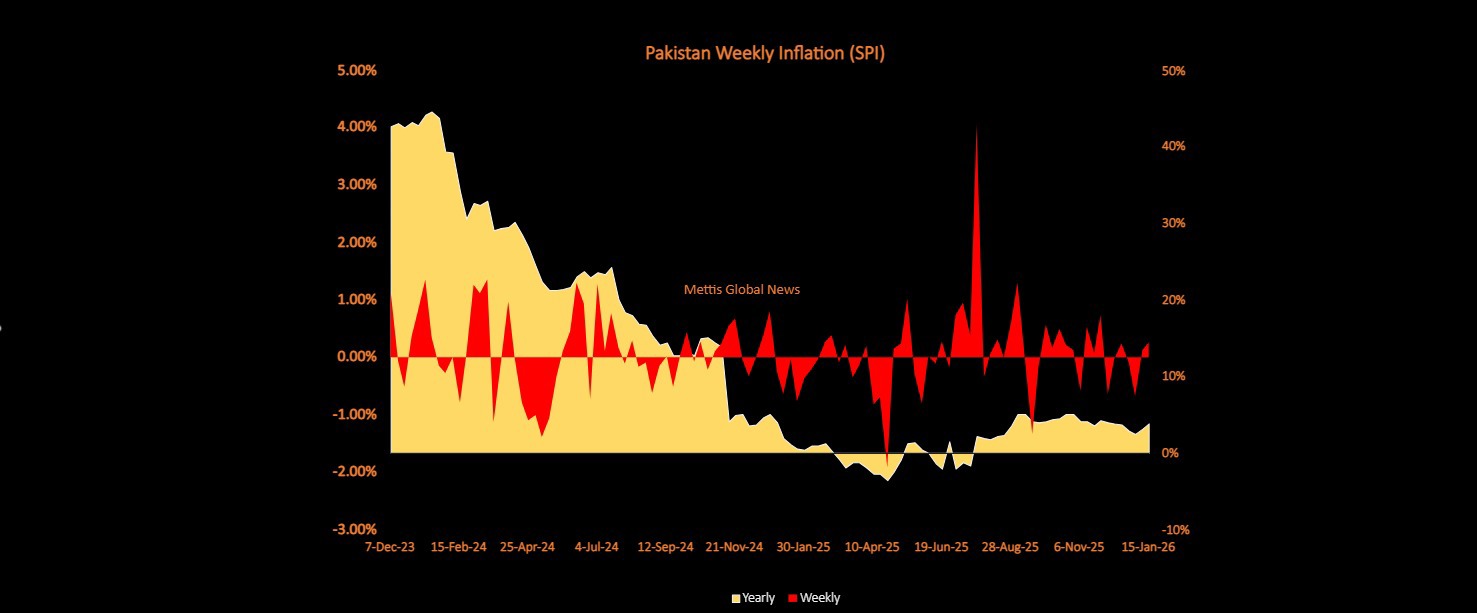

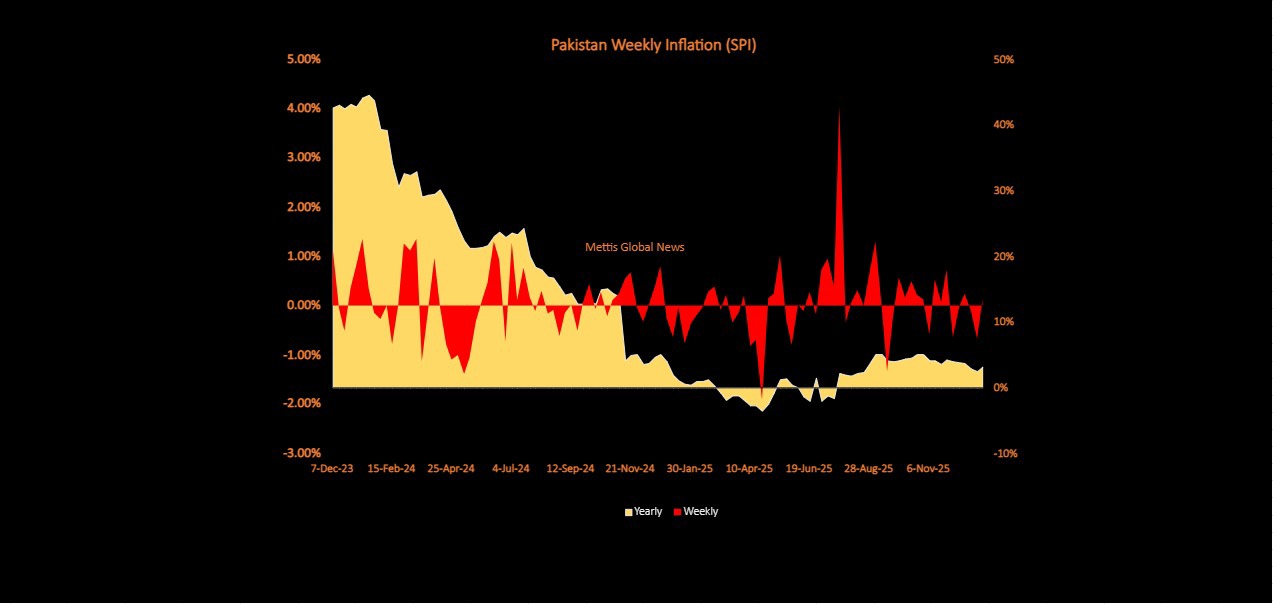

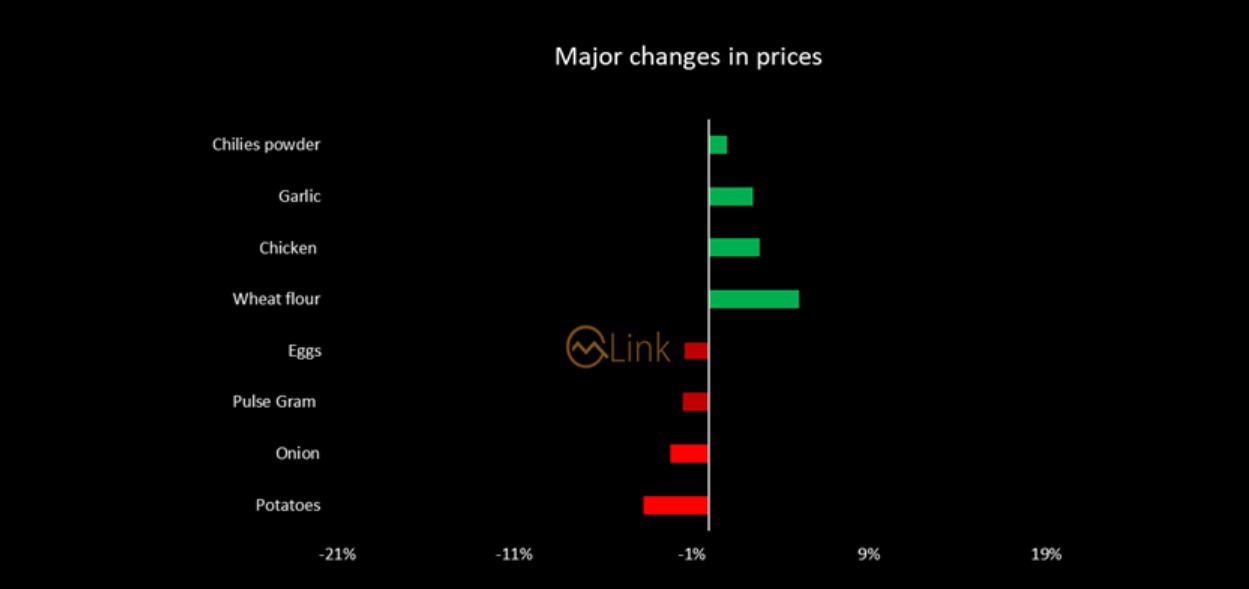

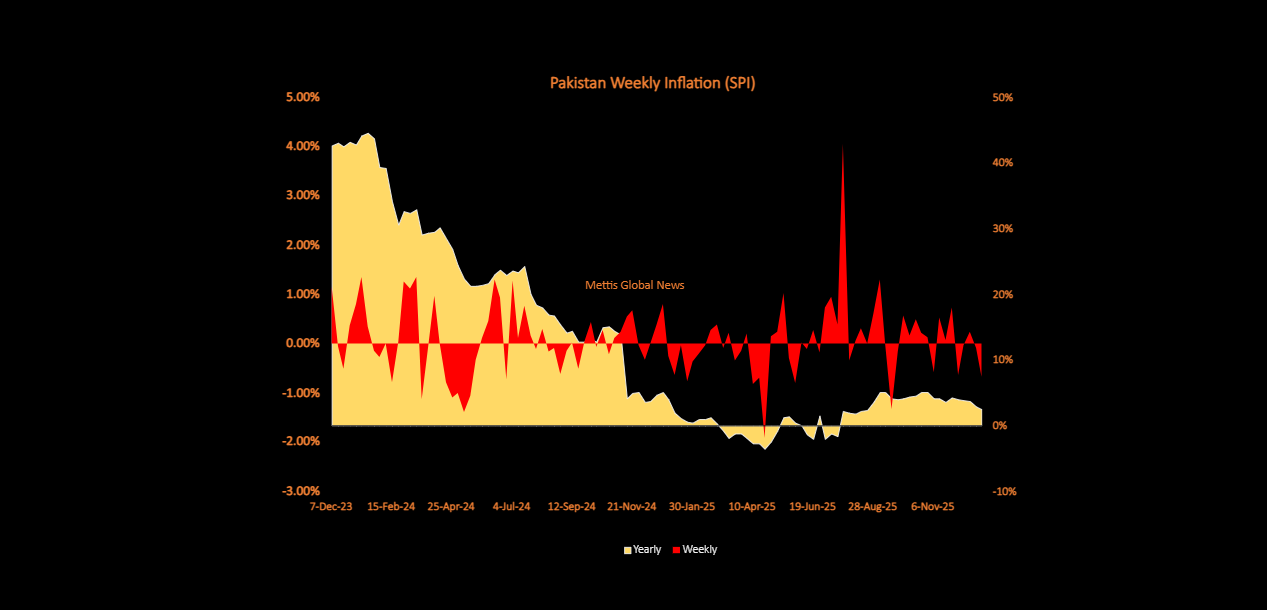

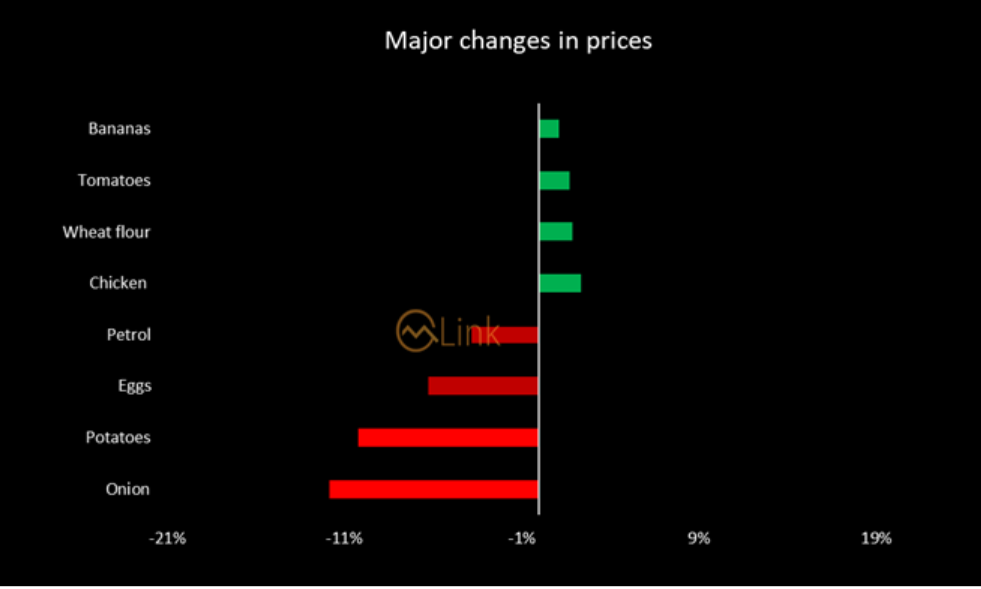

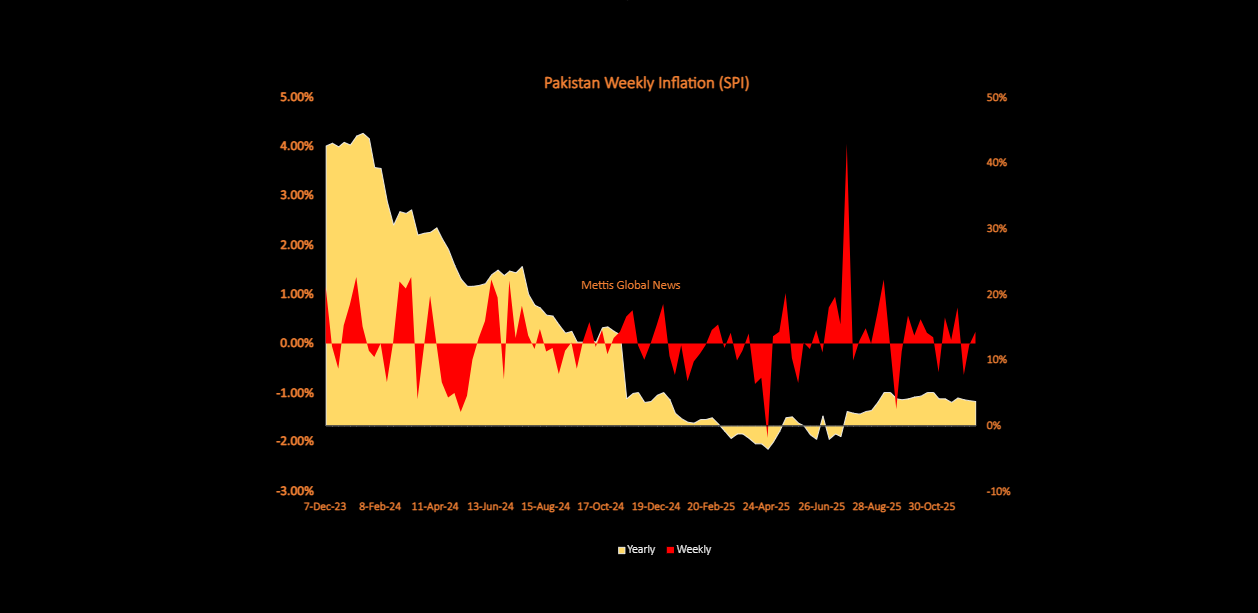

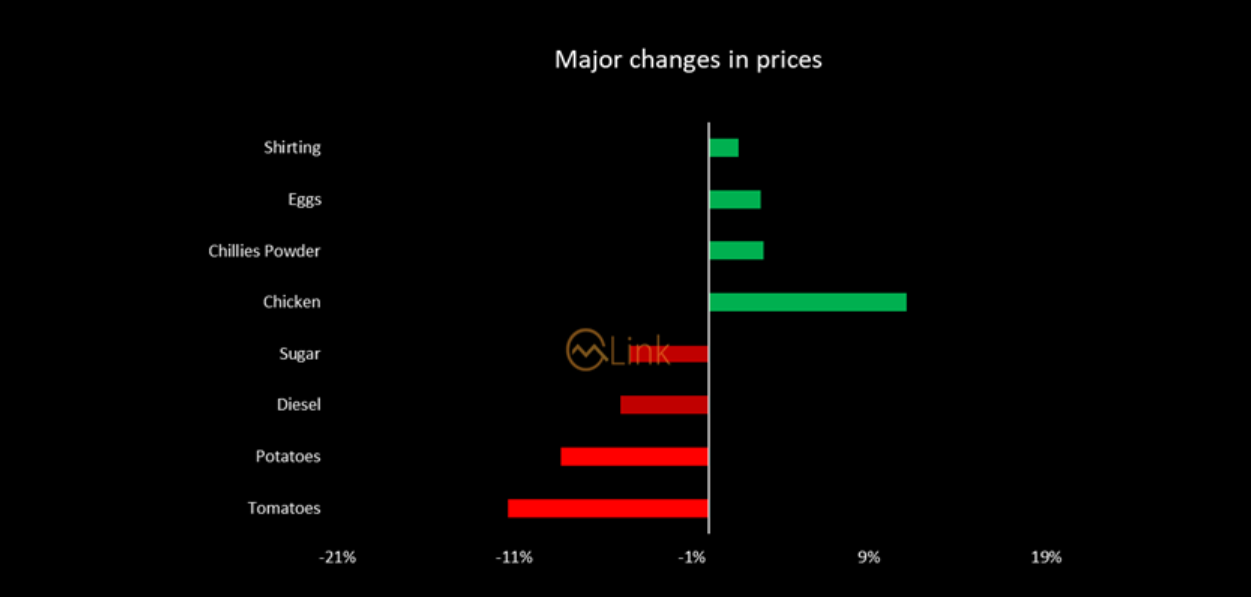

Weekly SPI increases by 0.25% WoW

pakistansharemarketnp@gmail.com0Edit

Pakistan’s short-term inflation Sensitive Price Indicator (SPI) increased by 0.25% compared to the previous week, while it rose by 3.87% compared to the same period last year, according to the Pakistan Bureau of Statistics (PBS).

During the week, out of 51 essential items, prices of 13 items (25.49%) increased, 13 items (25.49%) decreased, while 25 items (49.02%) remained unchanged, according to PBS data.

The major increase during the week was observed in the prices of tomatoes, which rose by 27.64%, followed by LPG up 7.03%, wheat flour increasing 3.26%, eggs for higher by 2.19%.

Bananas rising 1.68%, chilies powder up 1.02%, firewood increasing 0.80%, pulse moong rising 0.70% and georgette edging up by 0.69%.

On the other hand, the major decrease was recorded in the prices of potatoes, which declined by 6.72%, onion down 3.82%, chicken falling 1.66%.

Salt powder easing 0.67%, pulse gram falling 0.58%, rice basmati broken down 0.44%, vegetable ghee 1kg declining 0.31% and pulse masoor lower by 0.29%.

The year-on-year trend for the current week depicts an increase of 3.87% in the Sensitive Price Indicator (SPI).

The major annual increase was observed in the prices of Wheat Flour, which surged by 34.90%, followed by Gas Charges for Q1 up 29.85%, Eggs increasing 20.85%, Beef rising 12.83%, Chilies Powder higher by 12.56%.

Sugar up by 10.43%, Firewood rising 10.35%, Gur up 9.97%, Powder Milk higher by 9.90%, Bananas increasing 8.92% and Lawn Printed rising 8.29%.

On the contrary, a significant year-on-year decrease was recorded in the prices of Potatoes, which plunged by 46.60%, followed by Onions down 37.30%, Garlic declining 35.91%, Tomatoes lower by 32.88%.

Pulse Gram falling 31.03%, Tea Lipton decreasing 17.79%, Pulse Mash down 13.69%, Pulse Masoor falling 9.55%, Diesel declining 1.27% and Petrol easing 0.95%.

The average price of Sona urea stood at Rs4,375 per 50 kg bag, up by 0.66% from last week’s price, and a 3.43% decrease from last year.

Meanwhile, the average Cement price rose to Rs1,400 per 50 kg bag, which is 0.31% lower than the previous week, and 0.64% above last year.

PBS calculates short-term inflation using the SPI on a weekly basis to assess the price movement of essential commodities at shorter interval of time so as to review the price situation in the country.

SPI comprises 51 essential items collected from 50 markets in 17 cities of the country.

OMO Result: SBP injects Rs13.1tr into market

pakistansharemarketnp@gmail.com0Edit

The State Bank of Pakistan (SBP) conducted a reverse repo and Shariah Compliant Modarabah based Open Market Operation (OMO) today, in which it cumulatively injected a total of Rs13.12 trillion into the market of which Rs12.7tr were injected through reverse repo OMO.

| Summary of OMO Result (Conventional) | |||||||

| Amount (Rs in Million) | Rate (%) | Quotes | |||||

| Tenor | Type | Offered | Accepted | High – Low | Accepted | Offered | Accepted |

| 7D | Reverse Repo (Injection) | 745,500 | 745,000 | 10.55-10.53 | 10.53 | 05 | 05 |

| 14D | 11,970,900 | 11,970,900 | 10.57-10.51 | 10.51 | 20 | 20 | |

| Total | 12,715,900 | 12,715,900 | |||||

Meanwhile, the remaining Rs410bn was injected through Shariah-compliant Modarabah-based OMO.

| Summary of OMO Result (Shariah) | |||||||

| Amount (Rs in Million) | Rate (%) | Quotes | |||||

| Tenor | Type | Offered | Accepted | High – Low | Accepted | Offered | Accepted |

| 7D | Reverse Repo (Injection) | 390,000 | 390,000 | 10.55-10.53 | 10.53 | 02 | 02 |

| 14D | 20,000 | 20,000 | 10.53-10.53 | 10.53 | 01 | 01 | |

| Total | 410,000 | 410,000 | |||||

Explanatory Note

Open Market Operation is a tool used by SBP to inject or mop up funds from the banking system, based on liquidity requirements, via the purchase or sale of eligible securities.

Operationally, in case of OMO (Injections), SBP lends funds to banks/Primary Dealers (PDs) against eligible collateral to address liquidity shortage in the system.

For OMO (Injections), marketable government securities, i.e. Market Treasury Bills (MTBs) and Pakistan Investment Bonds (PIBs) are eligible securities.

In OMO (Mop-up), SBP sells MTBs to banks in exchange for funds to remove surplus liquidity from the system.

Eligible collateral for OMO (Mop-up) includes selling MTBs (on repo or outright basis) to banks for removing excess liquidity from the system.

In case of Bai-Muajjal, a Shariah compliant tool for managing liquidity in the Islamic banking system, GOP Ijara Sukuk are eligible securities.

Banks and PDs are eligible counterparties to OMO transactions. For Bai Muajjal transactions, Islamic banks and specialized Islamic windows of conventional banks are eligible counterparties.

