Oil prices spike on Iran unrest, Venezuela supply worries

Crude oil prices climbed on Friday amid rising concerns over potential disruptions in Iran’s oil production and uncertainties surrounding Venezuelan exports.

Both major benchmarks, Brent and West Texas Intermediate (WTI), rebounded after two consecutive days of losses, with Brent set to rise about 2.8% for the week and WTI up roughly 1.5%.

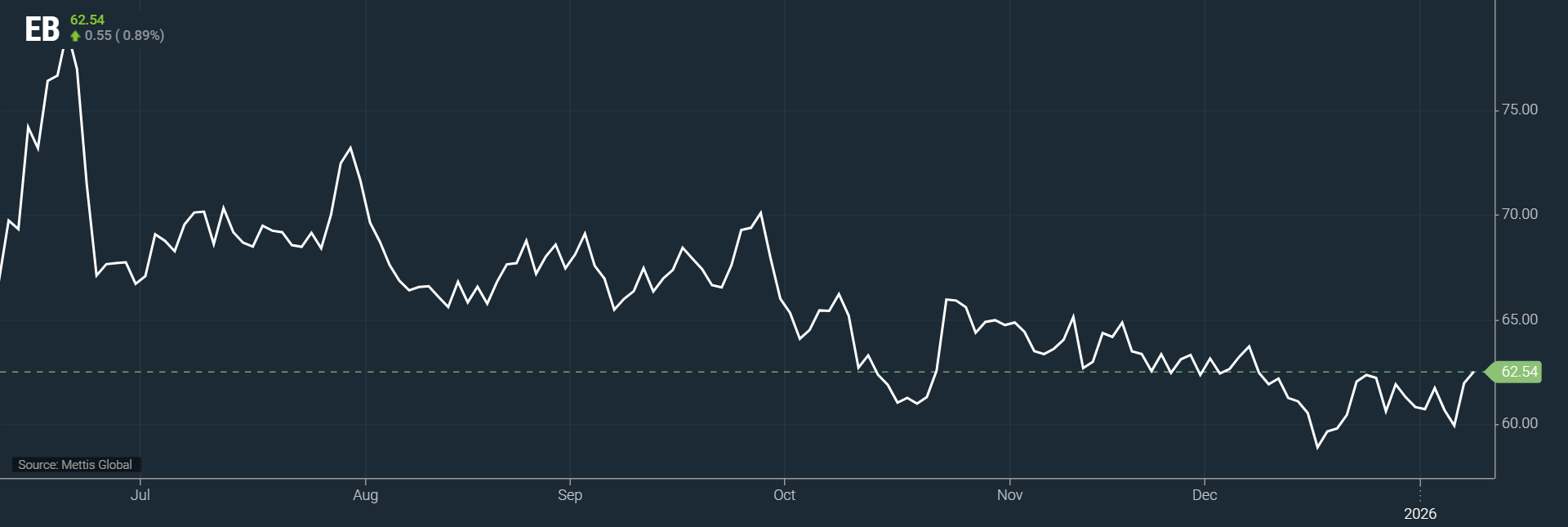

Brent crude futures went up by $0.55, or 0.89%, to $62.54 per barrel, according to data by Mettis Global.

West Texas Intermediate (WTI) crude futures increased by $0.51, or 1.88%, to $58.27 per barrel by [5:10 pm] PST.

The gains attributed to intensifying unrest in Iran, which has sparked fears of supply interruptions.

Nationwide protests, particularly in Tehran, Mashhad, and Isfahan, coupled with a reported internet blackout, have heightened worries that oil output or logistics could be affected, according to CNBC.

Meanwhile, tensions from the ongoing Russia Ukraine conflict continue to create uncertainty around Russian oil exports, adding further pressure on global supply.

The situation in Venezuela has also drawn investor attention.

Following the capture of President Nicolás Maduro, the U.S. government is negotiating with oil majors and trading houses, including Chevron, Vitol, and Trafigura, to market up to 50m barrels of Venezuelan crude stored by state-run PDVSA amid sanctions and tanker seizures.

The outcome of these negotiations is expected to significantly influence global oil flows and pricing.

Despite the recent price surge, analysts caution that global crude inventories remain high, and oversupply could limit further gains.

While geopolitical risks are currently driving volatility, structural demand weakness and steady production from other regions continue to temper market optimism.