PSX Closing Bell: Market Holds Its Ground

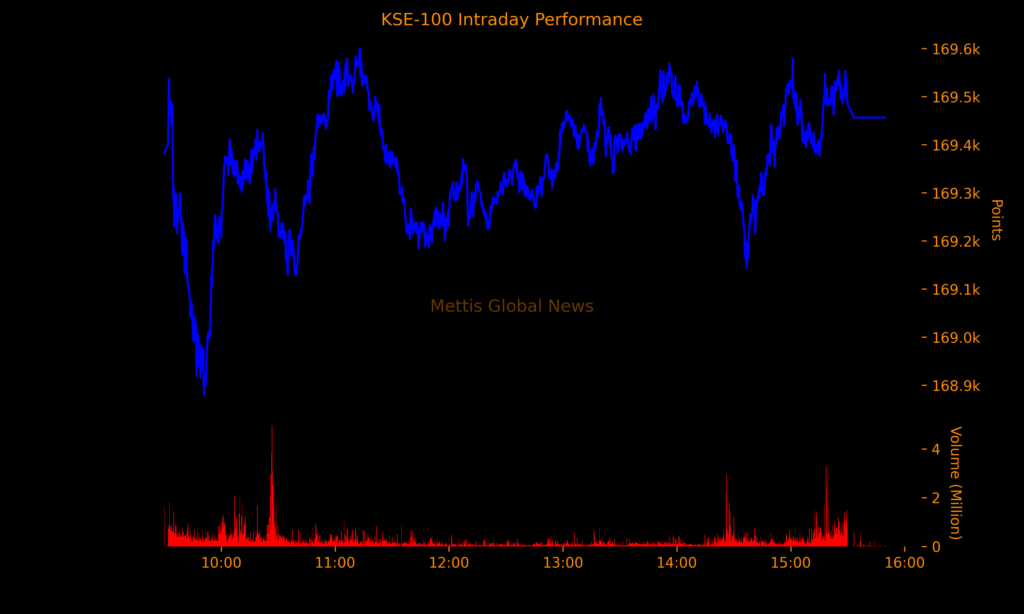

The benchmark KSE-100 Index concluded Tuesday’s trading session at 169,456.38, showing an increase of 1,153.14 points or 0.69%.

The index remained positive throughout the day showing an intraday high of 169,601.03 (+1,297.79) and a low of 168,880.21 (+576.97) points.

Market sentiment continued to draw strength from Pakistan’s improving macroeconomic backdrop following the IMF Executive Board’s approval of a $1.3 billion loan package.

The decision which cleared $1.09bn under the EFF and $200mn under the RSF has reinforced investor confidence at a time when the economy is stabilising but still exposed to vulnerabilities.

The total volume of the KSE-100 Index was 433.91 million shares.

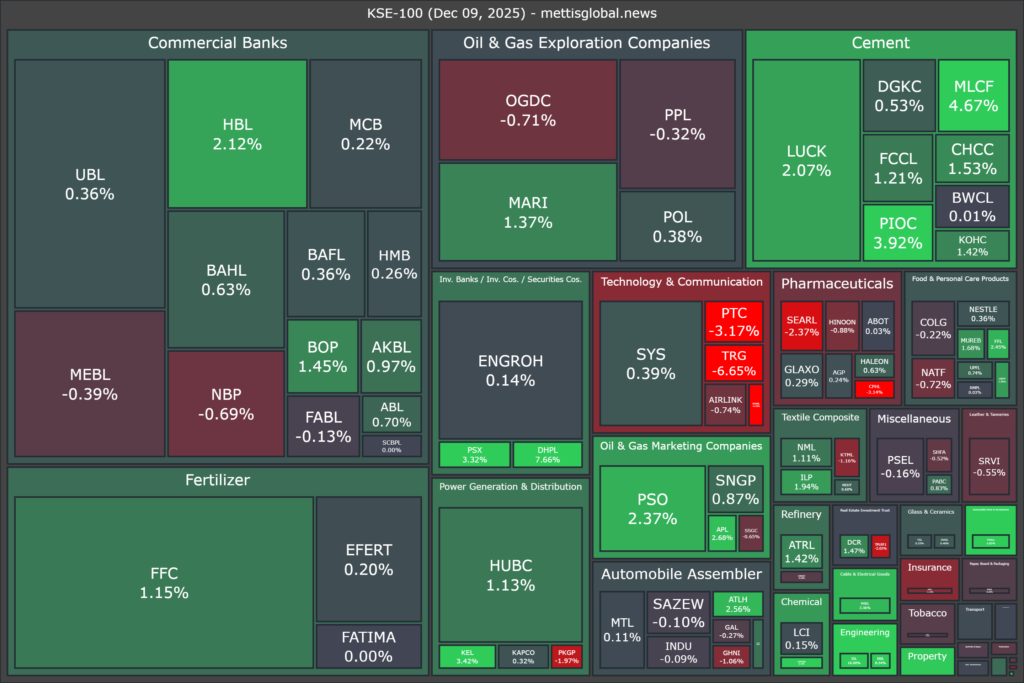

Of the 100 index companies 64 closed up, 34 closed down, while 2 were unchanged.

Top gainers during the day were ISL (+10.00%), INIL (+8.54%), DHPL (+7.66%), BNWM (+6.34%), and LOTCHEM (+6.13%).