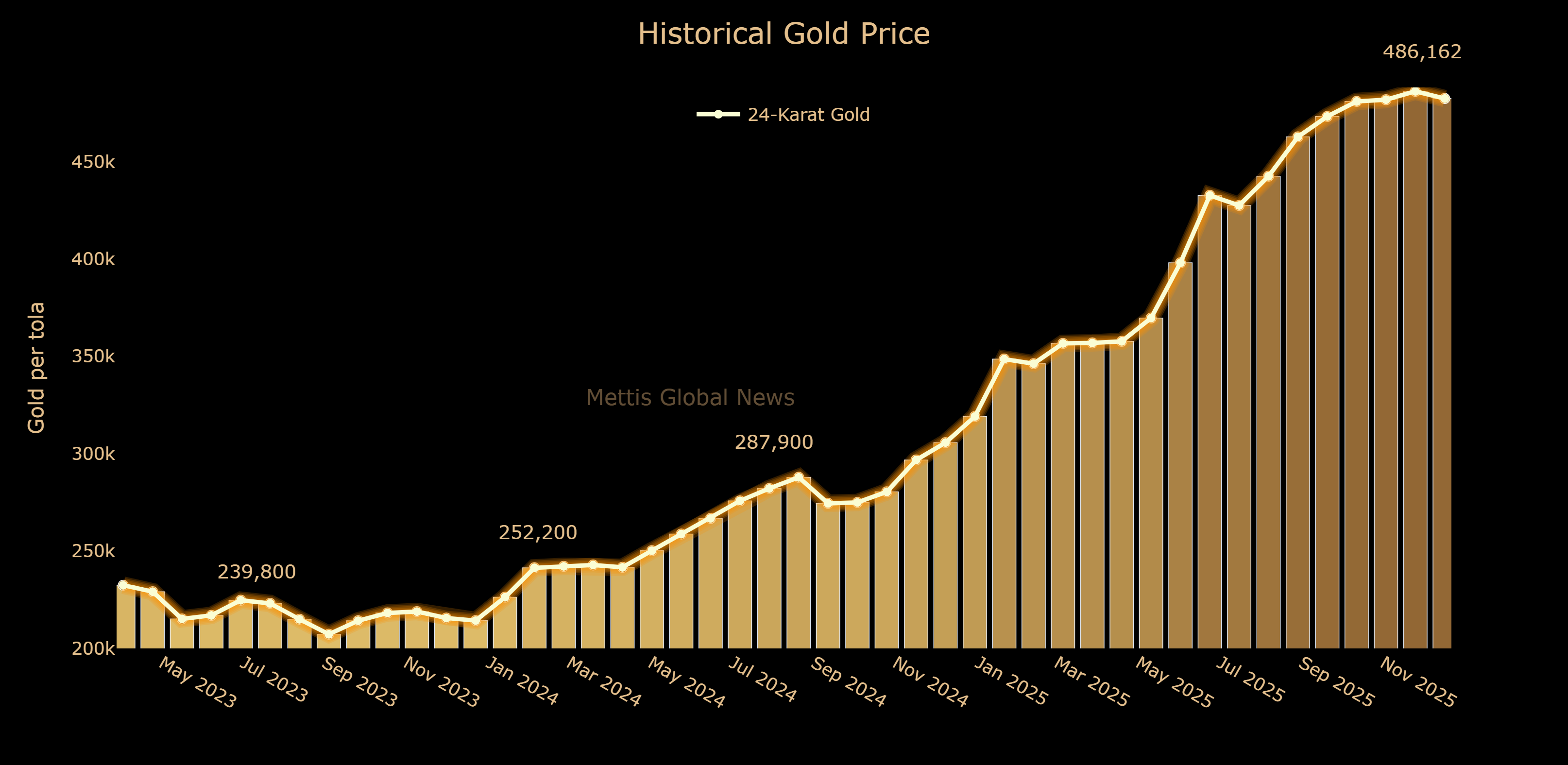

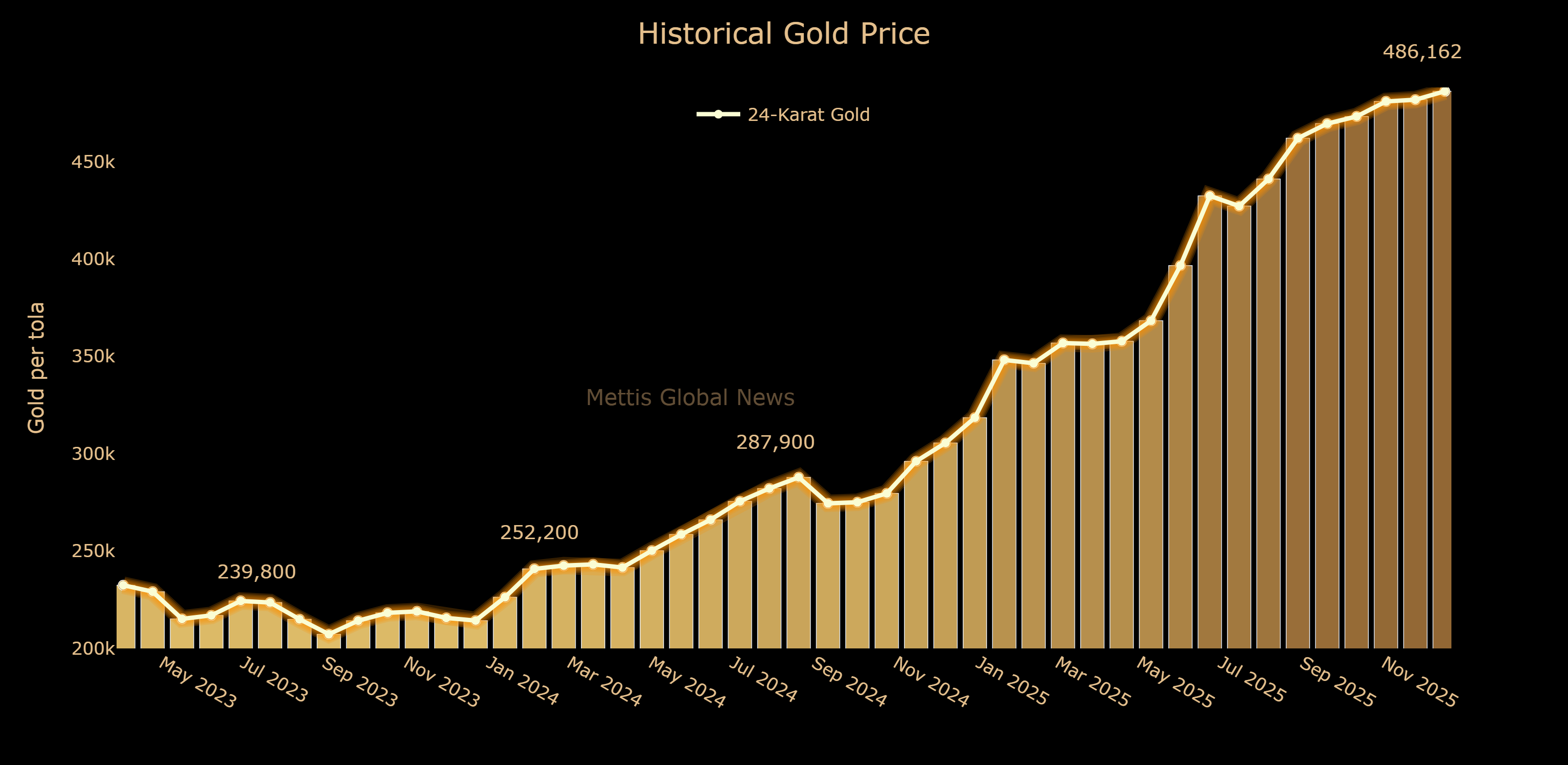

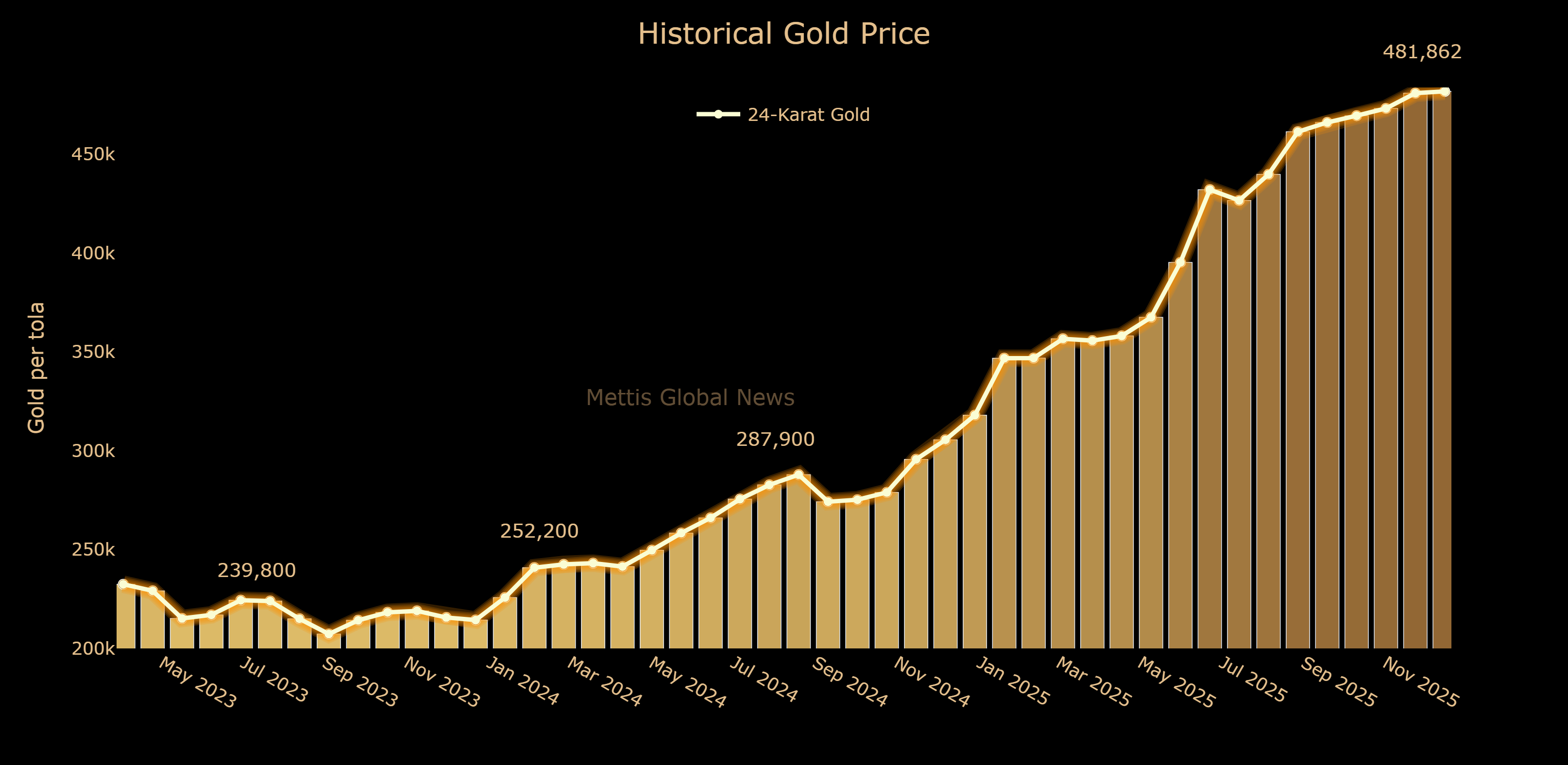

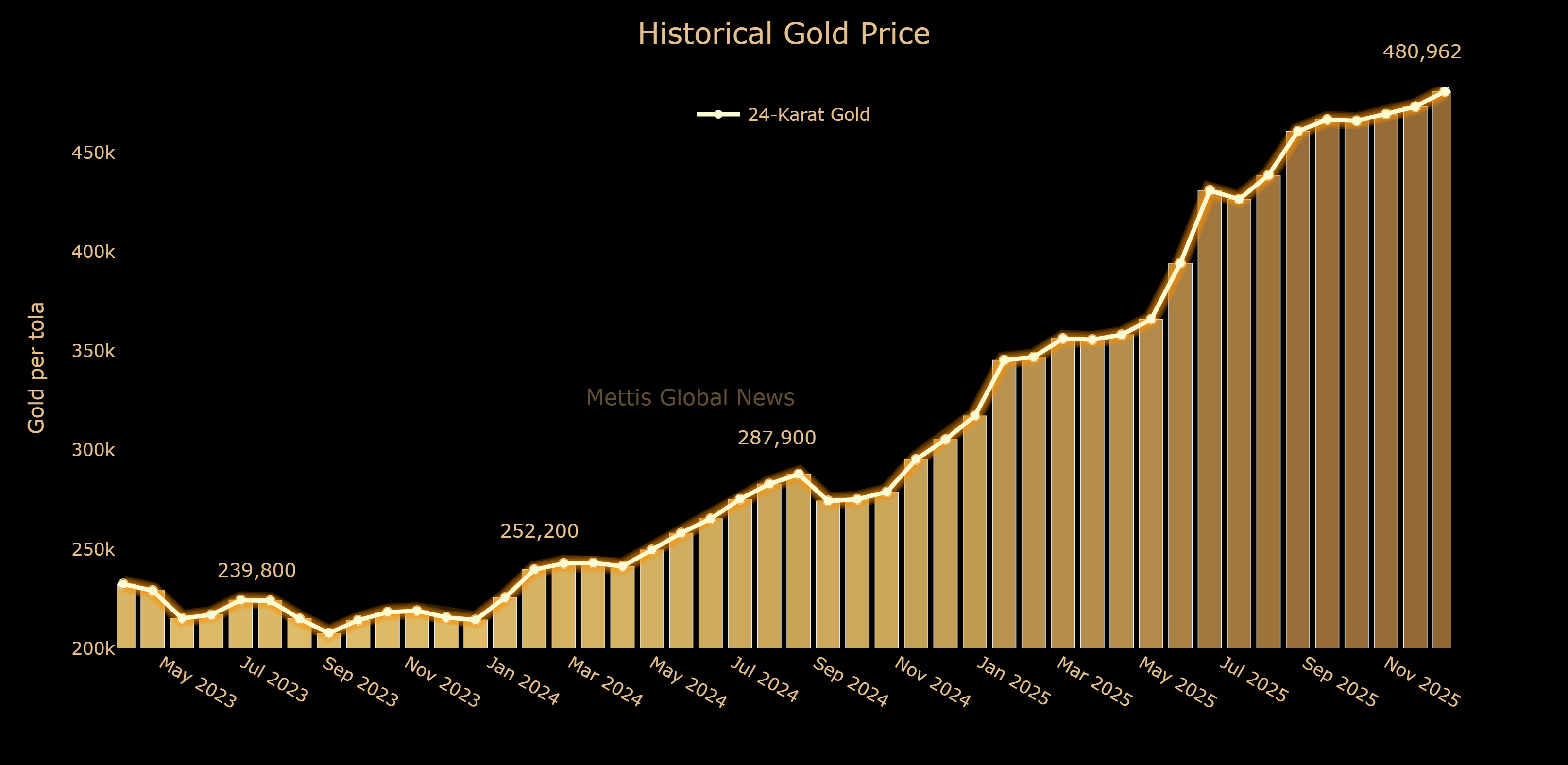

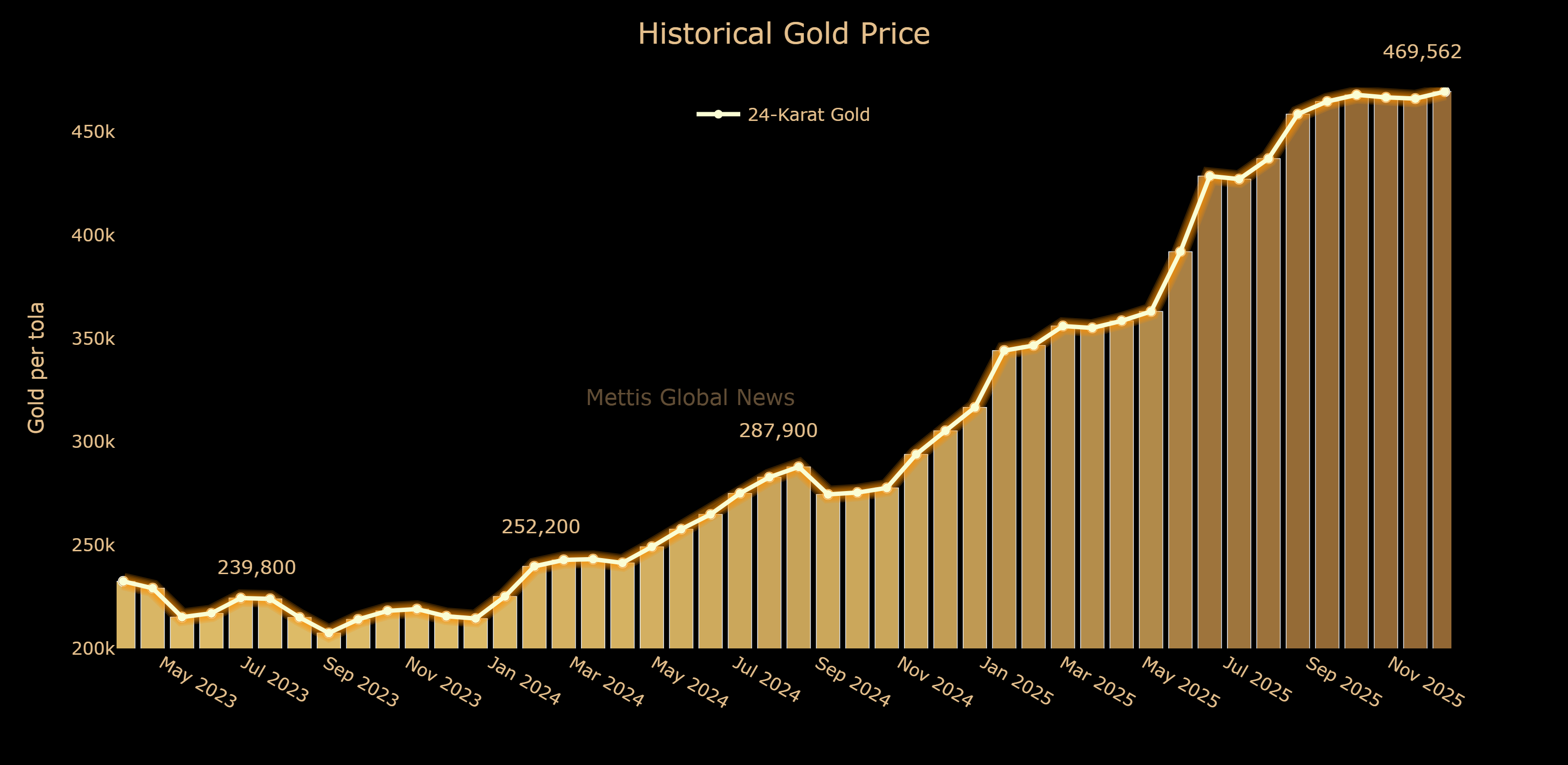

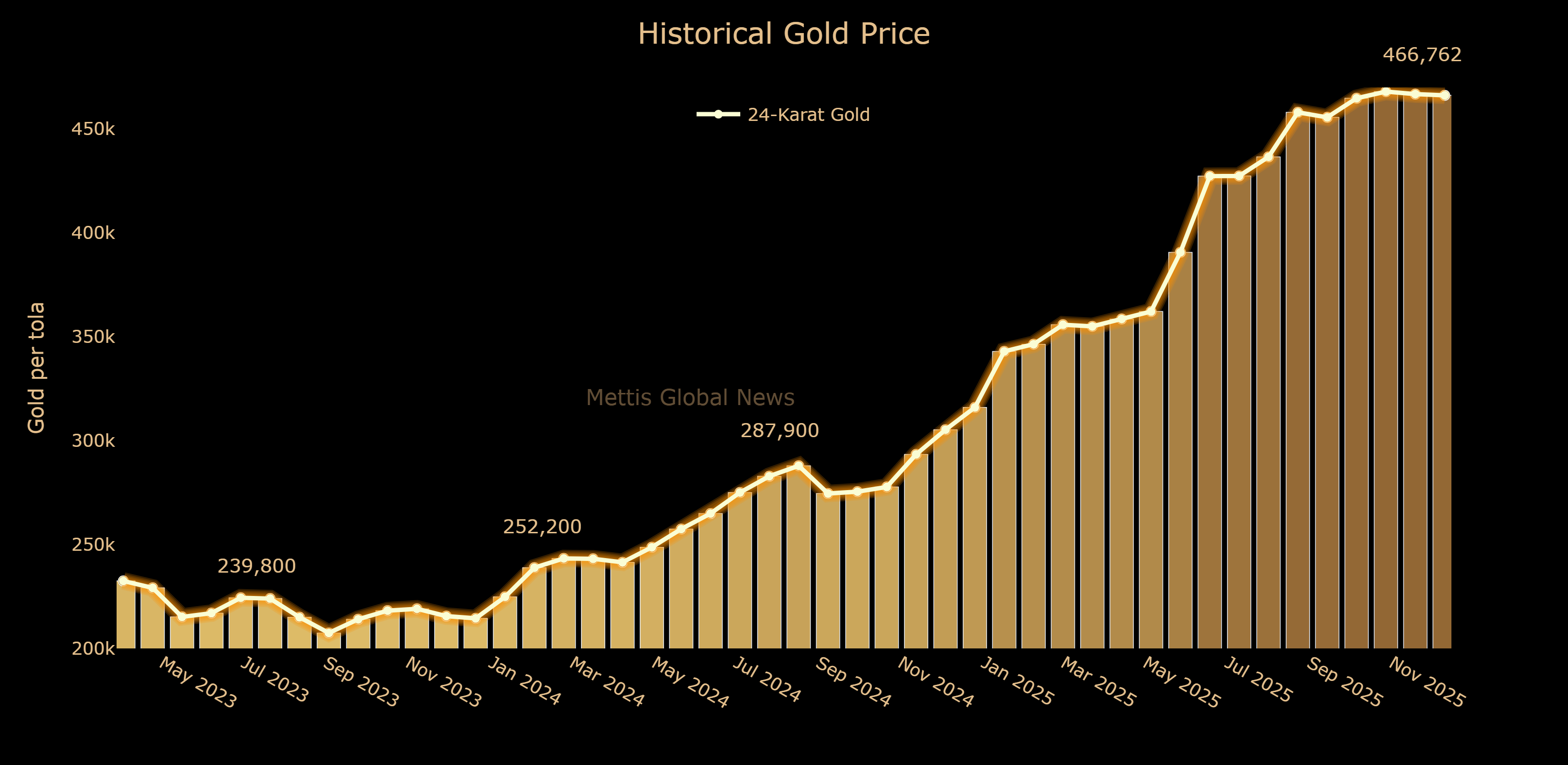

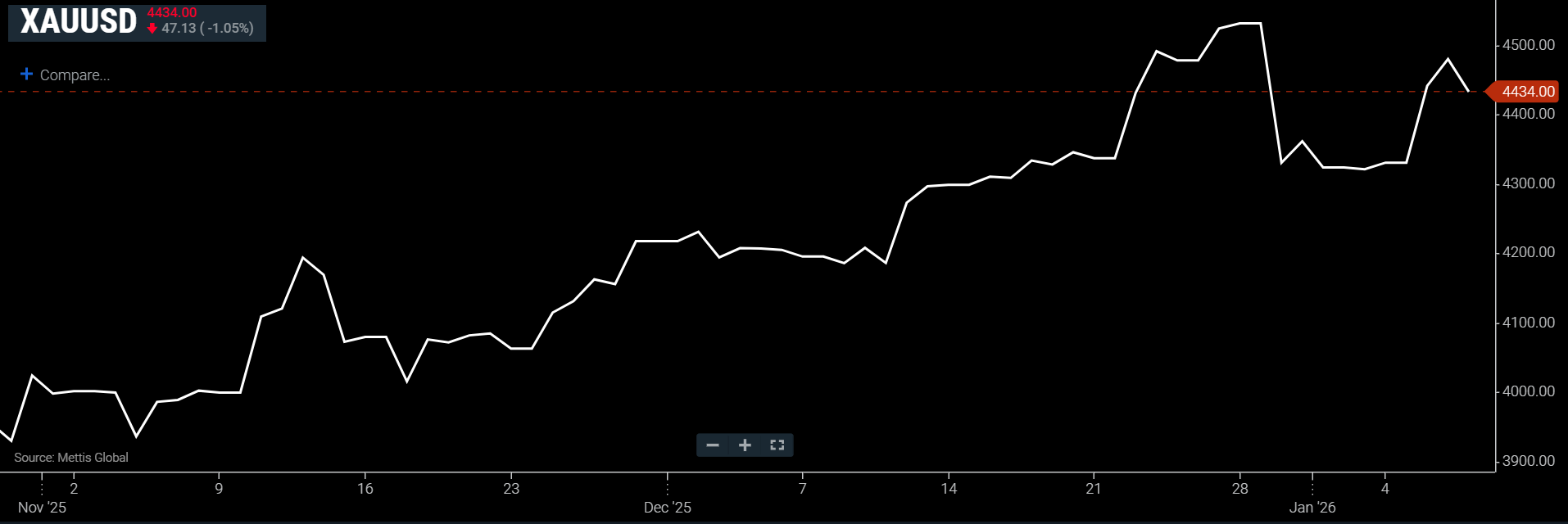

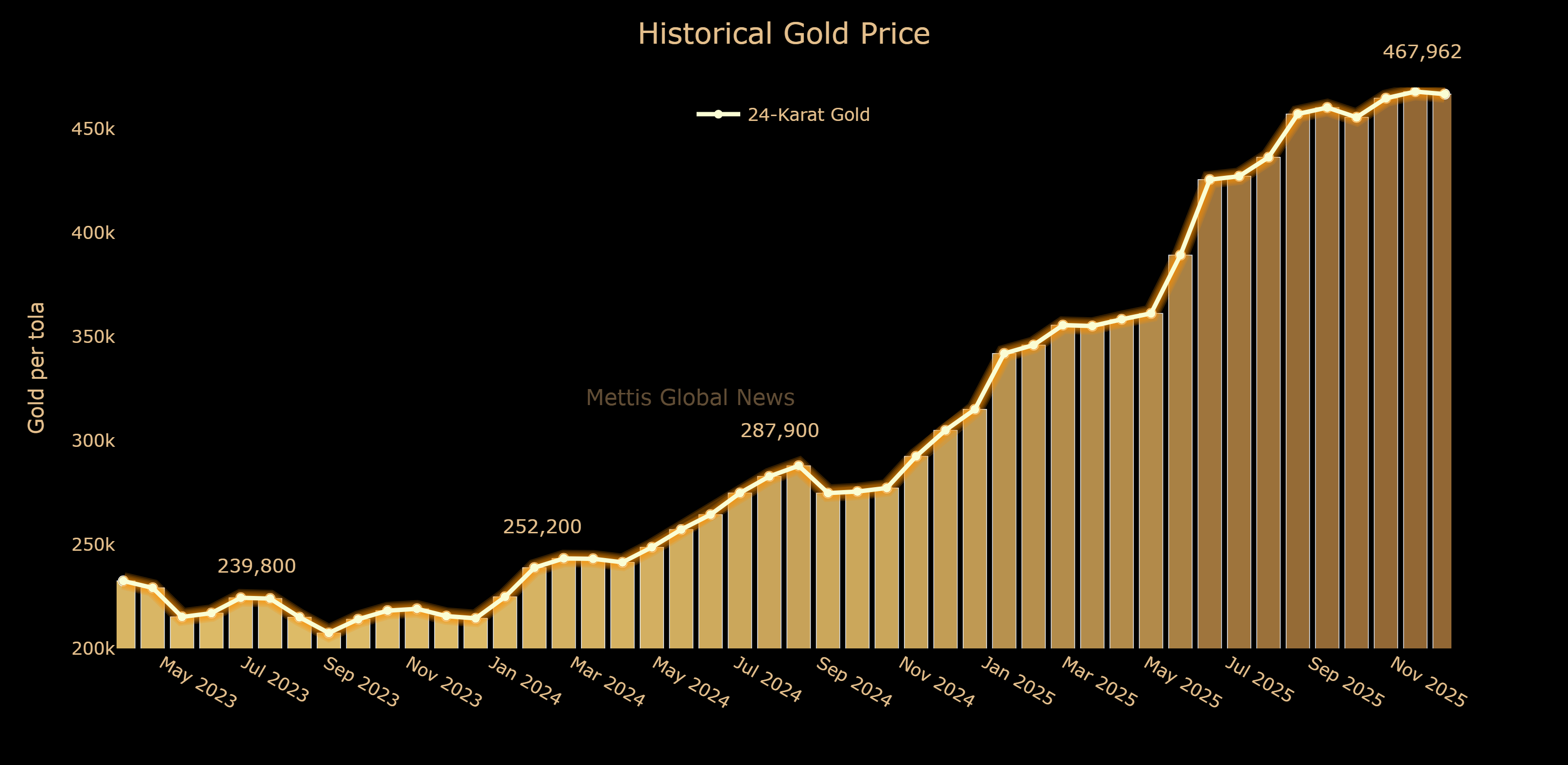

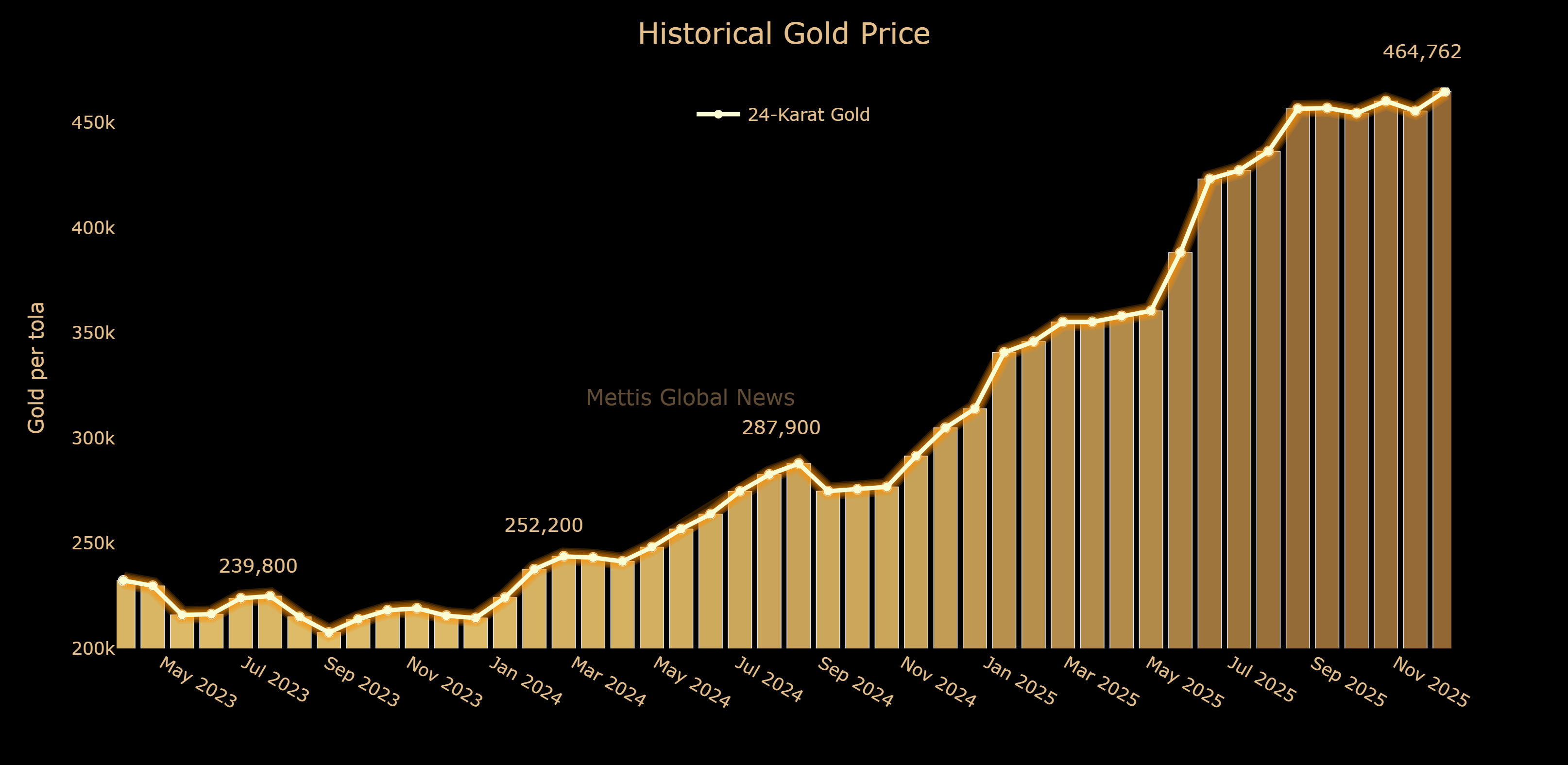

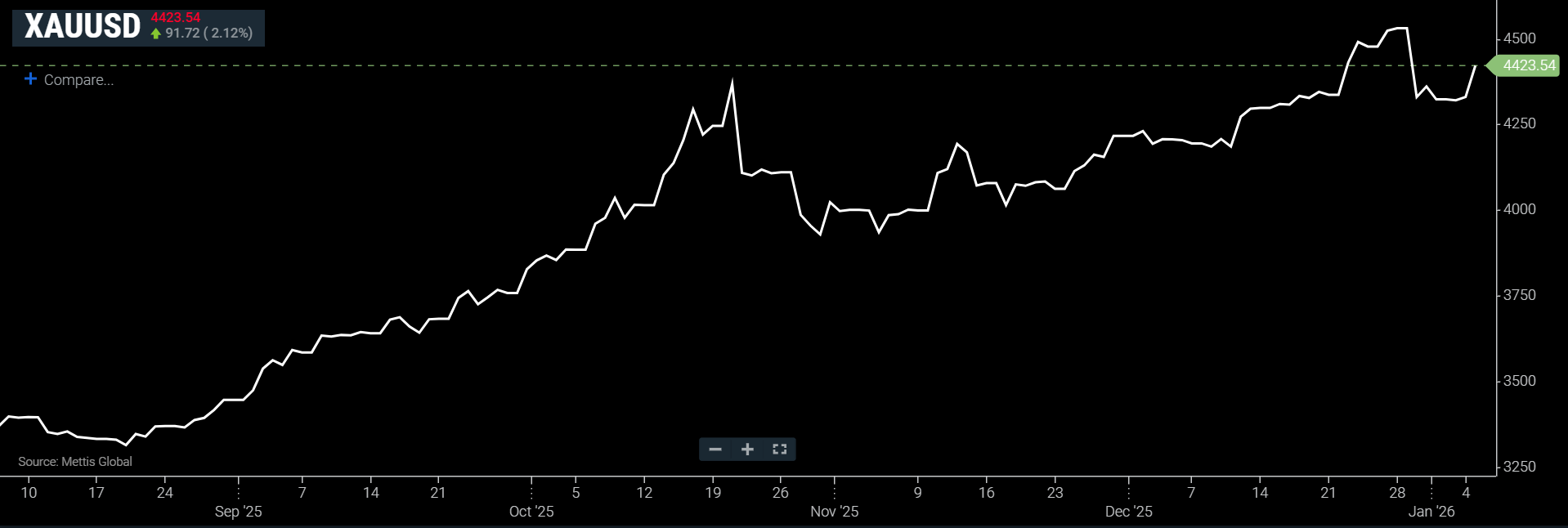

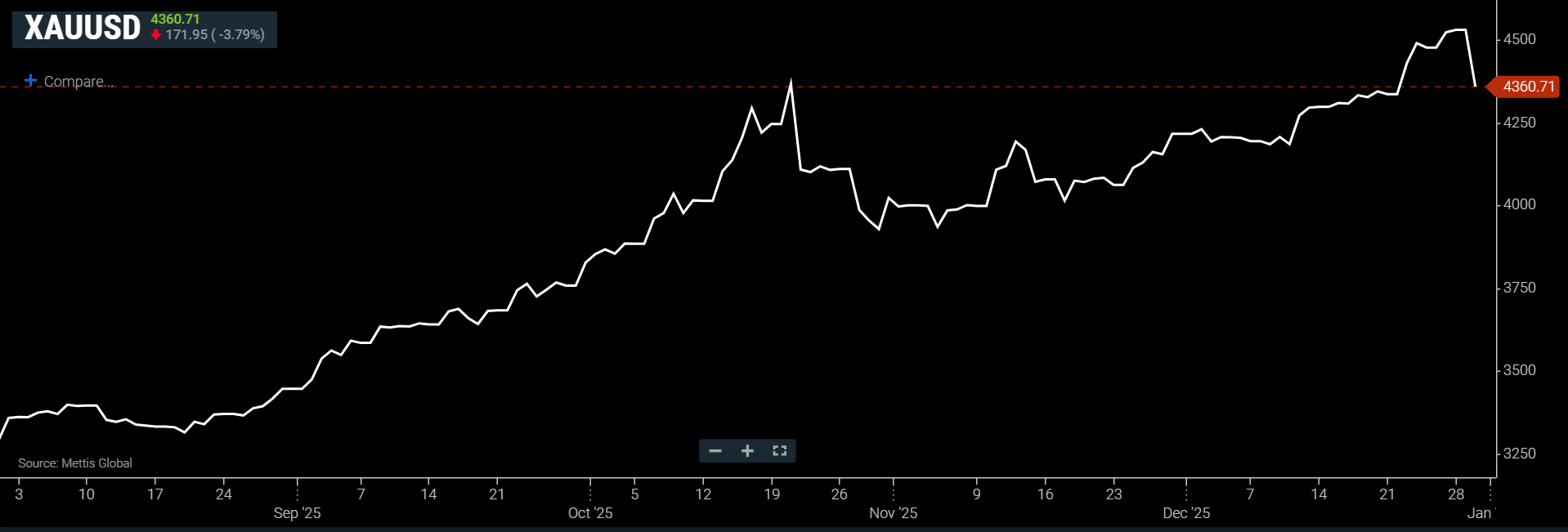

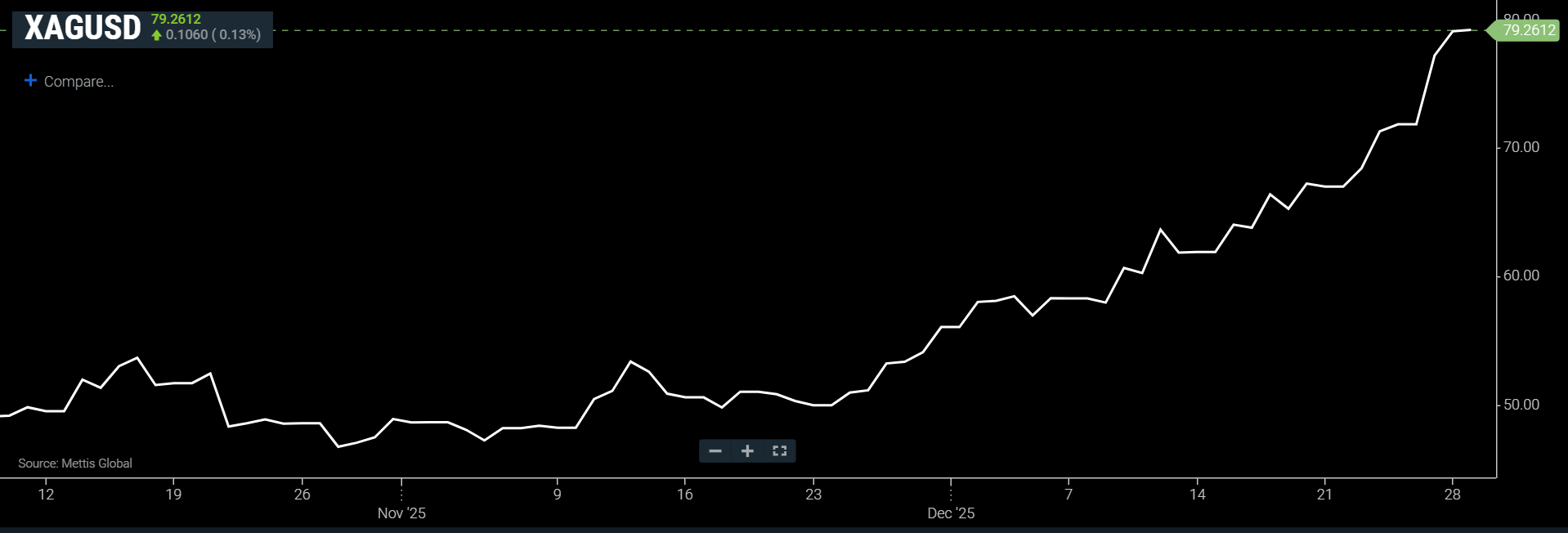

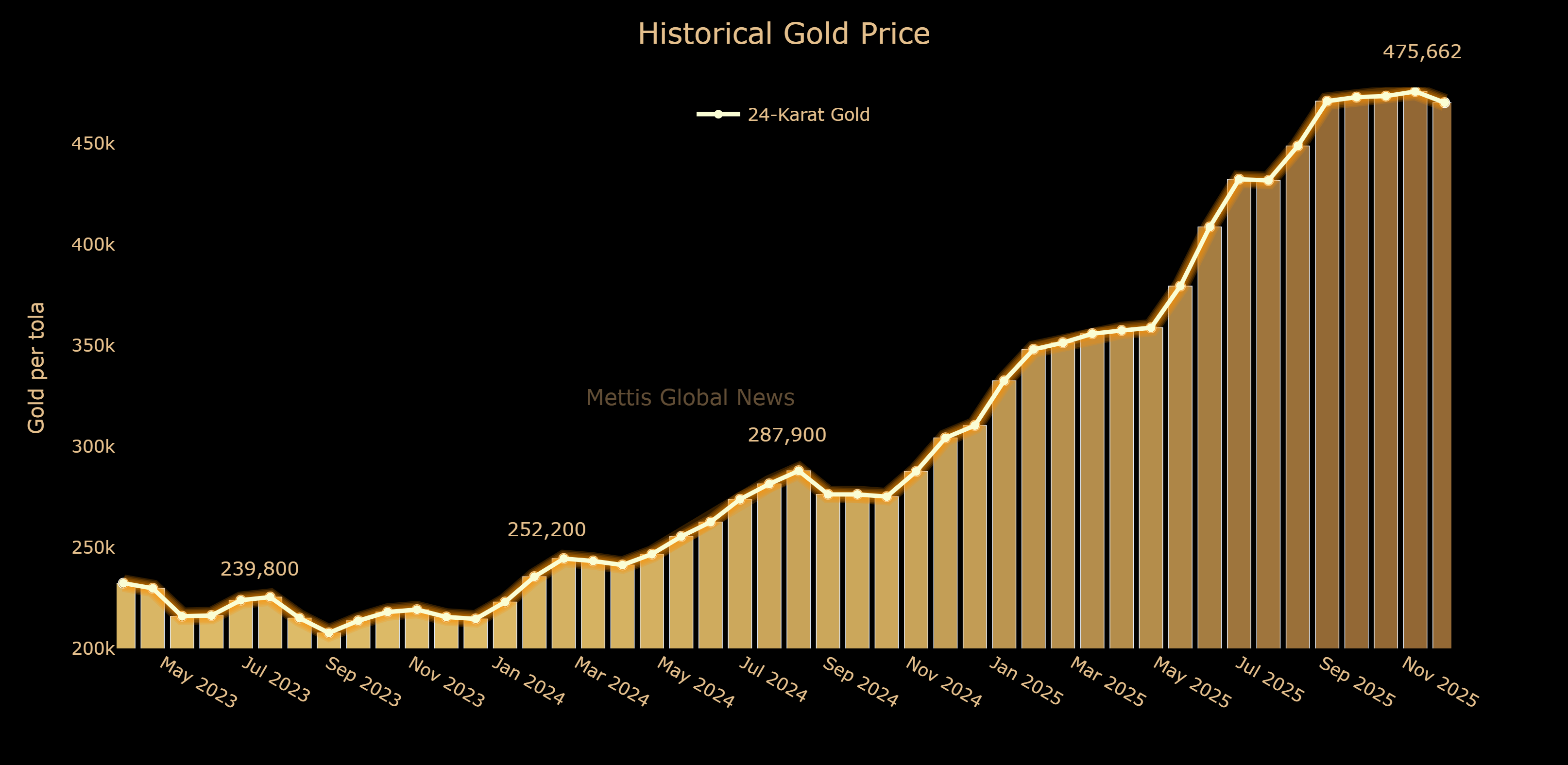

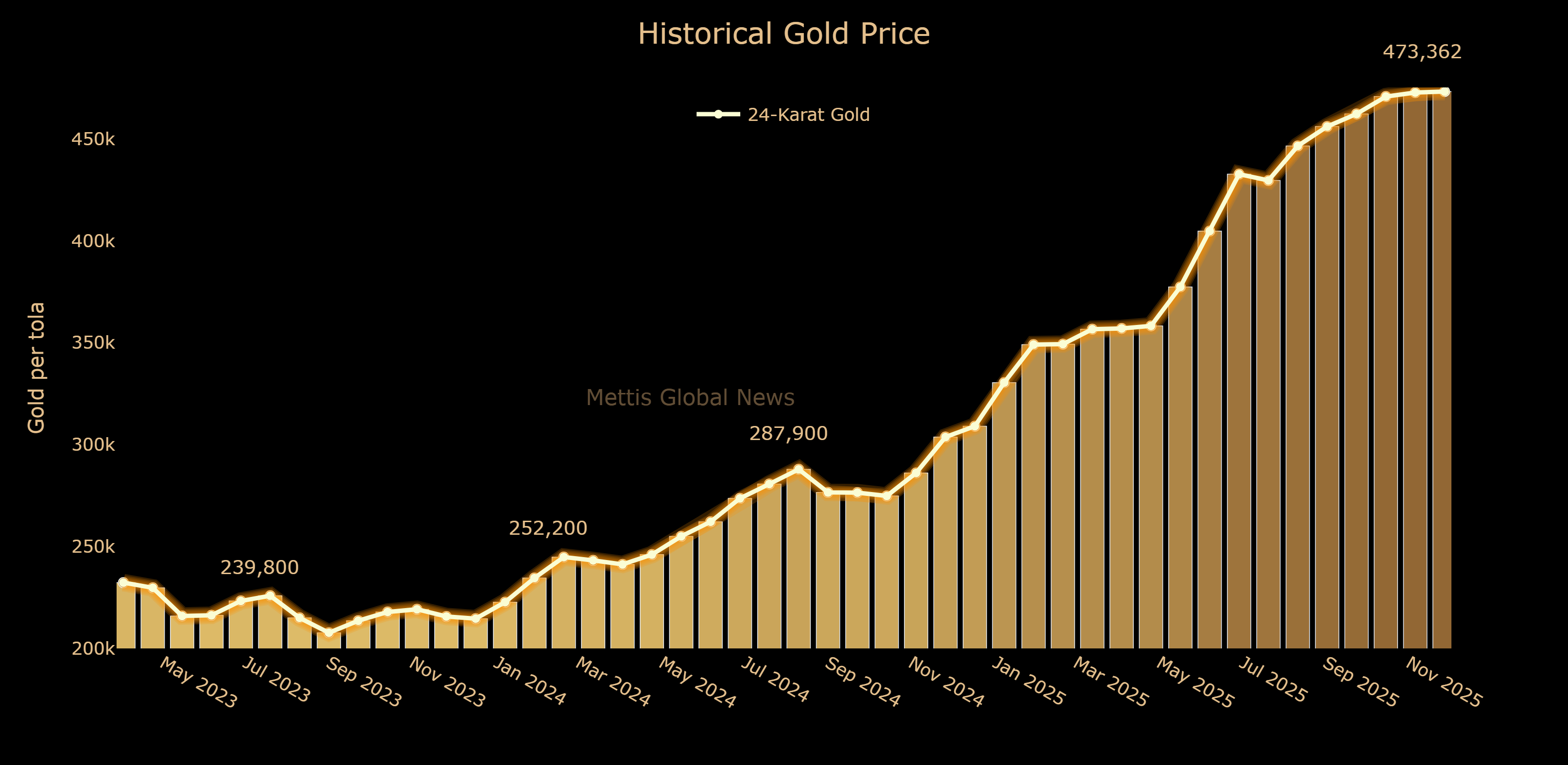

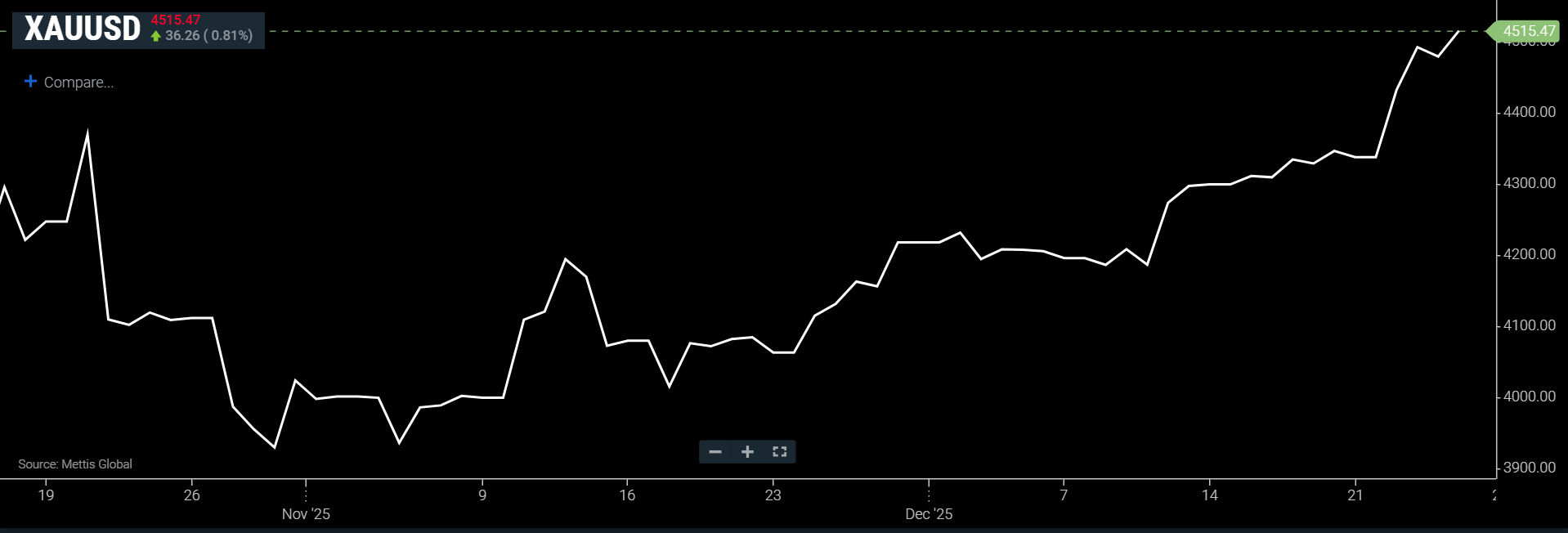

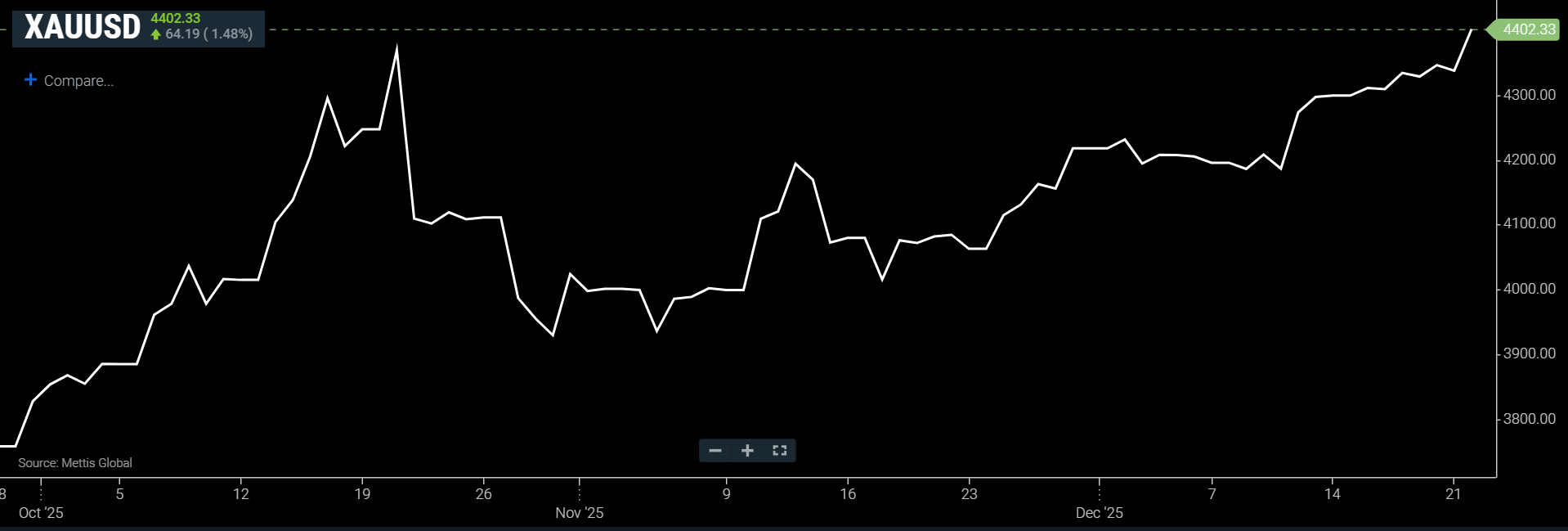

Gold price in Pakistan remain unchanged

Gold price in Pakistan remained unchanged on Friday, with 24-karat gold being sold at Rs482,462 per tola, unchanged from the previous session.

