Gold, silver hit new peaks

Gold and silver surged to record levels on Friday, fueled by speculative buying, thin year-end liquidity, expectations of further U.S. interest rate cuts, and rising geopolitical risks.

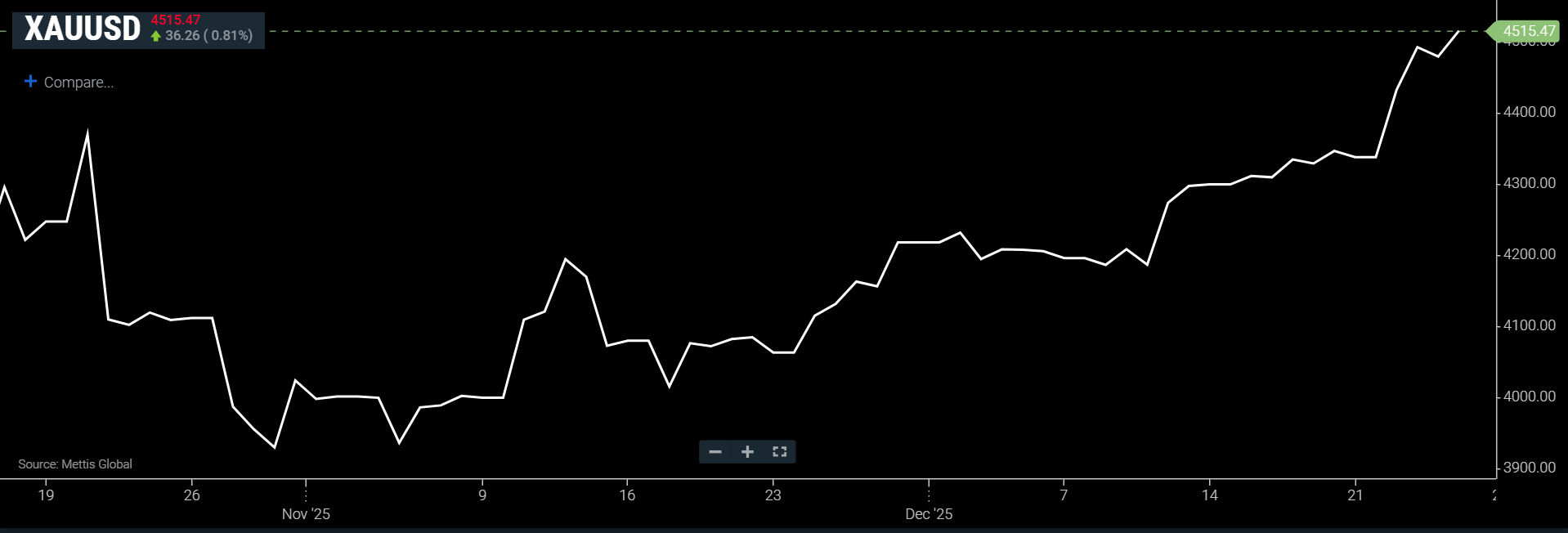

Spot gold was up 0.81%% at $4,515.47 an ounce as of [2:16 pm] PST, according to data reported by Mettis Global.

U.S. gold futures for February delivery climbed 0.7% to $4,535.20. Silver jumped 3.6% to $74.56 per ounce, after touching a record $75.14, CNBC reported.

“Momentum-driven buying and speculation have propelled gold and silver higher since early December,” said Kelvin Wong, senior market analyst at OANDA, according to CNBC.

Gold has posted its strongest annual performance since 1979, boosted by Federal Reserve easing, geopolitical uncertainty, strong central bank demand, rising ETF holdings, and the global trend toward de-dollarization.

Silver has outpaced gold, soaring 158% year-to-date, supported by structural supply deficits, its designation as a U.S. critical mineral, and robust industrial demand.

With markets pricing in two U.S. rate cuts next year, non-yielding assets like gold remain well-supported in a low-interest-rate environment.

Geopolitical developments have also played a role, including U.S. measures on Venezuelan oil and recent strikes against Islamic State militants in northwest Nigeria.

Platinum and palladium, used in automotive catalytic converters, also surged.

Spot platinum rose 7.8% to $2,393.40 per ounce, earlier hitting a record $2,429.98, while palladium gained 5.2% to $1,771.14, following a three-year high in the previous session.

Both metals have benefited from tight supply, tariff uncertainties, and shifts in investment demand from gold, with platinum up roughly 165% and palladium more than 90% year-to-date.

All major precious metals are on track for strong weekly gains.