Gold, silver rally amid geopolitical turmoil

Gold has push passed the $4,600-per-ounce barrier while silver also touched historic peaks, as safe havens became an investor umbrella amid a perfect storm of geopolitical turmoil, economic uncertainty, and mounting pressure on the Federal Reserve to slash interest rates, in a dramatic Monday trading session.

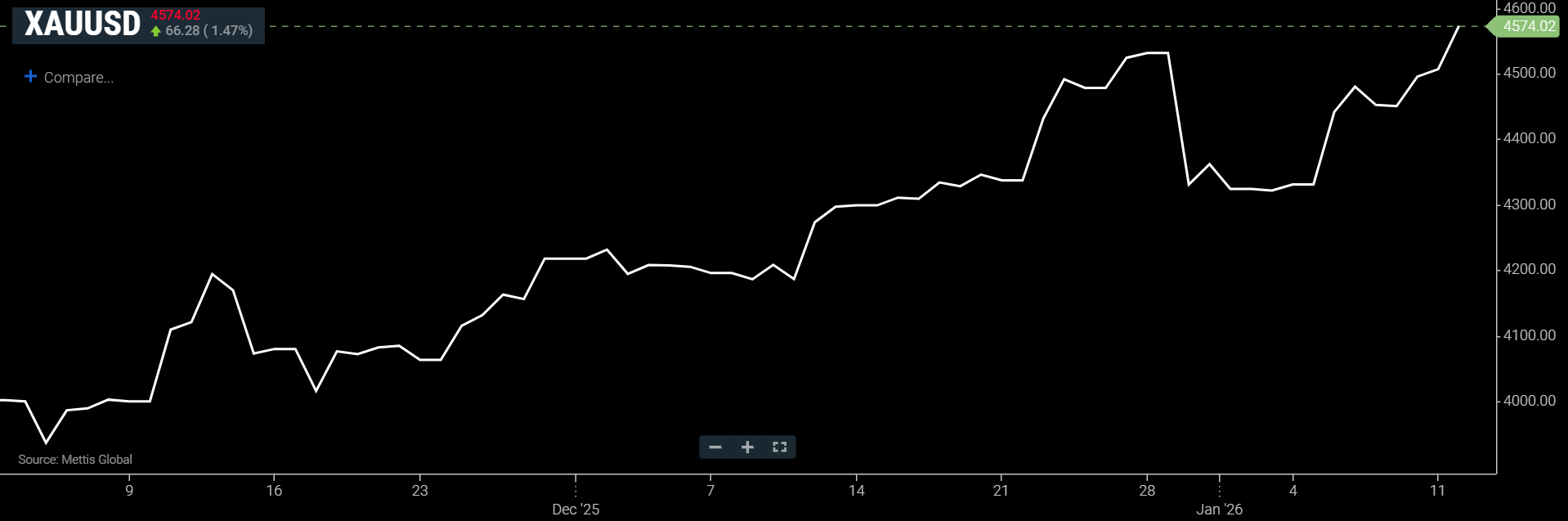

Currently, Spot gold has retreated, it was up 1.47% at $4,574.02 an ounce as of [11:38 am] PST, according to data reported by Mettis Global.

February U.S. gold futures advanced 2% to $4,591.10.

“The geopolitical risk factor is clearly the main driver behind the intraday bullish momentum we’re witnessing in both gold and silver markets,” explained Kelvin Wong, senior market analyst at OANDA, CNBC reported.

Escalating tensions in Iran, with Tehran warning of potential strikes against American military installations should President Donald Trump follow through on threats to intervene militarily in support of demonstrators.

The Iranian situation represents just one element of a broader pattern of U.S. international assertiveness under Trump, including the recent removal of Venezuelan President Nicolas Maduro and ongoing discussions regarding Greenland’s acquisition.

Domestic economic signals are also influencing market sentiment. Friday’s employment report revealed weaker-than-anticipated job creation in December, with losses concentrated in construction, retail, and manufacturing.

Despite the disappointing headline number, the unemployment rate’s decline suggests the labor market isn’t experiencing rapid deterioration.

Adding to the pressure, Fed Chair Jerome Powell disclosed Sunday that the Trump administration had threatened criminal charges related to his Congressional testimony, a move Powell characterized as a “pretext” designed to compel rate reductions.

A weakening dollar, which pulled back from month-long highs, provided additional support for precious metals.

Gold and silver typically benefit during periods of low interest rates and heightened geopolitical or economic uncertainty, as they don’t generate yield.

Silver surged 3.5% to $82.72 per ounce after reaching an all-time high of $83.96. Platinum jumped 3.2% to $2,345.40 following its December 29 record of $2,478.50. Palladium advanced 3.3% to $1,875.68.