Similarly, 24-karat gold per 10-gram was sold at Rs413,633 unchanged from the previous session, according to rates shared by the All-Pakistan Gems and Jewelers Sarafa Association (APGJSA).

The price of 22-karat gold was also quoted at Rs379,177 per 10-gram.

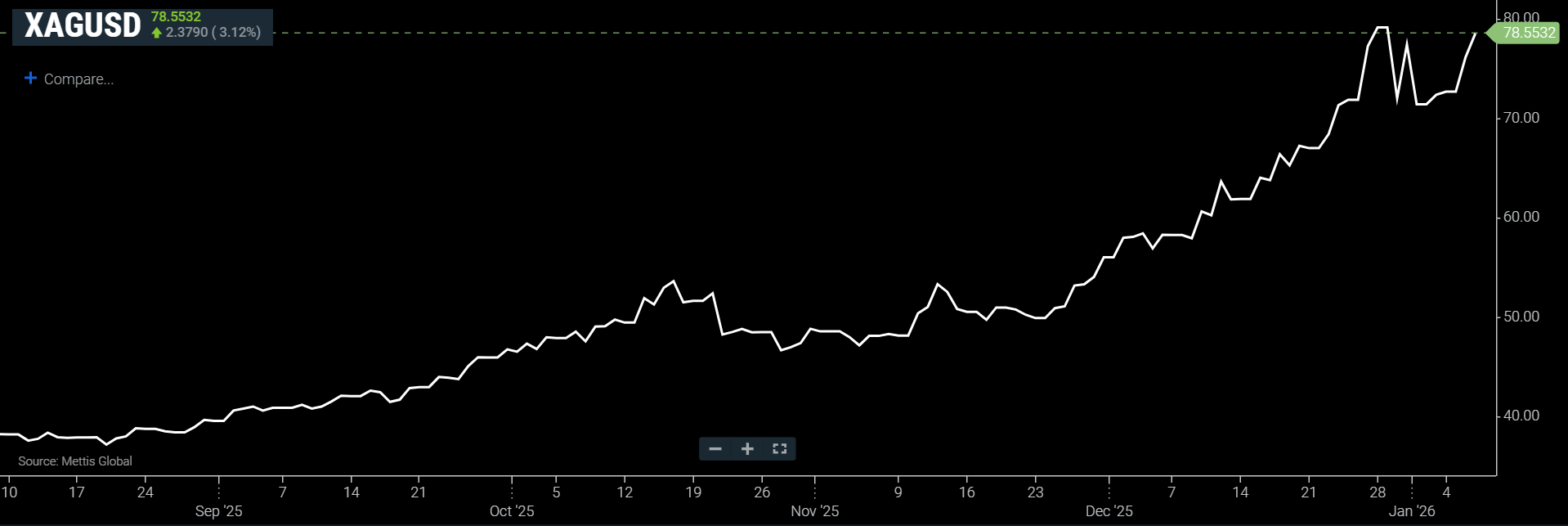

On the other hand, silver prices rose in the domestic market, with 24-karat silver being sold at Rs9,525 per tola (+Rs100) and Rs8,166 per 10-gram (+Rs86).

| PKR (24-karat per tola) | Jan 16, 2026 | Jan 15, 2026 | DoD | 1 Month | FYTD | CYTD |

|---|---|---|---|---|---|---|

| Gold | 482,462 | 482,462 | 0 | 28,900 | 132,262 | 25,500 |

| Silver | 9,525 | 9,425 | 100 | 2,703 | 5,743 | 1,807 |

Globally, spot gold traded near $4,608 an ounce, down $1.5 or 0.03% from the previous session, as easing geopolitical tensions reduced the demand for the metal as a safe-haven asset.

