Oil inches up on Iran unrest, Venezuela caps gains

Crude oil futures climbed Monday as intensifying protests in Iran raised supply concerns from the OPEC producer, though Venezuelan export plans and oversupply forecasts limited the advance.

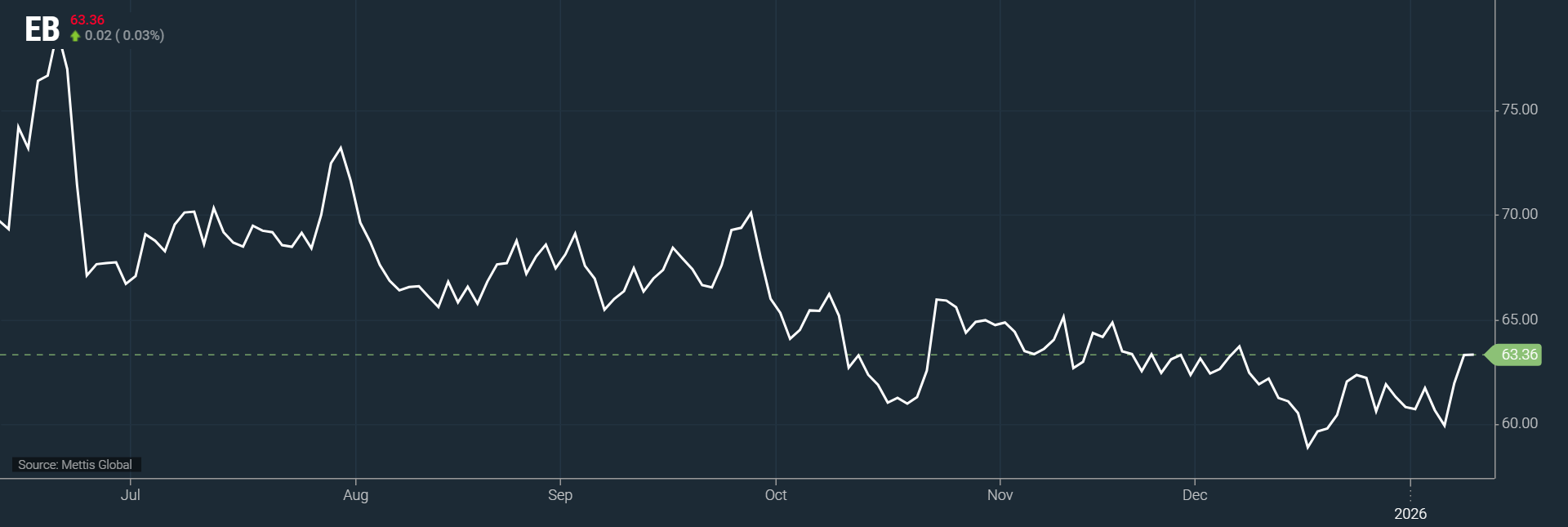

Brent crude futures went up by $0.02, or 0.03%, to $63.36 per barrel, according to data by Mettis Global.

West Texas Intermediate (WTI) crude futures increased by $0.01, or 0.02%, to $59.11 per barrel by [12:30 pm] PST

Both benchmark contracts surged more than 3% last week, marking their strongest weekly performance since October.

The rally came as Iran’s clerical establishment escalated its crackdown on the largest demonstrations the country has seen since 2022.

President Donald Trump has repeatedly warned against using force on protesters and is expected to meet senior advisers Tuesday to discuss Iran options, according to CNBC.

Venezuela is expected to restart oil shipments soon following President Nicolas Maduro’s ouster. Trump said last week Caracas would turn over as much as 50 million barrels of sanctioned oil to the United States.

This has triggered a scramble among oil companies to secure tankers and organize shipping operations from Venezuelan vessels and deteriorating ports.

Oil prices are expected to remain range-bound without a clear demand revival or significant supply disruption. Oil futures are increasingly showing an oversupply narrative as markets move into 2026.

Supply disruptions from Russia amid ongoing Ukrainian attacks targeting Russian energy facilities and possible tougher U.S. sanctions on Russian energy are also potentially being monitored.