On the other hand, top losers were TRG (-6.65%), HUMNL (-4.33%), PTC (-3.17%), CPHL (-3.14%), and SEARL (-2.37%).

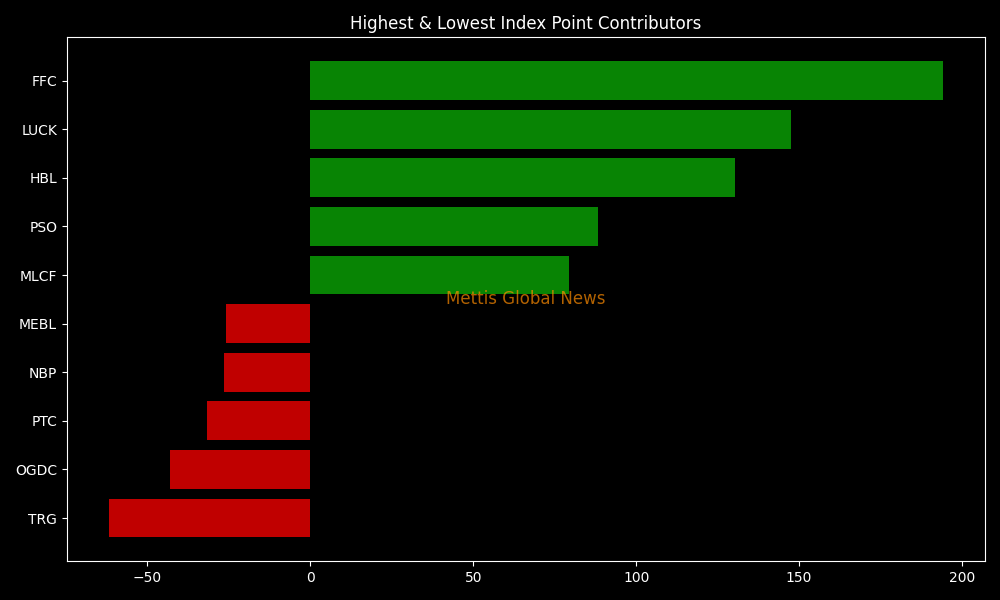

In terms of index-point contributions, companies that propped up the index were FFC (+194.27pts), LUCK (+147.60pts), HBL (+130.30pts), PSO (+88.42pts), and MLCF (+79.48pts).

Meanwhile, companies that dragged the index lower were TRG (-61.94pts), OGDC (-43.07pts), PTC (-31.72pts), NBP (-26.39pts), and MEBL (-25.91pts).

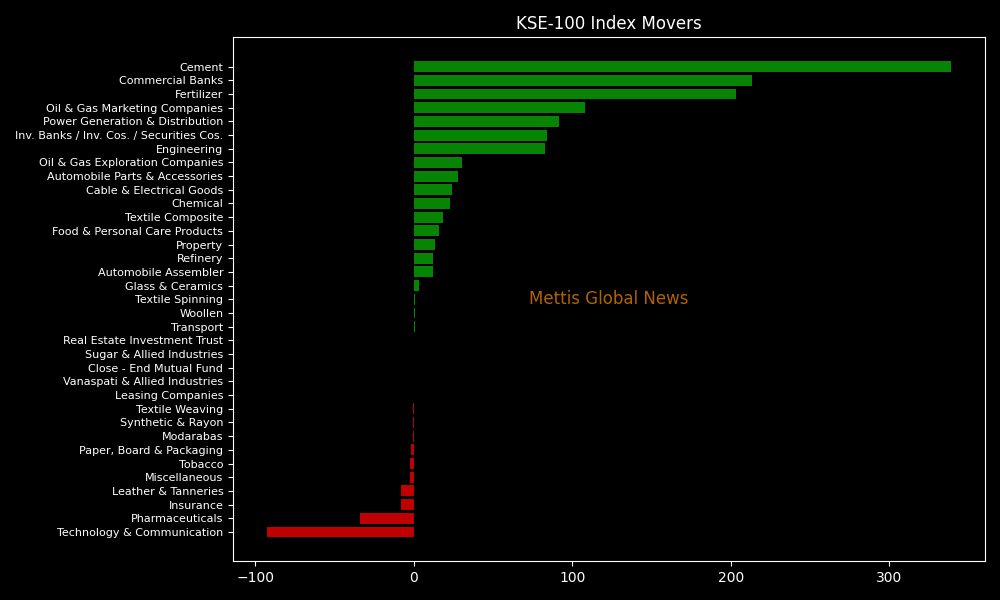

Sector-wise, KSE-100 Index was supported by Cement (+338.92pts), Commercial Banks (+213.30pts), Fertilizer (+203.07pts), Oil & Gas Marketing Companies (+107.93pts), and Power Generation & Distribution (+91.48pts).

While the index was let down by Technology & Communication (-92.58pts), Pharmaceuticals (-33.89pts), Insurance (-8.20pts), Leather & Tanneries (-7.95pts), and Miscellaneous (-2.42pts).

In the broader market, the All-Share Index closed at 102,478.57 with a net gain of 679.64 points or 0.67%.

Total market volume was 1,031.80 million shares compared to 783.08m from the previous session while traded value was recorded at Rs51.32 billion showing an increase of Rs1.37bn.

There were 460,012 trades reported in 483 companies with 272 closing up, 179 closing down, and 32 remaining unchanged.