Federal bucks ahead, provinces lag behind in Pakistan’s tax race

Pakistan’s tax performance highlights a significant gap between federal and provincial revenue collections.

While the federal government continues to show steady growth, provincial tax efforts remain far below potential.

In the fiscal year 2025, the federal government collected over Rs13 trillion in taxes and levies, equivalent to 11.3% of GDP, which was Rs114.7 trillion.

For countries at Pakistan’s development level, a benchmark tax-to-GDP ratio of 18% is considered healthy, with 15% expected from federal collections.

The federal tax system is on track to reach 15% of GDP by June 2028.

By comparison, provincial governments combined collected Rs979 billion, or 0.85% of GDP, substantially below the 3% target.

According to Khurram Schehzad on his X platform, the focus should be on revenue yield from the existing taxable base, rather than just nominal collection figures.

The gap in revenue performance is evident across multiple sectors.

The services sector, which falls under provincial taxation, has an estimated taxable base of Rs29tr, yet provincial collections amounted to Rs650bn, or 2.2%.

Federal collections on goods, by contrast, reached Rs3.9tr, representing 13% of the estimated base.

Agricultural income tax, another provincial subject, yielded just 0.2% of its Rs3.7tr base.

Property taxes, including stamp duties and urban immovable property tax, accounted for 0.3% of a real estate asset base of Rs21.7 tr, lower than several regional peers.

Federal tax yields exceed 17% of their estimated base, while provincial yields remain far below potential.

The provincial tax gaps alongside federal reforms could improve public services, reduce fiscal stress, and support a more balanced fiscal federalism.

The discussion on resource allocation and fiscal federalism, therefore, is increasingly seen as one that should be grounded in measurable revenue outcomes rather than perceptions. Strengthening tax performance at both federal and provincial levels is central to tapping Pakistan’s economic potential.

CCP approves interlinked Toyota, Daimler vehicle merger transactions

The Competition Commission of Pakistan (CCP) has approved two interconnected merger transactions linked to a global restructuring involving Toyota Motor Corporation and Daimler Truck AG, clearing the way for the joint consolidation of Hino Motors and Mitsubishi Fuso Truck and Bus Corporation (MFTBC).

The approved transactions form part of a single integrated restructuring designed to consolidate and jointly manage the commercial vehicle operations of Hino and MFTBC under a newly created holding structure , said a press release issued.

Under the arrangement, Toyota Motor Corporation, through its subsidiary Hino Motors Limited, has acquired full ownership of MFTBC.

Simultaneously, Daimler Truck AG has taken an interest in a newly incorporated holding company, AIB Limited, through which Hino and MFTBC will be jointly owned and managed.

The CCP assessed both transactions together, focusing on their potential impact on competition in Pakistan’s commercial vehicle market, particularly in the manufacturing and distribution of buses and trucks.

While some overlap between the operations of Hino and MFTBC was identified, the Commission concluded that the restructuring does not create or strengthen a dominant market position.

The Commission noted that Pakistan’s commercial vehicle sector remains competitive, with multiple established players continuing to operate.

In reviewing Daimler Truck AG’s stake in the holding company, the CCP observed that Daimler Truck AG no longer has any independent commercial vehicle operations in Pakistan, as its only relevant interest MFTBC had already been acquired by Toyota.

Consequently, this transaction was deemed competitively neutral.

Based on its overall assessment, the CCP determined that the two interconnected transactions do not raise competition concerns when viewed as part of the broader restructuring.

Both were approved under the Competition Act, 2010 and the Competition Merger Control Regulations, 2016.

