Oil retreats on reduced geopolitical risk

Oil markets dropped sharply in early Asian trade on Thursday as comments from U.S. President Donald Trump eased fears of military conflict in the Middle East.

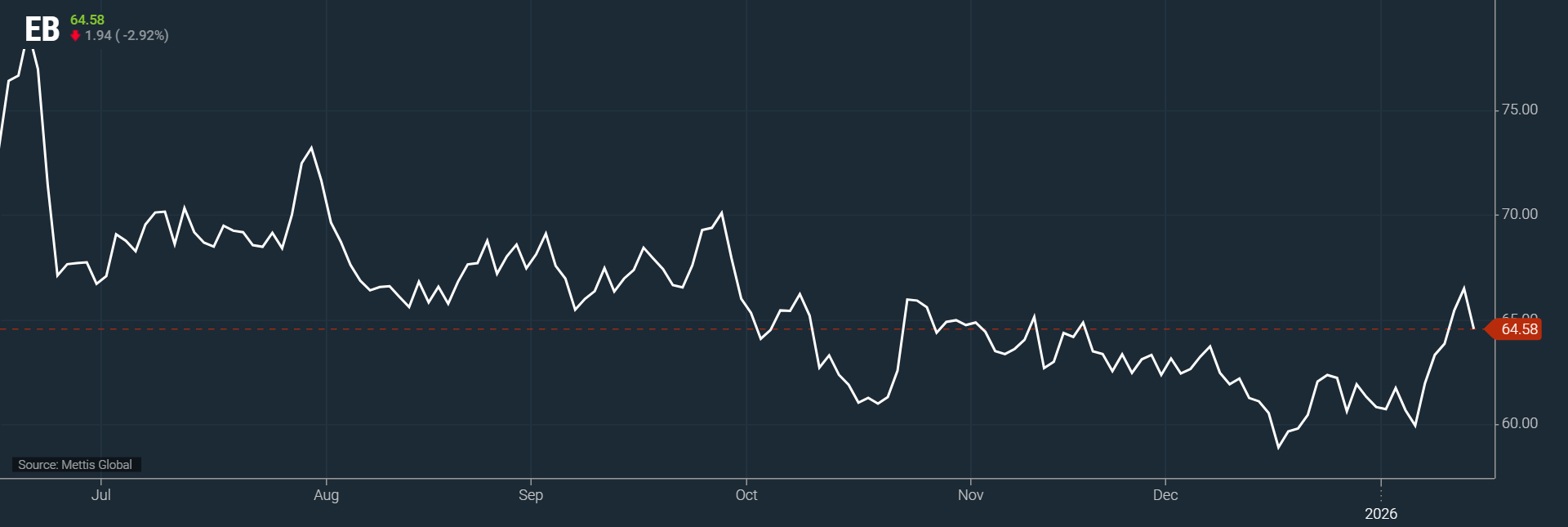

Brent crude futures went down by $1.94, or 2.92%, to $64.58 per barrel, according to data by Mettis Global.

West Texas Intermediate (WTI) crude futures decreased by $1.83, or 2.95%, to $60.19 per barrel by [11:45 am] PST.

Trump showed that violence against protesters in Iran had started to subside and said there were no plans for mass executions, calming investors who had been concerned about potential U.S. intervention.

The remarks reduced geopolitical risk premiums that had previously supported higher oil prices.

Market watchers also pointed to rising U.S. crude and gasoline inventories as a bearish factor.

Data from the Energy Information Administration showed crude stocks increased by 3.4m barrels last week.

Further weighing on prices, Venezuela began reversing production cuts imposed under previous U.S. sanctions, allowing crude exports to resume.

Despite these supply-side pressures, demand signals remained mixed: China’s crude imports surged 17% year-on-year in December, pushing total 2025 imports up 4.4%, and daily import volumes reached record highs.

Experts project WTI crude will trade between $55 and $65 in the near term, as lingering geopolitical tensions are balanced by rising inventories and increased production from key suppliers.