Gold retreats on easing Iran concerns

Gold retreated from record highs as profits were locked in, the pullback came amid a softer tone from President Donald Trump on both Federal Reserve policy and tensions with Iran, which reduced demand for the safe-haven metal.

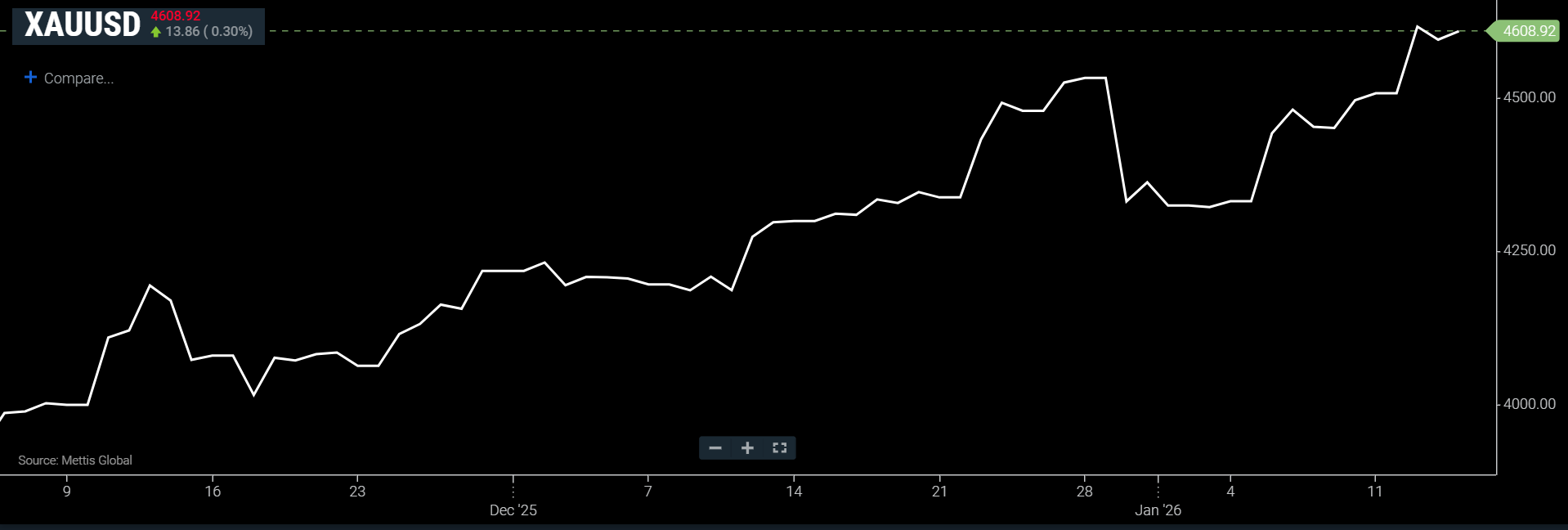

Currently after the retreat, gold has recovered , Spot gold is up 0.35% at $4,608.92 an ounce as of [12:17 pm] PST, according to data reported by Mettis Global.

February U.S. gold futures dropped 1% to $4,587.70.

“Gold is easing today after Trump suggested a military strike in Iran may not happen immediately, which took some steam out of short-term safe-haven demand,” said Ilya Spivak, head of global macro at Tastylive, CNBC reported.

Iran is grappling with its worst domestic unrest since the 1979 revolution, meanwhile, Trump, signaled a wait-and-see approach toward the situation.

Trump also said he has no immediate plans to remove Federal Reserve Chair Jerome Powell, despite a Justice Department criminal inquiry, noting that it was “too early” to decide.

Low interest rates and global uncertainty generally boost demand for non-yielding assets like gold.

Other precious metals retreated sharply: silver slid 5.6% to $87.46 per ounce after a record $93.57, platinum fell 4.3% to $2,282.90 following a $2,478.50 peak on December 29, and palladium dropped 3.3% to $1,766.25, near a one-week low.