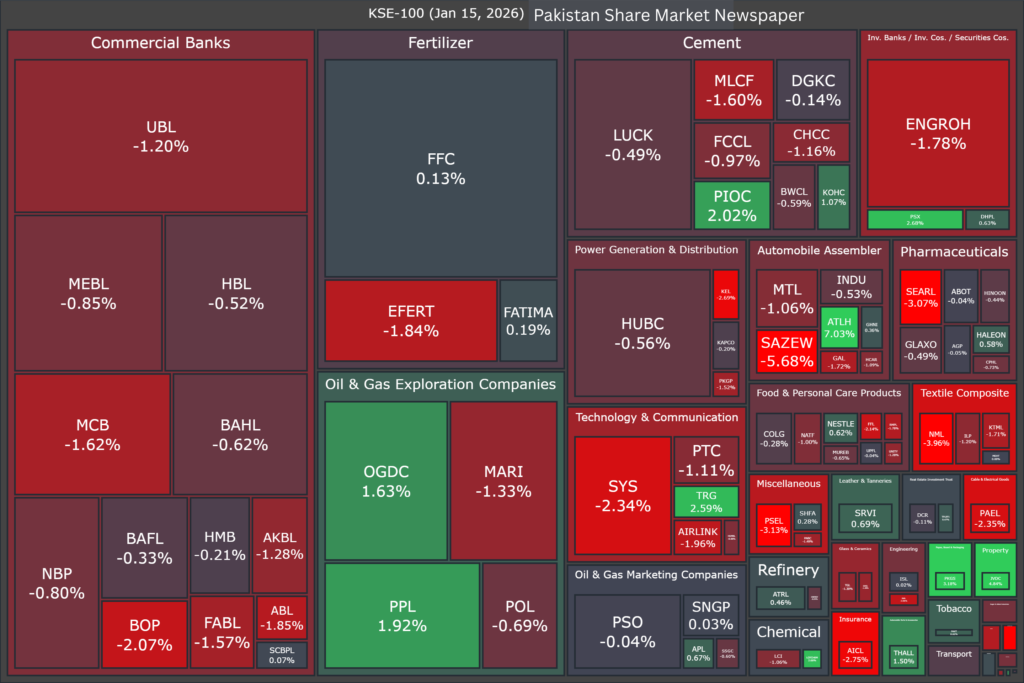

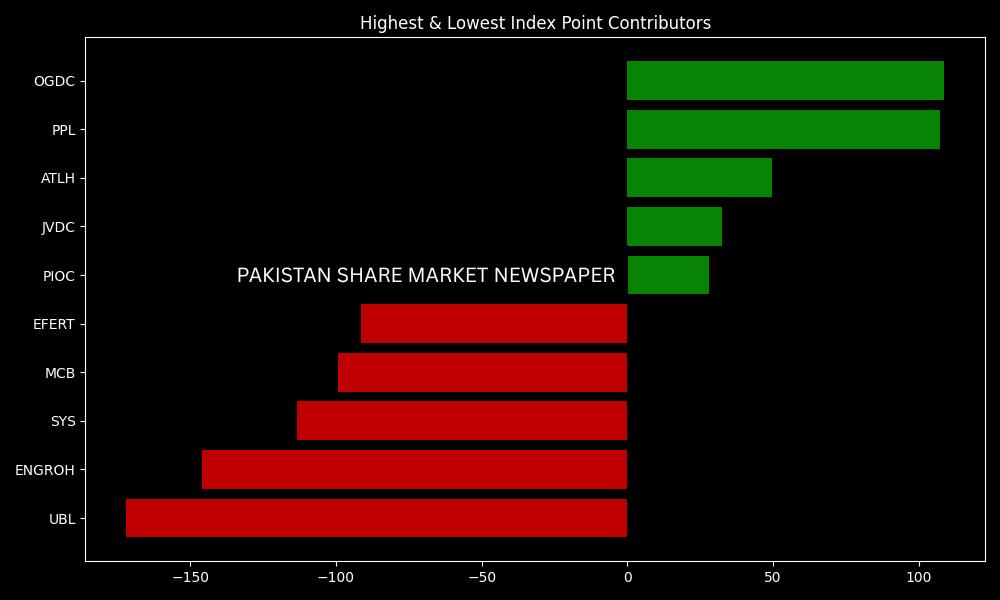

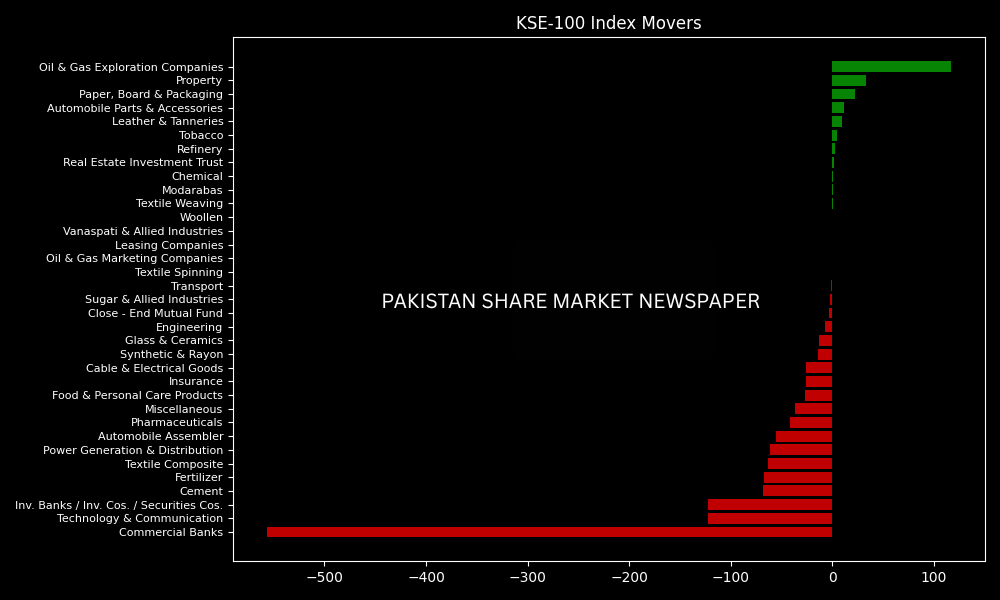

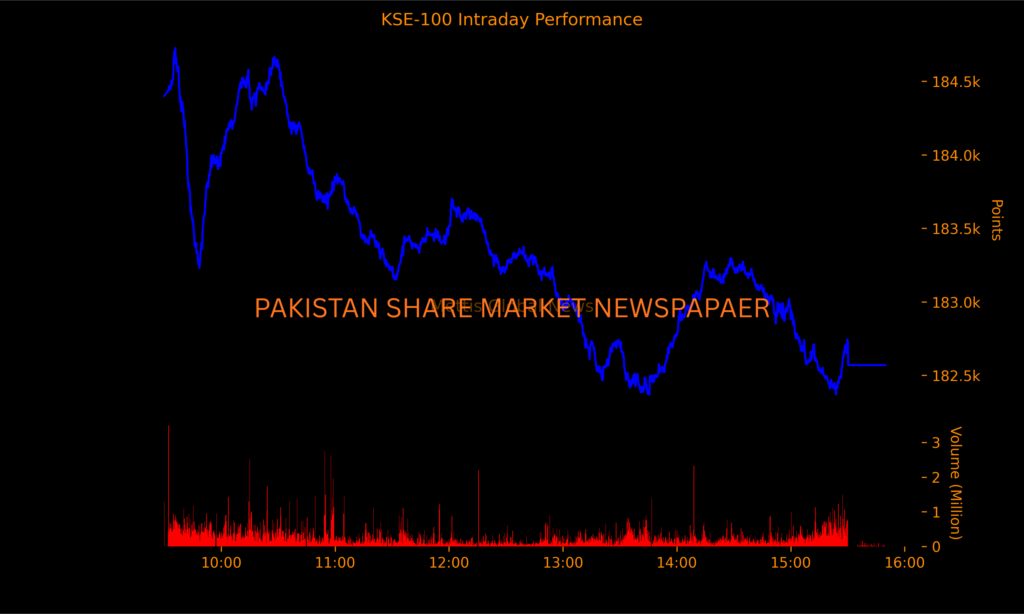

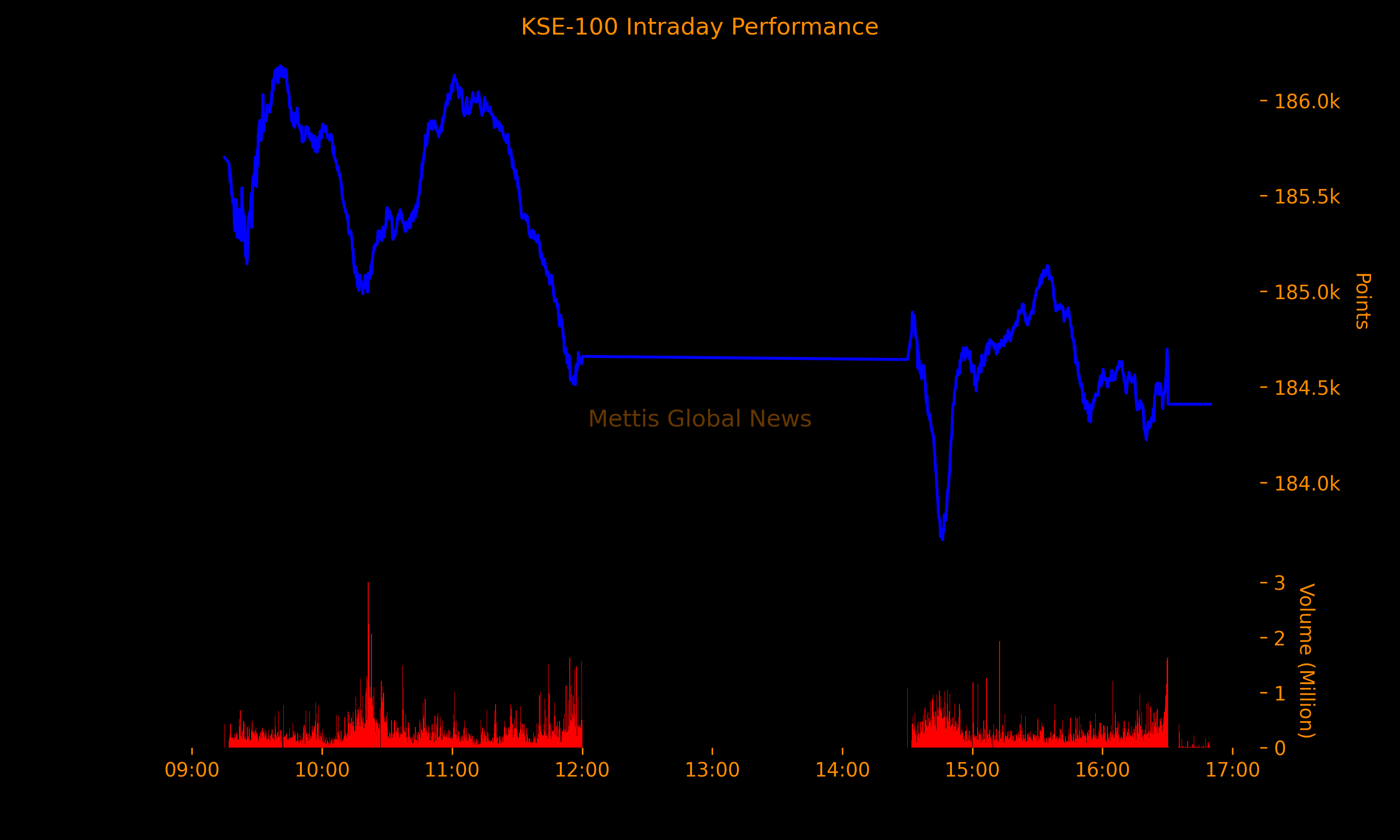

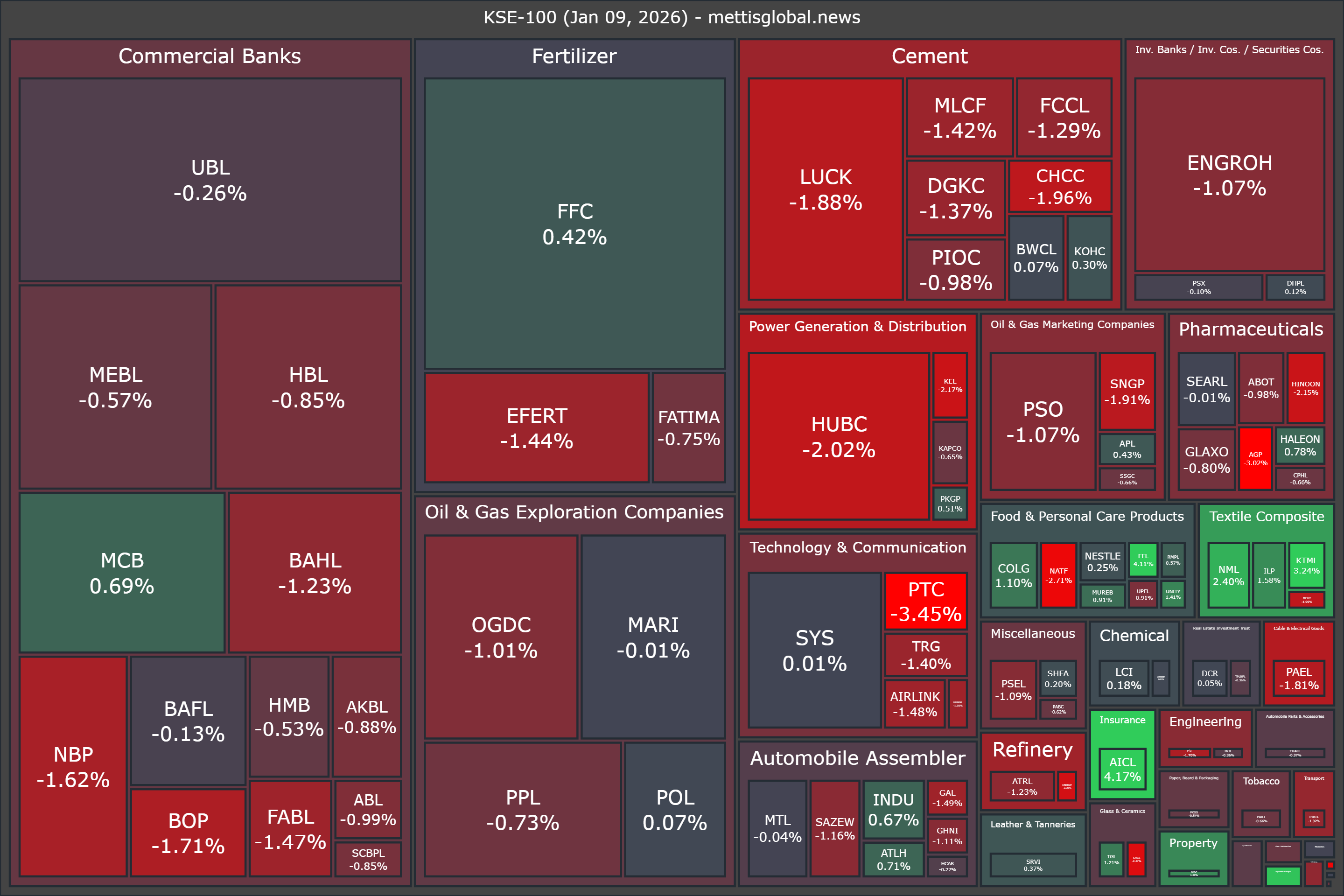

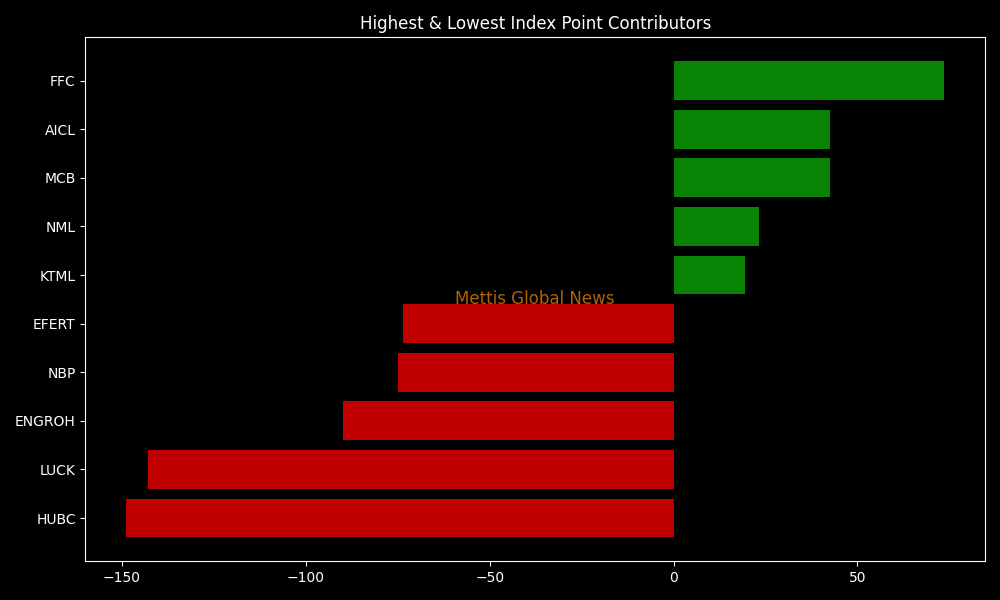

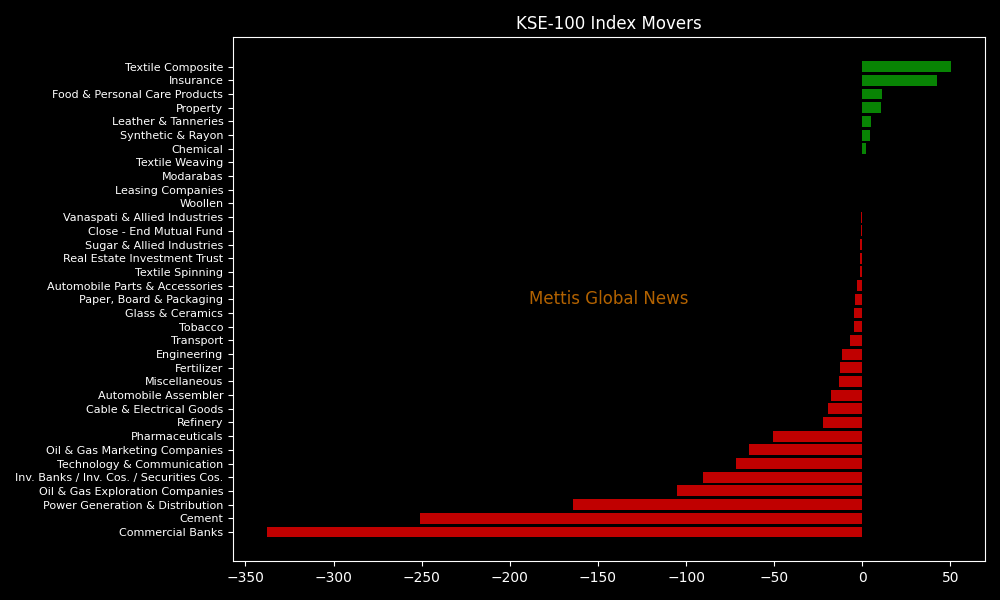

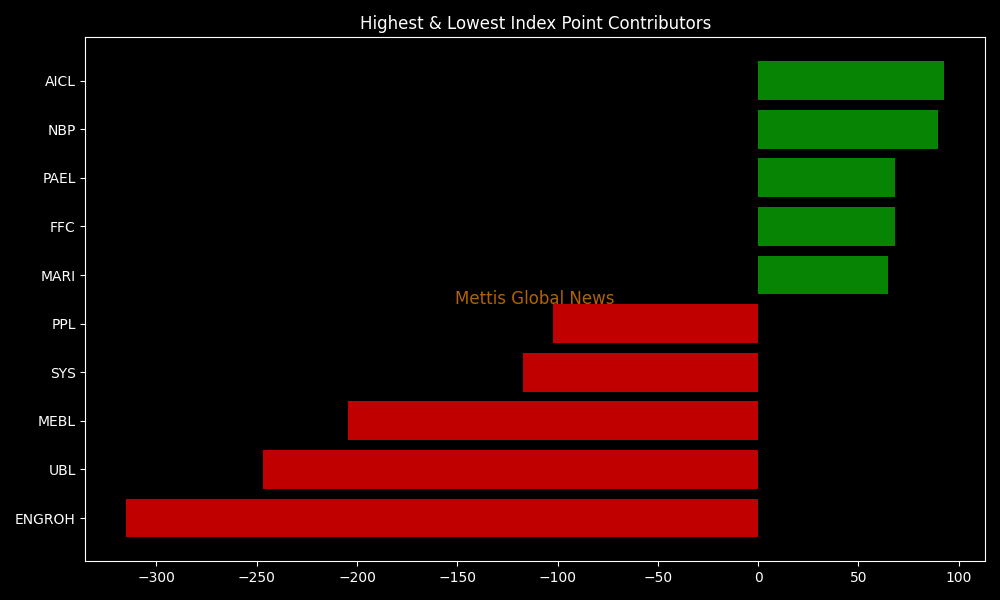

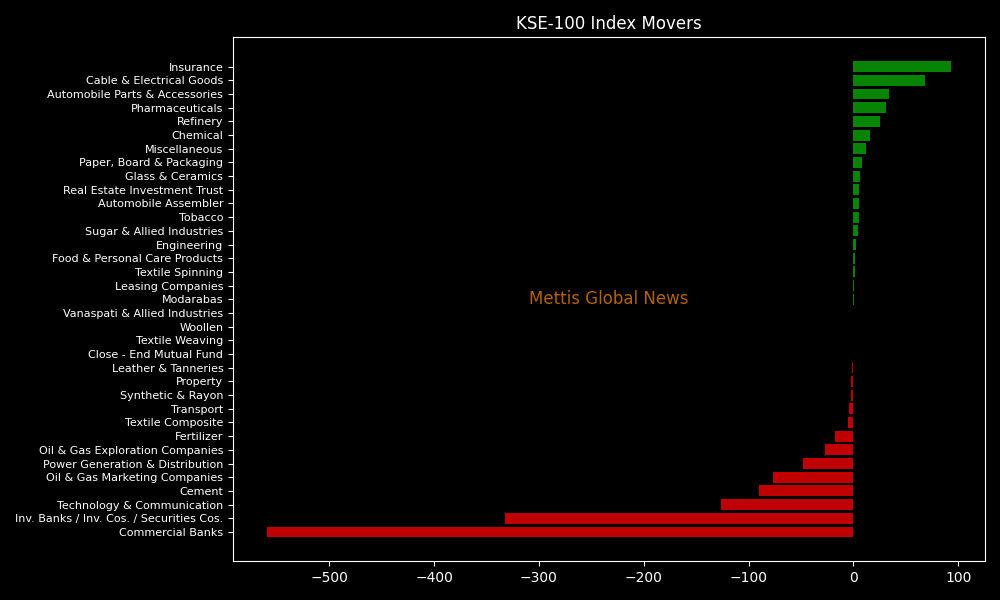

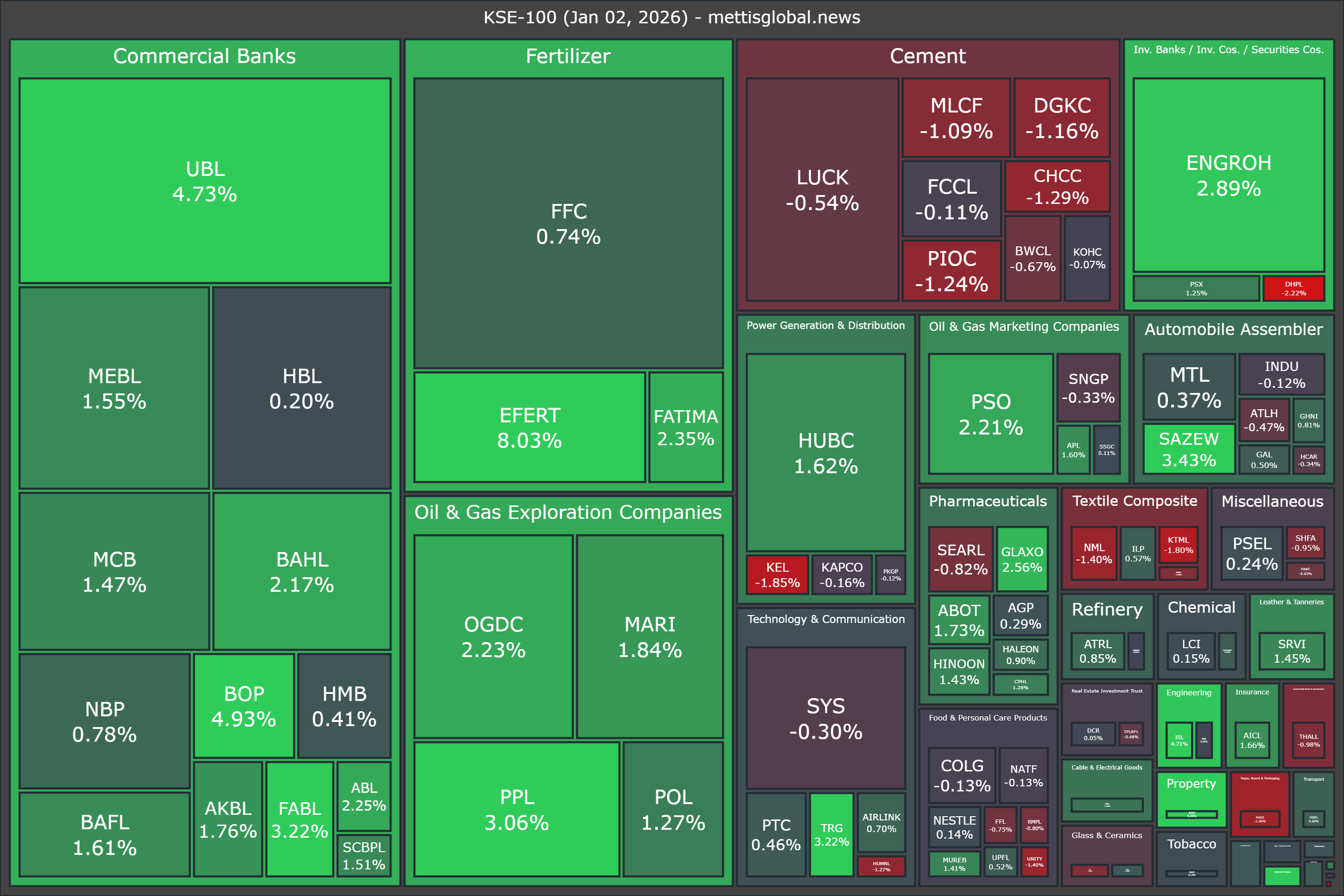

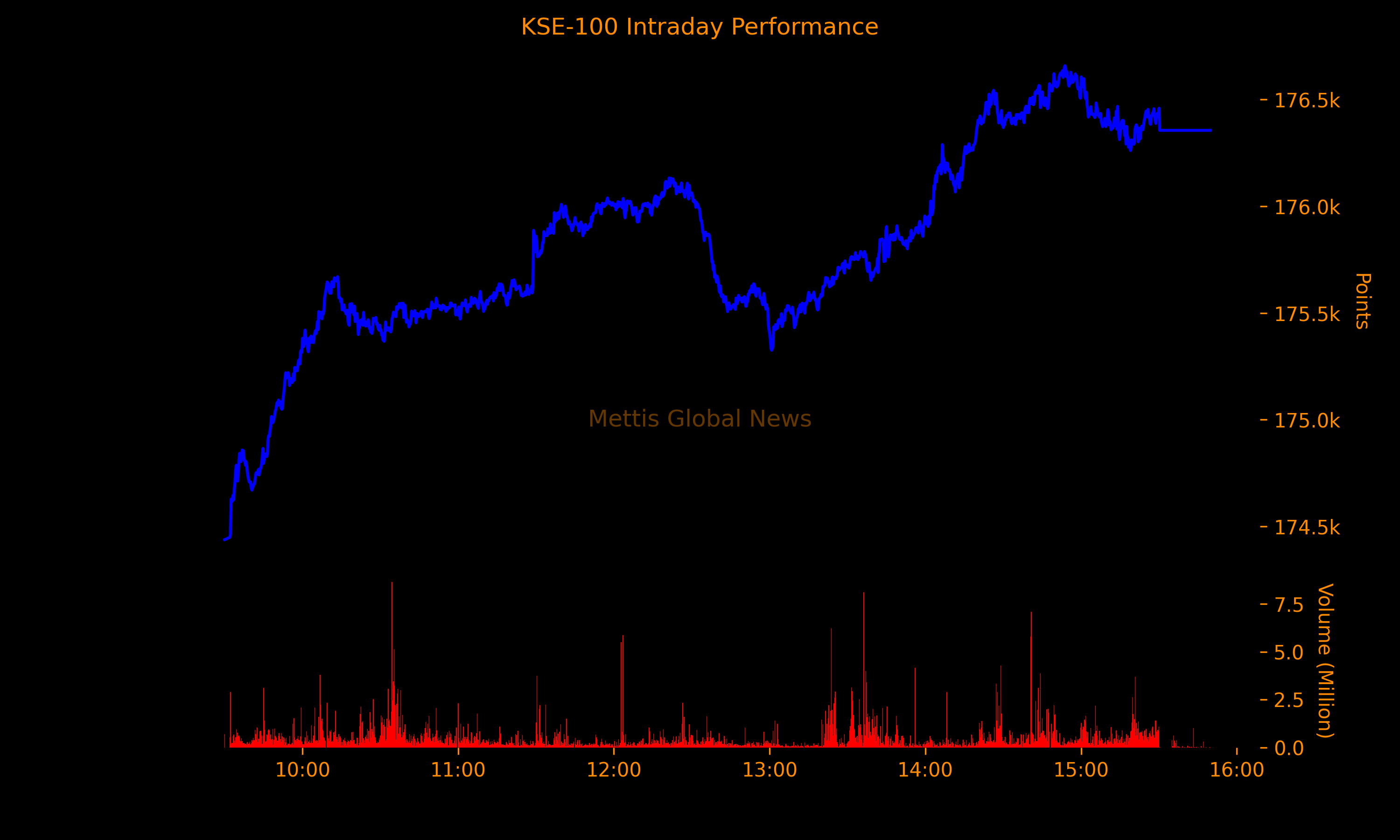

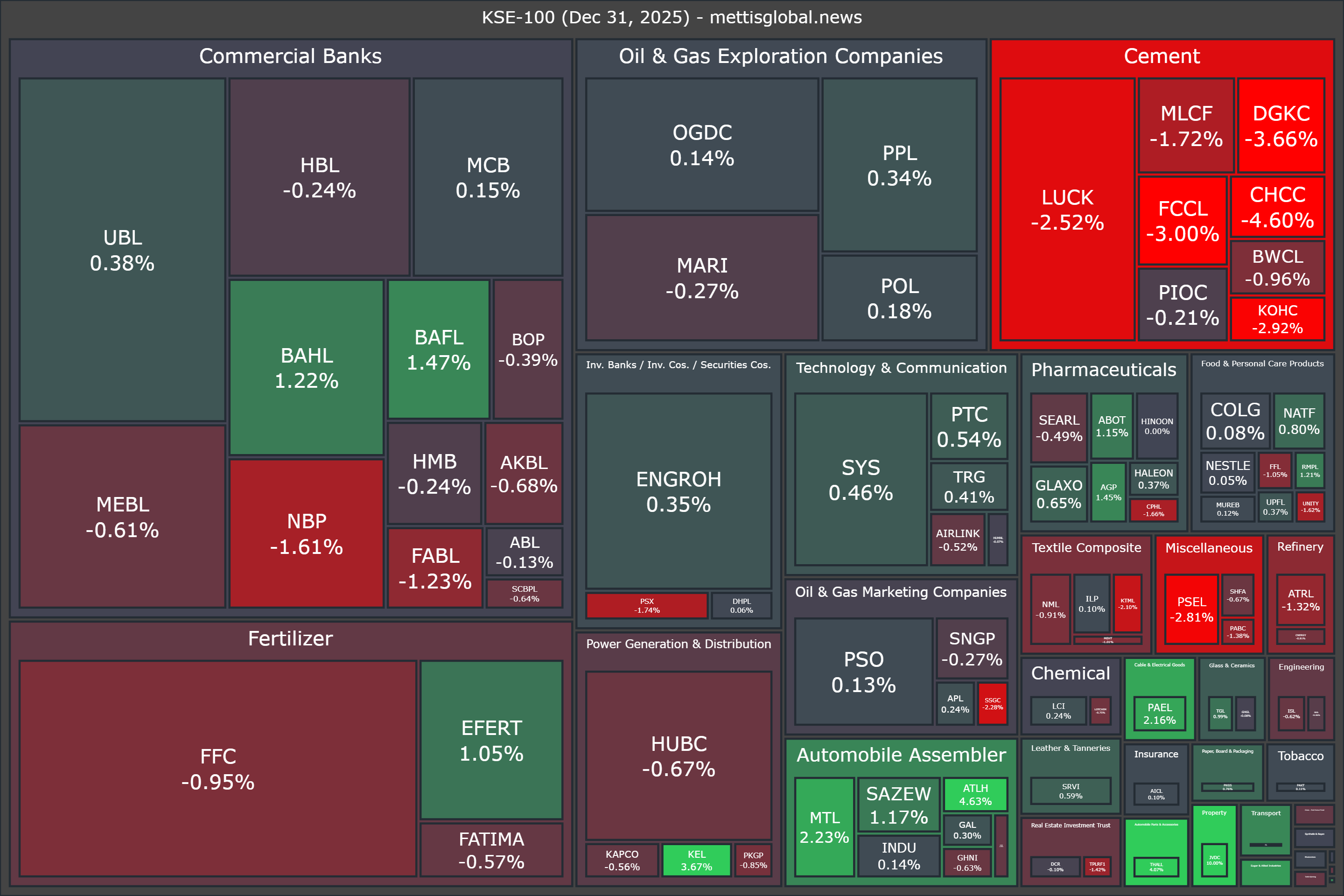

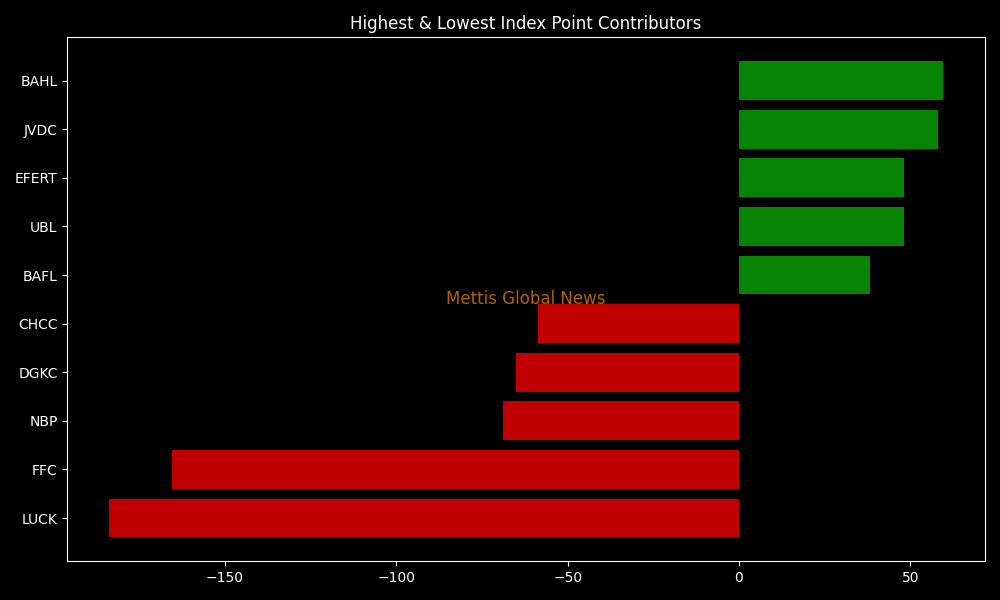

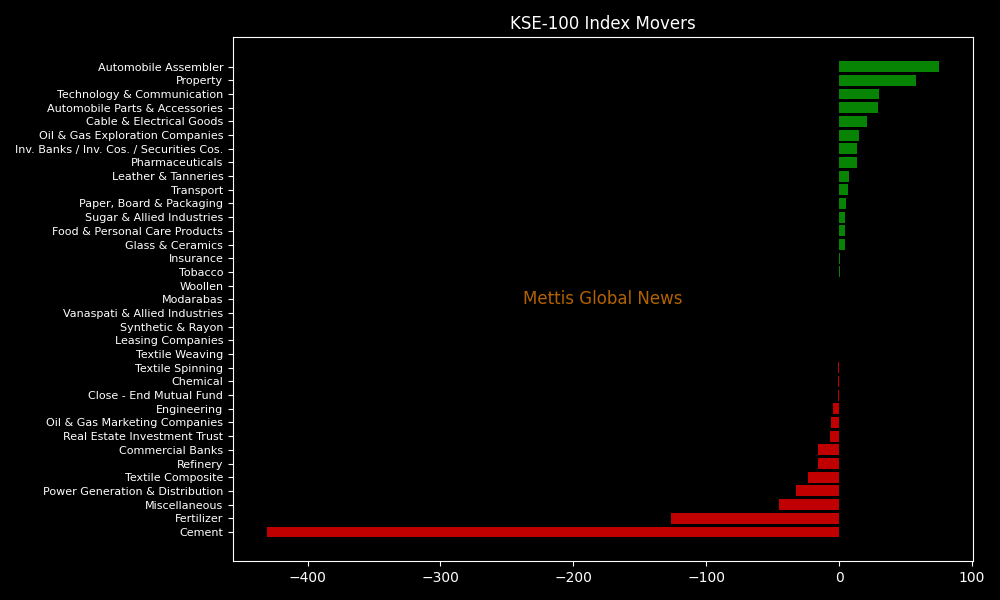

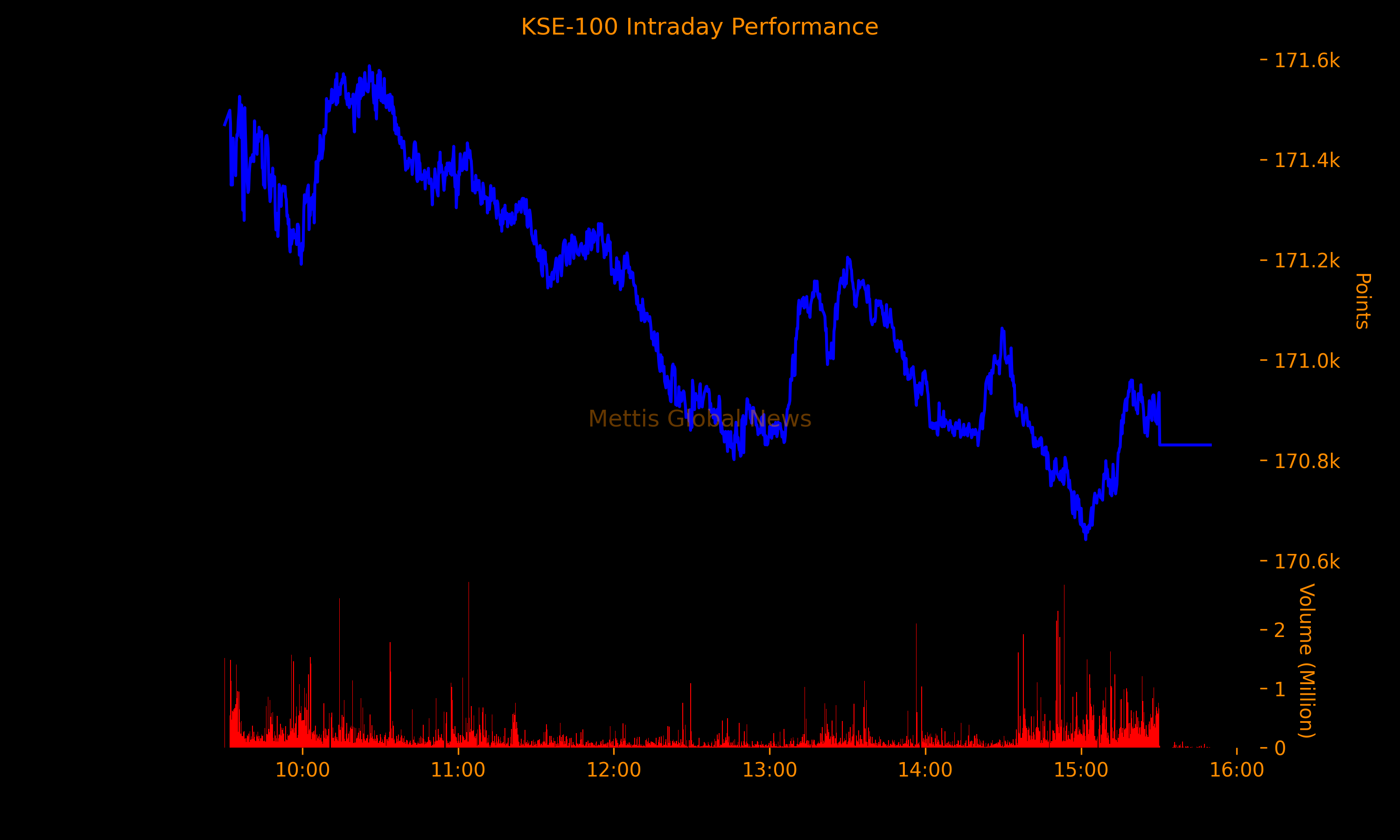

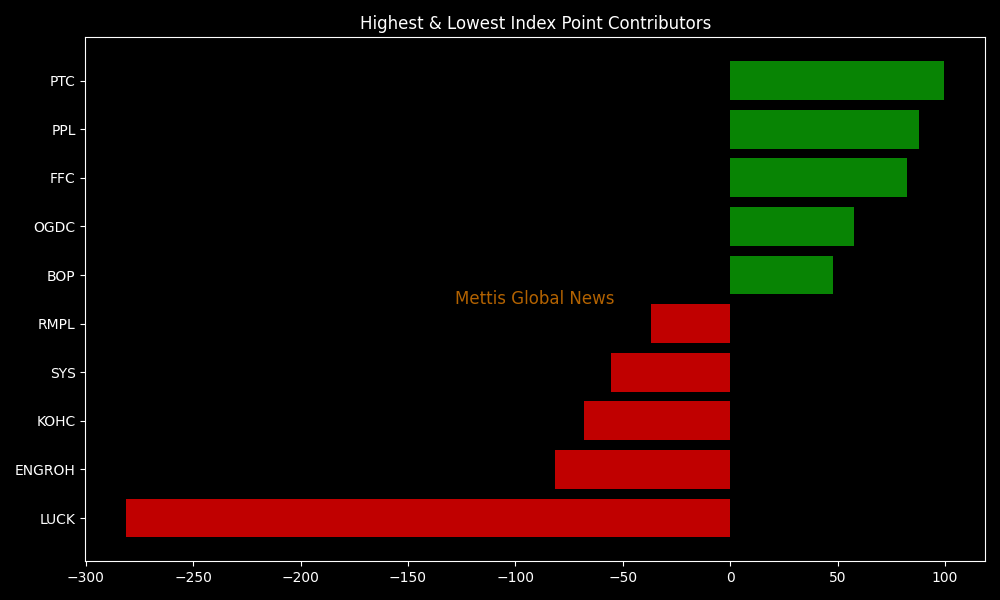

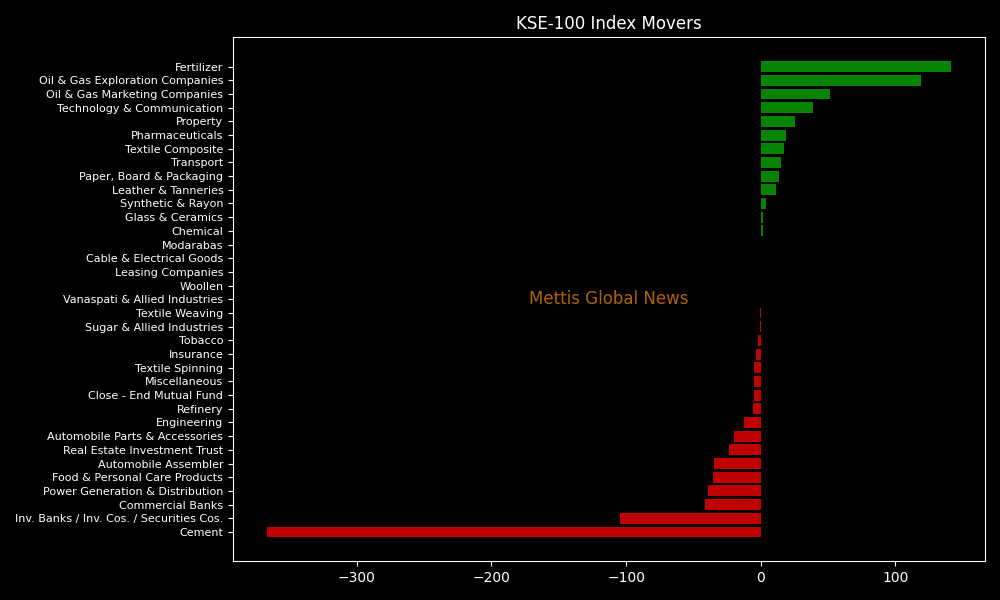

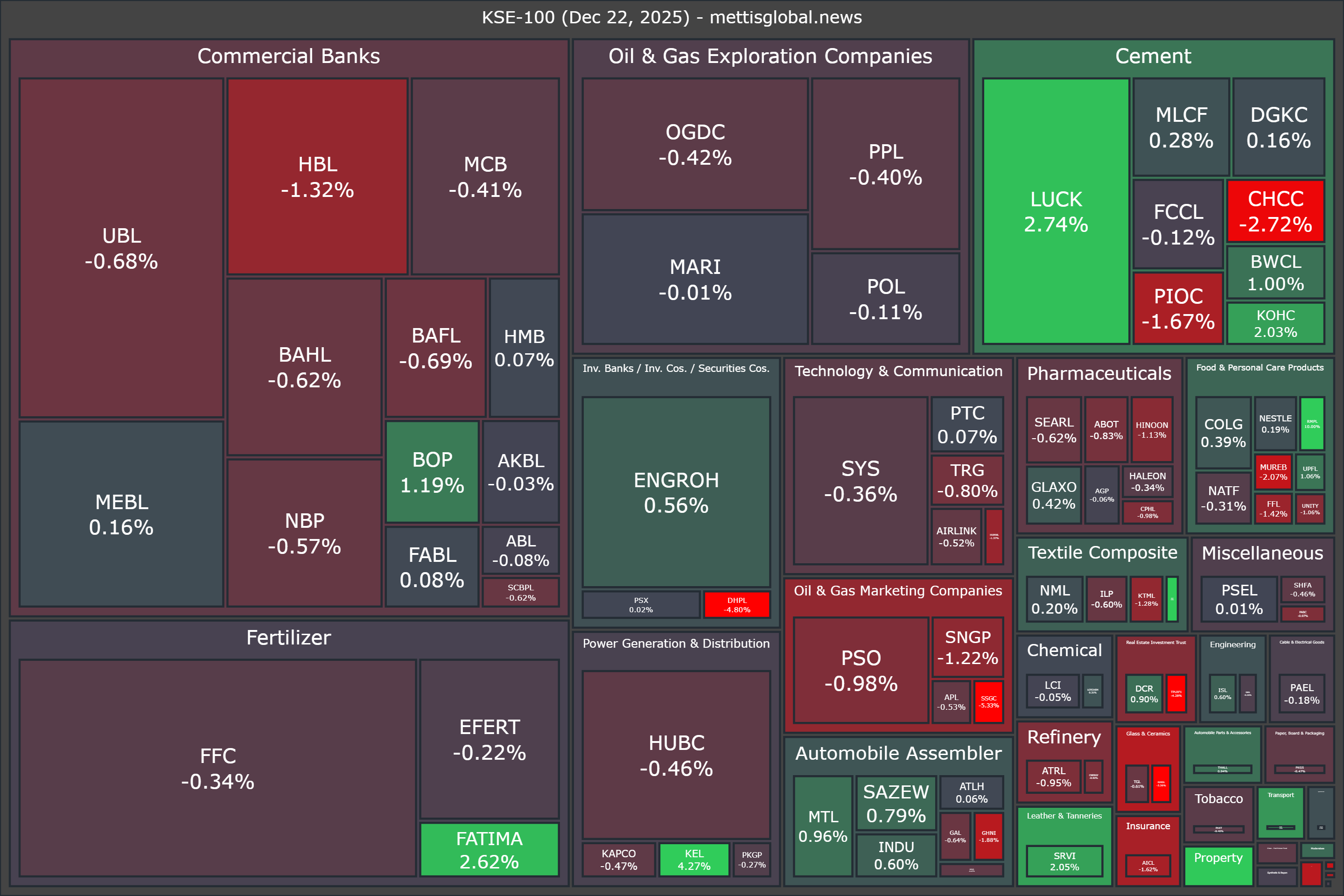

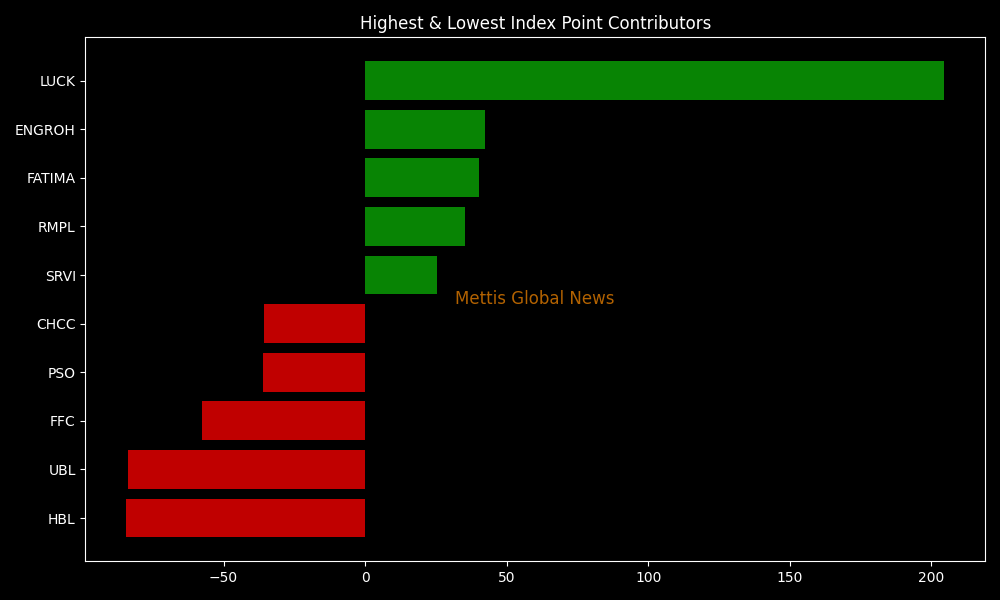

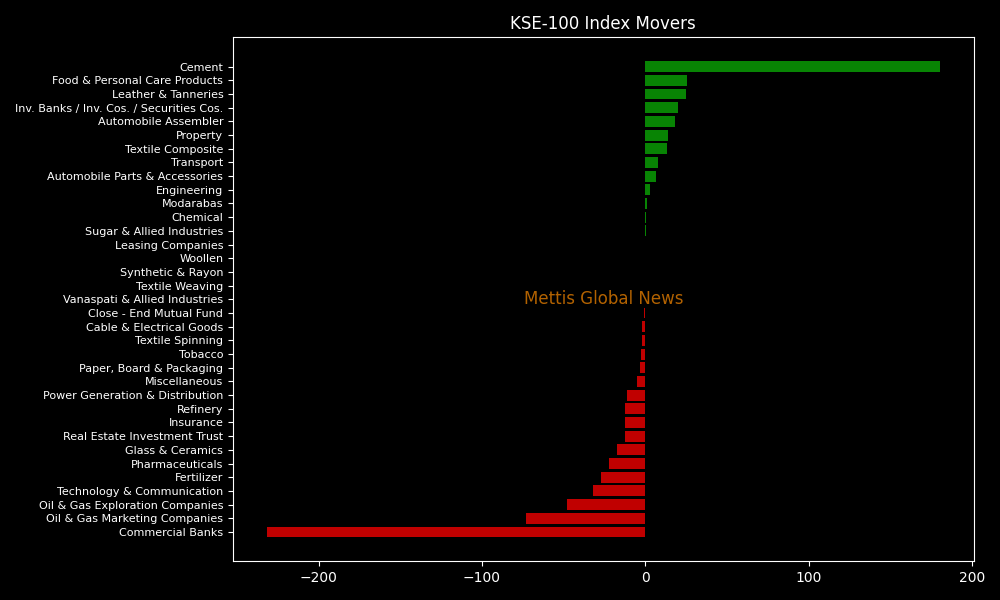

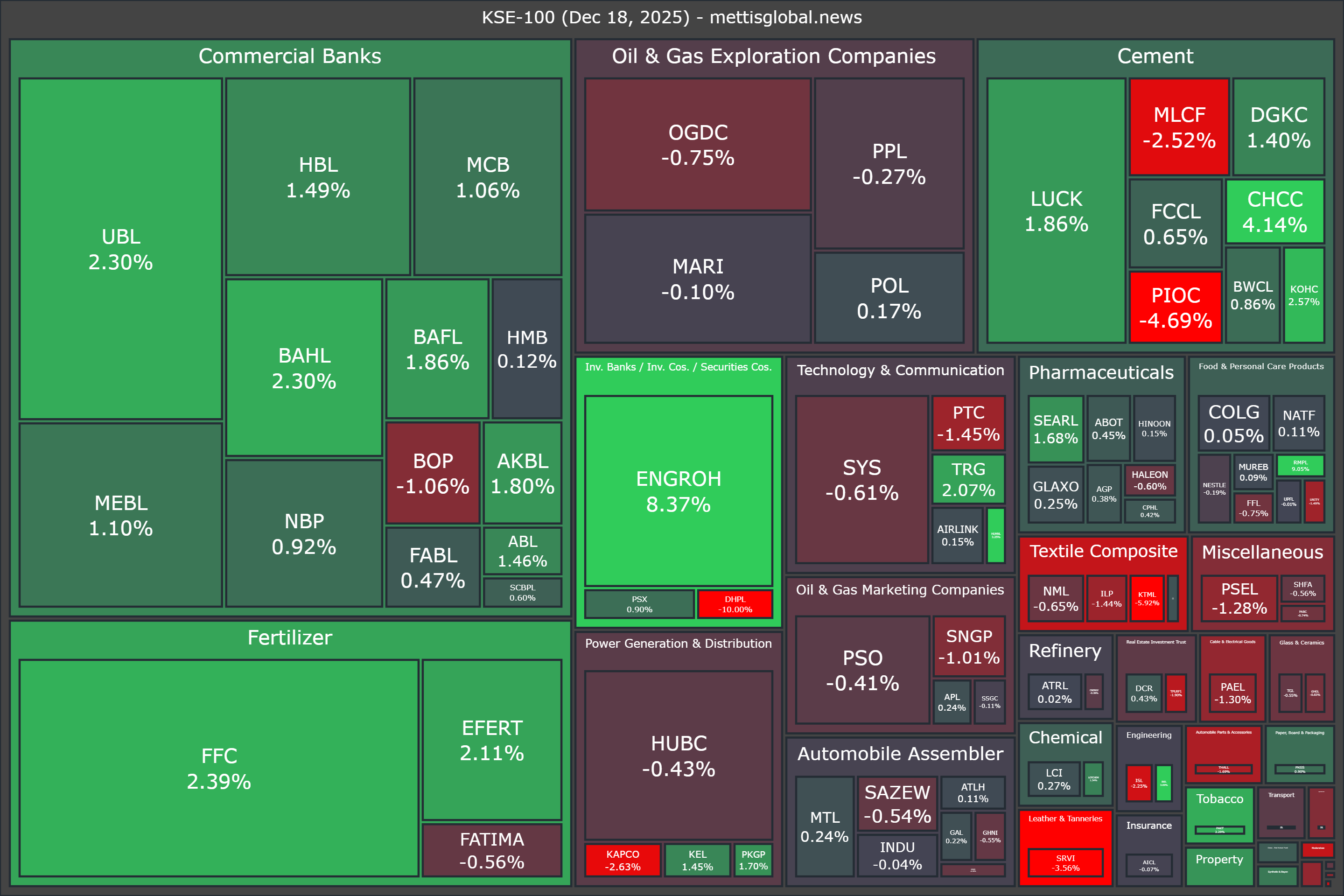

PSX Closing Bell: Red Sweeps the Board

The benchmark KSE-100 Index concluded Thursday’s trading session at 181,456.33, showing a decrease of 1,113.48 points or 0.61%.

The index traded in a range of 2,933.91 points showing an intraday high of 183,717.53 (+1,147.72) and a low of 180,783.62 (-1,786.19) points.

The total volume of the KSE-100 Index was 280.78 million shares.

Of the 100 index companies 28 closed up, 71 closed down, while 1 were unchanged.

Top losers during the day were IBFL (-9.89%), SAZEW (-5.68%), PGLC (-5.60%), NML (-3.96%), and PSEL (-3.13%).

On the other hand, top gainers were ATLH (+7.03%), JVDC (+4.84%), PKGS (+3.18%), PSX (+2.68%), and LOTCHEM (+2.66%).

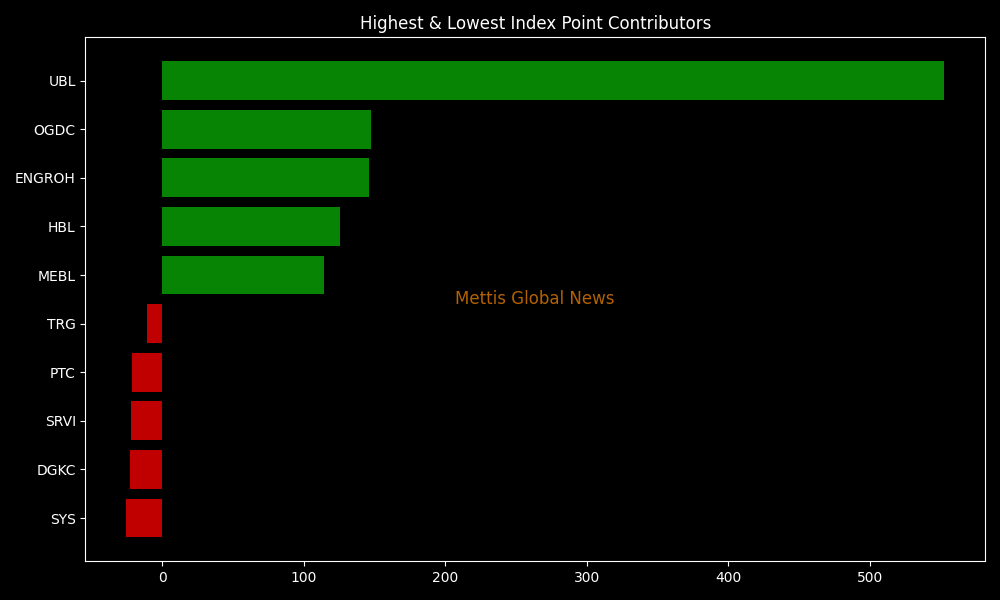

In terms of index-point contributions, companies that dragged the index lower were UBL (-171.97pts), ENGROH (-146.03pts), SYS (-113.22pts), MCB (-99.46pts), and EFERT (-91.49pts).

Meanwhile, companies that added points to the index were OGDC (+108.78pts), PPL (+107.38pts), ATLH (+49.75pts), JVDC (+32.63pts), and PIOC (+28.20pts).

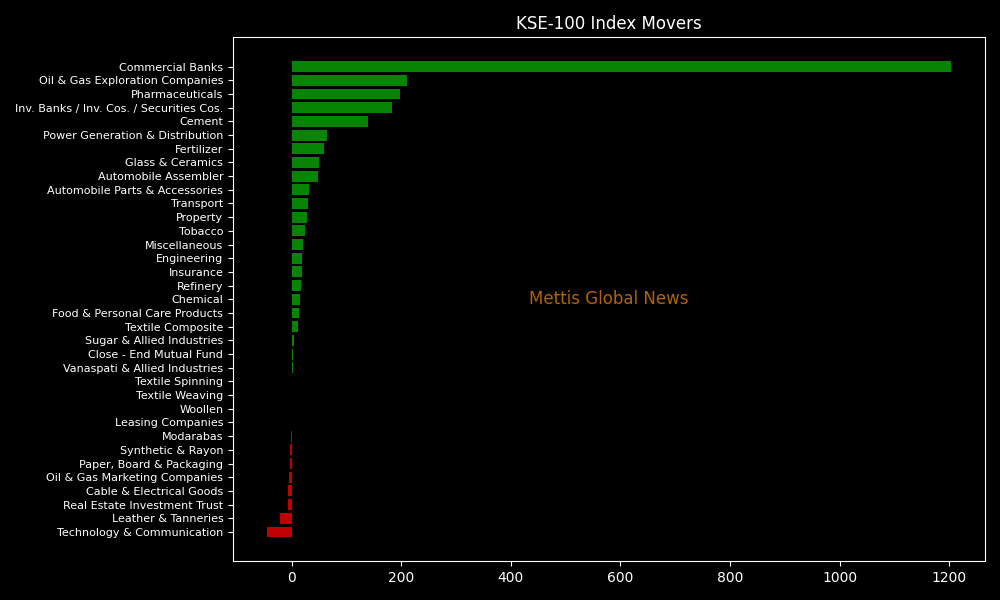

Sector-wise, KSE-100 Index was let down by Commercial Banks (-556.31pts), Technology & Communication (-122.20pts), Inv. Banks / Inv. Cos. / Securities Cos. (-122.16pts), Cement (-67.82pts), and Fertilizer (-67.15pts).

While the index was supported by Oil & Gas Exploration Companies (+116.56pts), Property (+32.63pts), Paper, Board & Packaging (+22.50pts), Automobile Parts & Accessories (+11.83pts), and Leather & Tanneries (+9.12pts).

In the broader market, the All-Share Index closed at 109,182.32 with a net loss of 492.15 points or 0.45%.

Total market volume was 820.03 million shares compared to 1,034.12m from the previous session while traded value was recorded at Rs45.98 billion showing a decrease of Rs19.99bn.

There were 445,267 trades reported in 482 companies with 150 closing up, 289 closing down, and 43 remaining unchanged.

| Symbol | Price | Change % | Volume |

|---|---|---|---|

| HASCOLNC | 20.64 | 5.58% | 62,524,009 |

| MDTL | 8.15 | 10.58% | 43,655,786 |

| NCPL | 71.02 | 1.14% | 36,689,540 |

| BOP | 40.69 | -2.07% | 29,259,185 |

| BNL | 12.22 | 9.99% | 21,659,742 |

| WTL | 1.72 | -1.15% | 20,943,110 |

| FCSC | 7.17 | 5.60% | 19,662,039 |

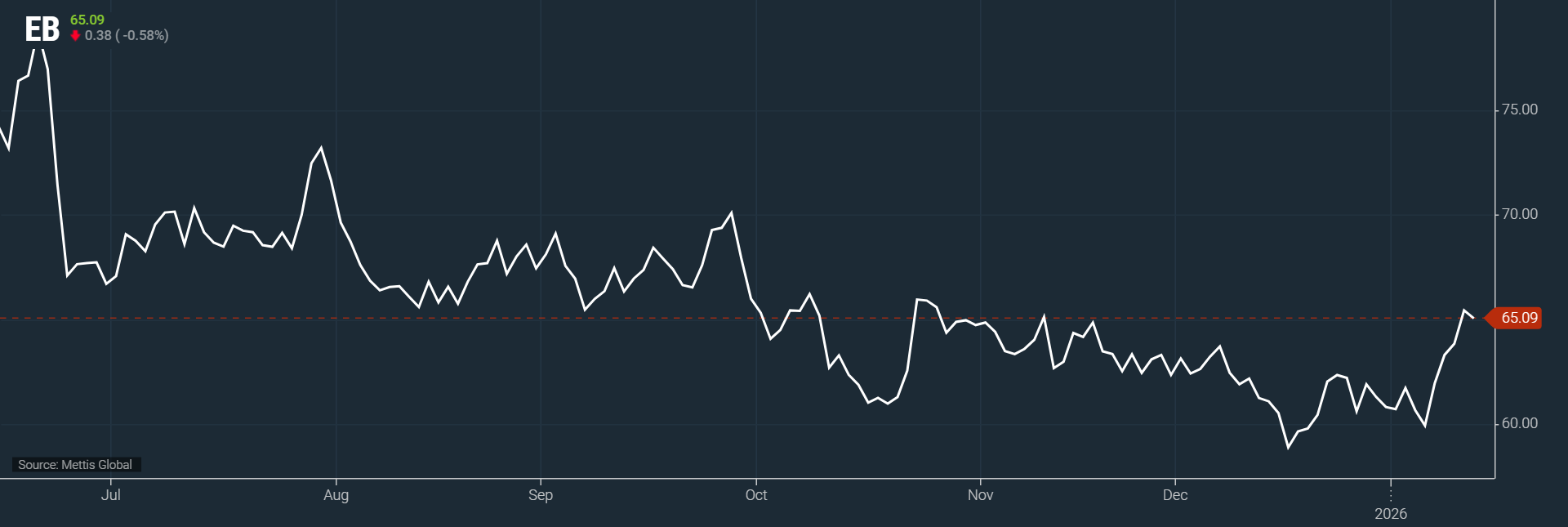

| PTC | 65.09 | -1.11% | 19,027,747 |

| KEL | 6.16 | -2.69% | 18,991,264 |

| THCCL | 74.12 | -9.44% | 18,672,794 |

To note, the KSE-100 has gained 55,829 points or 44.44% during the fiscal year, whereas it has increased 7,402 points or 4.25% so far this calendar year.

1Link and Trustdecision unveil “enterprise fraud defense: Pakistan’s next chapter”

1LINK in collaboration with global anti-fraud and KYC technology leader TrustDecision, hosted a landmark industry event titled “Enterprise Fraud Defense: Pakistan’s Next Chapter”. The event brought together over 100+ senior leaders from industry including banks, payment service providers, and fintechs academia to discuss the future of fraud prevention and digital trust in Pakistan.

The event marked a key milestone with the adoption of Device Fingerprinting and Anti-Fraud solutions by nine leading banks / FIs through 1LINK’s platform, aimed at strengthening defenses against emerging digital fraud risks in Pakistan.

Through expert panels and technology showcases, participants explored how artificial intelligence, data aggregation, and industry collaboration are enabling more effective fraud prevention. Industry leaders highlighted the integration of TrustDecision’s risk decision engine with 1LINK’s Enterprise Fraud Risk Management Services (EFRMS), delivering real-time fraud detection across both financial and non-financial transactions while ensuring a secure and seamless consumer experience.

The locally hosted solution, trusted by some of the world’s largest global financial institutions, like ICBC, Hong Leong Bank, Bank of China, TikTok, Shein and many more represents one of the most advanced fraud defense systems introduced in Pakistan to date. It empowers banks with enhanced visibility, faster risk assessment, and stronger protection – supporting the continued growth of Pakistan’s digital finance industry and the broader digital economy.

Mr. Najeeb Agrawalla, CEO – 1LINK, said, “This partnership reflects our shared commitment to advancing financial and digital inclusion. TrustDecision plays a pivotal role in closing access gaps and enabling broader participation, aligning seamlessly with 1LINK’s journey of growth and innovation.”

“In TrustDecision, financial and digital inclusion in emerging markets is pursued through the application of technology and experience. Pakistan has been identified as a key strategic growth market, and meaningful social impact is being created in collaboration with a valued partner such as 1LINK.” shared Mr. Li Ru Zhao, Managing Director of South Asia & MEA – TrustDecision.

Verizon resolves telecom service outage that vexed US users

Verizon said it planned to provide account credits to people who experienced service interruptions

US telecom giant Verizon said Wednesday it had resolved a widespread service disruption that impacted mobile phone customers in major cities across the US east coast for around 10 hours.

“The outage has been resolved. If customers are still having an issue, we encourage them to restart their devices to reconnect to the network,” Verizon said in a statement about 10:15 pm Eastern Time (0315 GMT Thursday).

The outage began about noon in New York where the company has its headquarters.

Internet service tracker DownDetector indicated that it received more than 1.5 million reports of problems with Verizon mobile phone or internet connections.

Verizon did not disclose the extent of the disruption or its cause but posted a statement during the outage apologizing to those impacted.

Late Wednesday, Verizon said it planned to provide account credits to people who experienced service interruptions.

Spectrum auction could finally fix Pakistan’s internet woes, says Jazz chief

Six spectrum bands with a combined capacity of 600 megahertz will be auctioned

Pakistan’s upcoming spectrum auction is a “once-in-a-decade opportunity” to transform internet quality for the public, said Aamir Ibrahim, chief executive officer (CEO) of Jazz, Pakistan’s leading digital operator and VEON’s leading operating company.

His comments follow last week’s announcement by the Pakistan Telecommunication Authority (PTA) that the long-awaited spectrum auction is set to be held in late February.

Under a plan approved by Prime Minister Shehbaz Sharif, six spectrum bands with a combined capacity of 600 megahertz will be auctioned—an expansion expected to significantly strengthen data capacity and support next-generation services across the country.

Speaking at Pakistan’s first Pakistan Policy Dialogue, organised by the Policy Research and Advisory Council in collaboration, Ibrahim said the real public demand is for an internet that works consistently and affordably across the country.

Explaining the significance of the auction, Ibrahim described Pakistan as a spectrum-constrained country, noting that it currently has around 274 megahertz of spectrum available nationwide, far below international benchmarks and roughly one-fourth of what countries such as Japan have on a per-capita basis.

He said limited spectrum has become a structural constraint on internet quality, regardless of operator investment.

The upcoming auction, expected to release about 600 megahertz of additional spectrum, represents a “once-in-a-decade opportunity” to strengthen Pakistan’s digital infrastructure, he said. Ibrahim noted that the government’s recently issued information memorandum reflects a more forward-looking approach, shifting away from maximising upfront revenues toward recognising the long-term economic value of improved connectivity.

He said the auction carries different implications for consumers, operators, and the state. For the public, the benefit lies in faster, more reliable, and more affordable internet—primarily through improved 4G services and a gradual, inclusive transition toward 5G. “What matters most to the customer is that the internet works,” he said.

To address the digital divide, he advocated handset financing models that allow consumers to pay for devices in instalments, a practice common in many markets but still limited in Pakistan.

Ibrahim also welcomed the growth of local handset assembly, saying it could help lower prices, meet domestic demand, and eventually support exports.

For the government, he said, the auction presents an opportunity to lay the foundation for a digitally enabled economy. He stressed that connectivity should be viewed as a cross-sector enabler—comparable to electricity—supporting education, healthcare, agriculture, finance, and enterprise.

Linking connectivity to broader inclusion goals, he said, smartphones and broadband can help bridge long-standing gaps in access to education and opportunity. While acknowledging progress over the past decade, he said Pakistan must now use the spectrum auction to build capacity for future demand.

“If done right,” Ibrahim said, “this auction can transform connectivity for people, enable sustainable investment for operators, and unlock long-term economic value for the country.”

Pakistan Customs enforces official bank rates, ends arbitrary shipping charges

Initiative expected to reduce cost pressures on traders, says FBR

Effectively ending the long-standing practice of arbitrary and excessive billing by international shipping lines, the customs achieved a historic and industry-wide breakthrough, ensuring the application of official bank exchange rates for shipping charges.

The All-Pakistan Shipping Association (APSA), through a formal communication on 12 January 2026, confirmed that all member shipping lines will charge shipping fees strictly based on exchange rates provided by their respective authorised commercial banks, in accordance with State Bank of Pakistan (SBP) regulations, the Federal Board of Revenue (FBR) said.

“This decisive development follows sustained engagement by a high-level committee constituted by Pakistan Customs, which held extensive consultations with shipping agents, terminal operators, trade bodies, and international shipping lines,” said the federal tax-collecting authority.

Maersk—the largest shipping line operating in Pakistan and handling nearly 26% of the country’s total cargo—began applying official bank exchange rates, setting a benchmark for the rest of the industry.

Written confirmations of compliance have been received from major international shipping lines and their local agents, including Hapag-Lloyd, Ocean Network Express (ONE), COSCO Shipping, CMA CGM, Mediterranean Shipping Company (MSC), OOCL, and United Marine Agencies, among others, establishing full industry-wide adherence to SBP-compliant exchange rates, the statement said.

For several years, traders and exporters had raised serious concerns regarding the arbitrary application of inflated dollar exchange rates by shipping lines, often far exceeding SBP-notified rates.

The FBR said that this practice significantly increased the cost of doing business, adversely impacted export competitiveness, and created uncertainty in shipping charges.

“The initiative is expected to substantially reduce cost pressures on traders and exporters, improve transparency and predictability in shipping charges, and restore confidence within the business community.

This achievement underscores FBR’s firm commitment to safeguarding legitimate trade, promoting ease of doing business, and supporting Pakistan’s export-led economic growth through effective regulatory oversight and stakeholder engagement.”

Gold price in Pakistan falls Rs3,700 per tola

Gold price in Pakistan decreased on Thursday, with 24-karat gold being sold at Rs482,462 per tola, down Rs3,700.

Similarly, 24-karat gold per 10-gram was sold at Rs413,633 after a decline of Rs3,172, according to rates shared by the All-Pakistan Gems and Jewelers Sarafa Association (APGJSA).

The price of 22-karat gold was also quoted lower at Rs379,177 per 10-gram.

Similarly, silver prices fell in the domestic market, with 24-karat silver being sold at Rs9,425 per tola (-Rs150) and Rs8,080 per 10-gram (-Rs129).

| PKR (24-karat per tola) | Jan 15, 2026 | Jan 14, 2026 | DoD | 1 Month | FYTD | CYTD |

|---|---|---|---|---|---|---|

| Gold | 482,462 | 486,162 | -3,700 | 31,600 | 132,262 | 25,500 |

| Silver | 9,425 | 9,575 | -150 | 2,893 | 5,643 | 1,707 |

Globally, spot gold traded near $4,603 an ounce, down $11.5 or 0.25% from the previous session, as profits were locked in, the pullback came amid a softer tone from President Donald Trump on both Federal Reserve policy and tensions with Iran, which reduced demand for the safe-haven metal.

Pakistan approves printing of new currency notes, cabinet forms design committee

Pakistan’s federal cabinet approves printing of new currency notes with enhanced security and inclusive designs, forms a committee to finalize designs reflecting history, environment

The federal cabinet has approved the printing of new currency notes, with a committee formed to finalize their designs, officials said Wednesday.

The briefing, presented by the Ministry of Finance, highlighted that the State Bank of Pakistan is working on modern and secure designs for the notes.

Prime Minister Shehbaz Sharif chaired the cabinet meeting at the Prime Minister House, where members were informed that new Rs100, Rs500, Rs1,000, and Rs5,000 notes will be introduced.

International experts have been consulted to ensure modern standards, advanced security features, and designs reflecting Pakistan’s regional diversity, historical landmarks, women’s contributions, and environmental themes.

The cabinet also approved sending the private Haj policy draft 2027–2030 to a committee for further review and endorsed previous decisions of the Energy Cabinet Committee (December 24, 2025) and Economic Coordination Committee (December 23, 2025).

Customs seizes over Rs412m vehicles, heavy bikes

These actions are part of the ongoing drive to curb smuggling, protect the national economy and ensure compliance with customs laws.

The customs enforcement Islamabad seized smuggled NCP vehicles, heavy bikes and electronic goods worth Rs. 412.2 million.

The Collectorate of Customs Enforcement, Islamabad, has seized a large consignment of smuggled and non-duty-paid goods, including luxury vehicles, heavy bikes, and electronic items, during intelligence-based operations conducted late at night.

The total estimated value of the seized goods is Rs. 412.2 million, said a release issued here on Wednesday.

Acting on credible intelligence regarding the movement and concealment of illicit goods within Islamabad and adjoining areas, Customs Enforcement teams carried out multiple targeted operations.

These actions are part of the ongoing drive to curb smuggling, protect the national economy and ensure compliance with customs laws.

During the operations, Customs officials recovered one Rolls-Royce luxury car, nineteen (19) heavy bikes of Suzuki and Kawasaki, along with a substantial quantity of laptops and other electronic devices.

Further investigations examination confirmed that the seized items were non-duty paid and had been brought into the country in violation of applicable customs regulations.

All recovered goods were shifted to the designated Customs warehouse for detailed examination and safe custody.

The consignments have been seized under the relevant provisions of the Customs Act, 1969, and further legal proceedings have been initiated. Investigations are underway to identify those involved and to uncover the broader smuggling network.

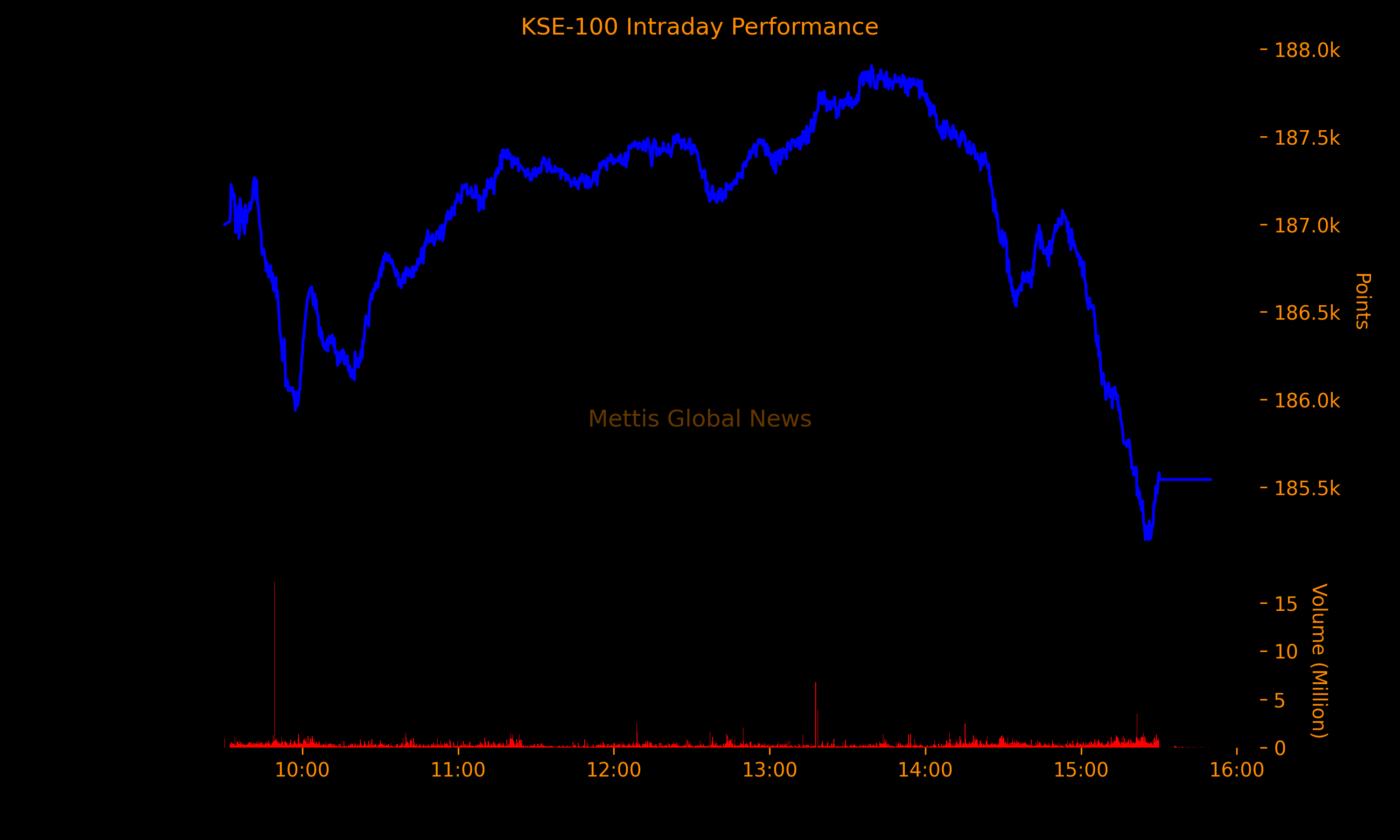

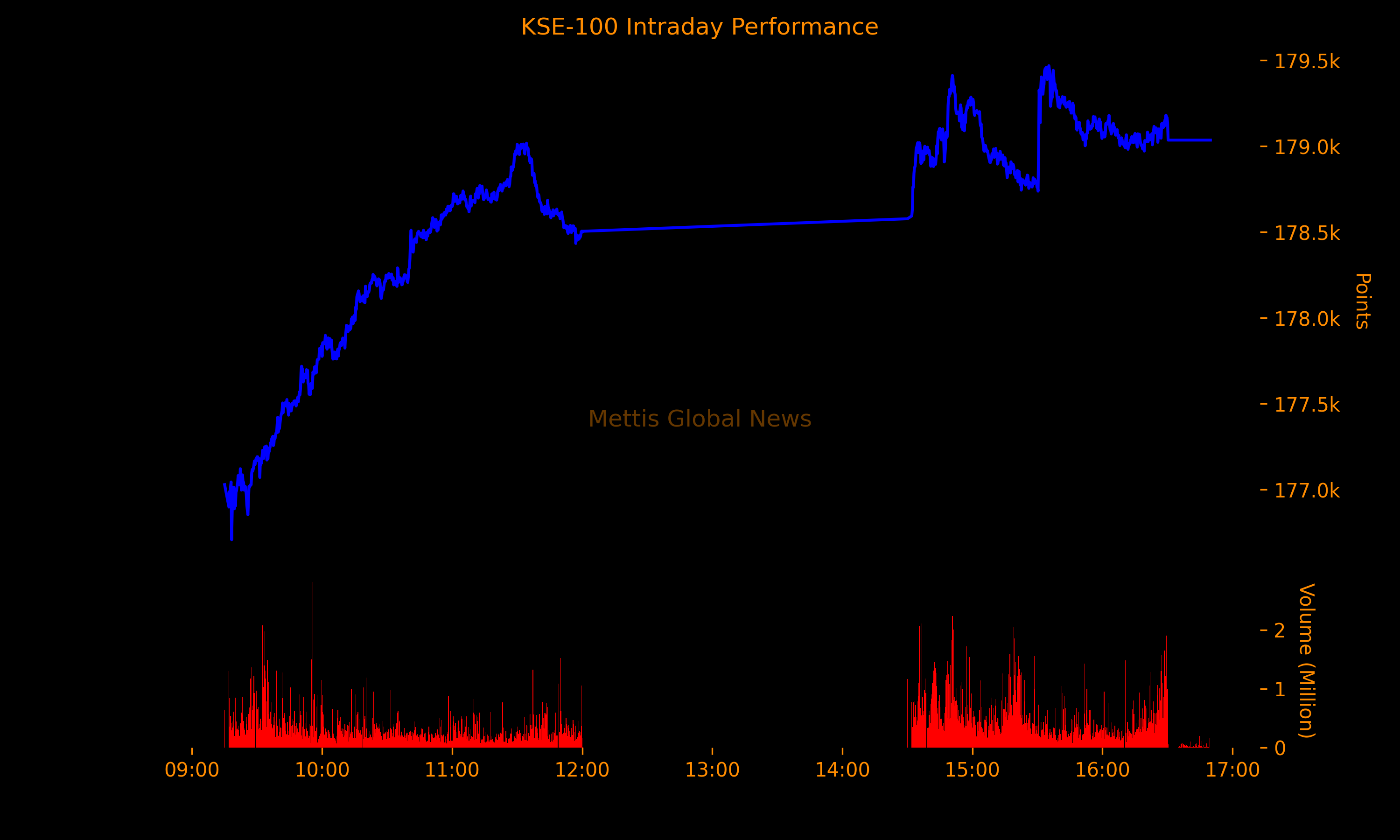

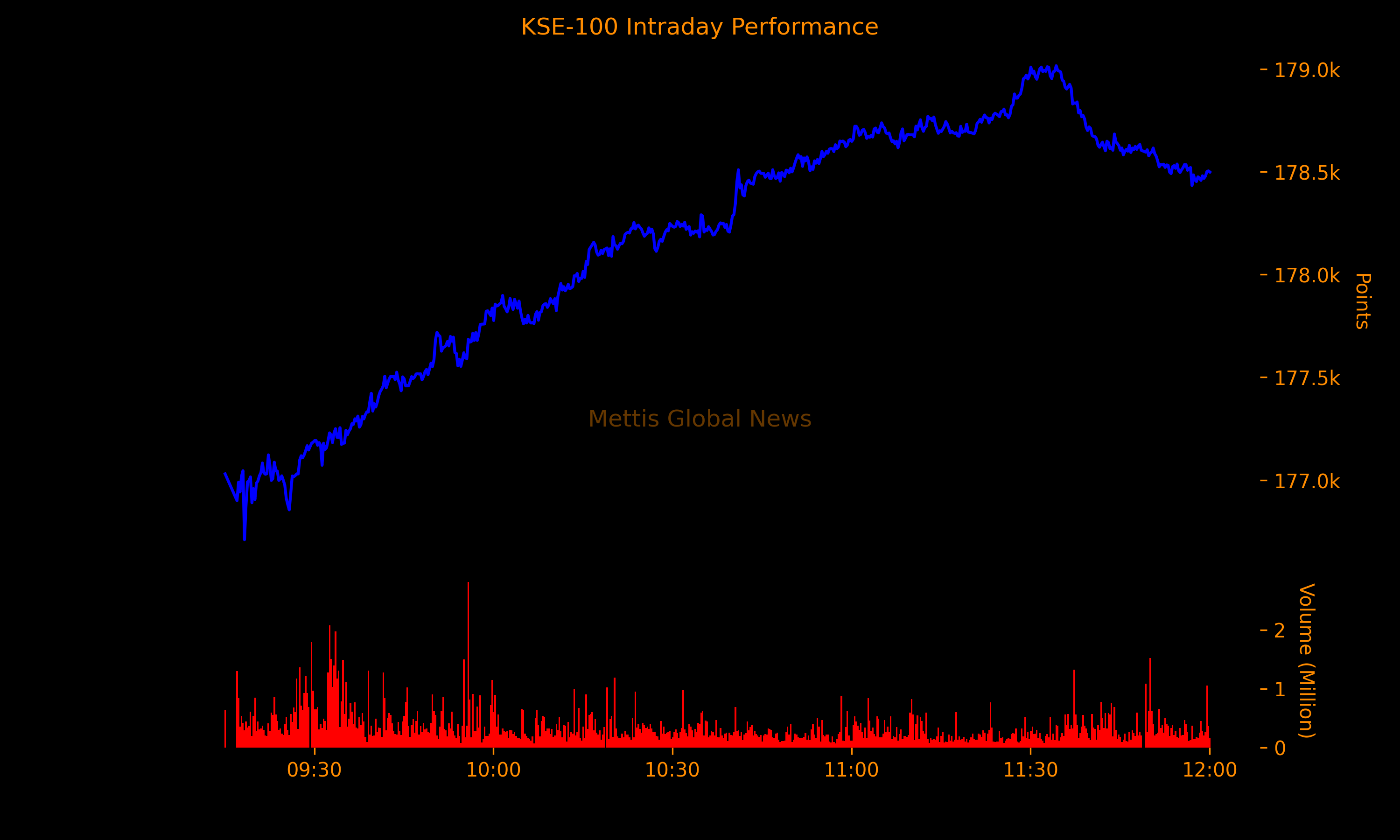

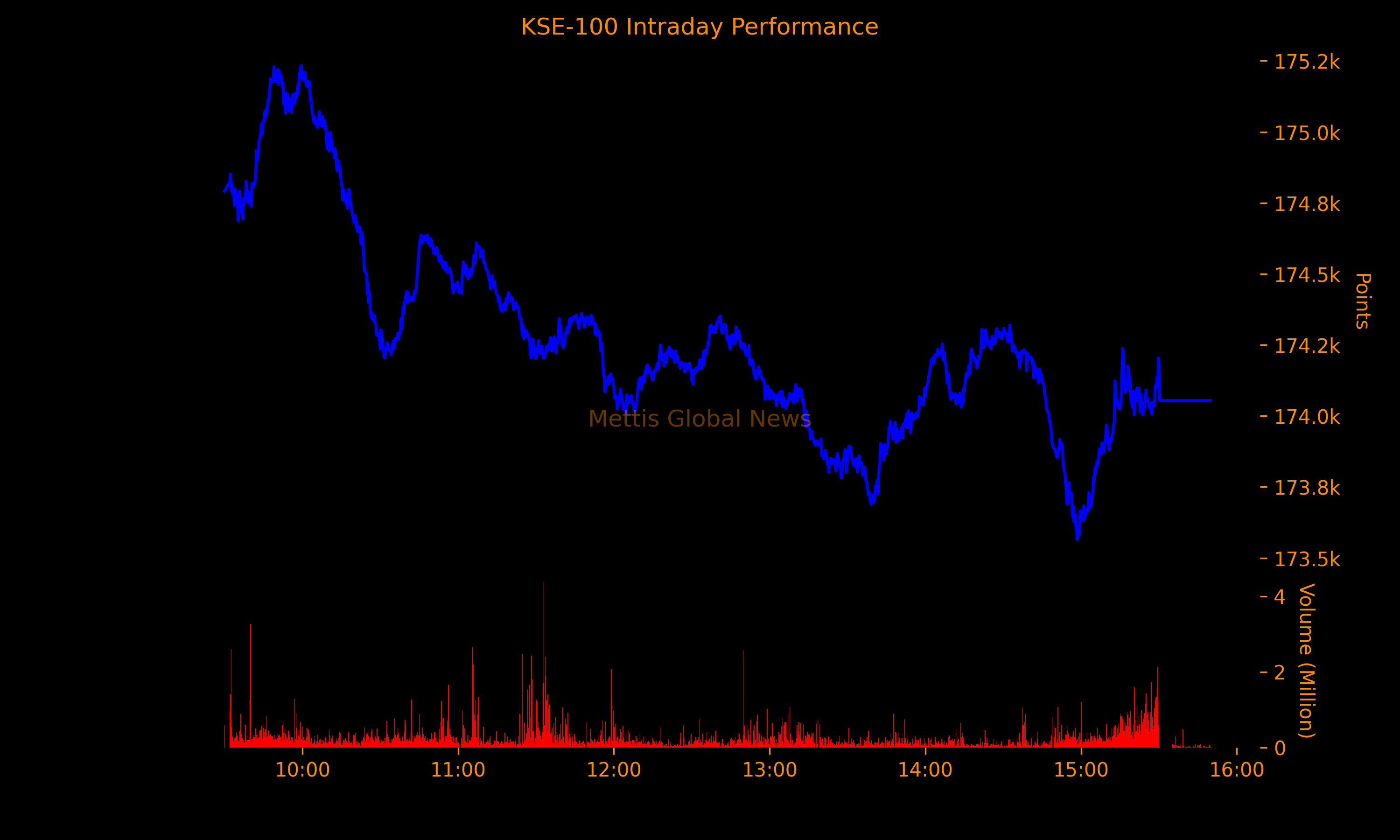

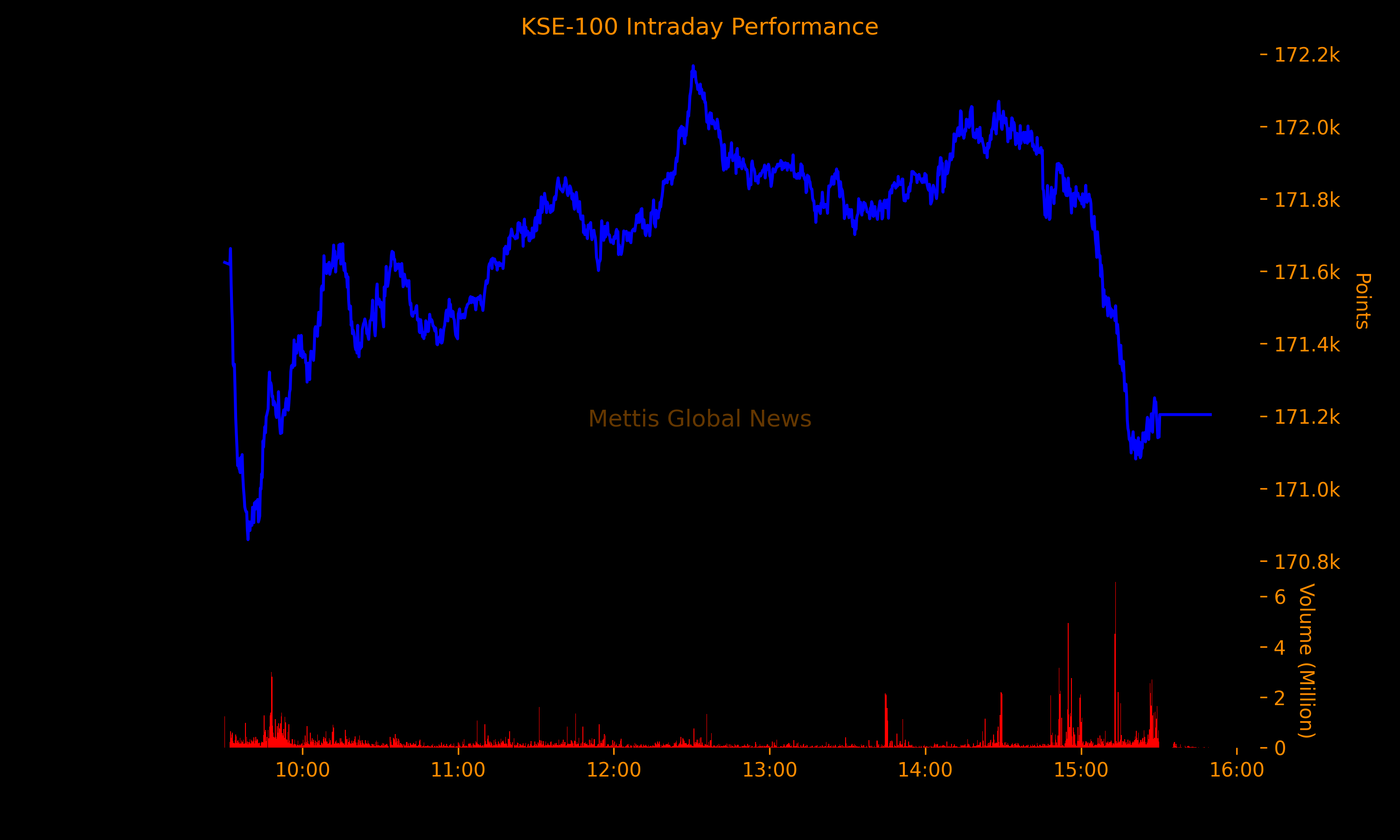

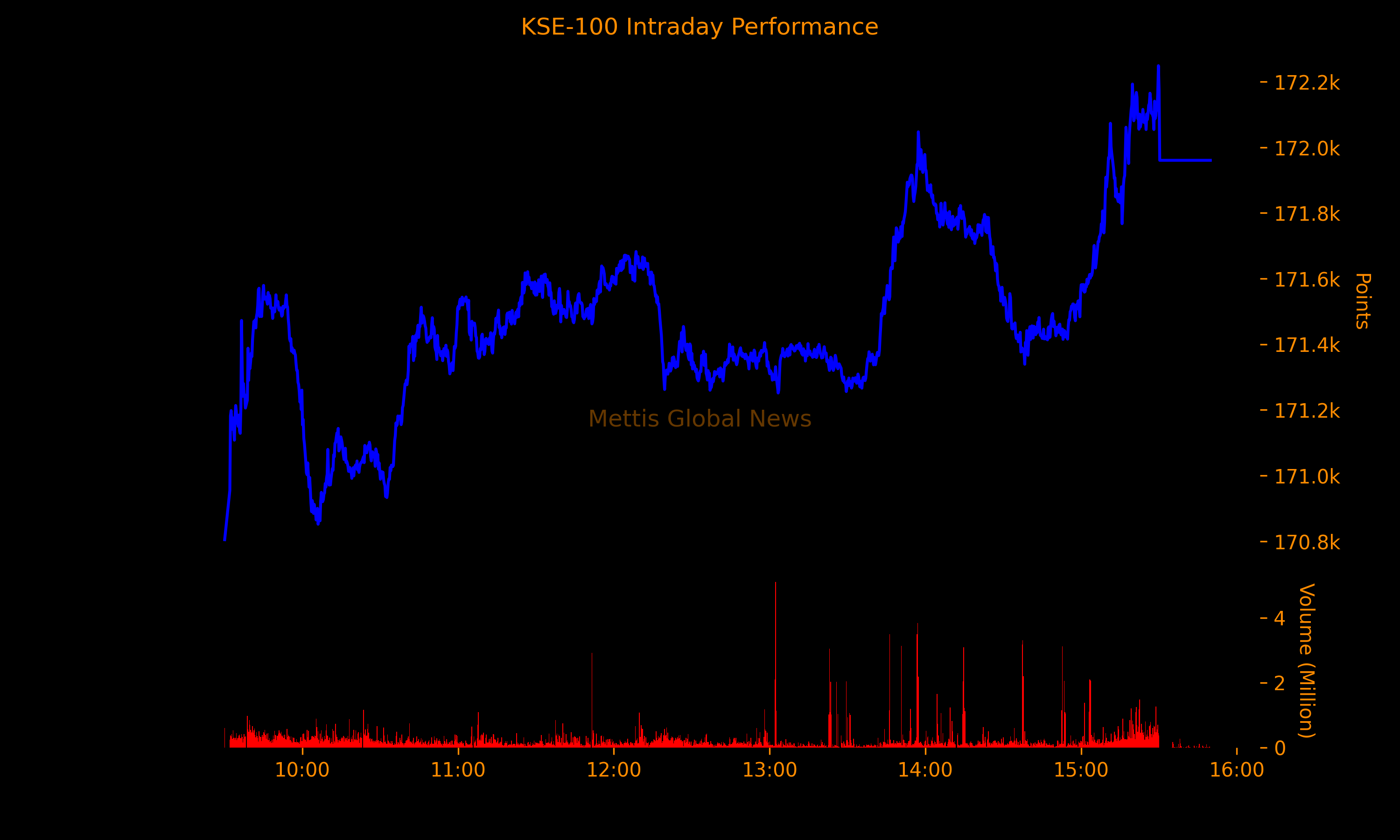

PSX plummets amid mounting Iran tensions

The Pakistan Stock Exchange (PSX) saw a brief rally before turning bearish, losing 69.29 points amid rising geopolitical tensions over potential US military action in Iran

The Pakistan Stock Exchange (PSX) extended losses after recorded an increase for a brief period as investors seem cautious amid rising geopolitical tensions involving Iran.

During intraday trading, the KSE-100 index touched 183,717.53 due to strong buying early sessions before it turned bearish by losing 69.29 points to 182,500.52 points compared to previous close of 182,569.81.

International officials have warned that US military intervention in Iran now appears likely and could take place within the next 24 hours amid sharply escalating tensions in the Middle East.

American, European and Israeli sources said preparations for possible action were under way as Washington began evacuating personnel from its major air base in Qatar.

Tehran has warned neighbouring countries that the military airfields would be targeted if Donald Trump orders a strike.

With Iran’s leadership trying to quash the worst domestic unrest the Islamic Republic has ever faced, Tehran is seeking to deter the US president’s repeated threats to intervene on behalf of anti-government protesters.

An American official said on Wednesday that the evacuation of Al Udeid Air Base was a precautionary move following warnings from a senior Iranian official.

Meanwhile, two European officials said military intervention now appeared likely, with one suggesting it could come within the next 24 hours.

A day earlier, the benchmark index shed 1,381.69 points, or 0.75% to close at 182,569.82, after swinging between an intraday high of 184,726.60 and a low of 182,369.87.

EU Green Deal rules put textile exports at a crossroads

Compliance costs, CBAM, Chinese shipments put textile sector under pressure

Pakistan’s textile sector has entered 2026 at a defining juncture, with its long-standing export model facing mounting pressure from tightening global regulations, intensifying competition and domestic cost constraints. After a modest recovery in 2025 that lifted textile exports to around $17.85 billion, industry leaders now warn that the sector’s preferential access to European markets under the GSP Plus regime is increasingly at risk.

These concerns dominated discussions at the Global Procurement and Supply Chain Summit (GPS 2026), held in Karachi, where policymakers, procurement leaders and textile executives assessed the evolving global trade environment. Addressing the summit as chief guest, Shahbaz H Syed, President and CEO of EXIM Bank of Pakistan, described the current environment as a “perfect storm”, driven by rising energy costs, aggressive sustainability regulations and redirected global supply flows.

At the core of the challenge is the European Union’s Green Deal, which is reshaping procurement standards worldwide. Regulations such as the Ecodesign for Sustainable Products Regulation (ESPR) and the Carbon Border Adjustment Mechanism (CBAM) are fundamentally altering how buyers evaluate suppliers. According to GPS Advisory Board member Imran Mushtaq, procurement is undergoing a structural shift.

“Procurement is no longer just about price; it’s about provenance,” Mushtaq said. He noted that EU regulations now require detailed traceability across the supply chain, standards that most Pakistani mills currently lack at a granular level. Without credible systems to demonstrate environmental compliance and product origin, exporters risk exclusion from key European buyers, regardless of price competitiveness.

Energy economics further complicates the picture. Pakistan’s elevated grid tariffs have significantly eroded margins, forcing manufacturers to reconsider their operating models. Industry participants highlighted that on-site renewable energy solutions, such as solar and biomass, are increasingly viewed not only as sustainability measures but also as strategic tools to manage cost volatility. Similarly, the use of recycled fibres and certified cotton has shifted from being a niche preference to a baseline requirement for access to EU markets.

Adding to regulatory pressure is the growing influx of diverted Chinese textile shipments. As the United States tightens trade restrictions on China, surplus Chinese inventory is being redirected to the European Union and Middle Eastern markets at sharply discounted prices. This has intensified competition, particularly in commoditised product categories.

Syed cautioned that Pakistani exporters cannot compete solely on price against such volumes. Instead, he urged a strategic pivot towards high-compliance and value-added segments. Vertically integrated mills, those controlling the entire value chain from spinning to stitching, retain an advantage through shorter lead times, higher transparency and better alignment with buyer compliance requirements. Crucially, strict adherence to the EU’s Rules of Origin allows Pakistani exporters to legitimately benefit from GSP Plus duty-free access, an option unavailable to diverted Chinese goods.

Technology adoption emerged as a recurring theme at the summit, particularly the role of artificial intelligence and digital traceability in procurement. Altaf Gul Muhammad, Chief Supply Chain and Operations Officer at Yunus Textile Mills, emphasised the need for stronger coordination across industry, regulators and technology providers.

He stressed that evolving procurement practices require practical alignment rather than fragmented initiatives. As part of this transition, Muhammad highlighted Digital Product Passports (DPPs) as a critical next step. “Mills must adopt blockchain-based or centralised ERP systems that can track a garment’s journey from seed to shelf,” he said, adding that such systems are rapidly becoming essential for credibility with international buyers.

Early adopters within Pakistan’s textile clusters are already reporting tangible benefits. AI-driven demand forecasting has helped leading mills reduce excess inventory by 15-20%, while automated vendor selection and predictive pricing have shortened procurement cycles by up to two weeks. In energy-intensive operations such as spinning, AI-enabled monitoring has delivered efficiency gains of 5-8% by optimising motor loads and humidity controls.

Despite these operational improvements, the most significant medium-term risk remains CBAM. Although currently applied to carbon-intensive sectors such as cement and steel, EU policymakers have signalled plans to extend CBAM to textiles by 2027. Once implemented, CBAM would effectively impose a carbon cost at the EU border, penalising exporters from countries with carbon-intensive production or weak emissions accounting.

For Pakistan, this could prove decisive. Industry estimates suggest that CBAM-related levies could offset the 10-12% price advantage provided by GSP Plus, effectively neutralising the benefit of preferential access.

OMO Result: SBP injects Rs358.5bn into market

The State Bank of Pakistan (SBP) conducted a reverse repo and Shariah Compliant Modarabah based Open Market Operation (OMO) today, in which it cumulatively injected a total of Rs358.5billion into the market of which Rs203.5bn were injected through reverse repo OMO.

| Summary of OMO Result (Conventional) | |||||||

| Amount (Rs in Million) | Rate (%) | Quotes | |||||

| Tenor | Type | Offered | Accepted | High – Low | Accepted | Offered | Accepted |

| 8D | Reverse Repo (Injection) | 203,500 | 203,500 | 10.54-10.51 | 10.51 | 08 | 08 |

| Total | 203,500 | 203,500 | |||||

Meanwhile, the remaining Rs155bn was injected through Shariah-compliant Modarabah-based OMO.

| Summary of OMO Result (Shariah) | |||||||

| Amount (Rs in Million) | Rate (%) | Quotes | |||||

| Tenor | Type | Offered | Accepted | High – Low | Accepted | Offered | Accepted |

| 8D | Reverse Repo (Injection) | 155,000 | 155,000 | 10.56-10.55 | 10.55 | 02 | 02 |

| Total | 155,000 | 155,000 | |||||

Explanatory Note

Open Market Operation is a tool used by SBP to inject or mop up funds from the banking system, based on liquidity requirements, via the purchase or sale of eligible securities.

Operationally, in case of OMO (Injections), SBP lends funds to banks/Primary Dealers (PDs) against eligible collateral to address liquidity shortage in the system.

For OMO (Injections), marketable government securities, i.e. Market Treasury Bills (MTBs) and Pakistan Investment Bonds (PIBs) are eligible securities.

In OMO (Mop-up), SBP sells MTBs to banks in exchange for funds to remove surplus liquidity from the system.

Eligible collateral for OMO (Mop-up) includes selling MTBs (on repo or outright basis) to banks for removing excess liquidity from the system.

In case of Bai-Muajjal, a Shariah compliant tool for managing liquidity in the Islamic banking system, GOP Ijara Sukuk are eligible securities.

Banks and PDs are eligible counterparties to OMO transactions. For Bai Muajjal transactions, Islamic banks and specialized Islamic windows of conventional banks are eligible counterparties.

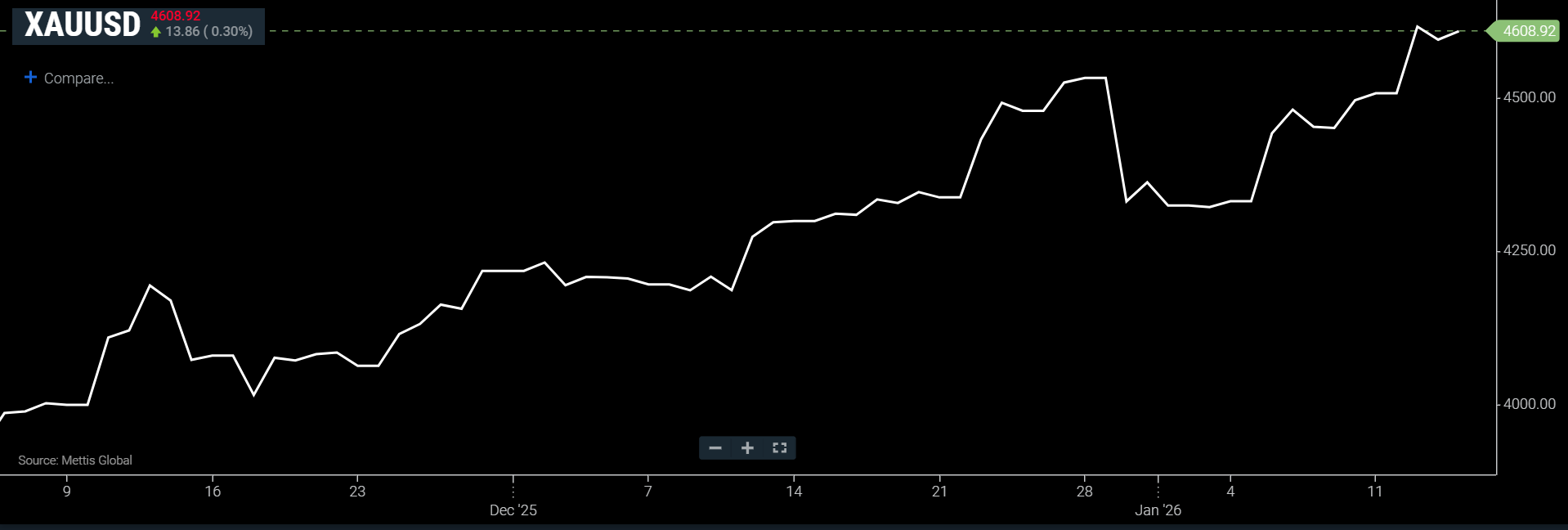

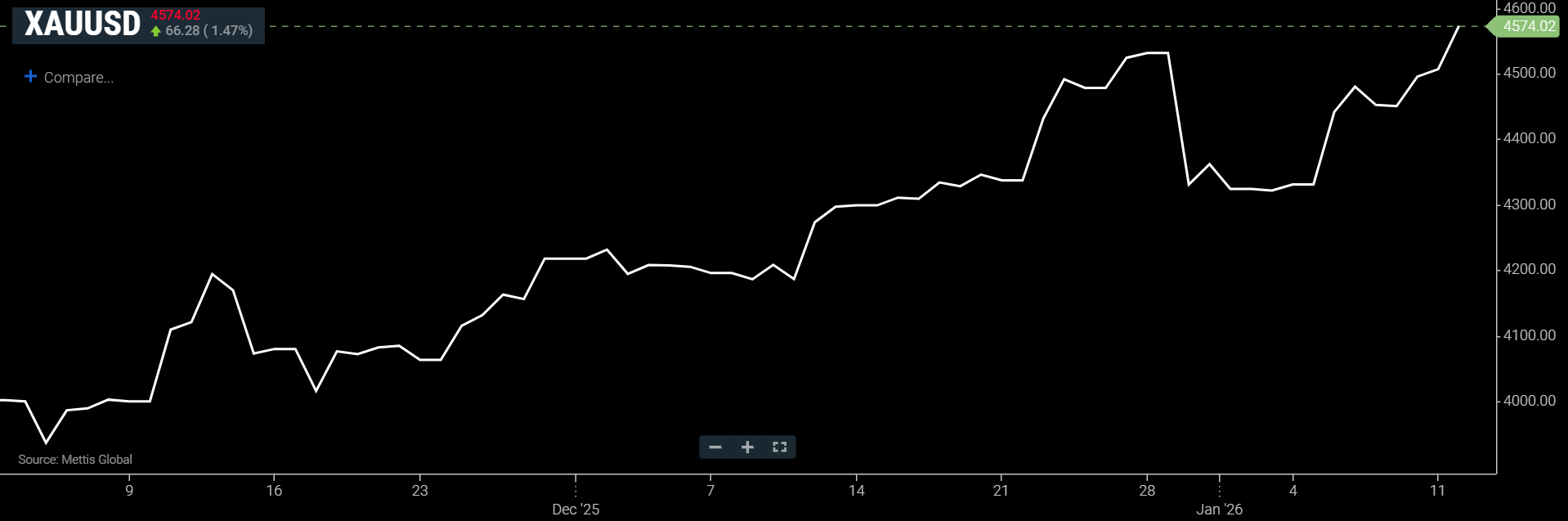

Gold retreats on easing Iran concerns

Gold retreated from record highs as profits were locked in, the pullback came amid a softer tone from President Donald Trump on both Federal Reserve policy and tensions with Iran, which reduced demand for the safe-haven metal.

Currently after the retreat, gold has recovered , Spot gold is up 0.35% at $4,608.92 an ounce as of [12:17 pm] PST, according to data reported by Mettis Global.

February U.S. gold futures dropped 1% to $4,587.70.

“Gold is easing today after Trump suggested a military strike in Iran may not happen immediately, which took some steam out of short-term safe-haven demand,” said Ilya Spivak, head of global macro at Tastylive, CNBC reported.

Iran is grappling with its worst domestic unrest since the 1979 revolution, meanwhile, Trump, signaled a wait-and-see approach toward the situation.

Trump also said he has no immediate plans to remove Federal Reserve Chair Jerome Powell, despite a Justice Department criminal inquiry, noting that it was “too early” to decide.

Low interest rates and global uncertainty generally boost demand for non-yielding assets like gold.

Other precious metals retreated sharply: silver slid 5.6% to $87.46 per ounce after a record $93.57, platinum fell 4.3% to $2,282.90 following a $2,478.50 peak on December 29, and palladium dropped 3.3% to $1,766.25, near a one-week low.

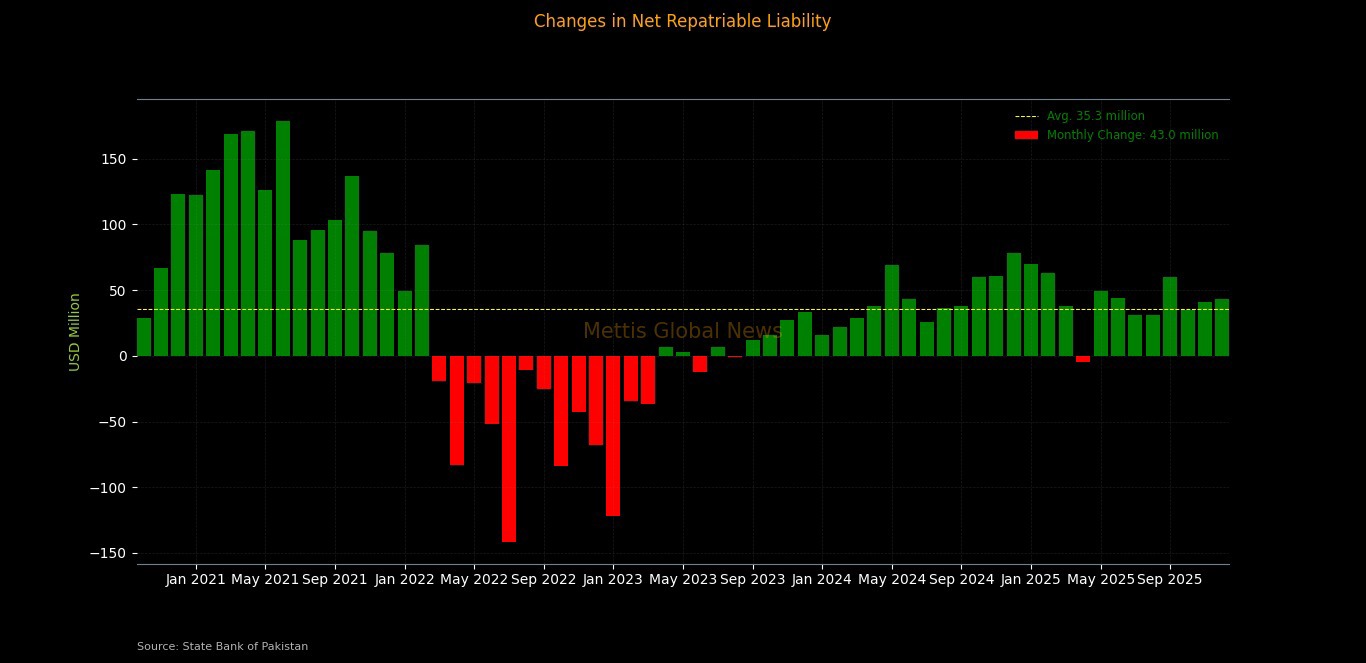

ESG Sukuk set to hit $70bn by end 2026

The global ESG sukuk market is on track to surpass $70 billion by the end of 2026, driven by strong demand in emerging markets (EMs).

ESG sukuk accounted for roughly 40% of EM ESG debt issuance in US dollars in 2025, up from 18% in 2024, highlighting the rapid adoption of sustainable finance instruments across the region, according to a new report by Fitch Ratings.

Saudi Arabia, Malaysia, UAE, and Indonesia lead issuance as ESG sukuk continue to attract global investors.

Alignment with ICMA principles and increased dollar-denominated issuance are expected to broaden participation from institutional investors. Despite growth, the market remains fragmented, with issuance largely concentrated in the four key markets.

“ESG sukuk momentum is expected to continue in 2026, supported by sustainability mandates, net-zero targets, new frameworks, robust investor demand, and the upcoming COP31 in Turkiye,” said Bashar Al Natoor, Fitch’s Global Head of Islamic Finance.

He noted that geopolitical tensions, evolving Sharia and ESG requirements, and greenwashing risks remain key challenges, but the market’s credit profile is strong: 92% of rated ESG sukuk are investment grade, all with Stable Outlooks, and there have been no defaults to date.

Global ESG sukuk issuance surged over 60% to $18.5bn in 2025, with Saudi Arabia contributing 33%, Malaysia 28%, the UAE 19%, and Indonesia 9%.

Total outstanding ESG sukuk reached $58bn by the end of 2025, of which 66% were dollar-denominated, marking a 30% increase from 2024.

The majority of ESG sukuk are labeled ‘sustainability’ or ‘green’, while social, sustainability-linked, orange, and climate sukuk are emerging in the market.

Notable developments include Pakistan issuing its first sovereign green sukuk and Oman Electricity Transmission Company SAOC launching Oman’s first ESG sukuk with a BB+ rating.

Policy support is strengthening market growth. Malaysia introduced tax exemptions for Sustainable and Responsible Investment sukuk, Saudi Arabia’s Capital Market Authority rolled out ESG debt guidelines.

Qatar’s central bank launched a Sustainable Finance Framework, and the UAE central bank is developing a Sustainable Islamic M-Bills programme.

With strong issuance momentum, increasing regulatory support, and growing investor appetite, the ESG sukuk market is poised for significant growth across emerging economies, making sustainable Islamic finance a key pillar of the global debt market.

One year deadline set for Karachi Chaman highway

Work on the long-awaited Karachi Chaman highway has formally begun, with the federal government setting a one year completion target instead of the originally planned two years.

Efforts intensify to upgrade one of the country’s most accident-prone routes.

Addressing federal cabinet members, Prime Minister Muhammad Shehbaz Sharif said he recently visited Quetta, where the foundation stone of the nearly 850-kilometre highway was laid.

Commonly referred to as a “bloody road” due to frequent fatal accidents, the highway will be reconstructed at an estimated cost of around Rs400 billion, fully financed by the federal government.

The prime minister said the Ministry of Communications had initially proposed a two-year timeline, but directions were issued to ensure completion within a year, as reported by APP.

He explained that savings generated from a previous decision to keep domestic petroleum prices unchanged during a sharp decline in global oil prices are now being utilised to convert the dangerous route into a pathway for economic growth and regional connectivity.

He also highlighted the completion of a Rs75 billion agricultural support package for farmers, including Rs50 billion provided by the federal government.

The initiative, he said, addressed the long-standing problem of electricity theft by shifting agricultural irrigation to solar power, enabling farmers to irrigate their land independently and sustain agricultural activity.

Progress on education initiatives was also shared, with construction of Daanish schools already underway in the province and contractors mobilised during the current month.

Five schools had earlier been approved, while two additional institutions were announced during the recent visit, bringing the total to seven. All seven Daanish schools are expected to be completed by the end of this year.

Under the prime minister’s education programmes, up to 100,000 laptops are being distributed across the country, while thousands of scholarships are being awarded to deserving male and female students to support higher education and skills development.

Referring to the broader economic outlook, the prime minister expressed satisfaction over improving stability and said further development measures would be taken to support growth and long-term prosperity in Pakistan.

He thanked stakeholders for their continued cooperation and confidence in government policies.

During a later exchange of views on political and security matters, he said that following the success of Marka-e-Haq, international demand for Pakistan’s defence equipment has increased, with several countries now engaged in talks to acquire locally manufactured military hardware.

He also paid tribute to the armed forces and law enforcement agencies for their sustained efforts and sacrifices in the fight against terrorism.

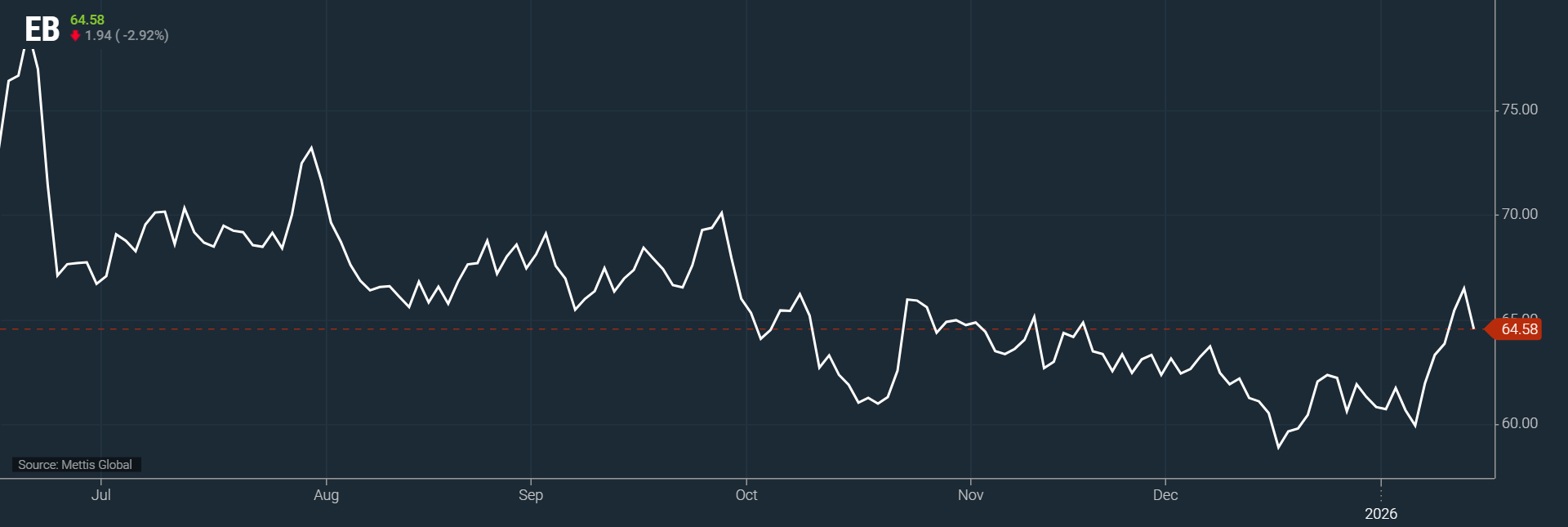

Oil retreats on reduced geopolitical risk

Oil markets dropped sharply in early Asian trade on Thursday as comments from U.S. President Donald Trump eased fears of military conflict in the Middle East.

Brent crude futures went down by $1.94, or 2.92%, to $64.58 per barrel, according to data by Mettis Global.

West Texas Intermediate (WTI) crude futures decreased by $1.83, or 2.95%, to $60.19 per barrel by [11:45 am] PST.

Trump showed that violence against protesters in Iran had started to subside and said there were no plans for mass executions, calming investors who had been concerned about potential U.S. intervention.

The remarks reduced geopolitical risk premiums that had previously supported higher oil prices.

Market watchers also pointed to rising U.S. crude and gasoline inventories as a bearish factor.

Data from the Energy Information Administration showed crude stocks increased by 3.4m barrels last week.

Further weighing on prices, Venezuela began reversing production cuts imposed under previous U.S. sanctions, allowing crude exports to resume.

Despite these supply-side pressures, demand signals remained mixed: China’s crude imports surged 17% year-on-year in December, pushing total 2025 imports up 4.4%, and daily import volumes reached record highs.

Experts project WTI crude will trade between $55 and $65 in the near term, as lingering geopolitical tensions are balanced by rising inventories and increased production from key suppliers.

CAT slashes fines on Unilever, Friesland for misleading ice cream ads

The Competition Appellate Tribunal (CAT) has upheld the Competition Commission of Pakistan’s (CCP) finding that Unilever Pakistan and Friesland Campina Engro misled consumers by marketing frozen desserts as ice cream, while reducing the financial penalties imposed on the companies.

The CAT cut the fines from Rs75m to Rs15m for each company. In addition, Unilever Pakistan’s penalty for claiming its frozen dessert was healthier than dairy ice cream was reduced from Rs20m to Rs5m.

The tribunal emphasized that the reduction in penalties does not condone the violation but reflects a proportional exercise of appellate discretion considering mitigating circumstances.

The CCP had initiated proceedings following a complaint by Pakistan Fruit Juice Company Private Limited, the maker of Hico ice cream, according to the press release.

The complaint alleged that Unilever and Friesland Campina Engro engaged in deceptive advertising by presenting frozen desserts as ice cream in television and social media campaigns.

During its inquiry, the CCP issued show cause notices to both companies, which market frozen desserts under the brand names Walls and Omore.

The Commission relied on standards set by the Pakistan Standards and Quality Control Authority and the Punjab Pure Food Regulations 2018, which differentiate ice cream from frozen desserts.

Ice cream is defined as a product made from milk, cream, or other dairy ingredients, whereas frozen desserts can include pasteurized mixes containing milk products and edible vegetable oils.

The CCP had directed the companies to stop advertising frozen desserts as ice cream which prohibits false and misleading information that can affect consumer choice.

The case has implications for Pakistan’s consumer protection framework and the frozen dessert market, signaling stricter regulatory scrutiny on product labeling and advertising practices in the food industry.

PSX invites bids for 3 million shares of ISE Towers REIT Management Company

Pakistan Stock Exchange (PSX) is inviting bids from companies, institutions, and banks for the purchase of 3,034,603 shares of ISE Towers REIT Management Company Limited (ISE REIT).

These shares were pledged with PSX under the Base Minimum Capital (BMC) requirements by a forfeited TRE Certificate Holder.

Proceeds from the sale will be used to settle approved registered claims against the forfeited TRE Certificate Holder.

As of June 30, 2025, the shares have a break-up value of Rs22.56 per share.

Prospective buyers must meet the shareholding criteria prescribed for Depository and Clearing Companies under the Central Depositories (Licensing and Operations) Regulations, 2016, and Clearing Houses (Licensing and Operations) Regulations, 2016., according to a notice issued by the exchange.

Eligible shareholders include securities exchanges or connected companies, development finance institutions, insurance companies, non-banking finance companies, banks, and corporates providing trading, custodial, clearing, or settlement services in the securities market.

Bids must be submitted in sealed envelopes marked “BIDS FOR PURCHASE OF ISE TOWERS REIT MANAGEMENT COMPANY LIMITED SHARES” and addressed to the Chief Regulatory Officer of PSX.

The deadline for submission is seven business days from the notice, i.e., January 8, 2026.

Each bid should include a Payment Order or Bank Draft of 10% of the total bid value as earnest money.

The successful bidder will be required to pay the remaining amount within seven business days of demand, otherwise, the earnest money will be forfeited, and the bid will be cancelled.

PSX reserves the right to reject any or all bids without assigning any reason.

All applicable charges, taxes, stamp duties, and other expenses related to the sale and transfer of shares will be borne by the successful bidder.

CCP flags rising concerns in rapidly expanding digital economy